Ach payment letter template

If you’re preparing an ACH payment letter, clarity and simplicity are key. Begin by including the payment amount, the recipient’s details, and the date of the transaction. Be sure to clearly state the reason for the payment to avoid any confusion on both ends.

Start with clear and concise information: Begin by addressing the recipient directly and stating the payment purpose. This will help the recipient understand the context right away. Include any reference numbers or transaction IDs to help track the payment process.

Be specific about payment terms: It’s important to specify when the payment will be processed and any relevant deadlines. Highlight any special instructions or conditions tied to the payment to ensure both parties are aligned on expectations.

End the letter by confirming your contact information for any follow-up questions. Keep your language professional but friendly, ensuring that the recipient feels confident in the details provided.

Here’s a detailed plan for an informational article on the topic “ACH Payment Letter Template,” with 6 practical, focused subheadings. The article is structured in HTML format using the

Start with a brief description of what an ACH payment letter is. Explain that it serves as a formal communication to notify a recipient about an ACH transaction. Mention its purpose in confirming transaction details and ensuring transparency between parties involved.

1. What is an ACH Payment Letter?

Clarify the function of an ACH payment letter. It is used to confirm that an ACH payment has been processed. This letter includes essential transaction details, such as the payment amount, date, and sender’s information. It’s commonly used for business-to-business transactions, payroll, or bill payments.

2. Key Elements to Include in an ACH Payment Letter

List the critical components of the letter: the payment amount, transaction date, sender and recipient details, and the reason for the payment. Make sure to note that clear and concise information should be provided to avoid any confusion. Adding transaction reference numbers can help in tracking payments.

3. How to Format an ACH Payment Letter

Provide a step-by-step guide to structuring the letter. Start with a formal greeting, followed by the body, which should mention the transaction details. Conclude with a polite sign-off. Use a professional tone throughout the letter and ensure that all relevant details are easily identifiable.

4. Common Mistakes to Avoid

Warn against common mistakes such as omitting important transaction details or using an informal tone. Also, emphasize the importance of double-checking payment amounts and recipient details to avoid errors. Ensure that the letter is clear and easy to read.

5. ACH Payment Letter for Different Scenarios

Offer examples of how the letter can be tailored for various situations, such as business payments, payroll disbursements, or loan payments. Each scenario may require slight adjustments in the language or additional details to meet specific needs.

6. Conclusion: Why Using a Template Helps

Summarize the advantages of using a template for ACH payment letters. Highlight that templates ensure consistency, save time, and reduce the chances of forgetting critical details. Encourage readers to keep the template professional and customizable for different payment scenarios.

Understanding the Basics of ACH Payments

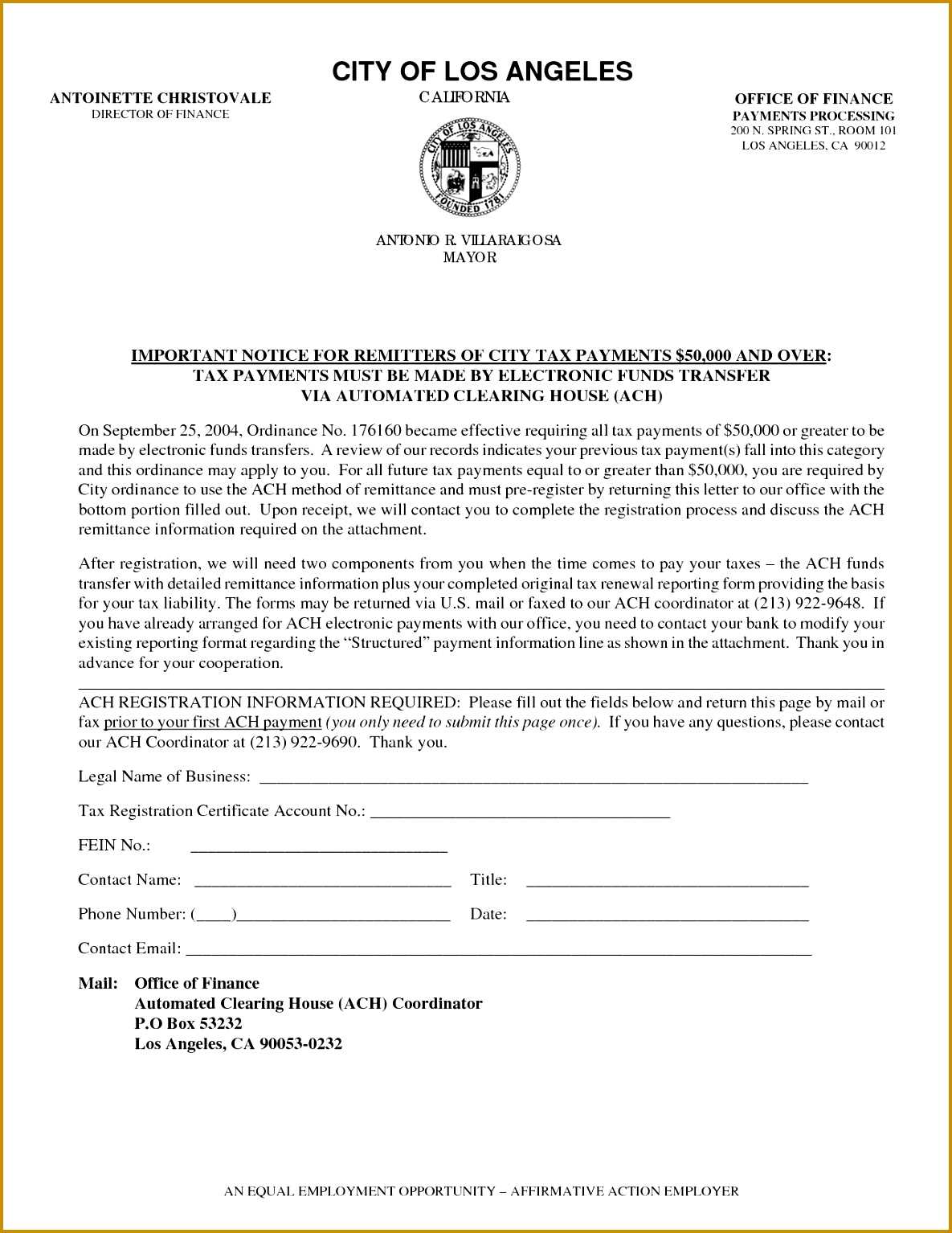

ACH payments are a simple and reliable way to transfer funds electronically. They work by routing funds between bank accounts through a network known as the Automated Clearing House (ACH). This method allows both personal and business transactions to be completed quickly without the need for paper checks or manual intervention.

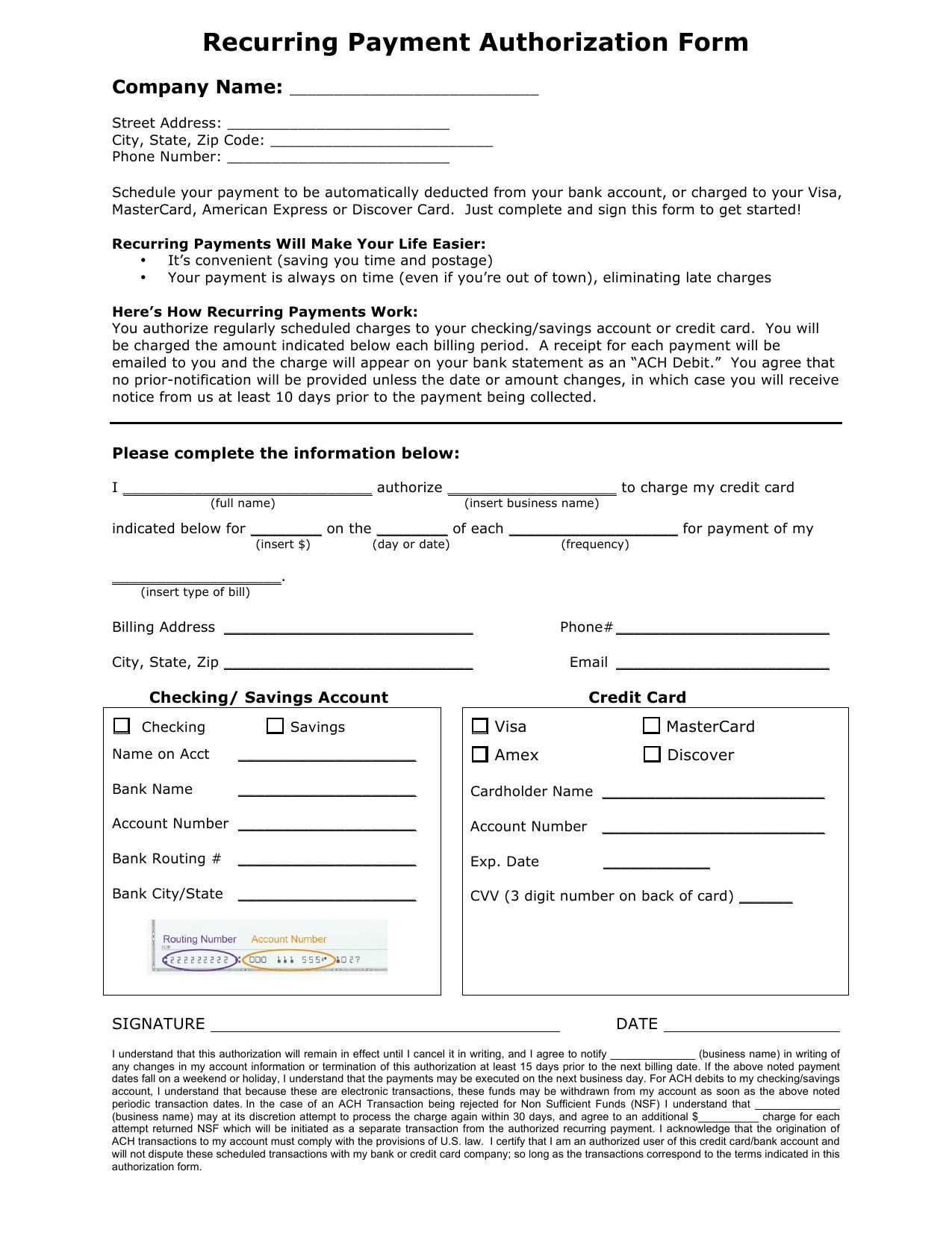

To initiate an ACH transfer, both the sender and receiver need to provide their bank account details, including routing and account numbers. These payments can be scheduled for one-time or recurring transactions, making them ideal for automatic bill payments or payroll deposits.

The processing time for ACH transfers typically ranges from one to three business days, depending on the transaction type and the banks involved. It’s worth noting that while ACH payments are secure and cost-effective, they are not as instantaneous as wire transfers or credit card payments.

Businesses and individuals appreciate ACH payments for their low transaction fees and the convenience of automating recurring payments. However, it’s crucial to ensure that all account details are accurate to avoid delays or errors in the payment process.

Key Components of an ACH Payment Letter

Each ACH payment letter must clearly define the key details of the transaction. Here’s what to include:

- Sender Information: Specify the full name or business name, address, and contact details of the payer. This information confirms the identity of the individual or organization initiating the payment.

- Recipient Information: Include the name, address, and payment details (such as bank account number and routing number) of the payee. This ensures the payment reaches the correct account.

- Payment Amount: Clearly state the exact sum to be transferred. Make sure this amount matches what was agreed upon in any prior communication or contract.

- Payment Date: Include the date when the payment is to be processed. This helps avoid confusion and sets expectations for both parties.

- Payment Method: Clearly identify that the payment is being made via ACH, specifying the method (e.g., direct deposit, electronic transfer) to avoid ambiguity.

- Authorization: Provide a statement confirming that the sender authorizes the payment and acknowledges the terms of the transaction.

Optional Details

- Reference Number: Adding a reference number or invoice number can help track the payment and link it to a specific account or purpose.

- Notes or Memo: If applicable, include any additional instructions or details that may help the recipient identify or apply the payment correctly.

By including these components, you ensure that the ACH payment letter is both clear and legally sound.

How to Draft a Payment Letter for Vendors

Begin with a clear subject line that directly reflects the purpose of the letter, such as “Payment for Invoice #12345”. This sets the tone for the reader and avoids any ambiguity about the content.

In the opening, state the reason for the letter. Mention the invoice number, date of the invoice, and the amount owed. Make sure this information is accurate to prevent confusion. For example: “We are writing to confirm the payment for invoice #12345, dated January 15, 2025, in the amount of $1,000.”

Next, confirm the payment method and any relevant details. If a check or wire transfer was made, specify the method, amount, and date. For example: “The payment of $1,000 was processed via wire transfer on January 20, 2025, to your bank account as per the details provided.”

Be sure to include any necessary reference numbers or transaction IDs to ensure that the payment is properly identified. If the payment is being made via ACH, you could write: “The payment has been processed under ACH transaction ID: 987654321.”

If there are any discrepancies or adjustments (e.g., partial payment or late fees), address them clearly and professionally. Keep this section concise and factual: “Please note that this payment covers 50% of the total amount, as per our agreement. The remaining balance will be settled by February 15, 2025.”

Finally, close the letter with a polite statement of thanks, expressing appreciation for the vendor’s cooperation. For instance: “Thank you for your prompt service and continued partnership. Should you have any questions regarding this payment, feel free to contact us.”

Finish with a closing phrase, such as “Sincerely,” followed by your name, job title, and company information to provide clarity and professionalism.

Common Mistakes to Avoid When Writing ACH Letters

Always verify that you have the correct bank account details before submitting any ACH request. A small error in account numbers can cause delays or rejection of the transaction. Double-checking routing numbers and account names is crucial.

Clearly specify the amount to be transferred. Ambiguous or incomplete payment instructions can create confusion and lead to disputes. Include both the dollar amount and any relevant transaction reference to prevent misunderstandings.

Avoid using vague or overly complicated language in the body of the letter. Stick to clear, concise wording to ensure the reader understands the purpose of the letter without unnecessary elaboration.

Don’t forget to include the correct date and signature. Without these, your ACH letter may be deemed invalid or incomplete. Ensure all dates are accurate to avoid issues with processing the payment on time.

Keep track of the format. Using non-standard formats for ACH letters can slow down the processing time. Adhering to recognized structures ensures smooth transactions and prevents administrative delays.

Never leave out the reason for the payment. Whether it’s for services, goods, or another purpose, the ACH letter should specify the purpose to avoid complications with the receiving party or the bank.

Legal Considerations in ACH Letters

ACH letters must comply with specific regulations to ensure smooth and lawful processing of payments. Begin by including a clear and concise statement about the terms of the transaction. This includes the payment amount, recipient’s bank details, and the date of transfer. Ensure the letter is signed by an authorized individual to validate the instructions.

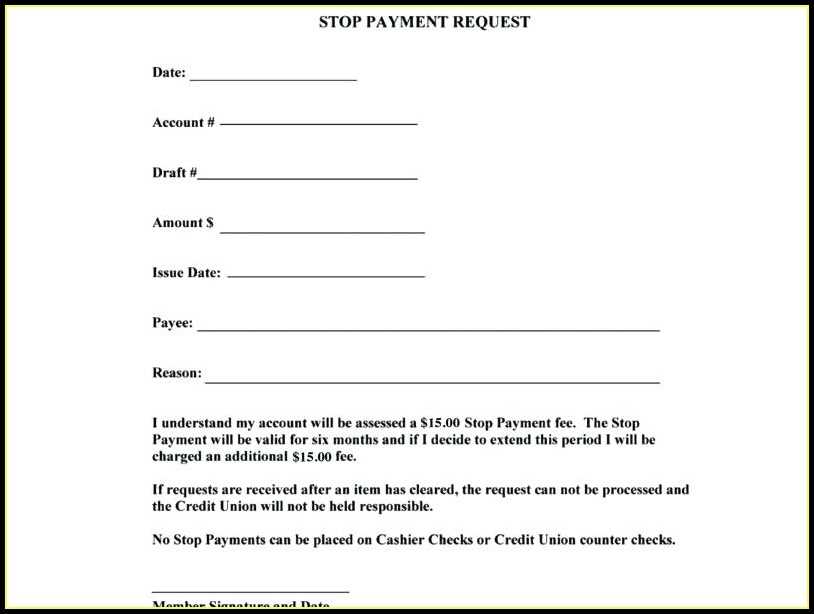

Authorization Requirements

To avoid legal disputes, obtain proper authorization from the payer before initiating the ACH transfer. This could include a signed agreement or consent form, outlining the payment details and the payer’s intention to proceed. Always keep a copy of the authorization for your records, as it serves as proof in case of any legal issues.

Dispute Resolution and Liabilities

In case of a dispute over an ACH payment, both parties should be aware of their rights and responsibilities under the NACHA rules. Make sure to include a section detailing how any potential disputes will be handled. Clarify who bears the liability in the event of incorrect payments, fraud, or technical errors.

Best Practices for Sending ACH Payment Letters

Ensure that the ACH payment letter includes all necessary details clearly. Start by confirming the recipient’s full name, address, and payment information. Avoid ambiguity in transaction details such as the amount and due date.

Double-check all figures before sending. Mistakes in payment amounts or account numbers can delay the process and cause confusion. Verify the routing and account numbers with the payer’s bank to minimize errors.

Be direct and concise in the letter’s language. Eliminate unnecessary information and focus on what the recipient needs to know to process the payment correctly. Clear instructions on how to proceed with the payment help streamline the transaction.

Maintain professionalism in tone. Although the letter may be a formal document, ensure it’s approachable and respectful. This helps build trust and reduces the chances of miscommunication.

Below is a sample ACH payment letter template for reference:

| Field | Details |

|---|---|

| Recipient Name | [Full Name] |

| Payment Amount | $[Amount] |

| Due Date | [MM/DD/YYYY] |

| Bank Name | [Bank Name] |

| Account Number | [Account Number] |

| Routing Number | [Routing Number] |

Lastly, send the ACH payment letter in a secure manner. Use encrypted emails or other secure channels to protect sensitive payment information from being exposed to unauthorized individuals.