Bank Details Letter Template for Secure Transactions

htmlEdit

When it comes to managing financial transactions, proper documentation is crucial for ensuring transparency and security. It’s important to provide clear and accurate records when sharing sensitive monetary information with others. This document serves as a vital tool in confirming the necessary specifics for processing payments or setting up transfers between parties.

Crafting an effective communication can help minimize misunderstandings and errors. A well-structured form or notification ensures all the necessary information is provided in a concise and organized manner. Understanding how to create such a written statement can significantly enhance the professionalism of your correspondence.

By carefully including essential elements, individuals can protect themselves from potential issues while maintaining efficiency. A well-prepared notification can help prevent delays or complications during financial dealings, making it an invaluable resource for both personal and business transactions.

htmlEdit

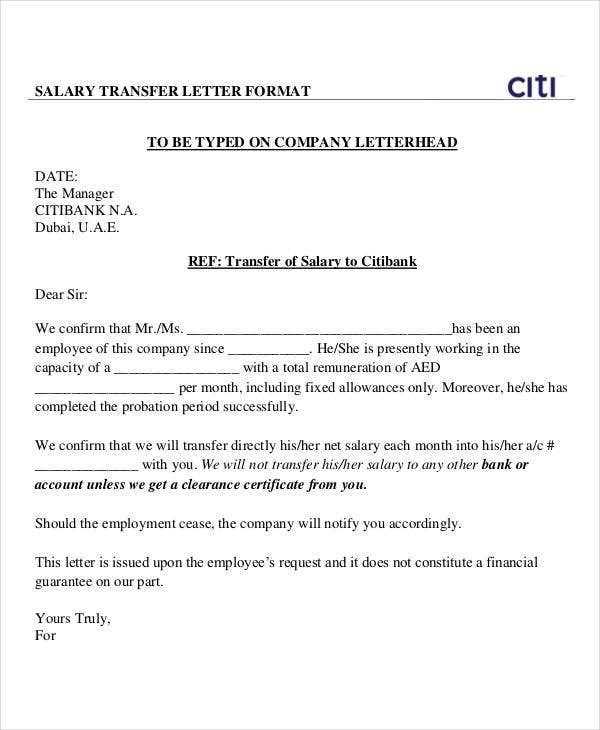

Understanding the Purpose of a Financial Communication

Effective communication of monetary specifics plays a key role in smooth transactions. Ensuring that all required data is properly shared with the recipient can prevent unnecessary delays and misunderstandings. Clear instructions and structured information are critical when it comes to ensuring payments are processed correctly and efficiently. Whether you are setting up a one-time transfer or a recurring payment, the proper format is essential for accurate and timely execution.

Key Elements to Include

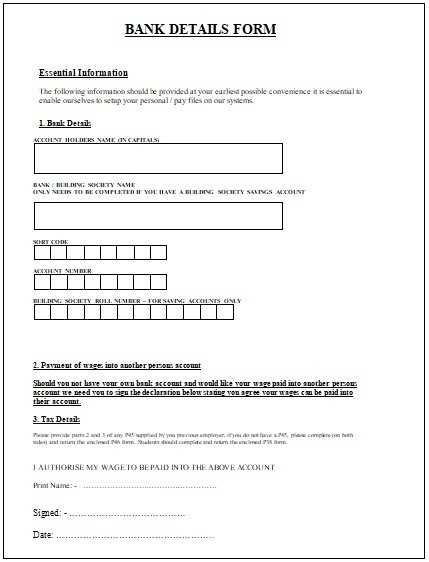

When constructing such a message, it is essential to provide precise information while maintaining clarity. Each component of the communication must be structured to ensure that the recipient can quickly identify and use the necessary details. Some of the key elements include:

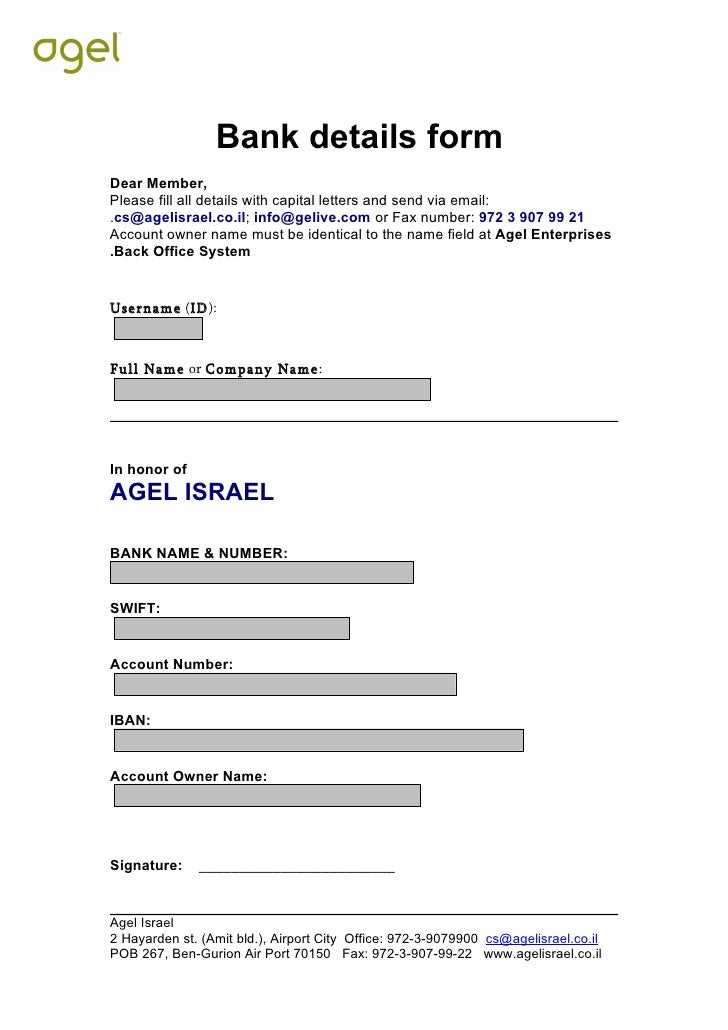

| Element | Description |

|---|---|

| Recipient’s Information | Ensure the recipient’s full name and contact information are clearly stated. |

| Financial Institution | Provide the name and address of the institution handling the transaction. |

| Transaction Details | Include any relevant reference numbers, amounts, and required deadlines. |

| Sender’s Information | State the sender’s full name, address, and any necessary identification information. |

Tips for Accuracy and Efficiency

For optimal clarity, ensure that each section is easy to read and formatted in a way that allows quick reference. Avoid including unnecessary information that could clutter the message and lead to confusion. It’s also advisable to double-check all provided details to avoid errors that could result in transaction issues. By keeping the structure simple and straightforward, you make it easier for the recipient to act promptly on the provided information.

htmlEdit

Why a Financial Information Communication Matters

Providing clear and accurate information when it comes to monetary transactions is essential for ensuring smooth exchanges. A well-crafted document helps in confirming critical specifics, which can prevent errors and avoid delays in processing payments. Without the right level of clarity, there is a higher risk of complications that could result in financial loss or unnecessary confusion.

Such communications are especially important for both personal and professional transactions, as they serve to establish trust and ensure that all parties involved are on the same page. When all the necessary information is conveyed properly, it facilitates the processing of payments or transfers with minimal disruption. This is why it’s crucial to handle such correspondence with care and precision.

htmlEdit

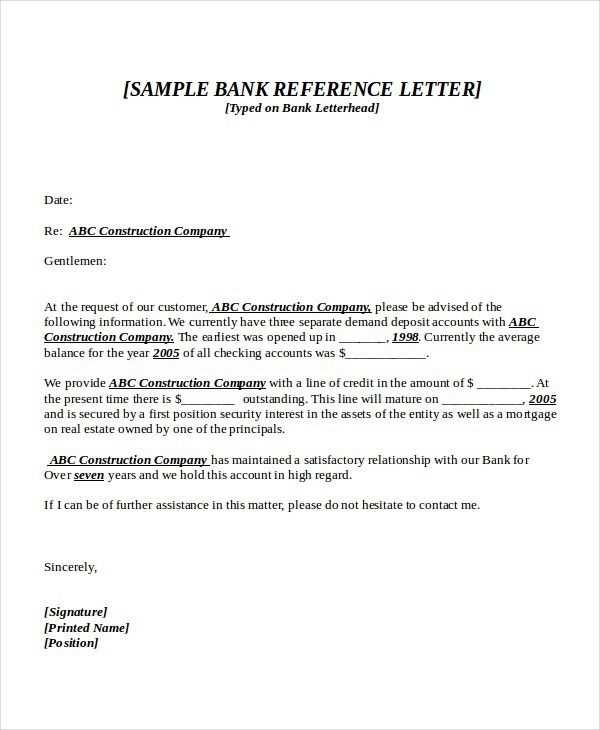

Key Components of a Financial Communication

When preparing a written document for sharing monetary specifics, it’s important to include the necessary components to ensure clarity and effectiveness. Each section should be designed to provide the recipient with all the required information in an easy-to-read format. The more structured and organized the communication, the less likely it is that misunderstandings or mistakes will occur.

Among the most important elements to include are the identities of both parties involved, the financial institution handling the transaction, the exact amounts or figures, and any relevant reference numbers or instructions. Each of these pieces plays a critical role in facilitating a smooth process and preventing unnecessary confusion.

htmlEdit

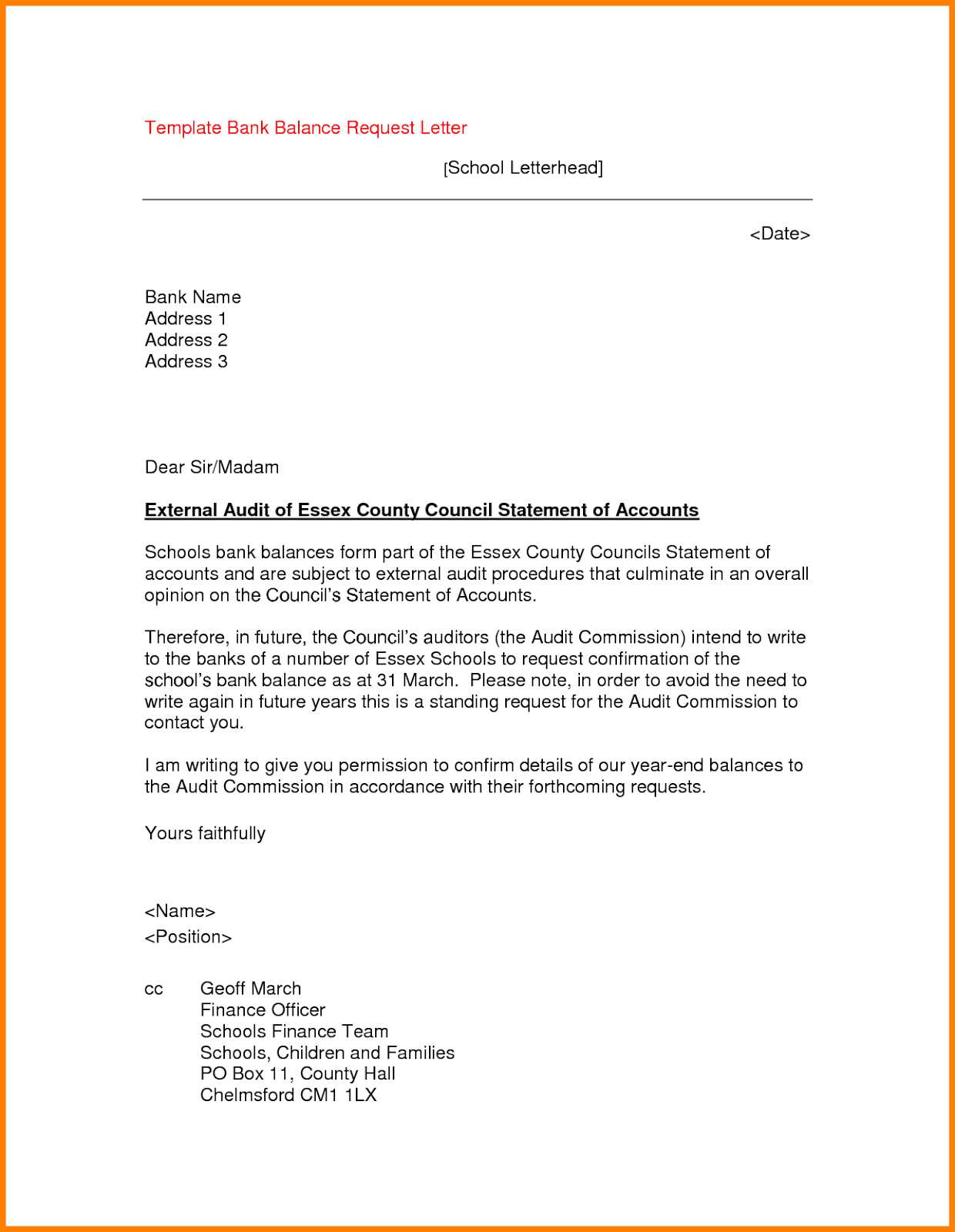

Step-by-Step Structure for Financial Information

When preparing a written communication for sharing financial specifics, it’s important to follow a clear and organized format. This ensures that all essential elements are addressed and minimizes the chance of errors or confusion. By adhering to a step-by-step structure, both the sender and recipient can quickly access and understand the relevant information.

Below is a structured approach to creating an effective communication:

- Introduction: Begin with a polite introduction stating the purpose of the document and briefly outlining the reason for sharing the financial information.

- Sender’s Information: Provide the full name, address, and any other relevant contact details of the sender.

- Recipient’s Information: Clearly state the name and contact information of the recipient.

- Transaction Information: Include any relevant transaction details such as amounts, reference numbers, and deadlines. This should be organized in a clear manner to avoid confusion.

- Instructions or Additional Notes: If there are any special instructions or further clarifications, include them here in a bullet point list for easy reference.

- Conclusion: Close the document with a polite ending, confirming the details and expressing willingness to assist with any further questions.

By following this structure, the communication will be clear, concise, and efficient, making it easier for the recipient to process the information and take the necessary actions.

htmlEdit

How to Protect Privacy in Financial Communications

When sharing sensitive monetary information, it is essential to safeguard the privacy of all parties involved. Ensuring that confidential details are kept secure helps to prevent unauthorized access and potential fraud. Implementing appropriate measures in written communications is key to maintaining trust and protecting personal and financial data.

One of the first steps in protecting privacy is limiting the amount of sensitive information shared. Avoid including unnecessary personal identifiers or figures that could be used maliciously. Additionally, make sure the communication is addressed only to the intended recipient and that secure methods of delivery, such as encrypted emails or protected physical mail, are used.

It’s also important to review the content before sending. Ensure that any sensitive information is clearly marked, and consider using codes or partial references when possible. Finally, educate recipients on the importance of handling this information responsibly to further reduce the risks of privacy breaches.

htmlEdit

Common Mistakes in Writing Financial Documents

When creating written communications that involve sensitive financial information, it’s important to avoid common errors that can lead to confusion, delays, or even financial loss. Even minor mistakes can have a significant impact, which is why attention to detail is crucial. Proper formatting, clear language, and accuracy are key to ensuring that the information is properly understood and acted upon.

1. Providing Incomplete Information

One of the most common mistakes is leaving out essential information that could lead to misunderstandings. This may include missing amounts, dates, or reference numbers, which can prevent the recipient from completing the transaction or verifying the details. Always double-check that all required information is included and correctly formatted.

2. Using Ambiguous Language

Another mistake is the use of vague or unclear language. Ambiguities in instructions or financial figures can cause confusion and delays in processing. To avoid this, use straightforward and precise terms that leave no room for interpretation. Additionally, when in doubt, clarify any potential uncertainties in a separate note or follow-up communication.

htmlEdit

When to Submit Your Financial Information Communication

Knowing the right time to provide financial information is essential to ensure smooth transactions and avoid unnecessary delays. Submitting such communications at the correct moment ensures that all parties have the necessary data when they need it, facilitating the process and reducing the chances of complications.

Below are some situations when it is important to submit your financial details:

- Before Completing a Transaction: Ensure that the necessary details are shared prior to initiating a financial transfer or any transaction involving payments.

- When Requested by the Recipient: Always respond promptly if a recipient asks for financial information in order to move forward with a transaction or agreement.

- As Part of a Formal Agreement: When entering into any contract or agreement, providing your financial specifics at the beginning helps set clear expectations and avoid delays.

By submitting the required information at the right time, you ensure that all procedures can be followed smoothly and without any unnecessary hold-ups.