Confirmation Paid in Full Letter Template for Debt Collectors

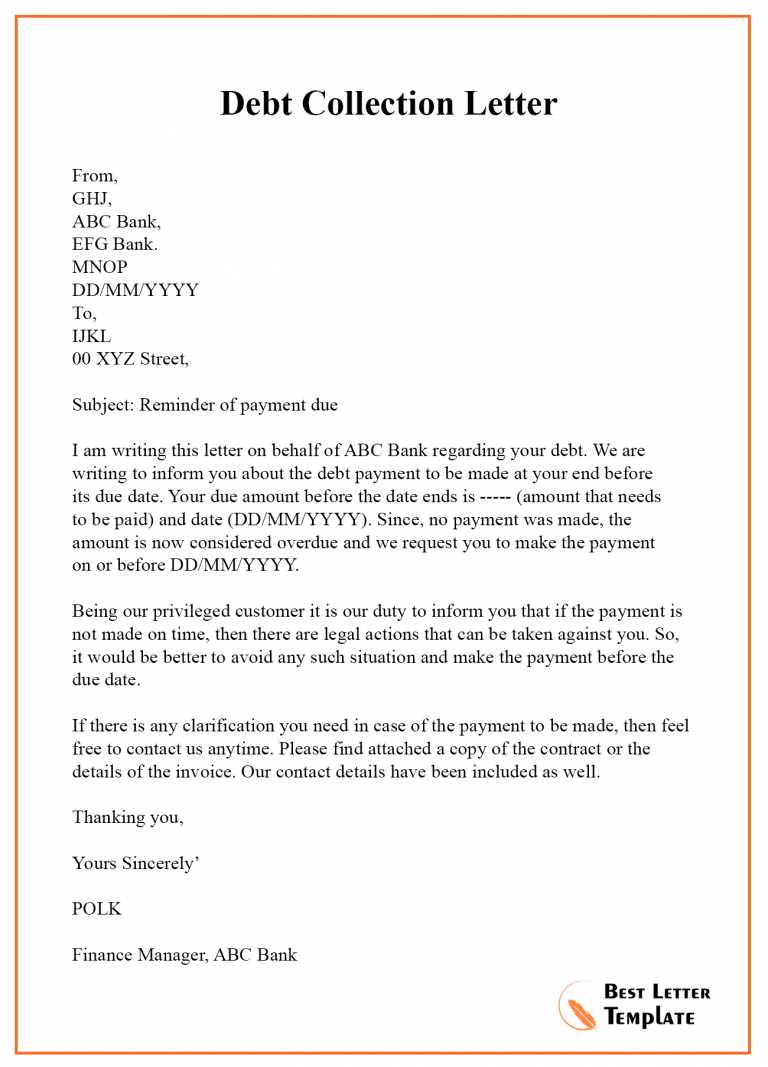

When a financial responsibility is resolved, it’s essential to properly document the conclusion of the arrangement. This process ensures both parties acknowledge the settlement and prevents future misunderstandings. Proper acknowledgment serves as a confirmation that the balance has been cleared, offering a clear and legally sound record.

Key Elements of an Acknowledgment Statement

An effective acknowledgment should include specific details that validate the completion of the transaction. These typically involve the following:

- Account Information – Clearly specify the account or obligation that was settled.

- Resolution Date – Indicate when the final payment was made and the responsibility concluded.

- Parties Involved – Identify both the creditor and the individual or organization that fulfilled the terms.

- Amount Paid – Outline the sum that was settled, confirming it covers the entire balance due.

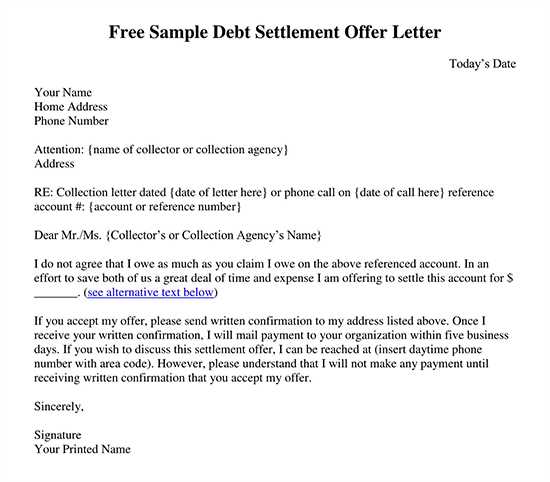

How to Draft an Effective Acknowledgment

Creating a proper acknowledgment involves clear, concise language that leaves no room for ambiguity. It should be formal, free of jargon, and state unequivocally that the agreement has been met. Here are some simple steps:

- Start with a formal salutation to the other party.

- Reference the original agreement, including dates and terms.

- Clearly indicate the total amount cleared and confirm that no further balance remains.

- Conclude by reaffirming that both parties have fulfilled their responsibilities and that the matter is now closed.

Legal Considerations

When preparing an acknowledgment, it’s vital to ensure that all statements made are legally binding. Avoid using ambiguous terms that could be misconstrued. It’s also important to maintain a professional tone to ensure the document holds weight in legal settings if needed. A well-drafted record will prevent any future disputes regarding the cleared obligation.

Why This Document is Important

Having a clear, documented confirmation that an arrangement has been satisfied can greatly protect both parties. It serves as proof that the matter is settled, which can be crucial for credit reports, future financial dealings, and avoiding any future claims of unpaid balances. It is a necessary piece of documentation that provides security and peace of mind.

Why Documenting the Settlement of Financial Obligations Matters

Documenting the completion of a financial responsibility is crucial for both parties involved. It serves as formal recognition that the agreement has been fulfilled, preventing any future confusion or disputes. These records protect both the individual and the institution from misunderstandings and ensure clear closure of financial matters.

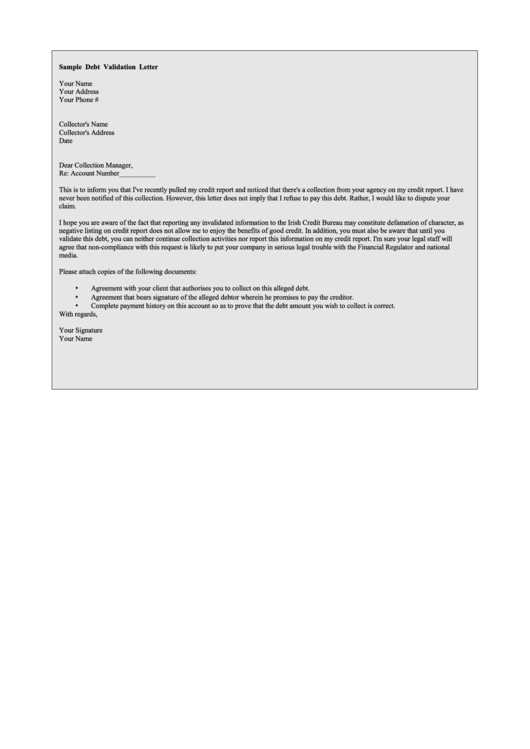

Key details in this type of acknowledgment must include specific information about the settlement. It’s essential to note the responsible party, the exact amount settled, and the date when the commitment was finalized. This provides a transparent and indisputable record that the matter has been resolved.

When drafting a statement of settlement, clarity and precision are paramount. It’s important to ensure that the document explicitly communicates that the financial obligation has been cleared in its entirety. Key components to include are a description of the transaction, the names of the involved parties, and the exact amount settled.

There are legal considerations to keep in mind when drafting a settlement statement. The language used should be direct, professional, and unambiguous. This ensures that the document holds legal weight if necessary. It is also advisable to ensure all terms and conditions are clearly stated, minimizing the chance of any future disputes or misunderstandings.

Common mistakes made in these types of acknowledgments include leaving out critical details, such as the precise amount paid or the date of settlement. Ambiguities in wording can also lead to complications later on. To avoid these issues, it’s essential to be thorough and precise in the language used.

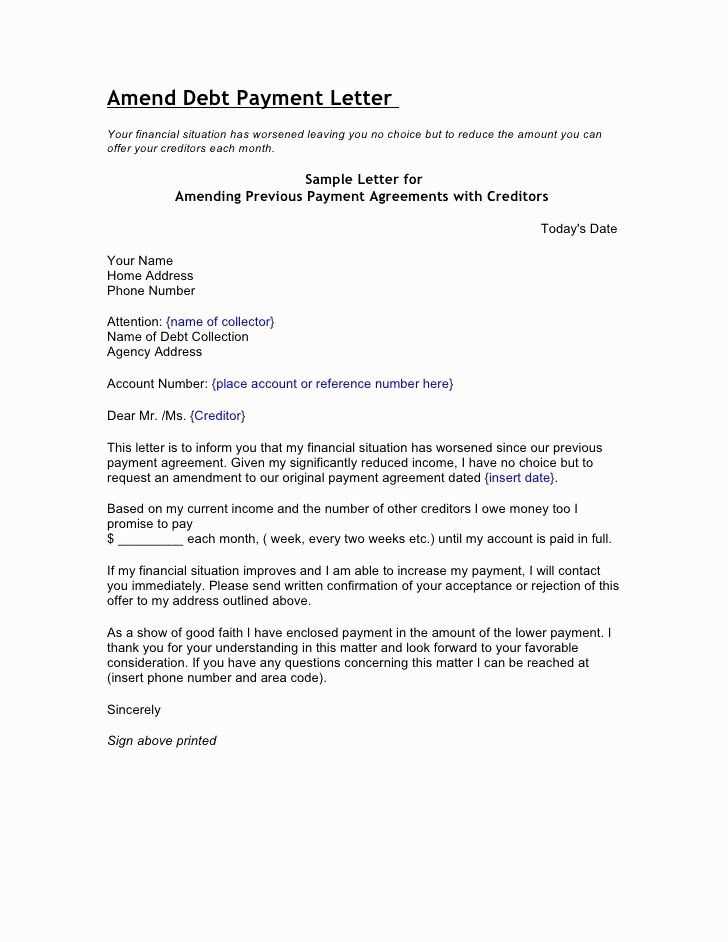

Issuing a document stating that the financial arrangement has been fulfilled should occur promptly after the final payment is made. Timing is important to ensure that the document reflects the most current information and that the involved parties have formal confirmation of the resolution.

These records also play a significant role in credit reports. Proper documentation of a fully settled obligation ensures that the creditor or institution reports the accurate status of the account. This can positively impact the individual’s credit score, demonstrating financial responsibility and closure of the matter.