Bankruptcy Letter Template Guide and Example

When dealing with financial hardship, it’s important to communicate clearly and professionally with creditors and other involved parties. A well-structured written request can serve as a tool for explaining your situation, seeking relief, or negotiating terms. This guide provides insights into how to effectively convey your financial concerns and request assistance.

Properly crafting your correspondence can help set the right tone, ensuring your message is received with understanding and respect. The ability to articulate your needs without overcomplicating the message is key. Whether you’re looking for more time to pay off debts or requesting a reduction in amounts owed, having a clear, concise, and polite approach is essential.

By following best practices, you can ensure that your message is professional and leaves a positive impression. In this section, we’ll explore the essential elements of a successful financial relief request, focusing on structure, language, and key points to include. Emphasis will be placed on clarity and effectiveness, making sure that your correspondence stands out in a professional way.

How to Write a Bankruptcy Letter

When facing significant financial challenges, drafting a clear and respectful message to creditors or financial institutions is crucial. The purpose of this communication is to inform the recipients of your current financial state and request the necessary adjustments to your payment terms. By expressing your situation in an honest and professional manner, you can open the door to possible negotiations and understanding from those involved.

Structure of Your Communication

The structure of your written request plays a vital role in ensuring that your message is well-received. Begin by clearly identifying yourself and stating the reason for writing. Be direct but polite when explaining your financial difficulties, and ensure that the tone is respectful throughout. It is important to outline your current situation, specify what kind of relief you are seeking, and indicate your willingness to cooperate with the terms set by the recipient.

Key Points to Include

Make sure to include all necessary information in your message, such as account numbers, dates, and any relevant documentation to support your claims. It is also beneficial to propose a plan or a solution that reflects your ability to make payments, even if it is a reduced amount. This shows your willingness to work towards a resolution. Closing your message by expressing gratitude for their time and understanding will leave a positive impression.

Essential Components of a Bankruptcy Letter

Creating a clear and effective communication when requesting financial relief requires attention to detail. Certain key elements must be included to ensure your message is both professional and persuasive. These components not only make your correspondence complete but also increase the likelihood of a favorable response from creditors or financial institutions.

| Component | Description |

|---|---|

| Personal Information | Start by clearly stating your name, account number, and any relevant personal identifiers to help the recipient easily locate your file. |

| Explanation of Financial Situation | Provide a brief yet thorough description of your current financial struggles. Be honest and straightforward about why you are unable to meet your obligations. |

| Requested Relief | Clearly state what kind of financial relief or adjustment you are seeking. Whether it is an extension, reduced payments, or another solution, be specific. |

| Proposed Plan | If possible, suggest a repayment plan or how you intend to manage future payments. This demonstrates your commitment to resolving the situation. |

| Closing and Gratitude | End your message by expressing appreciation for their time and consideration. A polite and respectful tone will leave a positive impression. |

Choosing the Right Tone and Language

When crafting a formal request regarding financial difficulties, the tone and language you use are just as important as the content itself. The goal is to be clear, respectful, and professional while conveying your situation and needs. The way you present your message can significantly impact the recipient’s response, making it crucial to choose your words carefully and with consideration.

Key Elements of a Professional Tone

- Politeness: Always maintain a courteous and respectful tone throughout your message. Politeness fosters goodwill and increases the chances of a positive outcome.

- Clarity: Keep your language simple and to the point. Avoid jargon or overly complex terms to ensure the message is easily understood.

- Formality: Use formal language, especially when communicating with financial institutions or creditors. This shows that you take the matter seriously.

Language Considerations

- Be Honest: Transparency is key when explaining your financial challenges. Avoid exaggerations and provide accurate information about your situation.

- Avoid Apologizing Excessively: While it’s important to express regret for your situation, refrain from over-apologizing as it may weaken your position.

- Focus on Solutions: Rather than just detailing your problems, highlight potential solutions or steps you plan to take to resolve the issue.

Common Mistakes to Avoid in Letters

When drafting formal communication regarding financial struggles, it is important to avoid certain pitfalls that can undermine your message. Mistakes in tone, structure, or content can detract from the professionalism of your request and reduce the likelihood of a favorable outcome. Recognizing these common errors can help ensure your correspondence remains effective and well-received.

One of the most common mistakes is failing to be clear and concise. Overly long or convoluted explanations can confuse the recipient, making it harder for them to understand your situation. Stick to the key points and avoid unnecessary details. Another error is being overly apologetic, which can give the impression of weakness or a lack of confidence. While it’s important to acknowledge your difficulties, focusing too much on apologies can detract from the main purpose of your message.

Additionally, it’s crucial not to make demands or come across as entitled. A request for assistance should always be framed in a respectful manner, allowing room for negotiation or adjustment. Lastly, neglecting to proofread your message for grammatical or spelling errors can reflect poorly on your professionalism. A polished and error-free document will create a stronger impression and demonstrate your commitment to resolving the issue.

How to Address Creditors Effectively

When reaching out to creditors for financial assistance or adjustments, the way you present your case can significantly impact the response you receive. It’s essential to maintain a professional, respectful tone while clearly outlining your situation. Properly addressing the creditor can help foster a constructive dialogue and potentially lead to a more favorable outcome for both parties.

Start by addressing the creditor by their formal title and providing relevant information, such as your account number or any previous correspondence. This ensures that they can easily identify your case and move forward with addressing your request. It is also important to acknowledge the importance of their time and express your gratitude for their consideration. Using polite and formal language throughout your communication helps establish credibility and respect.

Be specific about the type of assistance or arrangement you are requesting. Whether you’re asking for a payment extension, a reduction in payments, or another form of relief, clearly state your proposal. Providing a reasonable plan or timeline shows that you are proactive in resolving the situation. Ending your message with a courteous closing reinforces your respectful approach and encourages continued cooperation.

Legal Considerations When Writing a Letter

When crafting a formal request for financial relief, it is important to understand the legal implications of your communication. There are certain guidelines and principles you must follow to ensure your message is compliant with relevant laws and does not inadvertently harm your position. Being aware of these considerations helps protect both your rights and the integrity of your request.

Understanding Your Rights

It is essential to be familiar with your legal rights before reaching out to creditors. For example, you may be protected under specific consumer protection laws, depending on your jurisdiction. These laws can influence how creditors must respond to your request and may limit certain collection practices. Be sure to reference these rights where applicable to strengthen your position and demonstrate your awareness of the law.

Avoiding Misrepresentation

Honesty is paramount when presenting your financial difficulties. Falsifying information or making misleading statements can have serious legal consequences. Always ensure that the details you provide are accurate and truthful. This not only protects you from potential legal ramifications but also enhances your credibility in the eyes of the recipient.

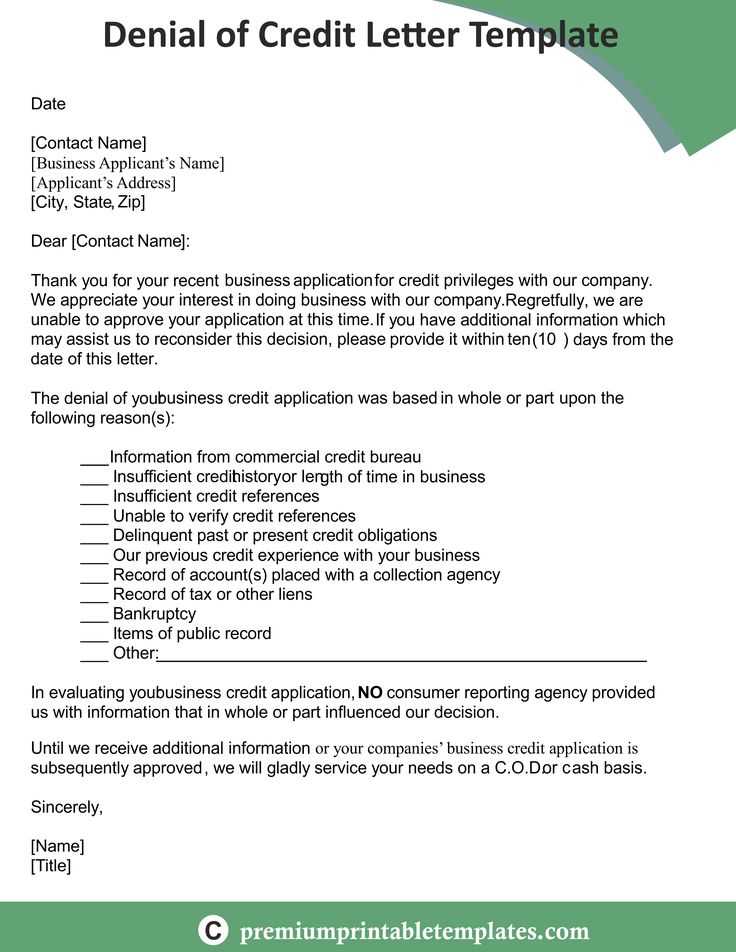

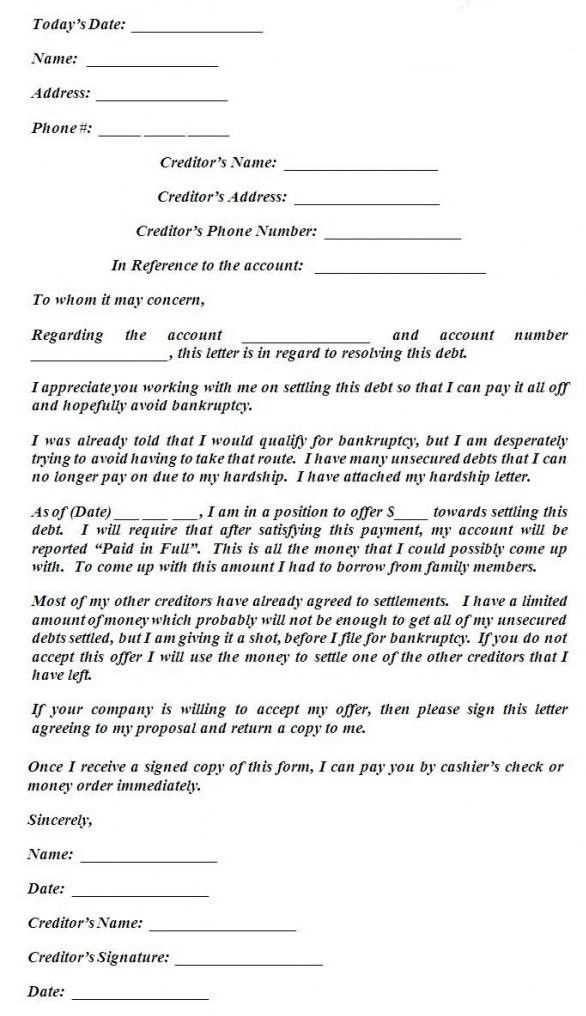

Templates and Samples for Reference

Having access to proven examples can help guide you when creating your own formal requests. Using sample documents as a reference allows you to structure your communication in a clear and professional manner while ensuring all necessary details are included. Below are some essential formats and sample structures you can use as a foundation for drafting your own message.

Basic Structure for Your Request

- Introduction: Briefly explain the reason for your communication and provide any relevant background information.

- Details of the Situation: Outline the challenges you are facing, providing clear and factual information.

- Proposed Solution or Request: State what assistance or action you are seeking and explain how this will help resolve the situation.

- Closing: Express appreciation for the recipient’s time and consideration, and provide any necessary contact information.

Sample Request Example

- Account Information: Provide your account number, reference numbers, and any prior communication for easy identification.

- Detailed Explanation: Explain your current financial situation with accuracy and transparency.

- Specific Request: Clearly ask for a specific action or solution, such as an extended payment period or modified terms.

- Professional Tone: Ensure the language remains formal and polite throughout, reinforcing a respectful approach.