Cash Receipt Letter Template for Clear Financial Records

When conducting a financial exchange, it’s crucial to provide clear evidence of the transaction. This document serves as a formal acknowledgment of money received, helping both parties maintain accurate records. It ensures transparency, promotes trust, and can be used for future reference or disputes. Whether you’re a business owner or an individual, having a standardized form to confirm payment is essential for smooth financial interactions.

Key Elements of the Confirmation Document

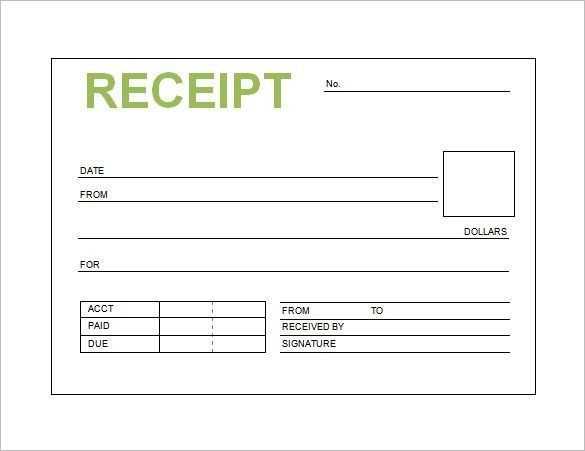

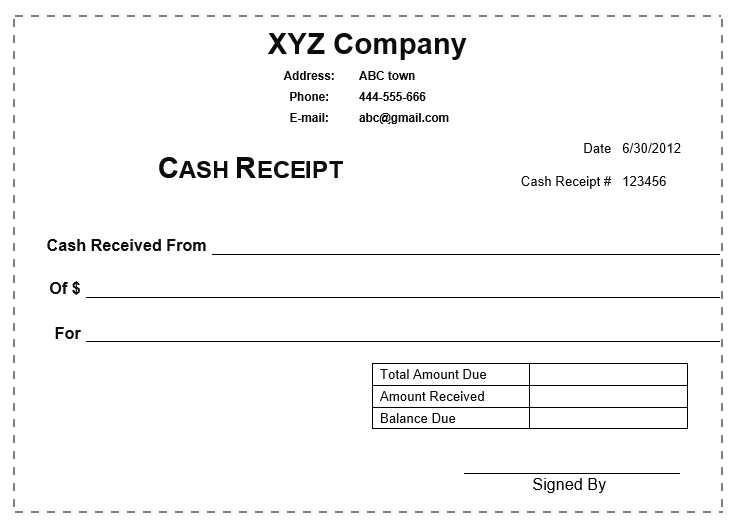

The structure of this document is simple yet effective. It typically includes the following elements:

- Recipient’s Information: Name and contact details of the individual or business receiving the payment.

- Payment Details: Amount paid, the method of payment, and the date of the transaction.

- Reason for Payment: A brief description of the purpose of the transaction.

- Signatures: Both the payer and the recipient sign the document, confirming the terms and agreement.

How to Create a Functional Document

To craft an effective document, focus on simplicity and clarity. Ensure that all necessary information is clearly stated, including the amount and purpose. If customizing for your specific needs, use simple text fields for easy input and include space for signatures. Additionally, provide clear instructions on where and how the document should be signed or submitted.

Benefits of Using a Standardized Form

Having a ready-made format offers several advantages:

- Consistency: It ensures that every transaction is documented in the same way.

- Legal Security: A properly filled form can serve as legal proof of payment.

- Efficiency: Saves time by providing a structure that requires minimal customization for each use.

Where to Use This Document

This document can be used in a wide range of scenarios, from personal transactions to professional exchanges. It is particularly useful in scenarios where payments are made in cash or by alternative methods that don’t provide automatic proof of payment. It’s also common in business agreements, freelance work, rental payments, and more.

Understanding Payment Acknowledgment Documents

When confirming a financial transaction, it’s crucial to have a document that clearly acknowledges the exchange. This type of record provides evidence for both the giver and receiver, helping ensure transparency in the transaction. Its importance lies in its ability to act as proof of a completed payment, serving both as a reference and a legal safeguard in case of any future disputes.

These documents are essential for maintaining organized financial records. They offer both parties a written confirmation of the amount paid, the date of payment, and the purpose behind the transaction. Without such a document, it can be challenging to verify the details of a financial exchange, especially in cases where the transaction wasn’t automated or directly recorded through digital systems.

The key aspects of an effective document include details like the identity of both parties involved, the payment amount, and the method used. Additionally, a description of the reason for the exchange adds further clarity. Signatures from both parties solidify the agreement, making the document legally binding and trustworthy for future reference.

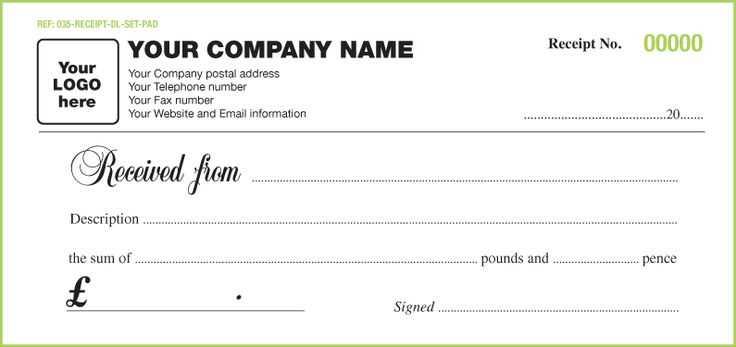

Personalizing such a document involves adjusting the format to suit specific needs, such as adding unique fields or customizing the text. If you’re using this for business purposes, you may choose to include company logos, contact information, or terms of service to make the document more professional and tailored to your branding.

There are several best practices for handling these forms. It’s important to keep them organized and ensure they are filled out completely and accurately. Both parties should review the details before signing, and copies should be made for future reference. Storing these documents digitally is also a good practice to avoid losing physical copies over time.

Common mistakes often occur when important details are left out, such as the method of payment or the correct amount. Another error is failing to get the necessary signatures, which can make the document less reliable. Always double-check all entries and ensure that the document is properly executed to avoid complications later.