Agreement to Pay Letter Template for Payment Arrangements

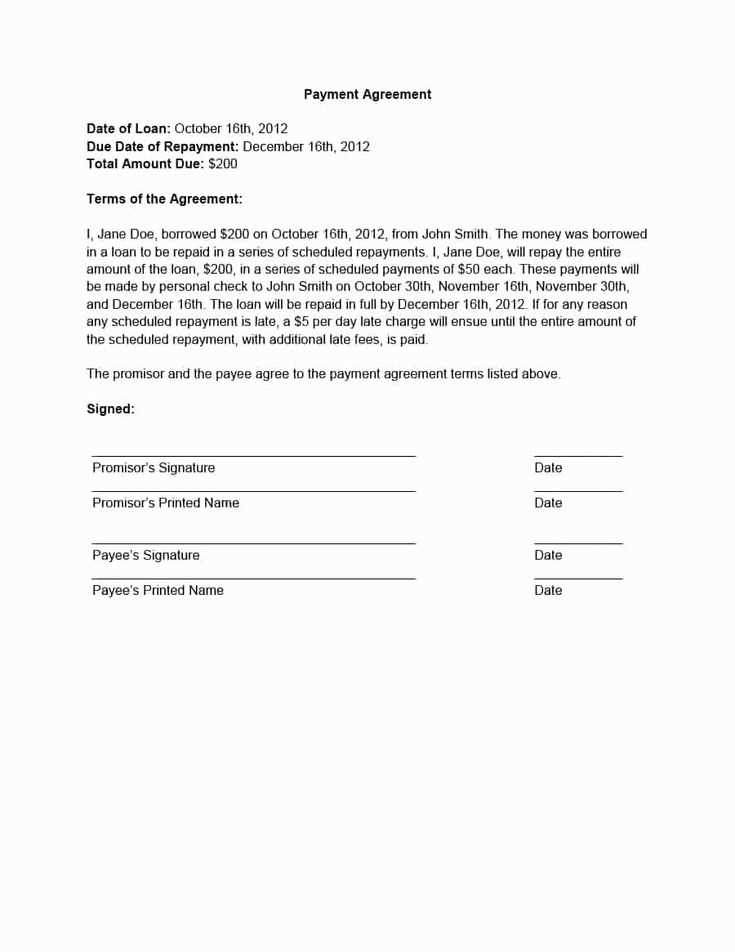

When facing financial difficulties, it’s essential to establish clear, formal arrangements for handling outstanding debts. Properly documenting these agreements ensures both parties are on the same page regarding terms, deadlines, and amounts. This approach not only promotes transparency but also reduces the likelihood of misunderstandings.

Creating a document that outlines the specifics of a repayment plan helps maintain professionalism and accountability. It provides a written record that can be referred to if any disputes arise in the future. Whether dealing with a creditor or a service provider, having this kind of formal communication is a key step in managing financial obligations effectively.

Knowing the right structure and components of such a formal document can make a significant difference in its effectiveness. This ensures the terms are clear and enforceable, offering protection to both the debtor and the lender.

Understanding the Importance of Payment Agreements

Formalizing financial arrangements with clear terms is crucial for ensuring both parties have a mutual understanding of their responsibilities. A well-structured document outlining repayment conditions creates a foundation for trust and minimizes the risk of disputes. It serves as a reference point in case of any confusion or disagreements about the terms set in place.

By establishing written commitments, individuals and businesses protect their interests and ensure accountability. This approach helps avoid unnecessary delays and misunderstandings, offering a sense of security to all involved. Clear documentation also provides legal clarity, making it easier to enforce agreed-upon terms if necessary.

Why You Need a Payment Agreement Letter

Having a formalized document to outline repayment terms is essential in managing financial obligations. This type of record provides clear communication between both parties, ensuring expectations are understood and respected. Without this written confirmation, misunderstandings can arise, potentially damaging relationships or complicating financial recovery.

Benefits of a Formalized Document

- Establishes clear terms and conditions for both parties.

- Reduces the risk of disputes by setting specific deadlines and amounts.

- Offers legal protection, ensuring that agreed-upon terms can be enforced if necessary.

- Improves transparency and accountability throughout the repayment process.

Consequences of Not Using a Formal Record

- Increased chances of confusion or miscommunication about repayment terms.

- Potential for strained relationships or loss of trust between the parties.

- Difficulty enforcing payment obligations without a formal document.

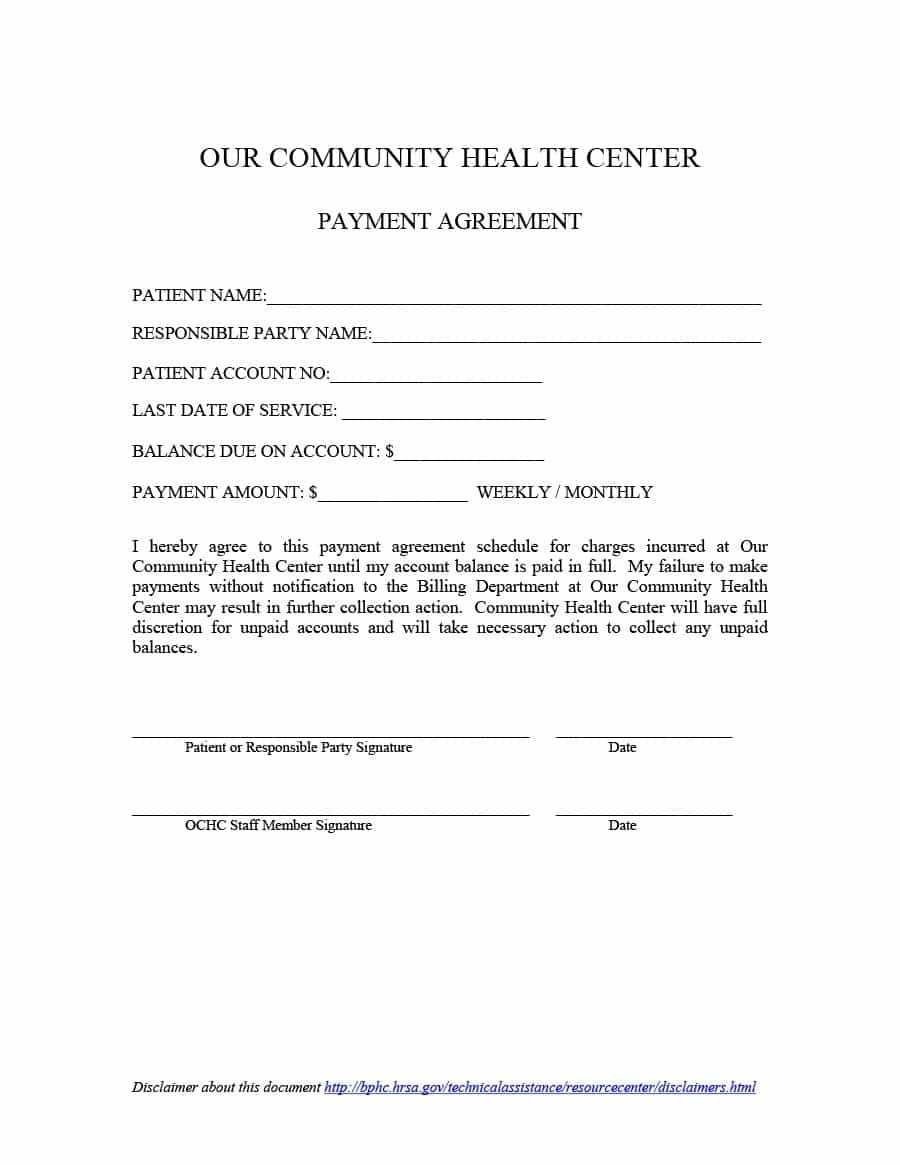

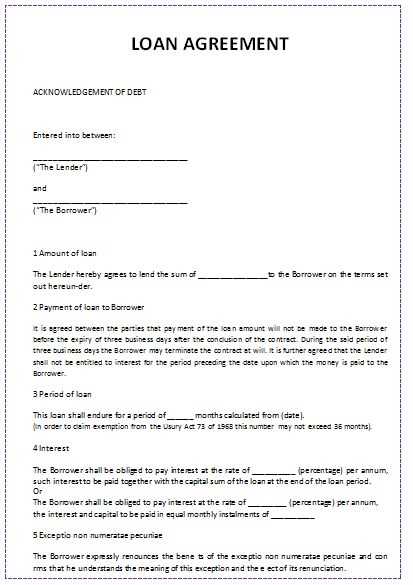

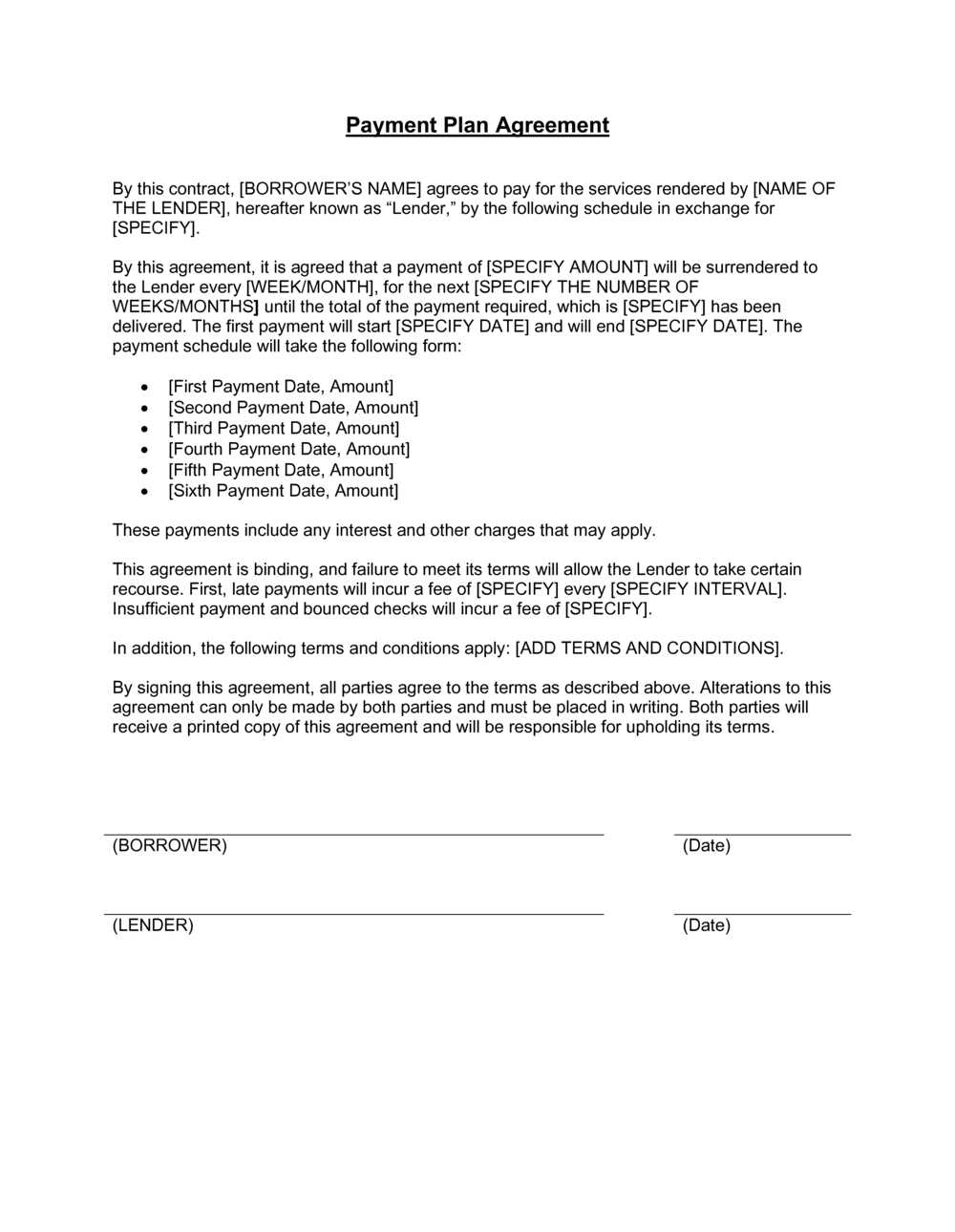

Key Components of a Payment Agreement

For a repayment arrangement to be effective, certain essential details must be included to ensure clarity and enforceability. The document should cover all aspects of the deal, leaving no room for ambiguity. These critical elements ensure that both parties are fully aware of their obligations and expectations.

| Component | Description |

|---|---|

| Parties Involved | Clearly identify the debtor and the creditor, including full names and contact details. |

| Amount Owed | State the exact amount to be repaid, including any interest or fees if applicable. |

| Payment Terms | Outline the frequency, method, and total number of payments, along with due dates. |

| Consequences of Non-payment | Describe the actions that may be taken if the terms are not fulfilled, such as legal steps or late fees. |

| Signatures | Ensure both parties sign the document, acknowledging their understanding and agreement to the terms. |

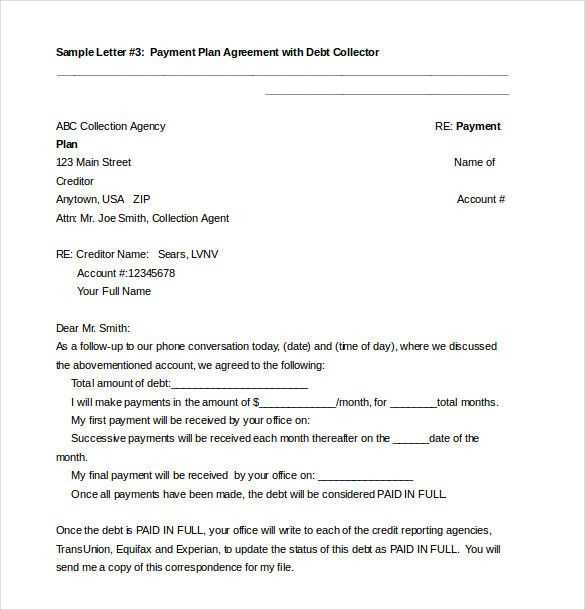

How to Structure an Effective Letter

When drafting a formal document to confirm repayment terms, clarity and organization are essential. A well-structured message ensures that both parties fully understand the terms and helps avoid confusion. The key is to present all necessary information in a logical, straightforward manner while maintaining a professional tone.

Start with a clear introduction that includes the purpose of the document. Begin by stating the amount owed and the intent to settle the debt under specific conditions. This establishes the tone and purpose right away.

Next, outline the specific repayment plan, detailing the amount of each installment, payment due dates, and the method of payment. Clearly list the responsibilities of both parties to prevent any ambiguity.

Conclude with a polite closing, reiterating the agreement and encouraging communication if necessary. This final section should leave no doubts about the next steps or the expectations from both sides.

Common Mistakes to Avoid in Letters

While drafting a formal document to outline financial arrangements, it’s easy to overlook important details that can lead to confusion or disputes. Making sure every element is correctly addressed will prevent unnecessary problems in the future. Awareness of common pitfalls can help in creating a clear and enforceable arrangement.

Vague or Ambiguous Terms

One of the most common mistakes is being unclear about the specific terms. Without precise details, such as payment amounts, deadlines, and methods, the recipient may have a different understanding of what was agreed upon. Always ensure that each aspect is well-defined to avoid confusion.

Failing to Include Contact Information

Omitting contact details can complicate communication if any issues arise. It’s essential to include both parties’ names, addresses, phone numbers, and email addresses. This ensures that all parties are reachable if any clarification or follow-up is needed.

Tips for Clear and Professional Communication

Effective communication is crucial when formalizing financial terms. A well-crafted message not only ensures that all details are clearly understood but also maintains professionalism and respect between both parties. By following a few simple guidelines, you can ensure that your document serves its intended purpose without causing confusion or misunderstandings.

Be Concise and Direct

Keep the message brief and to the point. Avoid unnecessary jargon or complicated phrasing. Stick to the facts, outlining the most important details without over-explaining. This helps prevent the recipient from feeling overwhelmed or confused.

Maintain a Polite and Respectful Tone

Even though the document may involve financial obligations, it’s important to maintain a courteous tone throughout. A respectful and professional manner helps in keeping the communication positive, which is vital in maintaining healthy relationships between all parties involved.

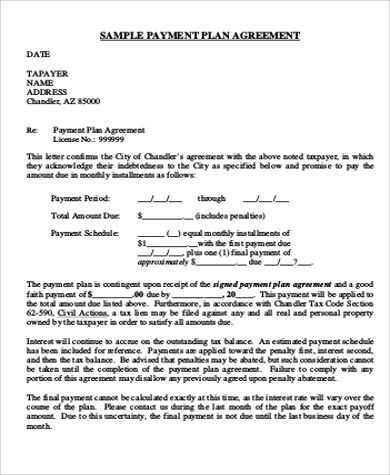

Legal Considerations When Drafting Letters

When drafting a formal document to outline financial commitments, it’s important to consider legal implications. A well-constructed document not only ensures clarity but also provides legal protection for both parties involved. Understanding the key legal aspects can help avoid disputes and ensure that the terms are enforceable if necessary.

Ensure Compliance with Relevant Laws

Make sure that the content adheres to local laws and regulations. This may include requirements for written contracts, interest rates, and other financial terms that must be legally compliant. Failing to follow legal standards can invalidate the document or lead to complications down the line.

Include Enforceable Terms

Clearly outline the obligations and penalties for non-compliance. This helps to ensure that the terms are enforceable in a court of law if necessary. Having well-defined clauses regarding late fees, legal action, or other consequences protects both parties in case of a breach.