Accord and satisfaction letter template

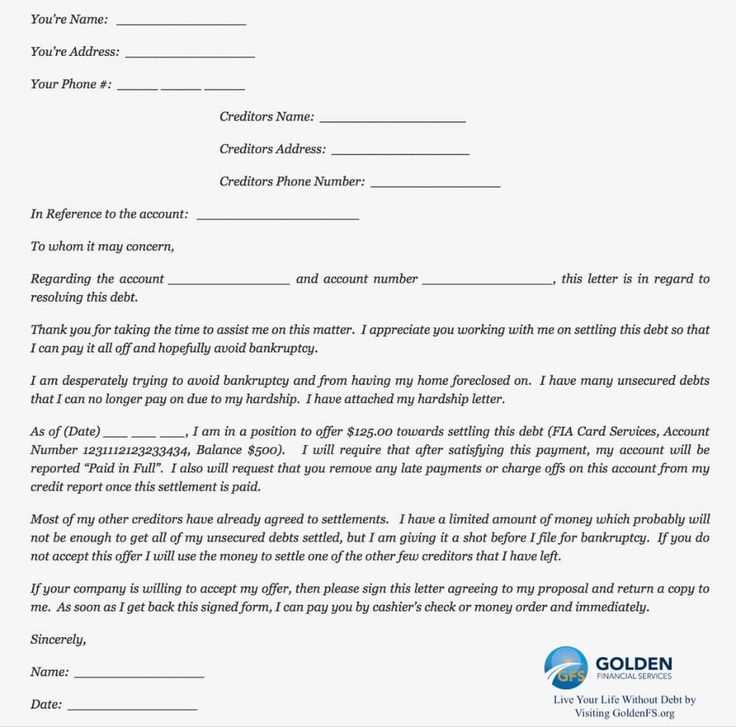

Use this Accord and Satisfaction Letter template to clearly document the resolution of a dispute or payment issue. The letter serves as confirmation that both parties have agreed to settle the matter, often by accepting a partial payment as full settlement of the debt. Make sure to customize the details to reflect your specific situation, including the parties involved, the amount paid, and the terms of the agreement.

Step 1: Begin with the date and the full names of both parties. Address the recipient by name and reference the specific issue being settled, such as the amount of debt, invoice number, or contract in question.

Step 2: Clearly state that the payment or action made will settle all obligations between the parties. Use language that indicates no further claims will be made once the payment is accepted. This provides clarity for both sides and ensures no misunderstandings arise after the agreement is reached.

Step 3: Conclude the letter by asking the recipient to confirm their understanding of the terms and provide their signature. This final step ensures both parties are on the same page and that the agreement is legally binding.

Here’s the Revised Version:

Ensure your Accord and Satisfaction letter is clear and precise. Start by stating the parties involved and the nature of the dispute. Then, outline the terms of the settlement agreement, including specific actions taken or remedies provided. It’s key to include both dates and signatures for authenticity.

Steps to Write the Letter:

- Identify the Dispute: Clearly state the issue that is being resolved.

- Specify the Agreement: List the exact actions taken to resolve the dispute.

- Include Dates: Provide the date the agreement was reached and any relevant dates for actions.

- Signatures: Both parties should sign and date the letter to confirm agreement.

The language should be formal but direct, leaving no room for ambiguity. When drafting, avoid using vague terms, and focus on what was agreed upon and the specific terms of resolution.

Things to Avoid:

- Avoid unnecessary legal jargon that might confuse the parties.

- Do not omit important details about the agreement’s execution.

- Ensure that both parties fully understand and agree with the terms before signing.

Once completed, ensure the letter is kept as part of your legal records. It serves as proof of resolution and can be used for future reference if needed.

- Accord and Satisfaction Letter Template

An Accord and Satisfaction Letter is a legal document used to settle a debt where both parties agree that a payment or action will fully satisfy the obligation, even if the agreed amount differs from the original debt. Below is a template you can adapt for your needs.

Start with the heading and date of the letter:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient’s Name]

[Recipient’s Address]

[City, State, ZIP Code]

Next, provide a brief introduction:

Dear [Recipient’s Name],

This letter serves as a formal agreement regarding the settlement of the debt of [$amount], owed by [debtor’s name]. We mutually agree to resolve this debt with the following terms:

Details of the Agreement:

| Debt Amount | Payment Amount | Payment Date | Other Terms |

|---|---|---|---|

| $[original debt amount] | $[settlement amount] | [payment date] | [specific terms of agreement] |

By signing this document, both parties agree that the settlement amount of [$amount] constitutes full and final payment of the debt, and no further claims or actions will be taken regarding this matter.

Please sign below to confirm your agreement:

[Your Name]

Signature: ____________________________

Date: ____________________________

[Recipient’s Name]

Signature: ____________________________

Date: ____________________________

This document becomes effective once signed by both parties and will serve as a complete resolution of the stated debt.

Begin by identifying the parties involved. Clearly state the names of the creditor and the debtor. Specify their roles in the agreement and make sure there’s no ambiguity about who is obligated to fulfill which part of the agreement.

Next, describe the original debt. Include the amount owed, the nature of the debt, and any relevant details such as the date the debt was incurred. This sets the context for the agreement and confirms what is being settled.

Then, outline the agreed-upon settlement terms. This is where you specify what the debtor will offer to satisfy the debt. It could be a reduced payment, a non-cash asset, or another form of consideration. Be clear about the value and any conditions attached to the offer.

Clearly state the exchange of consideration. In an Accord and Satisfaction, both parties must exchange something of value. Specify what the creditor receives and what the debtor gives, confirming that this satisfies the debt.

Include a release clause. Once the agreement is executed, both parties should release each other from further claims regarding the debt. The release should be specific, stating that the creditor waives any further rights to claim additional payments from the debtor regarding the settled debt.

Ensure the agreement is signed and dated by both parties. This final step formalizes the arrangement and ensures that both parties are bound by the terms. Signatures are a clear indication of mutual consent to the terms laid out in the agreement.

To ensure your Accord and Satisfaction letter is clear and legally binding, focus on these key elements:

1. Clear Identification of the Parties

Clearly state the names and roles of both parties involved, including the debtor and the creditor. This establishes who is agreeing to the terms and ensures that all individuals involved are properly identified in the agreement.

2. Details of the Debt and Dispute

Specify the original debt, including the amount owed and any previous agreements or disputes. Provide a brief summary of the issue being resolved. This gives context to the agreement and sets a clear understanding of the situation.

3. Description of the Consideration

Describe the specific action, payment, or goods being exchanged as part of the agreement. This is often a partial payment or another form of settlement that satisfies the original debt. Be detailed about what is being offered in return for the debt resolution.

4. Statement of Full Satisfaction

Include a clear statement that the debtor’s action (e.g., partial payment) will fully satisfy the debt. This helps avoid any future claims or confusion regarding the obligation. It should specify that no further claims will be made once the agreed terms are met.

5. Legal Language and Release of Claims

Make sure to include a release clause, confirming that once the agreed action is completed, the creditor will not pursue any further legal actions related to the debt. This gives both parties legal protection and closure.

6. Signatures and Dates

Include spaces for both parties to sign and date the agreement. This final step ensures that both parties have officially consented to the terms and provides a record of the date the agreement was made.

An accord and satisfaction can be used in debt settlement when there is a dispute about the amount owed, or when the debtor cannot fully pay the debt. It allows the debtor to offer a lesser sum or different terms to settle the debt, with the creditor agreeing to accept it as full payment. This method works best when both parties want to avoid lengthy litigation or other forms of dispute resolution.

It is a practical solution when the debtor is facing financial hardship but still wants to resolve the debt without going into default or bankruptcy. The creditor may agree to this arrangement if they believe it is more beneficial than pursuing further legal action or recovering nothing at all.

Use this option carefully; once the creditor accepts the offer, the original debt is considered settled, and the creditor cannot later claim the remaining balance. It is important for both parties to fully understand and agree to the terms, as this agreement is binding.

Misunderstanding the purpose of the agreement can lead to serious issues. Ensure that both parties agree on the intent of the document: to settle a disputed debt or obligation with a clear understanding of the terms.

- Ambiguity in the Terms: Avoid vague language that leaves room for interpretation. Define the agreed-upon amount and the conditions for satisfaction in specific terms. This will prevent misunderstandings later on.

- Failure to Address Full Satisfaction: Both parties must clearly agree that the payment or performance under the accord completely satisfies the disputed claim. If not explicitly stated, a court may rule that the original obligation remains intact.

- Not Considering the Impact on Future Claims: If the agreement involves settling a debt, ensure it is clear that no further claims will be made regarding the same issue. Ambiguity may lead to additional disputes after the agreement is signed.

- Inadequate Signatures or Witnesses: Missing or improper signatures can render the agreement unenforceable. All parties involved must sign the document, and if necessary, have it witnessed or notarized to ensure its validity.

- Ignoring State-Specific Laws: State laws regarding accord and satisfaction can vary significantly. Be sure the agreement complies with the legal requirements in the jurisdiction where it is being executed.

- Assuming Unilateral Acceptance: Both parties must reach a mutual agreement. If one party attempts to impose terms or assumes the other party will accept them without negotiation, the agreement could be invalid.

- Not Reviewing Previous Agreements: Before drafting, review any prior contracts or agreements related to the dispute. If the new agreement contradicts or ignores previous terms, it could create additional legal issues.

To validate an accord and satisfaction, both parties must meet specific legal requirements. Here are the key points to ensure the agreement is enforceable:

- Mutual Agreement: Both parties must voluntarily consent to the terms of the accord and satisfaction. Any coercion or fraud renders the agreement void.

- Consideration: There must be an exchange of value. One party offers something of value in return for the other party agreeing to a new arrangement or payment.

- Discharge of Original Obligation: The original contract or debt must be settled through the new agreement. The accord serves as a substitute for the original obligation.

- Clear and Definite Terms: The terms of the new agreement must be clear and specific. Vague terms or ambiguity could invalidate the agreement.

- Written Agreement: While oral agreements can be binding, having a written document helps in proving the terms and intentions of both parties in case of future disputes.

- Competence of Parties: Both parties must be legally capable of entering into a contract. If one party is a minor or lacks mental capacity, the accord may not be valid.

Before finalizing an accord and satisfaction, it’s advisable to consult with a legal professional to confirm that all conditions are properly met. This ensures that the agreement holds up in court if challenged.

Creating a clear and precise Accord and Satisfaction letter is key to resolving disputes and formalizing agreements. Here are examples of templates that you can customize for your specific needs. These templates cover various situations where an agreement has been reached to settle a debt or claim through an alternative form of payment or compromise.

Simple Accord and Satisfaction Template

This template is ideal for situations where a debtor agrees to settle an outstanding balance with a one-time payment or other agreed-upon terms. It’s concise and direct:

Accord and Satisfaction Agreement

This Agreement is made on [Date], between [Creditor’s Name], hereafter referred to as “Creditor,” and [Debtor’s Name], hereafter referred to as “Debtor.” The Debtor acknowledges owing a debt in the amount of [Original Debt Amount], and the Creditor agrees to accept [Payment Amount or Other Settlement] as full satisfaction of the debt. The Debtor will make the payment on or before [Payment Date].

Signatures:

Creditor: ___________________________

Debtor: _____________________________

Extended Accord and Satisfaction Template

This extended template is suitable for more complex settlements where multiple terms are involved. It ensures that both parties have clear expectations and outlines the steps involved in fulfilling the agreement:

Accord and Satisfaction Agreement

This Agreement is entered into on [Date], by and between [Creditor’s Name], hereafter referred to as “Creditor,” and [Debtor’s Name], hereafter referred to as “Debtor.” The Debtor acknowledges an outstanding balance of [Original Debt Amount]. The Creditor and Debtor have mutually agreed to settle the debt under the following terms:

- Payment of [Agreed Amount] to be made by [Payment Date].

- The Debtor shall also provide [Additional Terms, if applicable].

- Once the agreed amount is paid, the Creditor will consider the debt fully satisfied and waive any remaining balance.

The terms outlined in this Agreement are binding on both parties. No further claims will be made regarding this debt after full payment is received. Any breach of the terms will nullify this agreement.

Signatures:

Creditor: ___________________________

Debtor: _____________________________

Each of these templates can be tailored to the specific details of your case. Adjust the terms to reflect the payment methods, dates, and amounts that best fit the situation. Clear documentation ensures that both parties understand their obligations and protects everyone involved from future disputes.

Accord and Satisfaction Letter Template

To create a clear and concise Accord and Satisfaction letter, remove any redundant phrases while maintaining clarity and structure. Start by stating the agreement between the parties, specifying the obligations that were met, and confirming that both sides are satisfied with the arrangement. Use the following template as a guide:

| Section | Content |

|---|---|

| Header | Include your name, address, and contact details, along with the recipient’s information. |

| Introduction | State the purpose of the letter: to confirm the accord and satisfaction reached between both parties. |

| Agreement | Describe the original obligation and the new terms of the agreement. Include the specifics of the settlement. |

| Consideration | Clarify what was given in exchange for the agreement. Mention the exact terms for satisfaction. |

| Conclusion | End by confirming that the matter has been resolved and that both parties are satisfied with the terms. |

Be sure to avoid unnecessary information, focusing only on the facts and specifics of the agreement. The letter should leave no room for confusion, ensuring that both parties are clear on their obligations and the settlement terms.