Bounced Check Letter Template for Effective Payment Recovery

When a financial transaction fails due to insufficient funds or other reasons, it can lead to significant complications for both parties involved. To resolve such matters effectively, it’s essential to communicate clearly and formally with the individual or business responsible. One of the most important tools in this process is a formal document that outlines the problem and demands resolution.

Such a document serves as a professional means of requesting the owed amount while maintaining a polite and constructive tone. It’s crucial to include specific information regarding the failed transaction, the amount due, and any legal implications for non-payment. A well-crafted message can often prevent escalation and facilitate timely repayment without the need for further legal action.

In this guide, we’ll explore the key elements of creating a formal communication to address payment disputes, ensuring that the language used is both clear and effective. Whether you are a business owner, freelancer, or individual, knowing how to compose this type of correspondence can save time and help preserve valuable relationships.

When a payment fails to process due to insufficient funds or other banking issues, it creates an unnecessary financial burden and a potential legal headache for both the payer and the payee. This type of situation often leads to misunderstandings and a breakdown in trust, especially if the funds were expected to settle a debt or complete a transaction.

Impact on the Creditor

For the individual or business waiting for the funds, an unresolved payment can disrupt cash flow, affect business operations, and lead to additional administrative tasks. The situation requires swift attention to recover the owed amount while minimizing any further financial loss. Understanding how to formally address this issue helps protect the creditor’s rights and ensures proper documentation of the situation.

Challenges for the Debtor

On the other hand, the person responsible for the failed payment may face penalties or damage to their credit reputation. In some cases, if the matter isn’t resolved, legal consequences may arise. A clear, professional request for payment can help avoid escalating the situation into a legal dispute, giving both parties an opportunity to settle the matter amicably.

Reasons to Use a Bounced Check Letter

Addressing an issue where a payment fails to clear is a sensitive matter that requires clear and professional communication. Having a formal document to request payment serves not only as a reminder but also as a way to establish the seriousness of the situation. A well-crafted message can facilitate resolution without escalating the matter unnecessarily.

Clarity and Professionalism: A formal communication provides clarity about the amount due, the reason for the issue, and the necessary steps to resolve it. It ensures both parties are on the same page and reduces the chance of confusion. When dealing with financial matters, maintaining professionalism helps protect relationships while securing the owed amount.

Documenting the Dispute: One of the main advantages of using such a document is the ability to create a formal record of the issue. This record can serve as proof of your attempts to resolve the matter amicably should the situation require legal attention later. Having this documentation is valuable for both parties, especially in cases where further action may be needed.

Encouraging Timely Payment: By outlining the specifics of the failure to pay, the request becomes a clear call for action. A formal request shows that the situation is being taken seriously and encourages the recipient to act quickly to avoid potential legal consequences. This approach can often speed up the resolution process and ensure timely repayment.

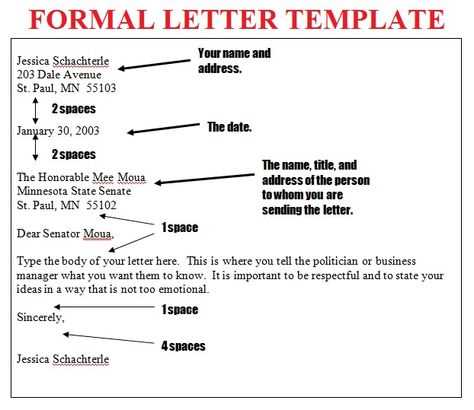

When addressing a financial dispute or overdue payment, it’s crucial to include specific elements in your communication to ensure clarity and effectiveness. A well-structured document not only communicates the problem but also demands action in a professional manner. These key components help convey the necessary information and create a sense of urgency while maintaining a respectful tone.

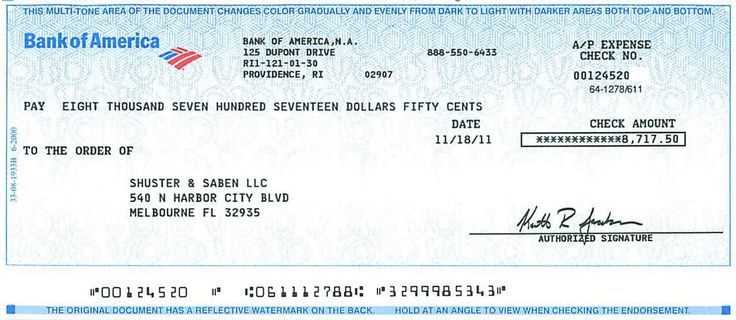

Identification of Parties: The first step in crafting an effective demand is to clearly identify both the sender and the recipient. Include full names, addresses, and any relevant account or reference numbers. This ensures that both parties are easily identifiable, and the letter is directed to the correct individual or business.

Clear Description of the Issue: Next, provide a concise and accurate description of the problem. Include the amount owed, the original transaction date, and any previous attempts made to resolve the issue. Being specific helps eliminate confusion and establishes the reason for the demand.

Requested Action and Deadline: Clearly state the action you expect from the recipient, such as immediate payment or a commitment to a payment plan. It’s important to include a firm deadline by which the issue must be resolved. This sets clear expectations and encourages prompt attention to the matter.

Consequences of Non-Compliance: Finally, outline any potential legal or financial consequences if the issue is not resolved within the specified time frame. While it’s important to remain professional, including this information emphasizes the seriousness of the matter and encourages compliance.

How to Create an Effective Demand Letter

Creating an effective communication to request payment or resolve a financial issue requires careful attention to detail. The message should be professional, clear, and concise, while also conveying the urgency of the situation. To ensure the recipient understands the seriousness of the matter and is encouraged to act promptly, follow these steps when drafting your correspondence.

Start with a Professional Tone: The first step is to begin with a formal, respectful greeting. Address the recipient by their full name or business name, and avoid using overly emotional language. A calm, professional tone sets the right atmosphere for resolving the issue amicably.

State the Purpose Clearly: Early in the document, briefly explain the reason for the communication. Provide relevant transaction details, such as dates, amounts, and any prior agreements. This helps the recipient immediately understand the situation and the purpose of the request.

Request Action with Specifics: Clearly state what you expect from the recipient. This may include full payment or a commitment to pay within a certain time frame. Be direct and firm, but always remain polite. Including a clear deadline for resolution is essential to avoid further delays.

Offer Payment Options: To make it easier for the recipient to comply, consider offering different methods of payment or a flexible payment plan. This can encourage quicker resolution by providing alternatives that fit the recipient’s financial situation.

Close with Legal Considerations: End the letter by reminding the recipient of the potential legal consequences if the matter is not addressed by the specified deadline. However, make sure to keep the tone professional and avoid threats. The goal is to motivate the recipient to act, not to escalate the situation unnecessarily.

When drafting formal communication related to unpaid debts or financial disputes, it’s essential to consider the legal implications. The content and tone of your message can have an impact on how the recipient responds and whether the situation escalates to legal action. Understanding the legal aspects helps protect both parties and ensures compliance with the law.

Ensure Accuracy in the Details: Legal documents must be clear and precise. Any ambiguity could lead to misunderstandings or disputes. Here are some key elements to include:

- Transaction Information: Be specific about the date, amount, and any prior agreements related to the payment.

- Clear Payment Terms: State the exact amount owed and specify the terms under which payment should be made, including deadlines.

- Consequences of Non-Payment: Mention potential legal actions or penalties for failing to resolve the matter on time.

Avoid Defamation or Threats: While it’s important to outline consequences, you must avoid making threats or using language that could be considered defamatory. Legal language should remain neutral and professional. This helps avoid potential lawsuits for harassment or intimidation.

Understand Jurisdictional Issues: Laws surrounding financial disputes vary by region. It’s crucial to be aware of the jurisdiction in which you and the recipient reside, as this may affect the enforceability of any claims. Always ensure your communication complies with the relevant local, state, or national laws.

Maintain a Record: Retaining a copy of all formal communications is vital for potential legal action. If the dispute escalates, your documentation can serve as evidence that you made a reasonable attempt to resolve the matter before seeking further legal remedies.

Effective Strategies for Dealing with Bounced Checks

When a payment fails to clear, it’s essential to handle the situation swiftly and professionally to prevent further complications. By following effective strategies, you can increase the chances of resolving the issue without escalating it to legal action. These strategies not only protect your financial interests but also help maintain good relations with the other party.

Step 1: Confirm the Issue

Before taking any action, make sure that the payment issue is due to a valid reason, such as insufficient funds or account errors. Contact the individual or business involved to verify the problem.

Step 2: Provide Clear Communication

Once the issue is confirmed, send a formal request for payment, clearly stating the amount due and providing a deadline for resolution. A well-crafted message ensures that both parties understand the situation and the steps required to resolve it.

Step 3: Offer Payment Alternatives

In some cases, the payer may be unable to make the full payment immediately. Offering options such as a payment plan or partial payments can help resolve the issue more quickly.

Step 4: Know When to Escalate

If the payment is still not made after several attempts, it may be necessary to take further steps, such as contacting a collection agency or seeking legal action.

| Strategy | Action | Result |

|---|---|---|

| Confirm the Issue | Verify the reason for payment failure | Ensure the issue is legitimate |

| Provide Clear Communication | Send a formal payment request | Clarify the amount owed and deadline |

| Offer Payment Alternatives | Provide options for repayment | Increase chances of resolving the issue |

| Know When to Escalate | Seek further legal or collection action | Protect financial interests |