Chexsystems Dispute Letter Template for Effective Resolution

Incorrect information on your financial report can affect your ability to access banking services or loans. If you spot any discrepancies, it’s crucial to take steps to correct them. One effective way is to submit a formal request to the agency responsible for maintaining these records. This process involves clearly stating the errors, providing supporting documentation, and requesting corrections to ensure your file reflects accurate details.

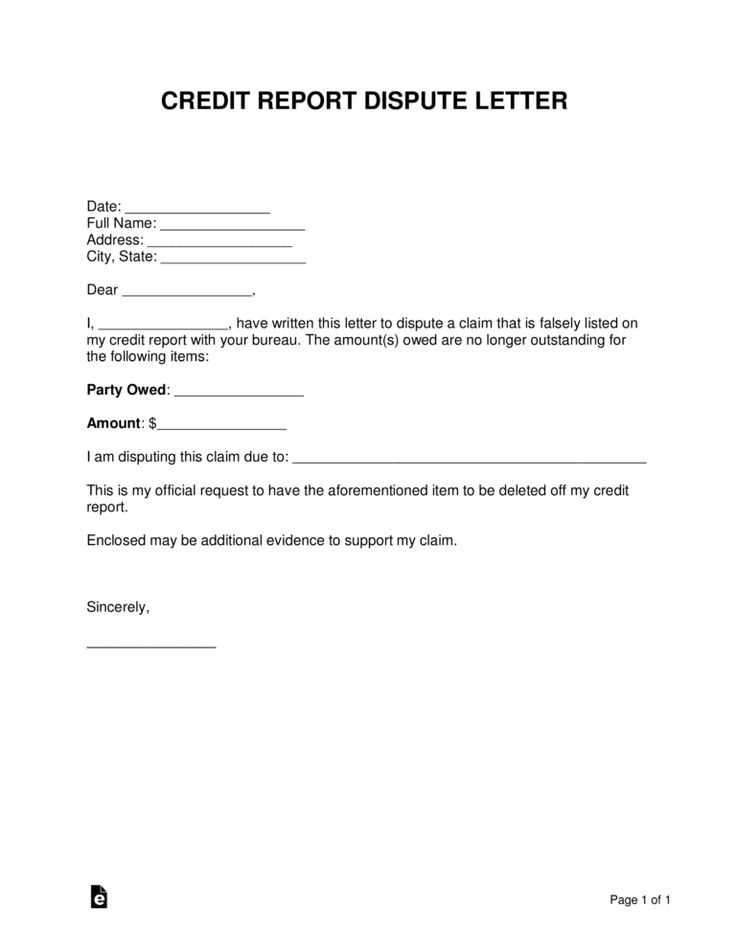

Essential Details to Include in Your Request

To ensure your request is properly processed, it’s important to include certain key details. The following are critical elements to mention:

- Your Full Name – Ensure your name matches the one on record.

- Account Number – Provide relevant account numbers related to the dispute.

- Description of the Issue – Briefly explain what is incorrect and how it affects you.

- Supporting Evidence – Attach any documents that back up your claim, such as bank statements or correspondence.

- Desired Resolution – Clearly state the correction you are requesting.

Step-by-Step Process for Crafting Your Request

Here are the basic steps to follow when writing your correction request:

- Start with Your Personal Information: Include your full name, address, and contact details to ensure the organization can easily locate your records.

- Describe the Error: Identify and explain the inaccurate information clearly. Be concise and stick to the facts.

- Provide Supporting Documents: Attach any relevant paperwork that proves the error. This can include transaction records or official statements.

- State the Correction You Want: Specify exactly how you want the agency to address the error.

- End with a Formal Request for Action: Politely ask for prompt attention to your matter and provide a way to contact you for further questions.

Avoid Common Mistakes

While it’s important to be thorough, there are several mistakes to avoid when addressing errors in your financial record:

- Vagueness: Avoid general statements or unclear explanations. Be precise about the error.

- Omitting Proof: Always include supporting documentation to back up your claims.

- Being Impolite: Maintain a professional and respectful tone in your request.

What to Do After Submission

Once your request is sent, you’ll need to follow up to ensure it’s being processed. Most agencies will respond within a specified time frame, but if you don’t hear back, don’t hesitate to contact them for an update. Keep copies of all correspondence for your records in case further action is necessary.

Understanding the Financial Record Correction Process

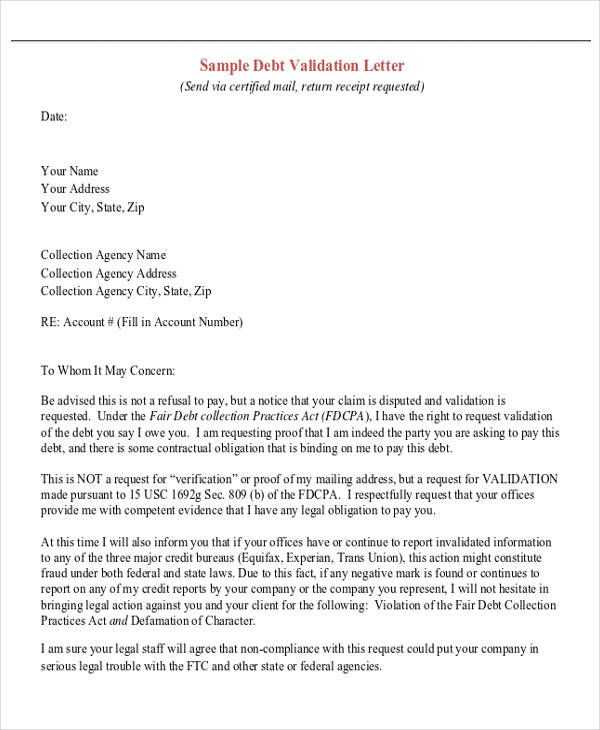

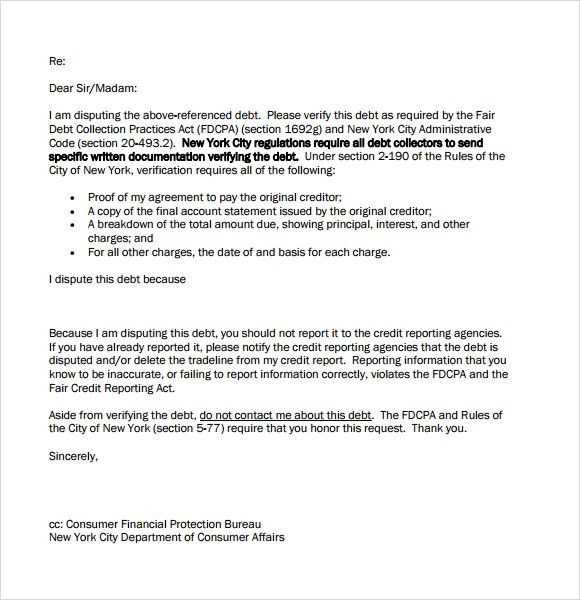

When errors are identified in your financial history, it’s crucial to address them promptly. These mistakes can influence your ability to access services or loans, so ensuring your information is accurate is vital. This section explains the steps you should take to request corrections, what to include, and how to avoid mistakes in the process.

There are several reasons why you might need to submit a formal request. Commonly, incorrect data such as outdated account statuses, payment discrepancies, or identity errors can negatively affect your financial reputation. A formal request ensures the organization reviews and rectifies these mistakes efficiently, safeguarding your rights.

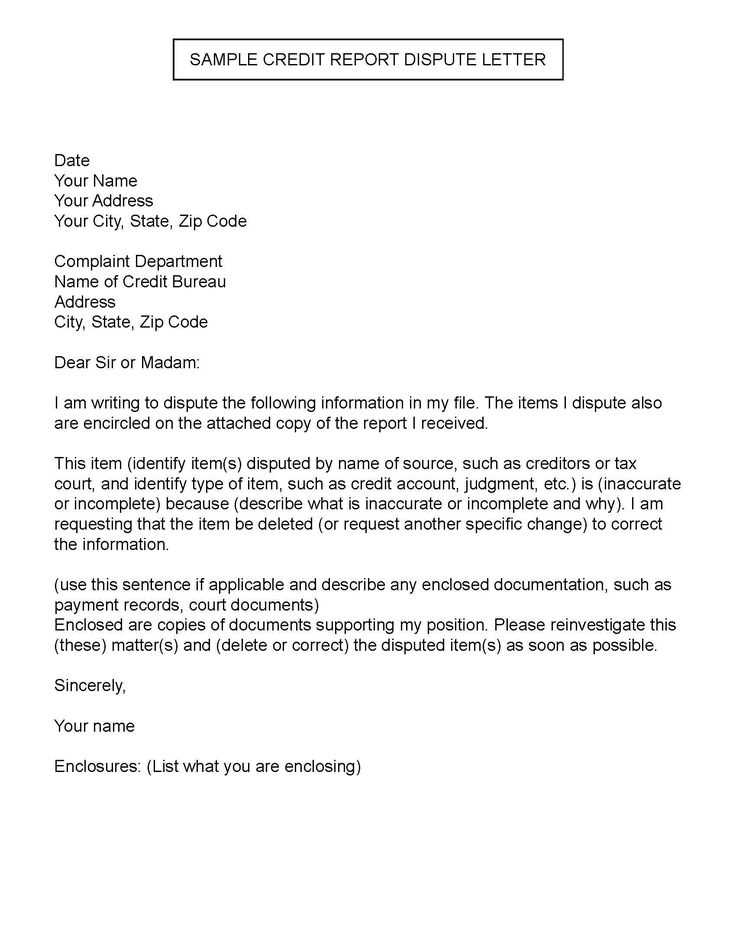

Key Information to Include

When preparing your request for corrections, certain details are essential for clarity and effectiveness:

- Your Full Information: Include your full name, contact details, and any identification numbers associated with your financial records.

- Explanation of the Error: Clearly outline the mistake, providing specifics on what is incorrect and how it affects your financial standing.

- Supporting Documents: Attach any relevant paperwork that proves your claim, such as bank statements, transaction records, or official correspondence.

- Requested Correction: State what action you would like the agency to take, such as updating account status or removing inaccurate information.

Steps for Crafting Your Request

Follow these steps to create an effective and professional request:

- Start with Your Contact Details: Provide your name, address, and contact information at the beginning for identification purposes.

- Describe the Error Clearly: Be specific about the incorrect data and how it impacts you, using concise and factual language.

- Provide Documentation: Attach relevant supporting evidence, such as copies of bills, statements, or official records.

- Request the Correction: Clearly state the correction you expect to be made, outlining the desired result.

Common Mistakes to Avoid

To ensure your request is taken seriously, avoid the following pitfalls:

- Vague Language: Be specific about the error and what you need fixed. Generalized statements may lead to confusion.

- Lack of Proof: Always include supporting evidence to back up your claims and strengthen your case.

- Inappropriate Tone: Use a polite, professional tone throughout your request to maintain credibility.

How to Follow Up

Once your request is submitted, it’s important to follow up to ensure the issue is being addressed. Keep a record of all communications and follow up if you do not receive a timely response. Stay organized and keep track of all correspondence for future reference.