Cover Letter Template for IRS Submission

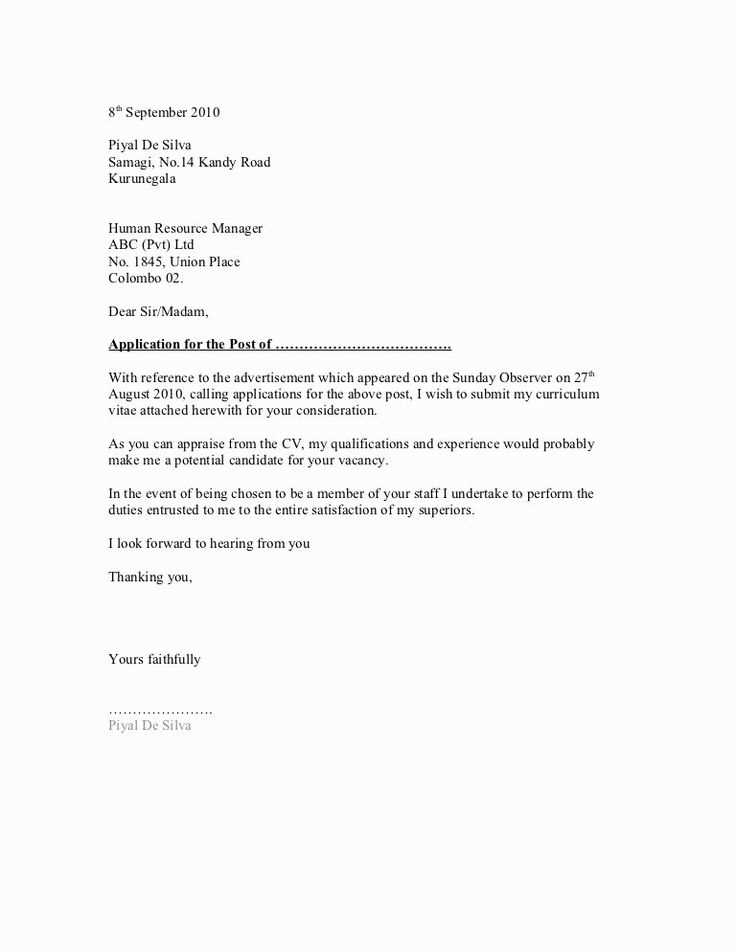

When dealing with the tax department, it’s essential to present your case clearly and professionally. Written requests or explanations should follow a specific structure to ensure the intended message is conveyed properly. Below is an overview of how to compose an effective correspondence for such purposes.

Structuring Your Document

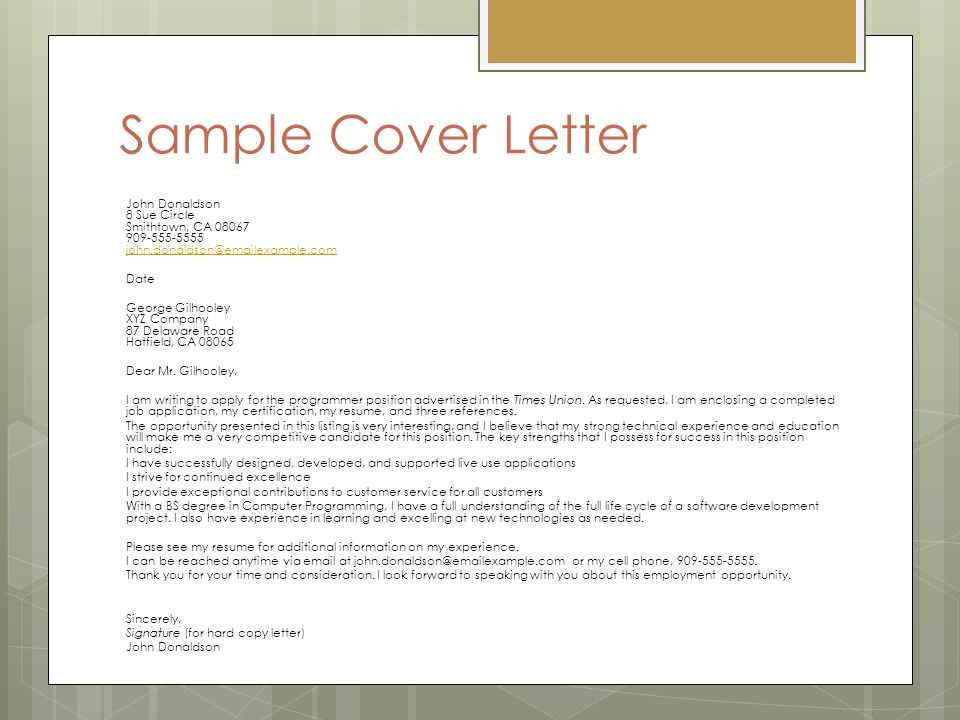

The key to a successful submission is clarity and organization. Start with a proper introduction, stating your reason for reaching out. Next, provide a detailed explanation or any supporting documents. Be concise yet thorough in addressing the matter at hand.

Essential Details to Include

- Full Name and Contact Information

- Taxpayer Identification Number (TIN) or Social Security Number (SSN)

- The purpose of your communication (request, clarification, etc.)

- Relevant dates or reference numbers

- Any additional information supporting your case

Avoiding Common Errors

One frequent mistake is failing to clearly state the purpose. Without a well-defined objective, your submission may cause confusion or delay. Additionally, neglecting to include required documentation can lead to unnecessary back-and-forth.

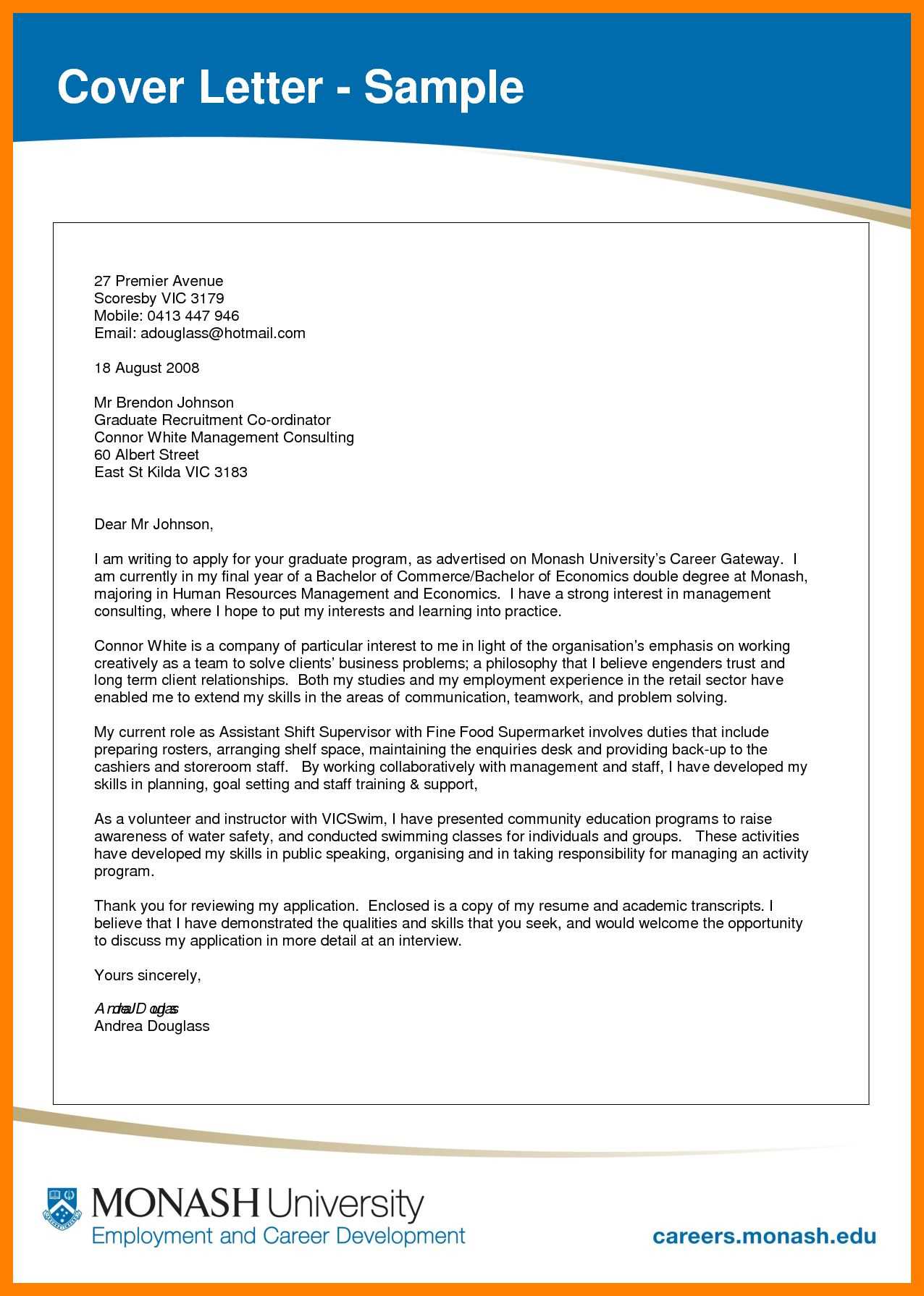

Formatting Tips

Adhering to a proper format is important. The layout should be clean, with clear paragraph breaks and organized sections. Use bullet points or numbered lists to highlight key points for easy reference. A formal tone should be maintained throughout the correspondence.

Final Thoughts

By following the guidelines outlined here, you can ensure that your communication is both professional and effective. Always review your work for accuracy and completeness before submission to avoid any complications.

Understanding the Importance of Communication with Tax Authorities

Effective written correspondence with tax agencies is crucial for resolving matters efficiently. Whether responding to inquiries or providing additional information, the way the communication is structured can significantly impact the outcome. A well-organized submission increases the chances of a swift and accurate resolution, ensuring that all necessary details are conveyed without confusion.

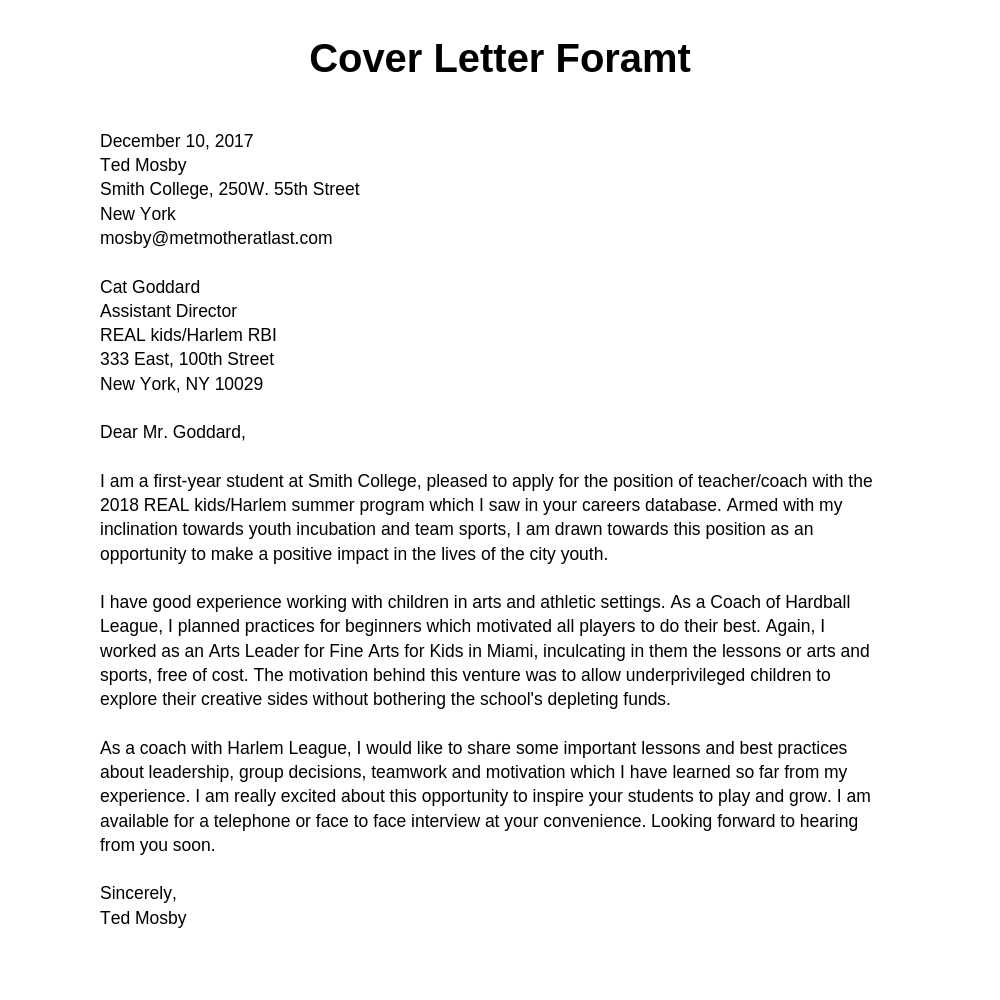

Proper Structure for Effective Communication

Organizing your correspondence logically is the first step toward clear communication. Begin by introducing yourself and stating the reason for reaching out. Provide all relevant details in a systematic manner, followed by any supporting documents. Conclude by reaffirming your request or intention, ensuring that the recipient has all necessary information to proceed.

Avoiding Common Mistakes

It’s essential to avoid errors that could delay your request. A common mistake is not including essential information, such as identification numbers or case references. Another issue is vague language; always ensure that your intent is explicitly clear. Avoiding these pitfalls ensures that your communication will be processed without unnecessary back-and-forth.

By following a clear structure, including all the right details, and avoiding common mistakes, you increase the likelihood of your communication being processed quickly and effectively. Proper formatting also contributes to a smoother review process, making it easier for tax officials to address your concerns without delays.