How to Use a Transunion Dispute Letter Template

When reviewing your credit history, it’s common to encounter inaccuracies that could affect your score and financial well-being. The process of addressing these discrepancies is essential to maintaining a healthy credit profile.

Taking action to rectify such issues involves formal communication with the credit bureaus, where you present your case for correction. This written correspondence plays a crucial role in initiating the review process and ensuring that any incorrect entries are properly examined.

In this guide, we’ll walk you through the necessary steps to draft a clear and effective communication, ensuring that all important details are included and increasing your chances of a successful resolution. Understanding how to structure your request can make a significant difference in how quickly and efficiently the matter is handled.

Transunion Dispute Letter Template Overview

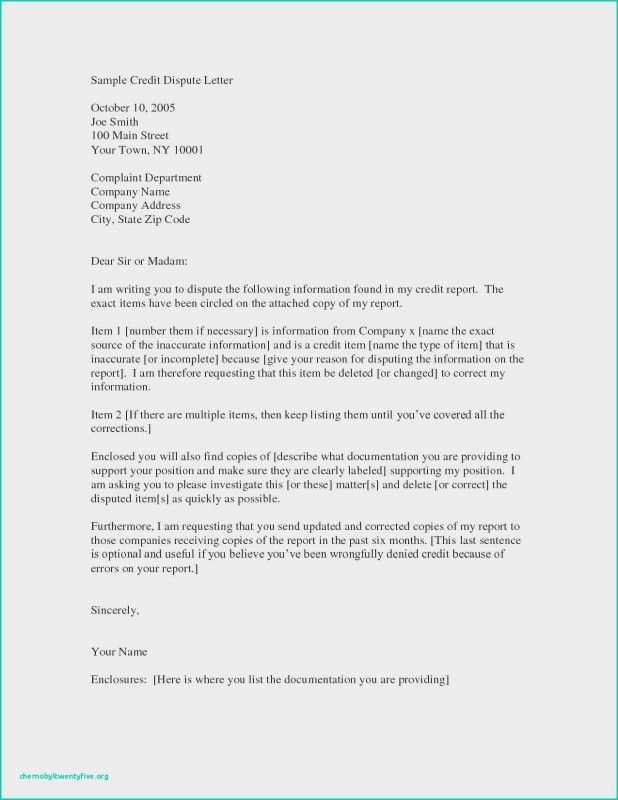

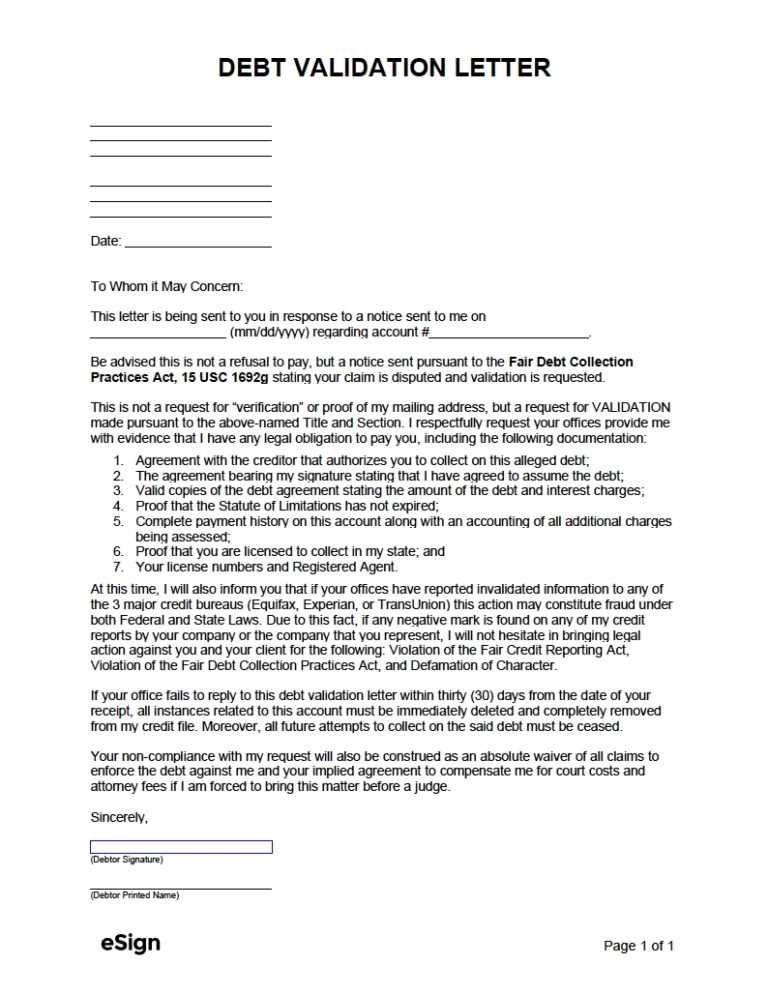

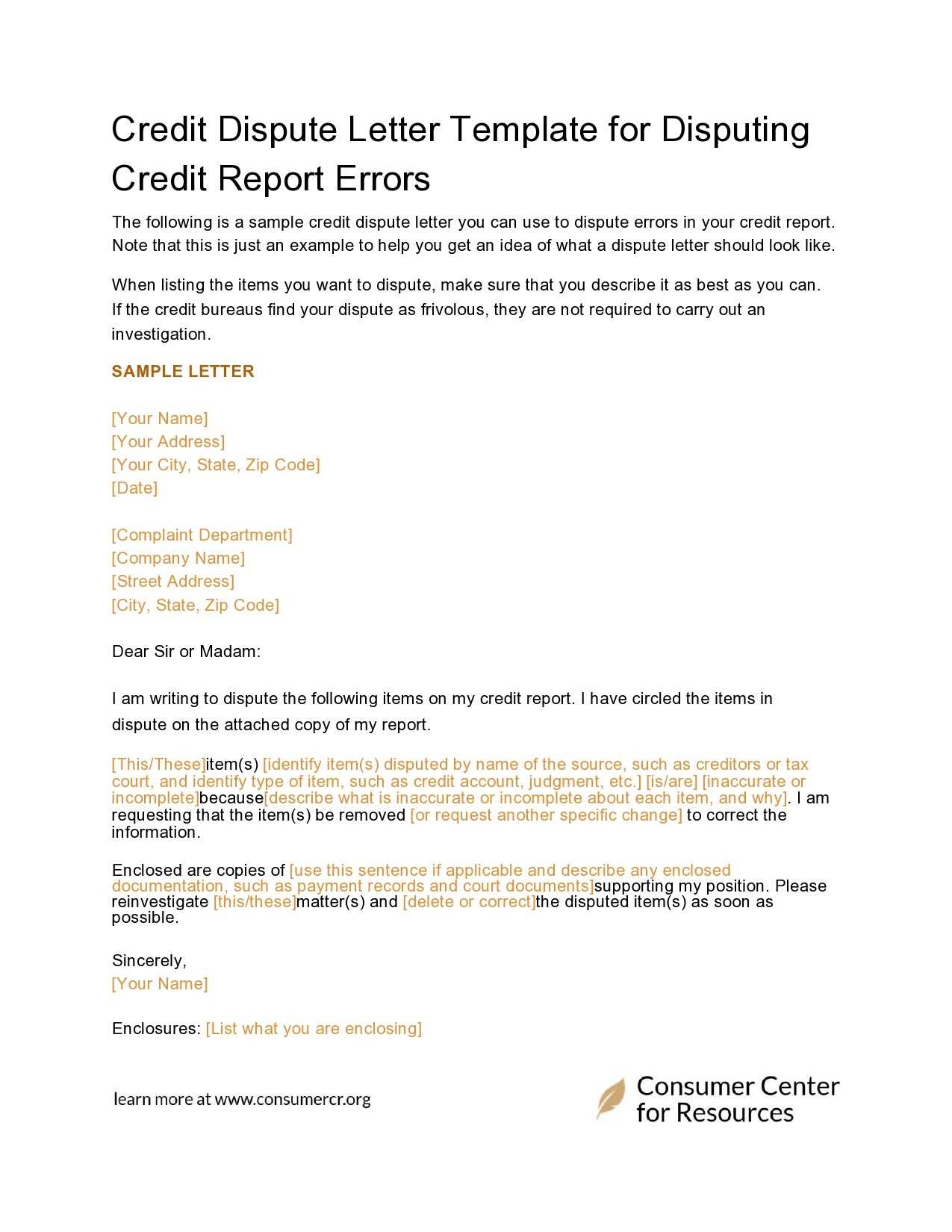

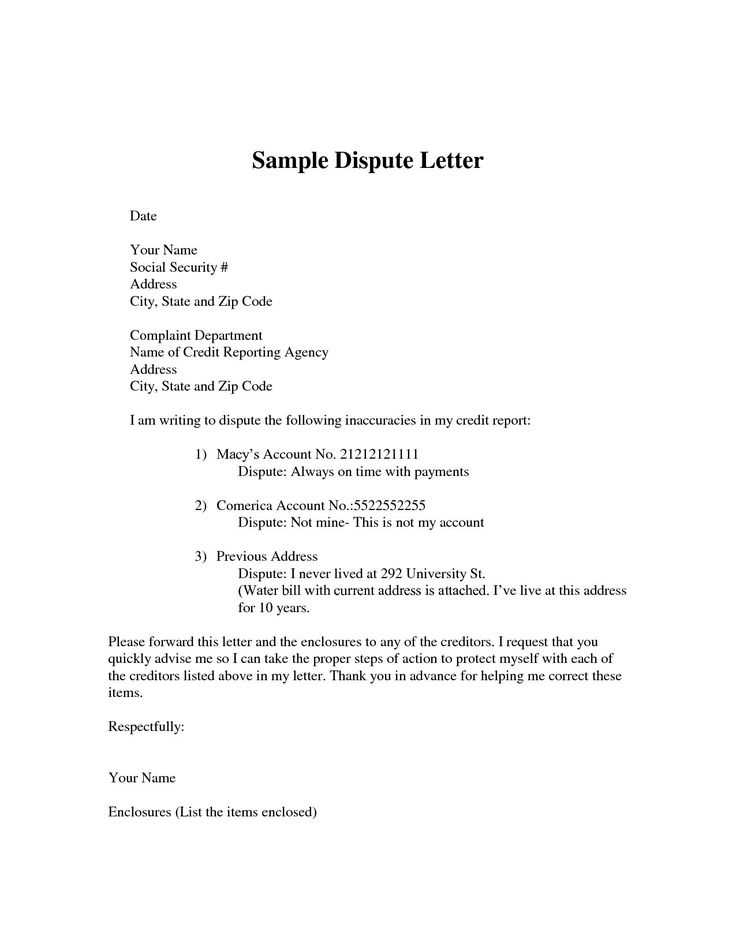

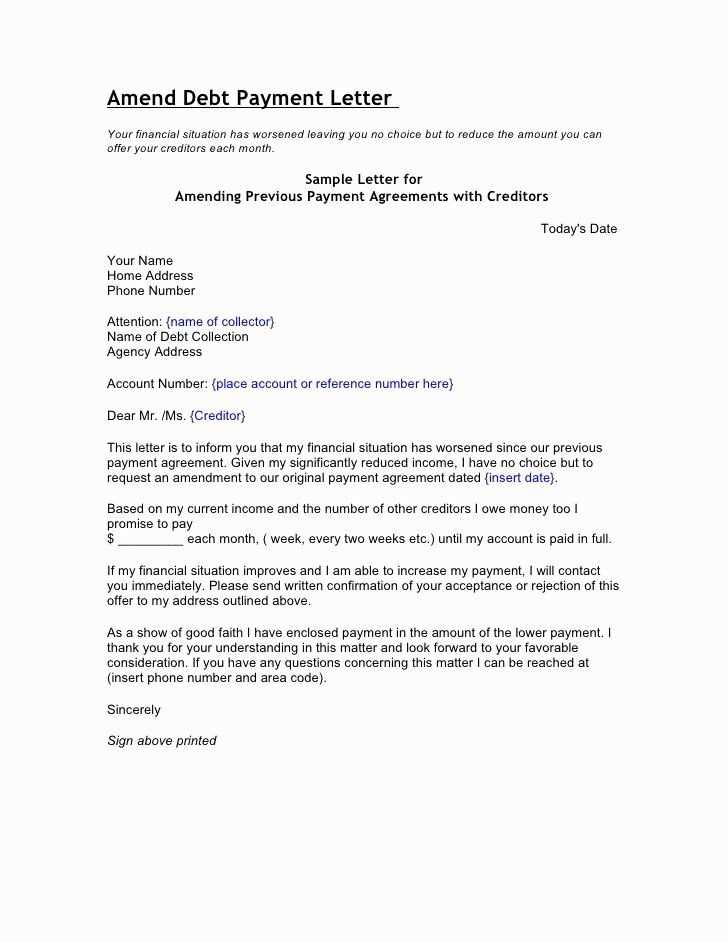

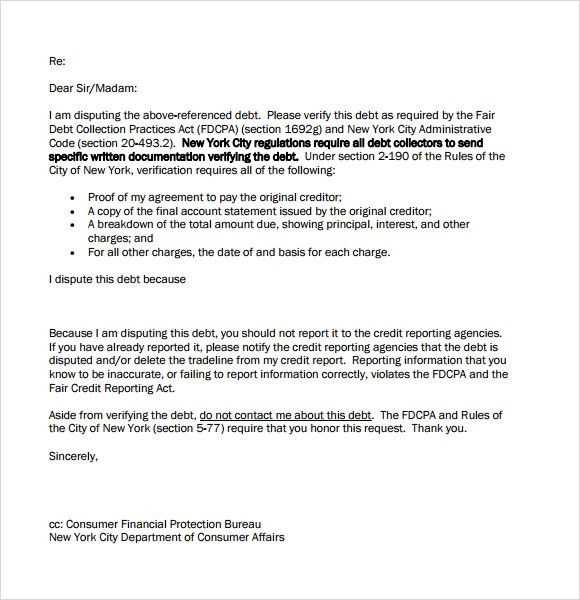

Correcting errors on your credit report requires a formal approach, where you outline the issues clearly and request a thorough review. This document serves as the primary method for communicating discrepancies to the relevant parties, aiming to resolve inaccuracies efficiently. Crafting an effective communication is key to ensuring your case is taken seriously and addressed promptly.

Essential Elements to Include

For a strong appeal, your correspondence should include key details such as the specific errors found, your personal information, and any supporting documentation that can verify your claims. A well-organized and concise request makes it easier for the recipient to understand the issue and act swiftly on it.

How to Structure Your Request

The structure of your communication should be clear and professional, beginning with a brief explanation of the error and followed by a request for rectification. Providing a step-by-step guide of the issue, along with a clear call to action, will ensure the recipient knows exactly what is being asked and how to proceed.

Understanding the Importance of Disputing Errors

Identifying inaccuracies in your financial records is a crucial step in maintaining your creditworthiness. Such mistakes, if left unaddressed, can lead to long-term consequences, including unfavorable credit scores and higher interest rates. Taking immediate action to correct these errors is vital to protecting your financial future.

Why Addressing Mistakes is Essential

Ignoring errors can have significant repercussions, including:

- Lowered credit scores

- Increased borrowing costs

- Difficulty obtaining loans or credit

By ensuring your credit information is accurate, you prevent these potential setbacks and improve your chances of favorable financial opportunities.

Steps to Effectively Correct Mistakes

Once you’ve identified an error, it’s important to follow a structured approach to correct it. Key steps include:

- Gathering necessary documentation

- Clearly outlining the issue

- Submitting your request to the appropriate party

Following these steps increases your chances of achieving a swift and favorable outcome, keeping your financial profile in check.

Key Components of a Dispute Letter

When addressing inaccuracies in your credit report, it is essential to communicate effectively with the relevant authorities. A well-constructed document serves as a formal request for correction and should include specific details to support your case. Including all necessary elements increases the likelihood of a swift and accurate review of your concerns.

Crucial Elements to Include

Your request should be clear and organized, containing the following key elements:

- Personal Information: Full name, address, and date of birth to verify your identity.

- Specific Errors: Clearly identify the inaccuracies or disputed items.

- Supporting Documentation: Include evidence that supports your claim, such as receipts, bank statements, or other relevant records.

- Requested Action: Clearly state what you expect to be corrected or investigated.

Proper Structure for Effectiveness

For maximum impact, your communication should follow a logical structure:

- Start with a brief introduction stating the purpose of the communication.

- Provide a detailed explanation of the error, backed by supporting documentation.

- Conclude with a request for action, including a reasonable time frame for response.

By organizing your correspondence thoughtfully and providing all the necessary details, you ensure that your concerns are taken seriously and processed promptly.

How to Customize Your Template

When preparing your formal request for correction, personalizing the document ensures that it addresses your specific concerns accurately. Customization allows you to present the unique details of your case in a clear and concise manner, increasing the effectiveness of your communication.

To properly tailor your request, consider adjusting the key sections based on your situation. Below is a guide to the elements that need personalization:

| Section | Customization Details |

|---|---|

| Personal Information | Include your full name, contact information, and any identification numbers as required for verification. |

| Discrepancy Description | Be specific about the issue you are addressing, including the exact entry or error in question. |

| Supporting Evidence | Attach any relevant documents, such as receipts or transaction records, that help prove your case. |

| Requested Action | Clearly state the changes you are requesting and provide a reasonable time frame for response. |

By carefully tailoring these sections to your individual situation, you ensure that your request is clear and compelling, improving your chances of a favorable resolution.

Common Mistakes to Avoid in Disputes

When addressing inaccuracies in your financial records, it’s important to approach the process with care. Making common mistakes can delay the resolution and even lead to the rejection of your request. Understanding and avoiding these pitfalls is essential for an efficient and effective process.

Common Pitfalls to Avoid

- Lack of Clarity: Failing to clearly explain the issue can lead to confusion and hinder your request. Make sure your explanation is direct and easy to understand.

- Incomplete Information: Providing insufficient details or missing documents can delay the process. Always ensure that all required information is included.

- Impolite or Aggressive Tone: A respectful and professional tone is key. Aggression or rudeness can harm your case and result in unnecessary delays.

- Failure to Follow Up: Not monitoring the progress of your request or failing to follow up can lead to missed opportunities. Stay proactive throughout the process.

How to Avoid These Mistakes

To increase the chances of a successful outcome, carefully review your communication before submitting it. Double-check that all information is accurate and complete, and ensure that you’ve presented your case in a calm, professional manner.

How Long Does the Process Take

The length of time it takes to resolve an issue with your financial records can vary depending on several factors. While some cases are resolved quickly, others may require more time due to the complexity of the situation or the need for further investigation. Understanding the typical time frame and factors that influence it can help you manage expectations and stay informed.

Generally, the process of reviewing and resolving inaccuracies can take anywhere from a few weeks to up to 30 days. In some cases, additional time may be required if the parties involved need to gather more information or documentation to support your claim.

To ensure timely resolution, it’s important to follow up periodically and provide any requested documents or clarification promptly. Staying proactive throughout the process can help prevent unnecessary delays.

When to Seek Professional Assistance

While many individuals can handle issues related to their financial records on their own, there are times when professional help may be necessary. If you encounter challenges or feel overwhelmed by the process, seeking assistance from an expert can help ensure a more efficient resolution.

Professional assistance is especially beneficial when the issue is complex, involves large amounts of documentation, or when previous attempts to resolve the matter have been unsuccessful. Experts can provide guidance, ensure that your case is handled appropriately, and help you navigate any legal or procedural obstacles.

If you’re unsure about how to proceed or need help crafting a persuasive communication, consulting a professional can save time and reduce stress. It’s also advisable to seek assistance if you suspect that the issue may have broader implications for your financial status or legal standing.