Effective Collection Letter Templates for Debt Recovery

When facing unpaid invoices, reaching out to clients or customers is essential. Crafting a clear, professional message can significantly enhance the chances of resolving the situation quickly. The right structure, tone, and content are crucial for maintaining a positive relationship while encouraging payment. This section discusses various methods for drafting successful communications aimed at debt resolution.

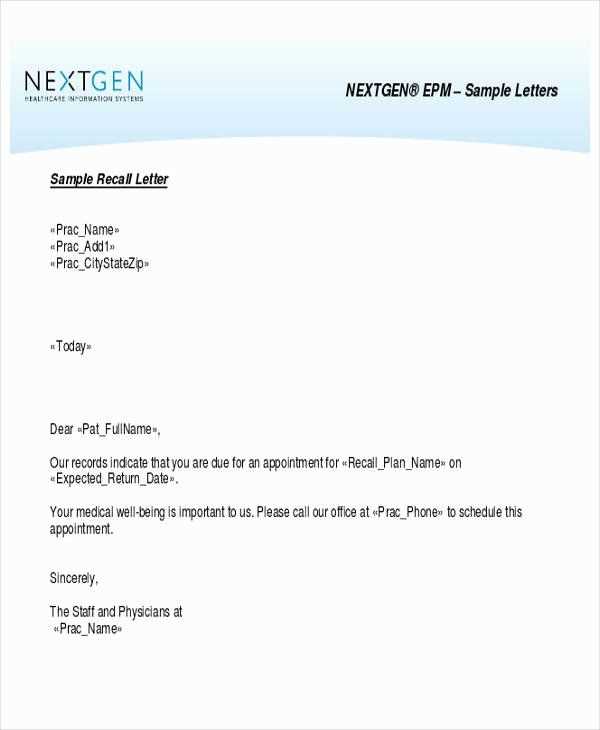

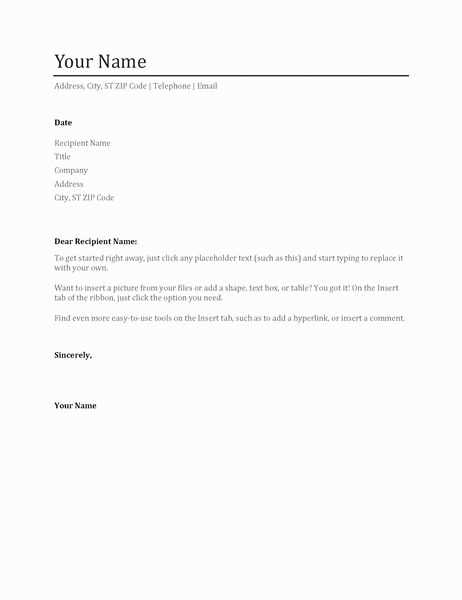

Essentials of a Professional Communication

Every communication regarding unpaid amounts should include certain key components. These elements ensure clarity and encourage prompt action from the recipient:

- Clear identification of the debt: Provide concise details about the amount owed, due dates, and any previous reminders.

- Respectful tone: Maintain professionalism, avoiding aggressive language while still emphasizing the urgency of the matter.

- Payment instructions: Offer clear steps on how the recipient can settle the debt, including payment methods and deadlines.

Why Structure Matters

The way a message is structured can affect its effectiveness. A well-organized communication is easier to read and understand, prompting quicker responses. Be sure to use:

- Simple, direct language to avoid confusion.

- A logical flow, starting with the reason for the communication, followed by the details and a clear call to action.

- A polite closing, encouraging further communication if there are any questions or concerns.

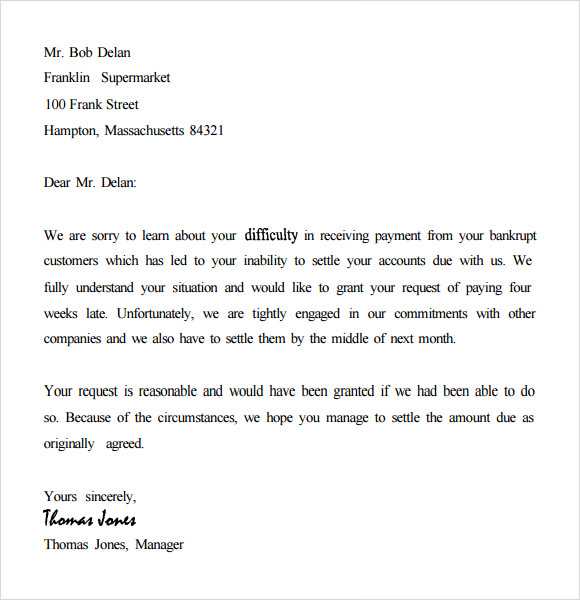

Customizing Communications for Your Audience

While the message should remain professional, adjusting the tone and content to suit the recipient’s situation can be beneficial. For example:

- For first-time reminders: A softer approach that acknowledges potential oversights can be effective.

- For recurring delinquents: A firmer, more urgent tone may be necessary, while still remaining courteous.

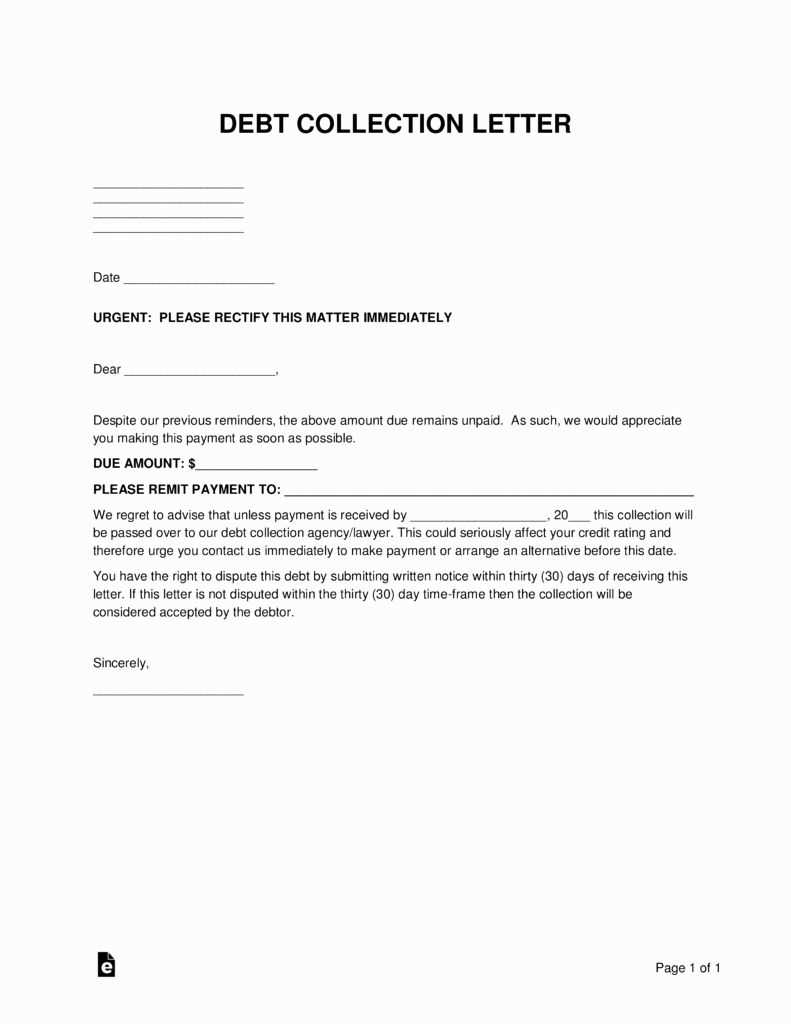

Boosting Response Rates with Clear Actions

The ultimate goal is to encourage timely payment. By providing actionable steps and outlining the consequences of further delay, the recipient will better understand the importance of resolving the matter. Make sure to:

- Specify a payment deadline.

- Provide contact details for any questions or disputes.

- Outline any additional charges or penalties if the debt remains unpaid after the given time frame.

Strategies for Debt Recovery Communications in Business

Effectively managing overdue payments requires clear and professional communication. Businesses need reliable tools to handle these situations, ensuring that the message is both firm and respectful. This section will guide you through selecting the appropriate structure, understanding essential components, and customizing content to suit your business needs. It also highlights potential legal concerns and common mistakes to avoid when drafting these important communications.

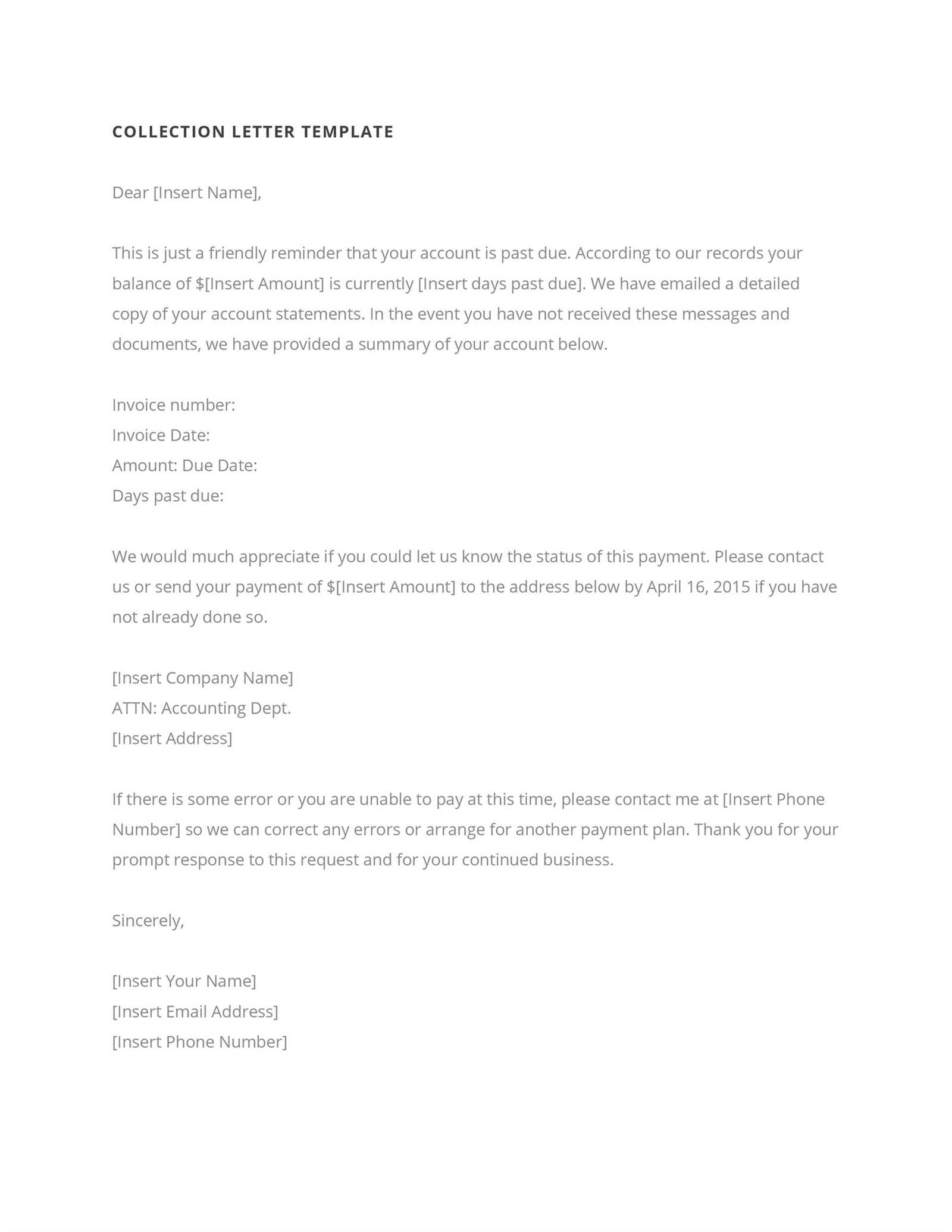

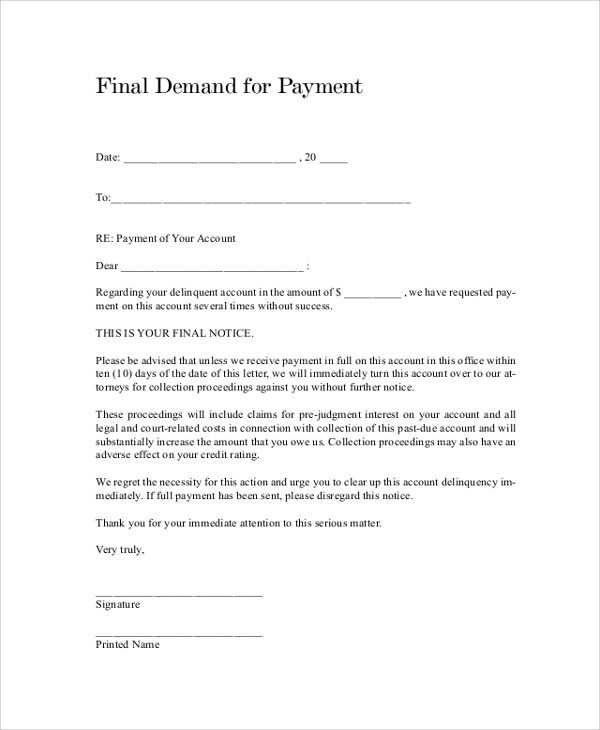

Choosing the Right Format for Your Needs

Selecting the appropriate format for your communication can impact how the message is received. Whether it’s a gentle reminder or a more formal request, choosing the right approach is critical for encouraging prompt payment. For a first reminder, a soft tone with a clear request for payment works best. However, for overdue accounts, a firmer stance with specific payment instructions is more effective.

Key Components of an Effective Communication

An effective communication should be clear, direct, and structured. The essential elements include:

- Clear identification of the debt: Provide details of the amount owed and relevant dates.

- Specific payment instructions: Clearly explain how and where payment should be made.

- Polite but firm tone: Encourage resolution while maintaining professionalism.

By including these components, you ensure your message is clear and actionable, improving the chances of receiving payment promptly.

Legal Aspects to Consider

When composing these communications, it is important to remain within legal boundaries. Ensure that the language used complies with the Fair Debt Collection Practices Act (FDCPA) or any applicable local laws. Avoid threatening language and always give the recipient adequate time to respond before taking further action. Adhering to legal requirements protects both your business and your reputation.

Incorporating these best practices into your approach can lead to more successful resolutions and improved cash flow.