Intent to lien letter template

To secure payment for a project or service, it’s important to send an Intent to Lien letter promptly. This letter informs the recipient of your intention to place a lien on their property due to an unpaid debt. It’s a legal step that can compel action if they fail to resolve the outstanding balance.

Start by including key details such as the amount owed, the work completed or materials provided, and the date the payment was due. Be clear and concise in your language, as this document serves as a formal notification of your intent. Avoid ambiguity to ensure there is no confusion about the situation.

Make sure to specify a deadline for payment before you take further legal steps. This shows you are serious about enforcing the lien and gives the recipient a fair chance to settle the debt. You can also mention any additional actions you might take if payment is not received, such as filing the lien with the county recorder’s office.

Sending this letter via certified mail will provide proof that it was delivered. Keep a copy for your records in case further legal action becomes necessary.

Here’s the revised version of the text, minimizing repetitions:

State the amount due clearly, referencing the specific services or goods provided. Include the agreed-upon terms to emphasize the obligation to pay.

Politely demand payment by a specific date. Make it clear that failure to pay will result in a lien filing.

If the payment has not been received by the deadline, outline the steps you will take, including the lien process. Be concise, but firm about your intentions.

| Item | Amount |

|---|---|

| Service Description | $X,XXX |

| Late Fee | $XXX |

| Total Due | $X,XXX |

Conclude by encouraging immediate payment to avoid further action. Provide clear contact information in case the recipient has questions or disputes the claim.

- Intent to Lien Letter Template Guide

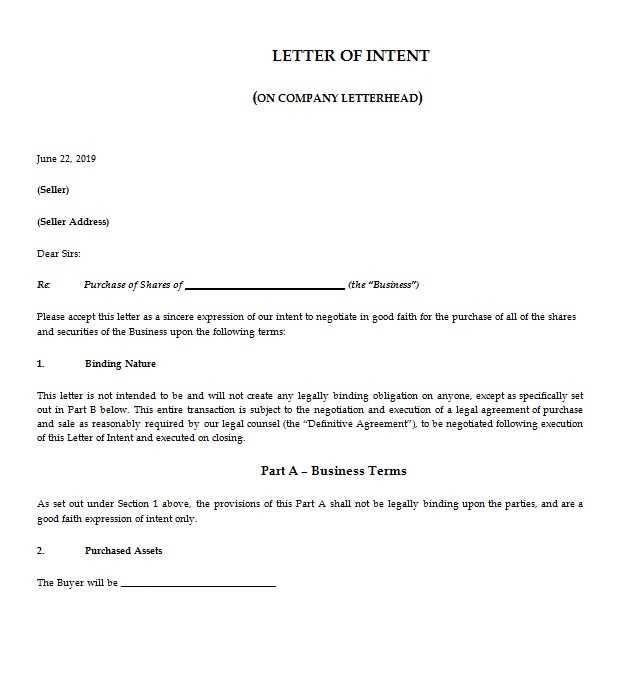

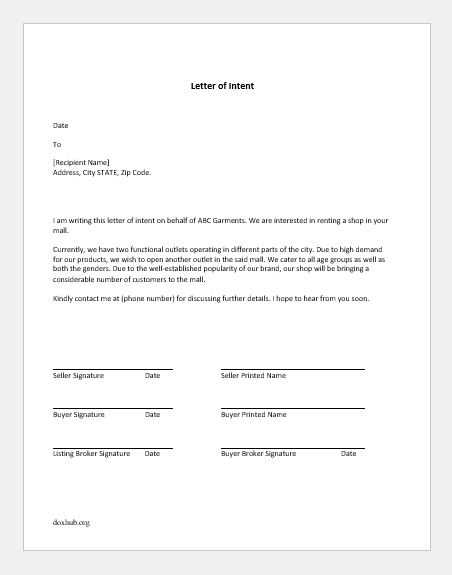

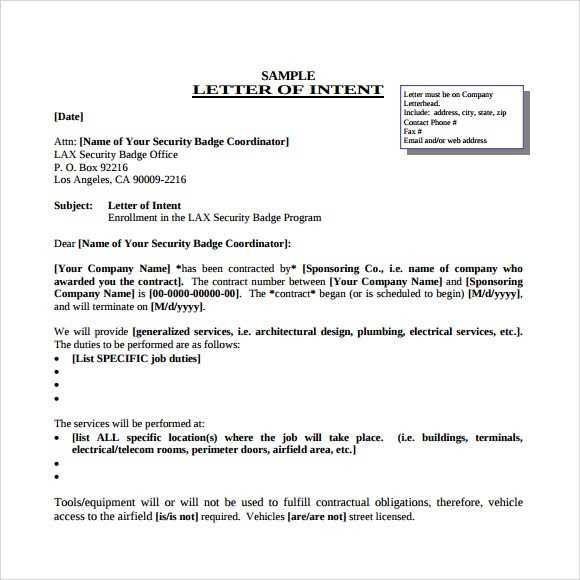

Start by including clear, accurate details about the parties involved. The letter should have the date, your name, business name (if applicable), and contact information. Identify the property or project in question. Be specific with descriptions, such as project location and contract details. Also, include the amount owed and the due date for payment, referencing previous communication or agreements made.

Key Components to Include

Make sure to address the recipient with a formal tone. Begin by clearly stating the intent to file a lien due to non-payment. Be direct but polite, emphasizing the urgency without sounding threatening. Include any legal requirements or deadlines for resolving the issue. If applicable, reference local or state laws that govern the lien process. Always include the amount overdue and a deadline to avoid legal action.

Final Steps

Before sending, double-check all details for accuracy. After sending, keep a copy of the letter for your records. If payment is not received by the given deadline, you may proceed with further legal steps, such as filing the lien with the appropriate authorities. This letter is a crucial step in protecting your right to payment and ensuring the work or services you’ve provided are compensated properly.

An Intent to Lien letter is a formal notice sent by a contractor, supplier, or subcontractor to a property owner or general contractor. It serves as a warning of the potential filing of a lien if payment is not received for work or materials provided. The letter is usually sent before the actual lien is filed, giving the recipient an opportunity to settle the outstanding amount and avoid legal action.

This letter is a key tool for protecting the rights of those providing labor or materials, allowing them to assert their claim to unpaid debts without resorting to immediate legal measures. By notifying the other party, it can often encourage payment or initiate a conversation to resolve the matter before escalating further.

| Purpose of Intent to Lien Letter | Timing | Contents |

|---|---|---|

| Notifies the recipient of unpaid debts and the intention to file a lien. | Typically sent when payment is overdue, but before a formal lien is filed. | Details of the debt, work completed, and a clear warning about the lien. |

The letter should include the amount owed, a description of the work completed, and a deadline for payment. Sending this notice is often a required step before pursuing further legal action, such as filing a mechanic’s lien, depending on local laws.

Clearly identify the parties involved in the notice, including the property owner and the contractor or subcontractor issuing the lien. State the property’s legal description and address to avoid any confusion regarding the property in question.

Specify the amount owed, detailing any unpaid invoices or work completed. Provide dates and a breakdown of the work or services provided, helping the recipient understand the financial obligation clearly.

Explain the reason for the lien, such as non-payment for completed services or materials. Ensure this reason is factual and backed by any applicable contracts or agreements.

Outline the steps the recipient can take to resolve the issue. This may include paying the outstanding amount by a set deadline or addressing the dispute in another way. This demonstrates a willingness to resolve the matter amicably.

Set a clear deadline for resolution and state the potential consequences of inaction, such as legal action or a formal lien filing. Be specific about the actions you will take if the matter is not addressed within the designated time frame.

Provide your contact information, including a phone number and email, for any questions or clarifications. This ensures the recipient knows how to reach you if they need more details before taking action.

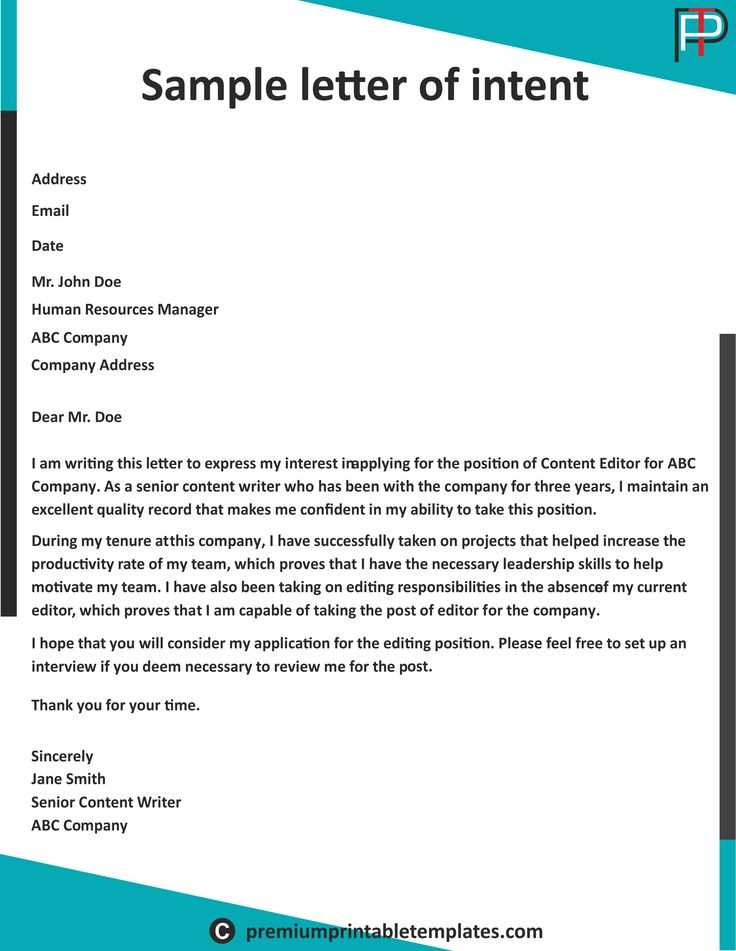

Begin with clearly identifying the purpose of the letter. State that it is an intent to file a lien due to non-payment for goods or services provided. Be specific about the amount owed, the due date, and any previous communications regarding the payment. This ensures the recipient knows exactly what the letter addresses.

Include Key Information

- Your Contact Information: Include your full name, address, phone number, and email.

- Recipient’s Contact Information: Provide the full name, address, and contact details of the person or business you’re addressing.

- Description of the Debt: Specify the nature of the debt, including the amount, date of the transaction, and relevant invoice numbers.

- Deadline for Payment: Set a clear deadline for payment or resolution, usually 10 to 30 days from the date of the letter.

- Consequences: State that a lien will be filed if the debt remains unpaid by the given deadline.

Formatting and Tone

Keep the tone professional and firm, but avoid being overly aggressive. The letter should focus on a resolution, making it clear that a lien is a last resort. Ensure the letter is properly formatted, easy to read, and free of any unnecessary jargon or complex language.

Inaccurate Property Description can lead to serious issues in enforcing a lien. Ensure the property details, including address and legal description, are accurate and match the official records. An incorrect description can cause delays or even make the lien invalid.

Failure to Include Specific Amounts may cause confusion about the amount owed. Always list the exact amount of the debt, along with any interest or additional charges, to prevent disputes.

Missing or Incorrect Dates can weaken the lien’s legitimacy. Make sure you correctly note the date of the lien, and any relevant deadlines, such as when the lien was filed or when payment was due.

Not Following Proper Filing Procedures is a frequent mistake. Each jurisdiction has its own requirements for filing a lien. Failing to comply with these procedures can result in a lien being dismissed. Double-check the local regulations before submission.

Neglecting to Notify the Debtor of the lien can result in complications later on. Most jurisdictions require you to send a formal notice to the debtor about the lien filing. Ensure this is done within the specified time frame to avoid invalidating the lien.

Vague Language can lead to misunderstandings. Be clear and specific in describing the debt, the reasons for the lien, and the amount owed. Ambiguity can undermine the effectiveness of the document.

Not Updating the Lien if the situation changes, such as partial payments or agreements, can create legal challenges. Regularly update the lien to reflect any changes in the amount owed or the debtor’s status.

Overlooking State or Local Variances can result in filing an invalid lien. Local laws may differ, and it’s important to be aware of these differences. Ensure your lien complies with all relevant legal requirements in the jurisdiction where it’s being filed.

Ensure you follow these key legal requirements when filing a lien claim to avoid delays or rejection:

- Timely Filing: File your lien within the statutory time frame, typically 90 days from the completion of the project or the last day materials or labor were provided.

- Proper Notice: Send a preliminary notice to the property owner, general contractor, or both, depending on state laws. This step is mandatory in many jurisdictions to preserve your right to file a lien.

- Accurate Documentation: Maintain detailed records of work performed or materials provided. Include invoices, contracts, and proof of delivery to substantiate your claim.

- Correct Filing Method: File the lien with the appropriate county or local office. Ensure the form is completed correctly, including the property’s legal description and the amount owed.

- Include Accurate Information: List the correct names of all parties involved, including the property owner, contractor, and subcontractors. Missing or incorrect information can invalidate the lien.

- Send Notice After Filing: After filing the lien, send a copy to the property owner and other parties involved. Keep a record of when and how the notice was delivered.

Common Mistakes to Avoid

- Failing to file within the required time frame.

- Incorrectly identifying the property or owner.

- Neglecting to send the preliminary notice, when required.

- Overlooking state-specific lien laws and requirements.

Send the intent to lien notice when payment is overdue, and you want to notify the property owner or contractor of your legal right to file a lien. The timing is critical to ensure you remain compliant with state-specific lien laws.

1. After Missing Payment Deadlines

Once the payment due date passes without receiving funds, it’s time to send the notice. This step warns the debtor about potential legal action and secures your right to file a lien if necessary.

2. Before Filing a Lien

A notice must be sent before filing the lien. In many states, sending this notice is a mandatory step to alert the property owner that you plan to pursue a lien for unpaid work or materials.

3. For Contractual Disputes

If there is a disagreement over the payment terms or contract conditions, sending the intent to lien letter is a formal way to express your intention to protect your rights while trying to resolve the issue.

4. Protecting Your Payment Rights

Sending the letter early in the payment delay process helps preserve your right to lien. Many jurisdictions require that you notify the property owner within a certain period from the last date of work or materials provided.

Some phrases have been replaced to avoid excessive repetition.

To maintain clarity and professionalism, replace redundant phrases in the lien letter template with direct language. For instance, rather than repeating “failure to pay,” you can use “nonpayment.” This substitution keeps the tone firm and concise. Another example is changing “you are required to” to “you must,” which delivers the message more directly. Similarly, replacing “any outstanding payments” with “unpaid balances” can streamline the communication. Adjusting sentence structure helps maintain engagement and clarity.

Eliminate vague language. Instead of overusing phrases like “in the event that,” use “if” for brevity. Simple phrasing ensures your message is clear and less formal, which is key in this context. Each phrase should carry weight and contribute to the goal of your intent to lien letter: securing payment.

Be mindful of word choice–use terms that convey urgency without overwhelming the reader. Opt for terms like “demand” or “request” when calling for action. Avoid unnecessary repetition of similar phrases to keep the letter impactful and to the point.