Bookkeeping Engagement Letter Template for Your Business

When providing financial services to clients, clear and precise agreements are essential to establish expectations and responsibilities. These documents serve as the foundation for a professional relationship, outlining key terms and ensuring both parties are aligned on the scope of work, deliverables, and timelines.

Creating a well-structured document is crucial for setting the tone of the collaboration and protecting the interests of both the service provider and the client. By detailing the specific terms of service, these agreements prevent misunderstandings and provide a reference point for any future questions or disputes that may arise.

Customizing such documents to fit each unique situation is important, as each client may have different needs and requirements. Properly drafted agreements not only promote transparency but also help build trust between professionals and their clients.

Why Agreements Matter in Accounting Services

Clear and well-defined agreements are critical in any professional relationship, particularly when providing financial services. These documents establish mutual understanding and set expectations, ensuring that both parties are on the same page regarding the scope of the work and any associated responsibilities. Without this foundation, there is potential for confusion, disputes, or even legal issues.

Clarifying Roles and Responsibilities

One of the main purposes of such an agreement is to clearly outline the roles of both the provider and the client. By specifying duties and deliverables, it eliminates ambiguity and helps to avoid misunderstandings throughout the course of the service.

- Defines tasks and responsibilities

- Prevents scope creep by setting boundaries

- Establishes a clear understanding of deadlines and reporting

Legal Protection for Both Parties

Having a solid agreement in place also provides legal protection for both the professional and the client. Should disagreements arise, the document serves as a reference point for resolving issues based on the agreed terms.

- Minimizes legal risks and misunderstandings

- Offers a means of recourse in case of disputes

- Protects against potential liability for both parties

Essential Components of a Professional Service Agreement

For any professional relationship, especially in financial services, it is important to outline key elements that define the terms of collaboration. These components ensure that both parties understand their obligations, helping to avoid confusion and disputes during the course of their work together.

Key Information to Include

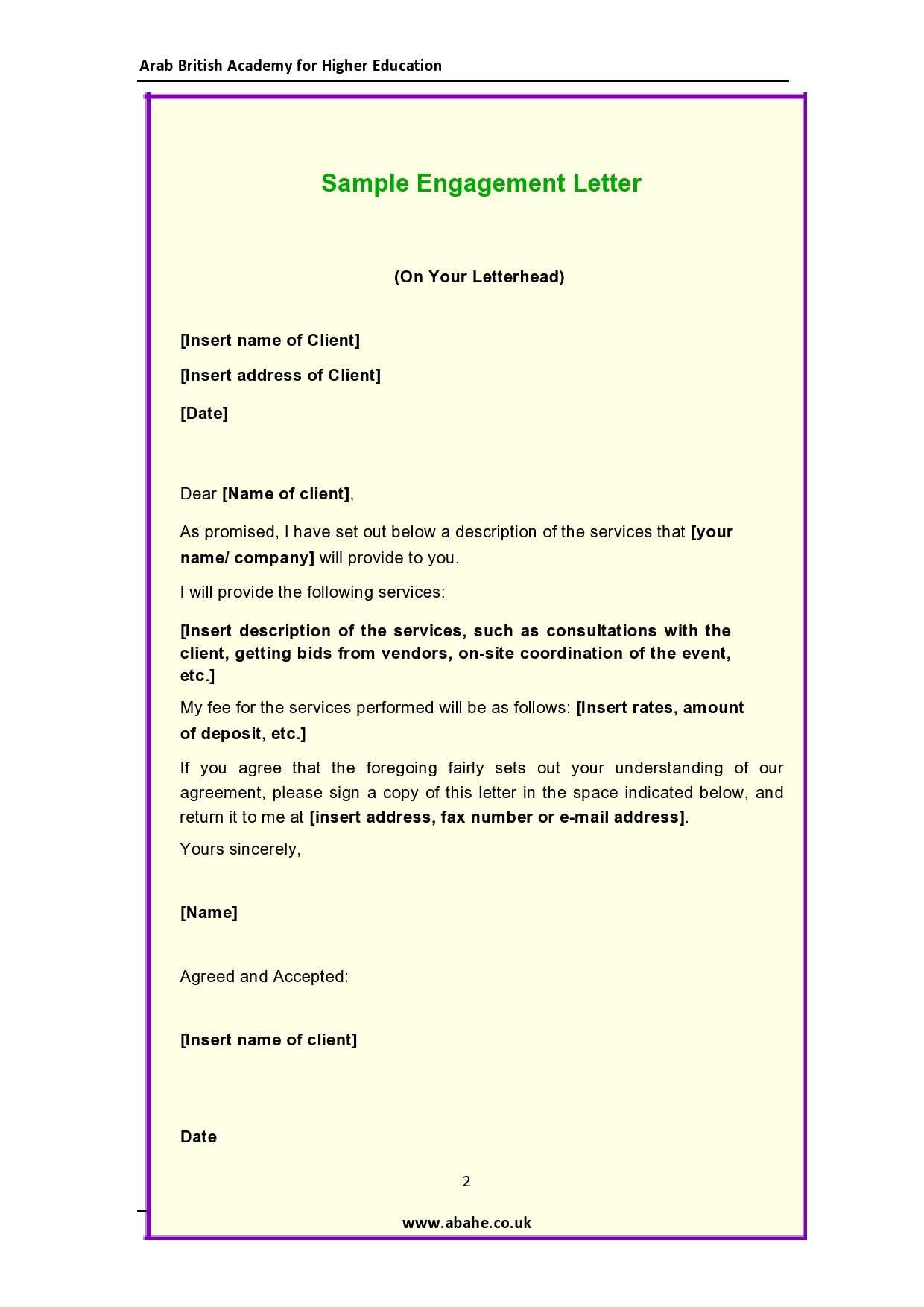

When drafting a formal agreement, several critical details must be addressed to ensure clarity and mutual understanding.

- Scope of Work: A detailed description of the tasks to be performed, including timelines and specific deliverables.

- Payment Terms: Clear statements about compensation, including amounts, due dates, and acceptable payment methods.

- Duration of Service: The period during which the services will be provided, including start and end dates if applicable.

- Confidentiality Clauses: Ensuring the protection of sensitive financial data and setting the expectations for privacy during and after the service.

Additional Considerations for Effective Agreements

In addition to the fundamental elements, the following factors contribute to a well-rounded agreement:

- Liability and Indemnification: Establishing the responsibility for errors and offering protection against potential claims or disputes.

- Termination Conditions: Outlining how the agreement can be terminated by either party and under what circumstances.

- Dispute Resolution: Methods for resolving conflicts without resorting to legal action, such as mediation or arbitration.

Steps to Create a Customized Service Agreement

Creating a personalized agreement involves several key steps to ensure that all terms are tailored to the specific needs of both the service provider and the client. A customized document reflects the unique nature of the services provided and helps prevent misunderstandings or disputes by setting clear expectations from the outset.

Follow these steps to craft an effective and detailed agreement:

- Define the Scope: Clearly specify the tasks, deliverables, and services to be provided, ensuring both parties are aligned on expectations.

- Set Payment Terms: Include the payment schedule, rates, and any conditions related to compensation, ensuring transparency about costs.

- Establish Duration: Outline the duration of the agreement, including start and end dates, or conditions for ongoing services.

- Include Legal Protections: Add clauses for confidentiality, liability, and dispute resolution to protect both parties legally.

- Review and Revise: Once the draft is complete, review it for any missing details or errors and make revisions as necessary to meet both parties’ needs.

Legal Implications in Financial Service Agreements

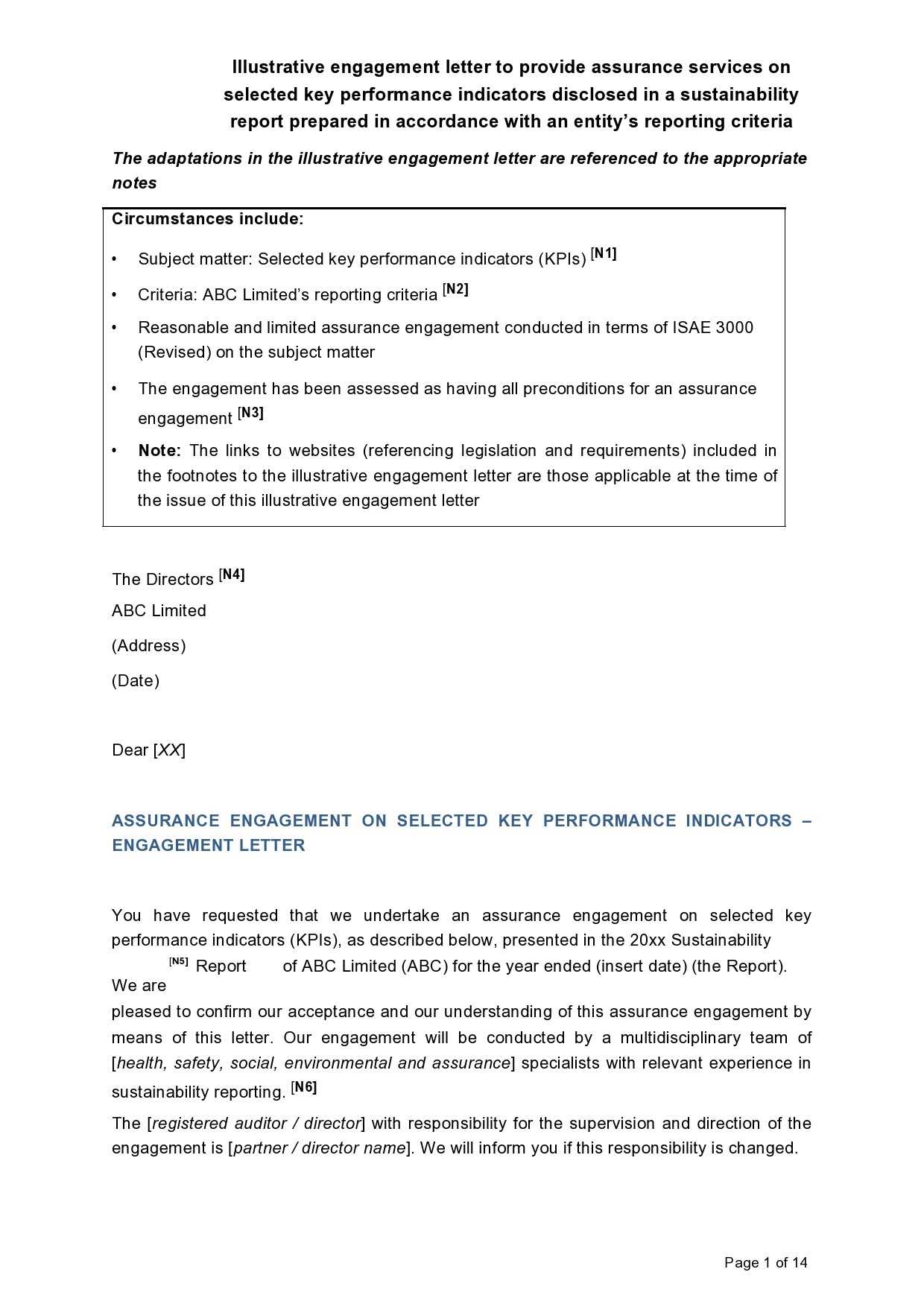

When providing professional financial services, it is crucial to understand the legal aspects of the agreement between the provider and the client. These documents not only define the terms of the collaboration but also protect both parties by outlining rights, obligations, and the consequences of any breach. Understanding these implications ensures compliance and reduces the risk of legal disputes.

Liability and Responsibility

One of the key legal elements in such agreements is the allocation of liability. The agreement should clearly state which party is responsible for what actions and the consequences in case of errors or omissions. This helps prevent legal complications related to mistakes or misunderstandings during the service period.

- Clarifies responsibility for actions taken during the service

- Protects both parties from unforeseen legal actions

- Ensures proper procedures are followed to limit errors

Confidentiality and Data Protection

Financial professionals often handle sensitive information, making confidentiality clauses a critical aspect of any agreement. These clauses legally bind both parties to protect private data and prevent unauthorized disclosure, which is essential in maintaining trust and complying with data protection regulations.

- Ensures protection of sensitive client information

- Defines the handling of confidential data throughout the agreement

- Sets guidelines for post-service data retention or destruction

How to Communicate Expectations Clearly

Clear communication is essential for successful professional relationships. Ensuring that both parties understand each other’s expectations from the start helps prevent misunderstandings and ensures smooth collaboration. It is important to be specific, transparent, and proactive when setting expectations for the services to be provided.

Be Specific and Detailed

Vague terms can lead to confusion. To avoid this, clearly define the scope of work, timelines, and deliverables. Break down the tasks into manageable steps and specify what is expected at each stage. By doing so, both parties will have a clear roadmap of what will be achieved and when.

- Provide detailed descriptions of services

- Set realistic timelines and deadlines

- List specific deliverables and milestones

Ensure Transparency and Open Dialogue

Establishing an open line of communication is crucial to ensure that both parties can address any concerns or changes in expectations promptly. Encourage questions, regular updates, and feedback to ensure that everything remains on track throughout the duration of the service.

- Encourage ongoing communication throughout the project

- Clarify any doubts immediately to avoid confusion

- Be open to adjustments and negotiations if necessary

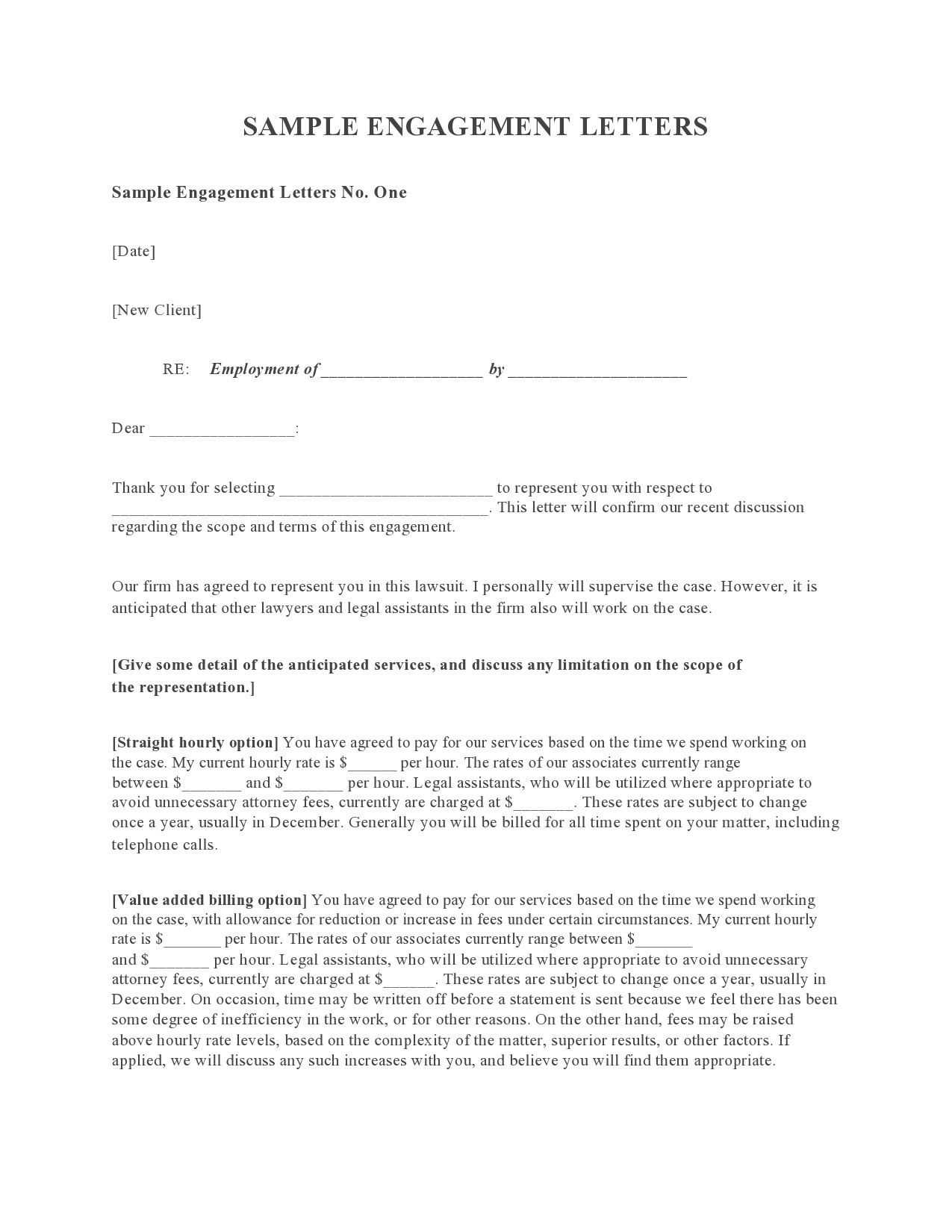

Common Pitfalls in Engagement Letters

When formal agreements are being drafted, certain mistakes often arise that can create confusion or lead to misunderstandings. These issues can affect the clarity of expectations and responsibilities, ultimately complicating the working relationship. Identifying these frequent errors is essential to ensuring both parties are on the same page and avoid potential disputes down the road.

Unclear Scope of Services

One of the most common issues is the failure to define the scope of the work adequately. Without clear boundaries, clients and service providers may have different interpretations of what tasks are included or excluded, leading to conflicts or unmet expectations. A detailed description of services can help avoid ambiguity.

Inadequate Terms of Payment

Vague or incomplete payment terms are another frequent pitfall. Whether it’s the payment schedule, method, or amounts, not specifying these details can result in delays or disputes. It is crucial to outline payment expectations explicitly to avoid financial misunderstandings.

| Potential Pitfalls | Impact | Solution |

|---|---|---|

| Unclear scope | Misunderstandings, dissatisfaction | Define specific tasks and deliverables |

| Ambiguous payment terms | Delays, disputes | Clarify amounts, timing, and methods |

When to Review and Update Agreements

Regular evaluation of formal agreements is vital to ensure they remain relevant and effective. As circumstances change, agreements should reflect any shifts in responsibilities, terms, or expectations. It is important to identify specific times when updates are necessary to maintain clarity and mutual understanding between parties.

Agreements should be reviewed annually or when there are significant changes in either party’s situation. This includes alterations in service scope, fees, or legal requirements. Additionally, updates are needed when any external factors–such as market trends, regulations, or business practices–affect the terms or execution of the arrangement.