Change of bank details letter to customers template

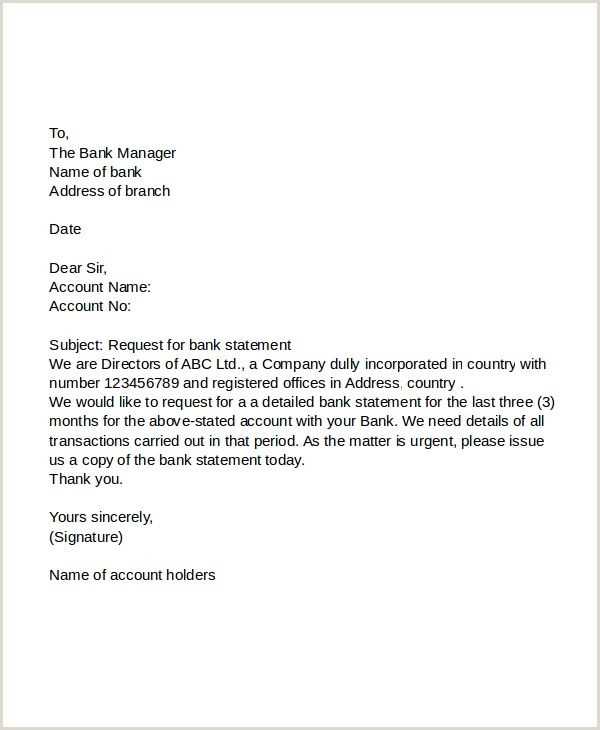

Notify your customers about a change in bank details with clear and concise communication. Use the following template to draft a letter that includes all necessary information for a smooth transition.

Begin by addressing the customer by name, ensuring the message feels personal. State the reason for the change and provide the new bank account details. Keep the tone friendly and informative, making sure the recipient feels reassured.

Example:

Dear [Customer Name],

We are writing to inform you of an update to our banking details. As of [Effective Date], all payments should be directed to the following account:

New Bank Account Details:

Bank Name: [Bank Name]

Account Number: [New Account Number]

Sort Code: [New Sort Code]

We kindly ask you to update your records and use these new details for all future payments. If you have any questions or concerns, feel free to reach out to us at [Phone Number] or [Email Address].

Thank you for your attention to this matter. We look forward to continuing our partnership.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

Here’s the corrected version:

Make sure the subject line is clear and direct. Use phrases like “Update to Your Bank Details” or “Important: Bank Account Information Change.” This helps your customers immediately identify the purpose of your communication.

Clear Details of the Change

Specify the change clearly. Include the old account details along with the new ones. Provide the full account number, bank name, and any relevant branch information. Keep the format clean and easy to follow.

Reassurance and Next Steps

Assure your customers that the transition will be smooth and there will be no disruptions to service. Mention if any action is required on their part, such as updating payment information on their end, and provide a deadline if necessary.

End the letter with a contact number or email for customers who may need further assistance. Be prompt in responding to any queries to avoid confusion.

Change of Bank Details Letter to Customers Template

How to Inform Customers About Updated Banking Information

Key Details to Include in Your Notification Letter

Appropriate Tone and Language for a Professional Letter

Best Practices for Ensuring Customer Trust and Clarity

When and How to Send the Bank Details Update Notice

Legal Aspects of Changing Bank Information for Customers

When informing customers about updated bank information, clarity and accuracy are key. Begin by stating the change clearly, and provide all necessary new banking details, such as account number, sort code, and bank name. Avoid including too much personal information that could cause confusion.

Key Details to Include: Include your old and new bank details for comparison, the effective date of the change, and any actions customers need to take. Provide clear instructions for payments or direct debits to avoid any disruptions. If the change is due to a merger or other significant business decision, briefly explain the reason for the update, but avoid over-explaining or over-sharing sensitive information.

Tone and Language: Use a professional yet approachable tone. Address your customers respectfully and ensure the letter is easy to understand. Use direct language–avoid jargon or overly formal wording that could confuse readers. Keep sentences short, to the point, and focused on the key information they need to know.

Best Practices for Trust and Clarity: Transparency is crucial. Make sure the letter is free from errors, and check all new details for accuracy. Offer a way for customers to contact you with questions or concerns. Be mindful that some customers may feel uncertain about the change, so reassure them that everything is secure and that this is a standard update.

Timing and Sending the Update Notice: Notify your customers at least 30 days in advance to give them time to adjust their payment methods. Ideally, send the letter via both email and postal mail to ensure delivery. Follow up with a reminder closer to the update date, especially if there are any pending transactions.

Legal Considerations: When changing banking details, check if your industry has specific regulations around notifying customers. Ensure the update complies with relevant financial and consumer protection laws. Avoid making any misleading statements about the security or reliability of the new banking arrangements. Always give customers ample time to adjust and update their payment methods accordingly.