Auto Loan Pre Approval Letter Template Guide

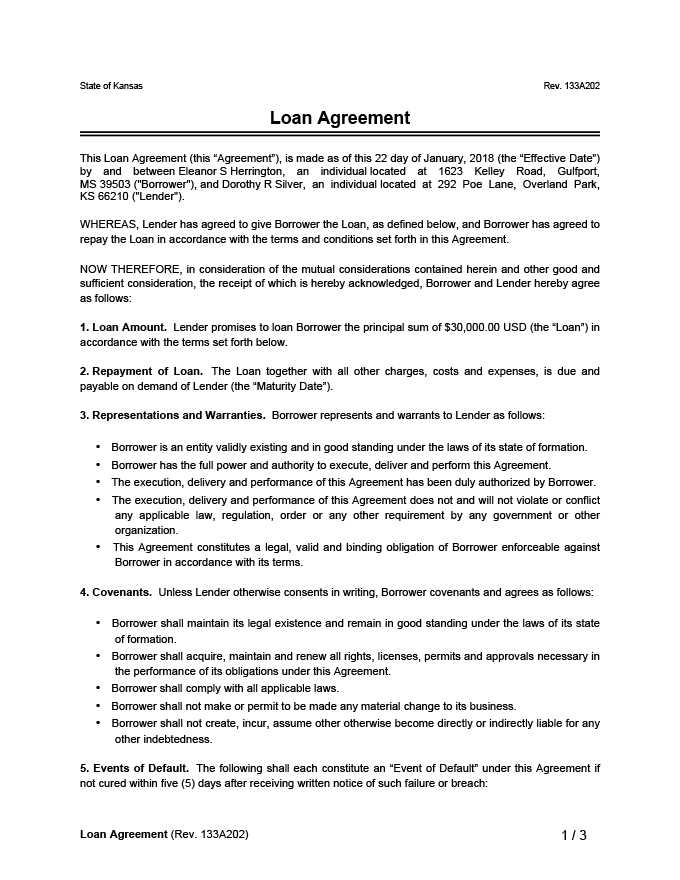

Securing financial backing for purchasing a vehicle often starts with a formal document that outlines your eligibility for borrowing. This essential piece of paperwork gives both lenders and borrowers a clear understanding of the terms and conditions involved in the financing process. Having this document in hand before shopping for a car can make a significant difference in how smooth and quick the process will be.

Key Details to Include in the Document

When crafting your approval document, it’s crucial to include specific information that ensures the lender understands your financial situation and eligibility. Below are some important points to consider:

- Personal Information: Your full name, contact details, and employment status.

- Credit Information: A summary of your credit history and score.

- Financial Details: The amount you wish to borrow, along with the expected interest rates.

- Duration: The period you intend to repay the amount borrowed.

Why It Is Important

Having a formal agreement in place before you begin shopping can provide several advantages. It signals to sellers that you are serious and financially capable of making a purchase. It also enables you to stick to a budget, as you’ll know exactly how much you can borrow.

How to Personalize the Document

Customizing your financing document to reflect your unique needs can help streamline the process. Make sure to include any specific terms or conditions that apply to your situation. This may include details such as down payments, trade-in values, or any specific requirements for the lender.

Common Mistakes to Avoid

While creating the document, there are some common errors you should watch out for to avoid delays or confusion later in the process:

- Incorrect Information: Ensure all personal and financial details are accurate and up to date.

- Unrealistic Terms: Make sure the terms of repayment are feasible for your financial situation.

- Missing Documentation: Double-check that all supporting documents are included with your application.

Improving Your Chances of Success

To increase the likelihood of a positive response, ensure that your document is clear, well-organized, and complete. A concise yet comprehensive document that meets all of the lender’s criteria will stand out and speed up the approval process.

Understanding the Financing Document Process

When seeking funding for a vehicle purchase, a vital document outlines your eligibility and borrowing capacity. This paperwork sets the foundation for securing funds and helps both parties understand the terms before proceeding. A well-prepared document can simplify the entire process, making it faster and more straightforward.

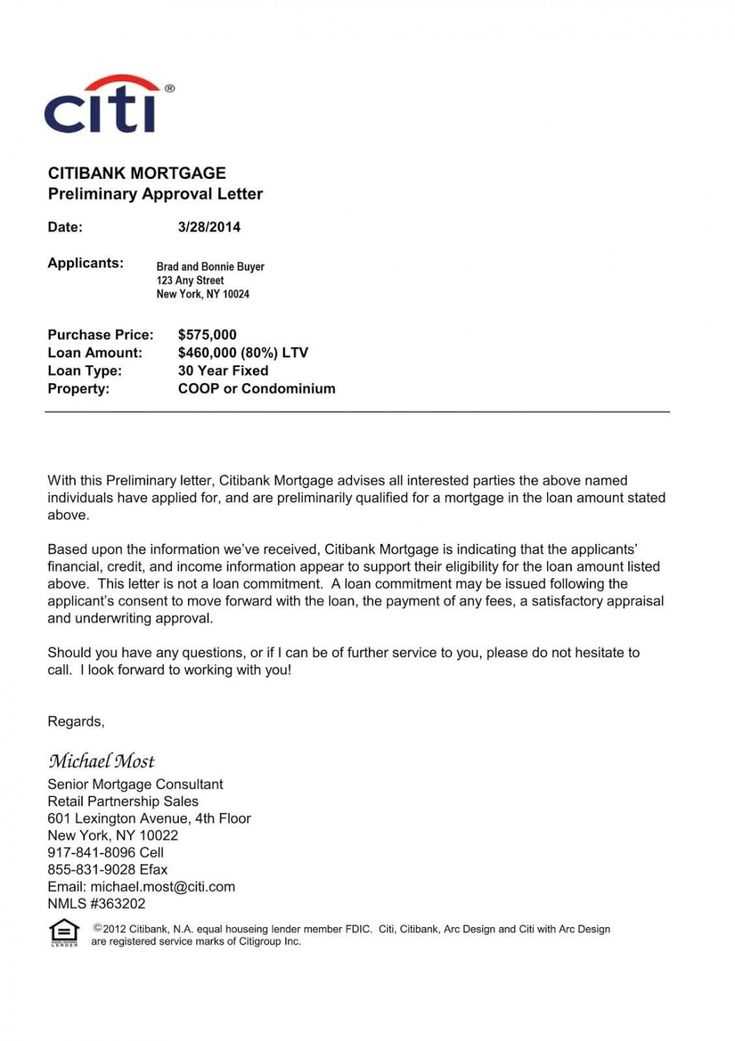

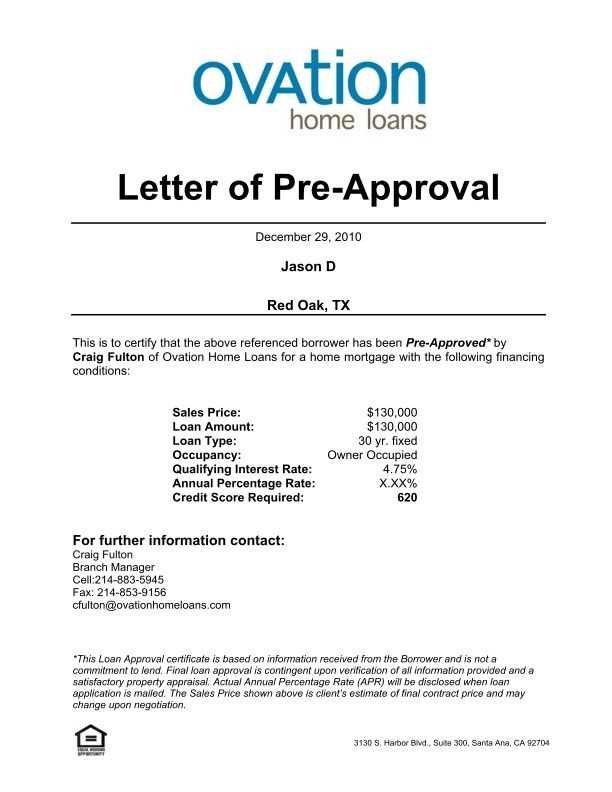

What Does the Document Entail?

The main purpose of this document is to provide a lender with the necessary details about your financial status. It includes personal, credit, and income information, which helps the lender assess your suitability for the financing agreement. It also specifies the amount you intend to borrow and the agreed repayment schedule.

Key Information to Include

For the document to be effective, certain information is essential:

- Personal Data: Your full name, address, and contact details.

- Credit and Financial History: An overview of your creditworthiness and past financial behavior.

- Requested Amount and Terms: The desired borrowing sum and repayment conditions.

Providing complete and accurate details ensures that the document is ready for processing without unnecessary delays.

Why It’s Beneficial for Buyers

Having a solid financial document in place before shopping for a vehicle helps buyers in multiple ways. It enables you to narrow down your options by establishing a clear budget and prevents you from exceeding the amount you can afford. Moreover, it increases your chances of securing a better deal, as sellers see you as a serious and qualified buyer.

Adjusting the Document for Your Needs

It’s important to tailor the document to reflect your unique financial situation. Adjustments might include adding specific terms, such as a trade-in vehicle or a larger down payment. Customization ensures that the terms align with your goals and financial capacity.

Avoiding Common Pitfalls

To make sure the document is processed smoothly, avoid these common errors:

- Incorrect Details: Double-check all personal and financial information to avoid discrepancies.

- Unrealistic Terms: Ensure the borrowing amount and repayment period are reasonable and manageable.

- Missing Documents: Include all necessary supporting documents, such as proof of income or identification.

Enhancing Your Chances for Approval

Maximize your chances of receiving a positive response by keeping your document clear, concise, and accurate. The more straightforward the process, the quicker the lender can assess your application, leading to a faster and smoother transaction.