Bank Letter of Indemnity Template for Your Business Protection

In various business transactions, it is crucial to ensure that parties involved are protected from potential risks. A financial assurance document serves as a tool to safeguard interests, establishing clear obligations and responsibilities. These documents are often used to provide security, ensuring that any potential liabilities are covered by the involved parties.

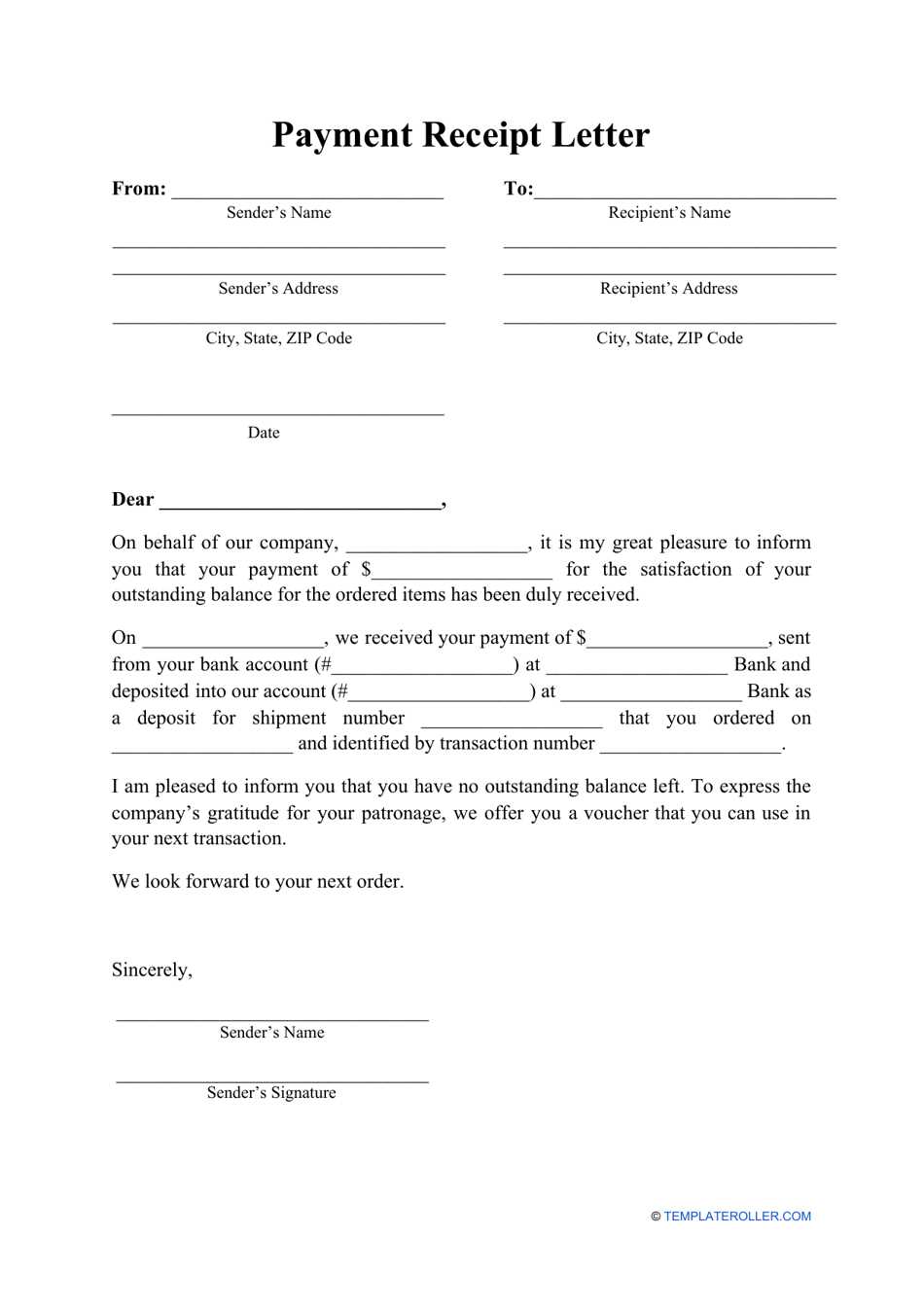

Structure of a Financial Guarantee Document

While drafting a guarantee document, it is important to maintain clarity and precision. Typically, the document should include:

- Parties Involved: The individuals or organizations responsible for the agreement.

- Purpose: A clear description of why the document is being created and the situation it addresses.

- Terms and Conditions: The obligations and responsibilities of each party involved.

- Amount Covered: The specific sum of money or assets that are being secured.

- Duration: How long the terms of the agreement will remain in effect.

Creating a Secure Document

When drafting this kind of document, it is vital to ensure that all information is accurate and unambiguous. Any mistakes or vague terms could lead to disputes or misunderstandings. This requires attention to detail and a clear understanding of the potential risks involved.

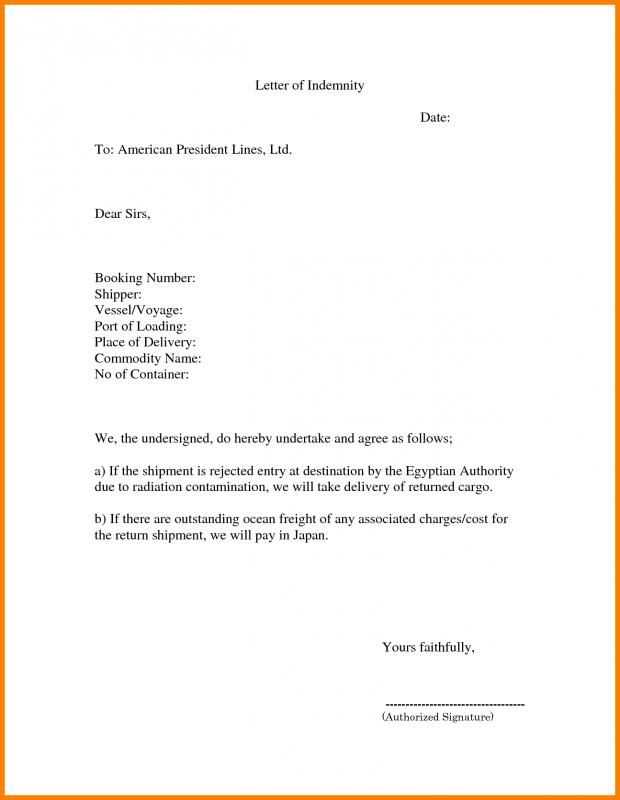

Common Scenarios for Using This Document

Such agreements are often required in situations where one party is exposed to financial risk. Common examples include:

- When engaging in international trade transactions.

- When securing a loan or financing arrangement.

- In cases involving large-scale projects or investments.

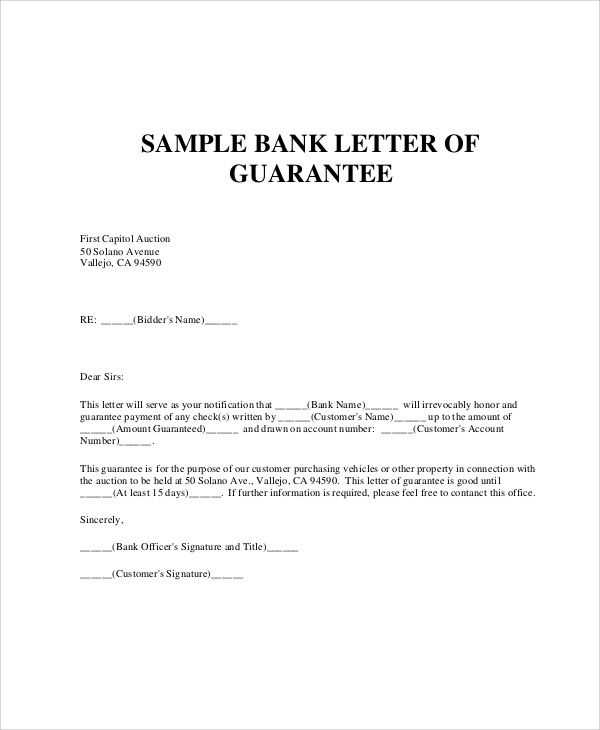

Key Legal Considerations

It is essential to be aware of legal implications when preparing a financial guarantee. Make sure the document complies with applicable laws and regulations to ensure its enforceability. Legal experts can help ensure that the document is valid and that all parties are protected under the law.

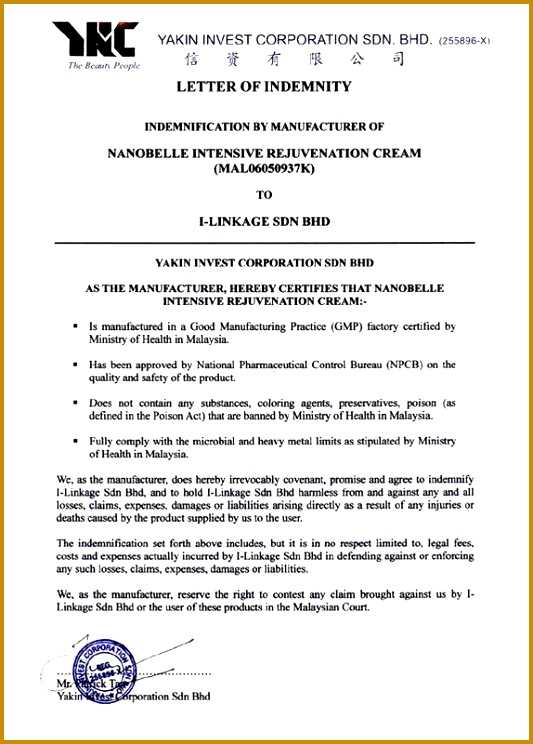

Benefits of Customizing the Document

Customizing the financial guarantee ensures that it meets the specific needs of the transaction and all involved parties. A tailored agreement helps to address unique risks and circumstances, offering better protection and minimizing the chance of conflicts.

Why Financial Protection Documents Matter

In many business and financial arrangements, having a secure method to ensure parties are protected from potential risks is essential. These agreements not only safeguard interests but also provide clarity regarding each party’s responsibilities. A well-drafted document can prevent future disputes and ensure a smoother transaction process.

Understanding the Structure of Financial Protection Documents

A typical agreement for securing obligations contains several key components. These include the parties involved, the purpose of the agreement, and the specific terms that outline each participant’s duties. The details should be precise, leaving little room for ambiguity. This clarity is crucial to prevent misunderstandings or legal challenges down the road.

How to Draft a Secure Document

When drafting a financial assurance document, it’s important to ensure that all details are correct and clearly defined. Each clause must reflect the specific conditions of the agreement, addressing the risks involved. Consulting with legal professionals can help avoid errors and ensure the document’s enforceability under law.

Common Scenarios Requiring Such Agreements

There are numerous situations where this type of document is crucial. For example, they are commonly used in:

- International trade agreements where goods or services are exchanged.

- Loan arrangements, where one party may need to ensure repayment security.

- Large-scale investments or contracts where significant sums of money are at stake.

Key Legal Considerations to Keep in Mind

Every agreement needs to comply with relevant laws to be legally binding. It is essential to understand the legal landscape in which the document will be enforced. By working with legal experts, businesses can ensure that the agreement is valid and will hold up in case of disputes.

How to Personalize Your Agreement

Personalizing the document allows businesses to tailor the agreement to their specific needs. Whether it’s for a unique transaction or a specialized arrangement, customization helps address particular risks. This ensures that both parties are well protected and the document is relevant to their specific situation.