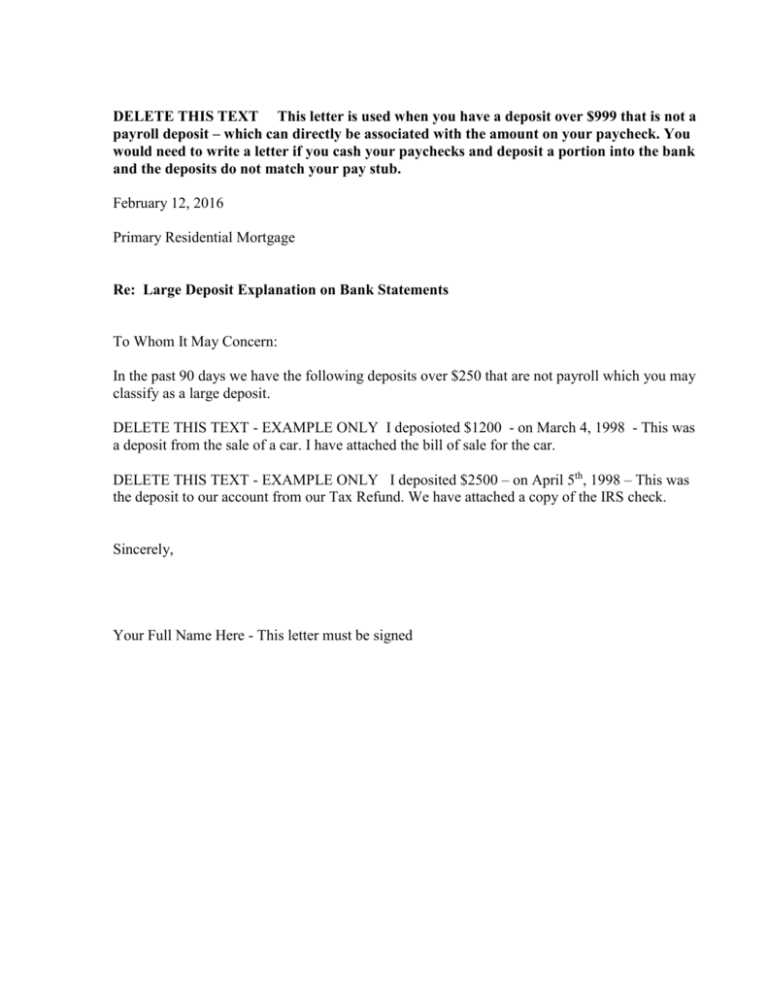

Cash out letter template

To create an effective cash out letter, include the necessary details in a clear and concise format. Start by addressing the recipient with their correct title and full name. Clearly state your intention to cash out the funds or assets, mentioning the specific amount or value. This ensures there is no ambiguity about your request.

Next, provide any relevant dates, such as when you expect the funds to be processed or when you last received the funds. It’s important to include any transaction numbers, account details, or references that will help the recipient locate the necessary information quickly. Include your contact details for follow-up questions or clarifications.

End your letter with a polite closing, reaffirming your request and expressing gratitude for their attention to the matter. This maintains professionalism and facilitates prompt processing of your request.

Here’s the corrected version without word repetition:

Ensure that your cash-out letter is clear and concise. Start with a professional tone, addressing the recipient by name. Be direct about your intention to cash out and mention the specific account or service in question.

Structure the Letter Effectively:

- Introduction: State your purpose right away. Clearly express the desire to initiate the cash-out process and mention any relevant account details.

- Request Details: Specify the amount and the preferred method of payment. If necessary, include instructions or preferences on how you would like the funds to be transferred.

- Final Steps: Close with a polite request for confirmation and any next steps. Indicate that you’re available for further clarification if needed.

Key Tips:

- Be clear and direct in your request to avoid any confusion.

- Use a respectful, formal tone throughout the letter.

- Keep the letter brief; avoid unnecessary details or complex wording.

After you’ve completed the letter, double-check for accuracy and professionalism before sending it to ensure smooth processing.

- Cash Out Letter Template

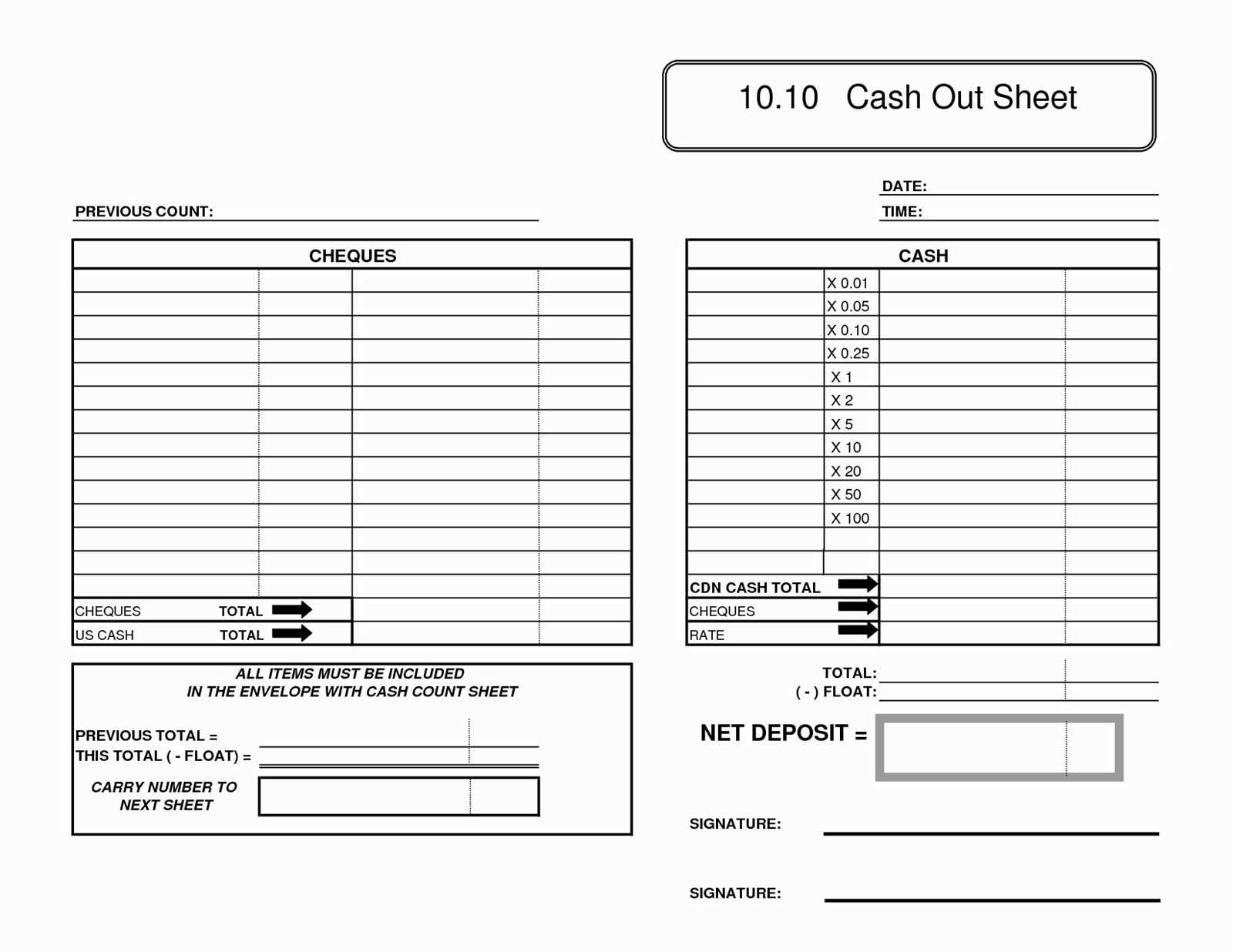

A well-structured cash out letter ensures clarity when requesting the release of funds or assets. The letter should state the amount to be withdrawn, the reason for the request, and any specific account details, along with the signatures required for approval.

Key Elements of a Cash Out Letter

Begin by clearly identifying the recipient, including their title or position within the company. Use a formal greeting, followed by the introduction of the request for cash out, specifying the amount and the account from which the funds should be withdrawn.

Formatting Your Cash Out Request

The letter should maintain a professional tone throughout. Include your contact information, the date, and the relevant account details. Ensure all instructions are easy to follow, and request confirmation of the transaction or approval at the end.

Here’s an example format:

Dear [Recipient Name],

I am requesting to cash out [Amount] from my [Account/Investment] as of [Date]. The details are as follows:

- Account Name: [Your Name]

- Account Number: [Account Number]

- Amount to Withdraw: [Amount]

Please let me know if you require additional information or documents to process this request. I look forward to your confirmation and processing of this request.

Sincerely,

[Your Full Name]

To write a clear and effective cash out letter, focus on providing all the necessary details without excess. Begin by clearly stating the purpose of the letter, whether you’re requesting funds, withdrawing earnings, or closing an account.

Start with your contact details. Include your name, address, phone number, and email address at the top of the letter for easy identification.

Specify the request. Be direct and concise about the amount you wish to withdraw and the method of payment. If necessary, refer to any relevant agreement or account number to make your request more straightforward.

Provide necessary supporting details. If the cash-out is tied to a contract or conditions, briefly mention those, ensuring you comply with all outlined requirements. This might include dates, amounts, or other transactional details that strengthen your case.

State the preferred timeline. If you have a deadline or specific time frame in mind, make it clear. Specify when you expect the funds to be available or the transaction to be processed.

Conclude politely. Thank the recipient for considering your request and provide any additional contact information or follow-up steps. Sign off with a formal closing, such as “Sincerely” or “Best regards,” followed by your name.

Be clear and specific in your cash out letter. Below are key components that should be included:

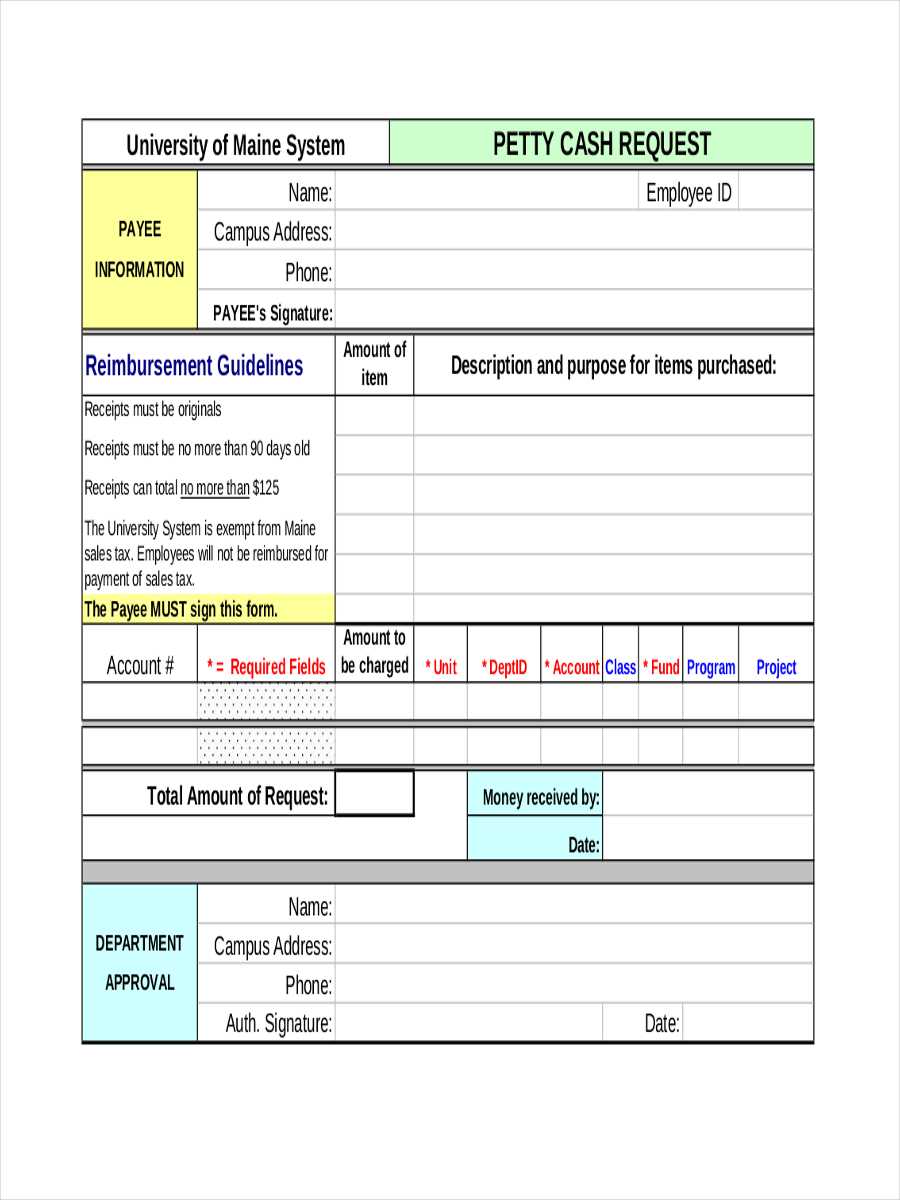

- Recipient Information: Include the full name, address, and contact details of the person or entity receiving the letter.

- Sender Information: Your name, address, and contact details should be listed clearly to ensure proper communication.

- Request for Cash Out: Clearly state that you are requesting the cash-out, including any amounts or specifics about the transaction.

- Account Details: Include any relevant account information, such as account numbers or identifiers, if applicable, to ensure smooth processing.

- Reason for Cash Out: Provide a concise explanation for why you are requesting the cash out, ensuring it aligns with any requirements or agreements.

- Date and Signature: Include the date of the letter and your signature to validate the request.

- Additional Terms: If there are any conditions or specific requests related to the cash-out, mention them clearly in the letter.

Ensure the letter is concise but provides all necessary details for processing the request efficiently.

One of the main mistakes is not providing clear and accurate details. Be specific about the amount you wish to withdraw and the date of the transaction. Avoid vague language or ambiguous terms. A precise figure will help avoid confusion or unnecessary back-and-forth.

Unclear Recipient Information

Make sure to address the letter to the correct person or department. Mistakes in the recipient’s name, title, or contact details can delay the processing of your request. Double-check these details before sending the letter.

Lack of Proper Formatting

Follow a clear and professional structure. Avoid using unorganized or informal formats. Include a proper salutation, body, and closing. A well-structured letter helps to convey your request in a clear, respectful manner.

Lastly, avoid neglecting follow-up actions. While sending the letter is important, checking for any required confirmation or response shows commitment and ensures your request is processed without delay.

Adapt your cash out letter to fit specific needs. Adjust the tone, details, and structure depending on the context. For example, if you’re requesting a cash out due to financial hardship, clearly outline your situation with supporting documents like bank statements or bills. Be direct and concise in explaining why you’re making the request.

1. For Personal Requests

In a personal context, emphasize your current financial situation and any steps you’ve taken to improve it. Make the letter formal but not overly technical. Keep the language clear and respectful.

2. For Business or Investment Cash Outs

When requesting a cash out for business purposes, focus on the financial metrics that justify the request. Include any relevant documents like balance sheets or cash flow statements. Address the return on investment and how the withdrawal will benefit the business.

Key Differences to Consider

| Type of Request | Key Points to Highlight | Required Documents |

|---|---|---|

| Personal | Financial hardship, supporting documentation, clear reasoning | Bank statements, proof of bills or debts |

| Business | ROI, financial performance, growth plans | Balance sheets, financial projections |

Tailoring your cash out letter increases the chances of approval. Always adapt it to the situation at hand, ensuring you present your case clearly and with the necessary documentation.

Ensure that the cash-out letter includes accurate information. The details provided must align with legal requirements to avoid future disputes. All terms and conditions should be clearly stated, including the amount, the parties involved, and the transaction date.

Authorization and Agreement

The person signing the letter must have proper authorization. If you are representing a business, ensure that the letter is signed by someone with legal power, such as an authorized officer or director. Without this, the letter may not hold legal weight.

Compliance with Local Laws

Check for compliance with your jurisdiction’s laws. Depending on where the transaction occurs, certain regulations may apply, such as tax reporting or consumer protection laws. Non-compliance can lead to penalties or invalidation of the agreement.

Begin by ensuring the letter is addressed directly to the recipient, including their full name and accurate contact information. Use a formal, professional tone throughout the letter to maintain clarity and respect. Double-check the recipient’s address to avoid any delays or miscommunication.

Be Clear and Concise in Your Message

State the purpose of the cash out request immediately. Include the amount, transaction details, and any relevant dates. Avoid unnecessary information that might confuse the reader. Keep the content focused and to the point.

Include Supporting Documentation

If required, attach documents that back up the cash out request, such as transaction records or invoices. This helps validate the request and allows the recipient to process it efficiently.

Before sending, proofread the letter for any errors in spelling, grammar, or formatting. A well-organized, error-free letter reflects professionalism and can expedite the process.

Lastly, choose a reliable delivery method. Certified mail or a tracked service ensures that the letter reaches the recipient and provides a confirmation of receipt.

When drafting a cash-out letter, ensure it is concise and clear. Begin with the full name and address of the sender, followed by the recipient’s details. State the purpose of the letter at the start, specifying the amount to be cashed out and the method of payment. Indicate the account or service from which funds will be transferred, along with any transaction reference number if applicable.

Next, provide details about the time frame for the cash-out process and any requirements that must be met, such as additional documentation or verification steps. If applicable, mention any fees or charges associated with the transaction. Be sure to end the letter with a polite closing statement, and provide contact details for follow-up or further inquiries.

Keep the tone professional and direct. Avoid unnecessary details and ensure that all necessary information is present for a smooth transaction.