Debt Consolidation Letter Template to Simplify Your Finances

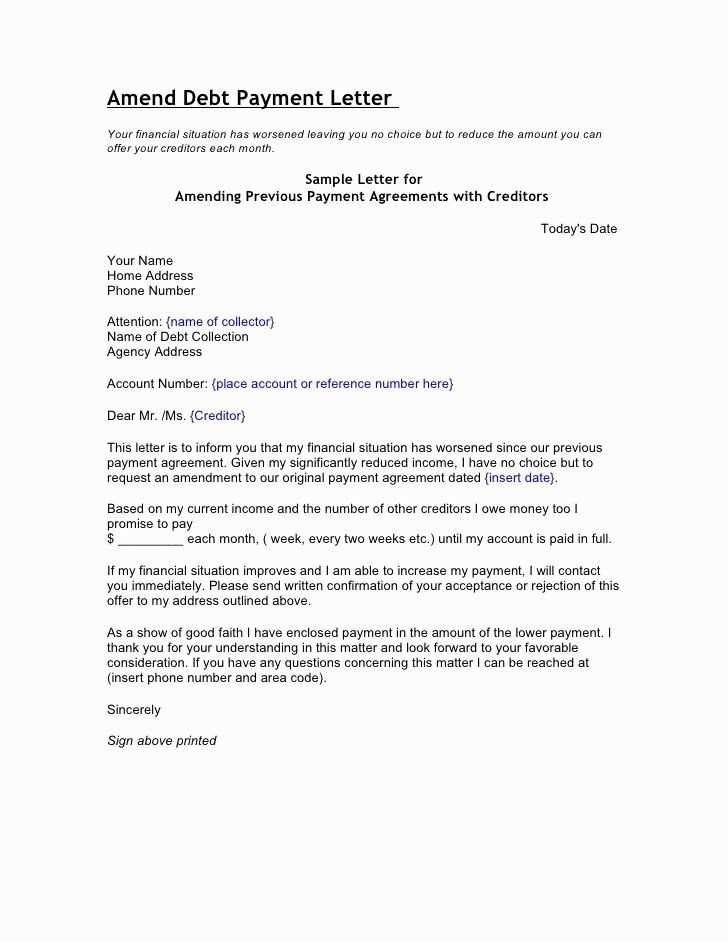

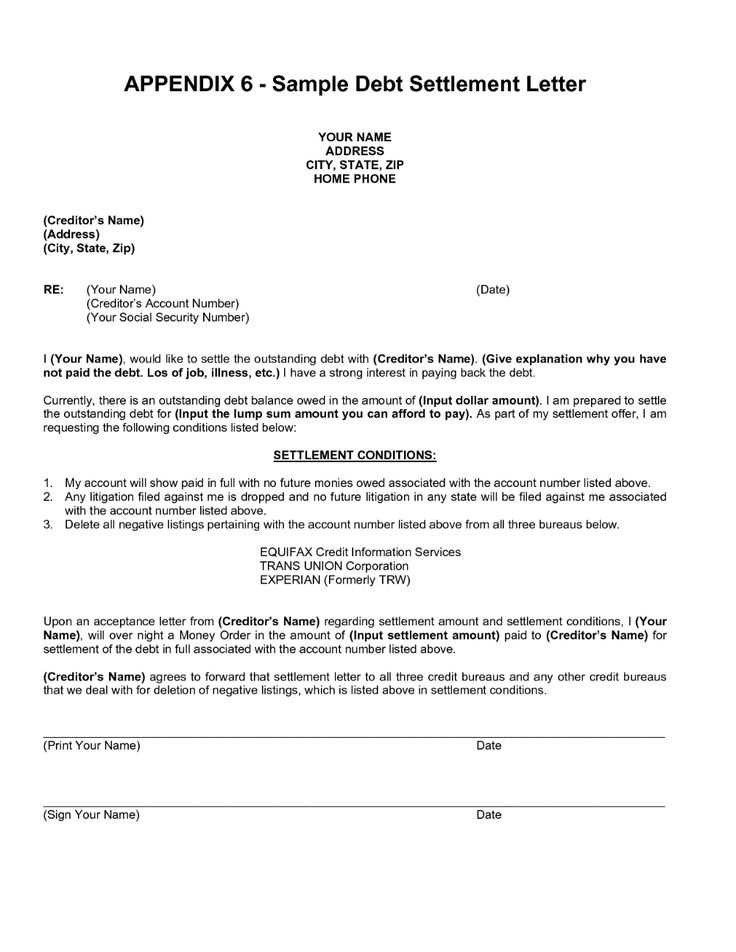

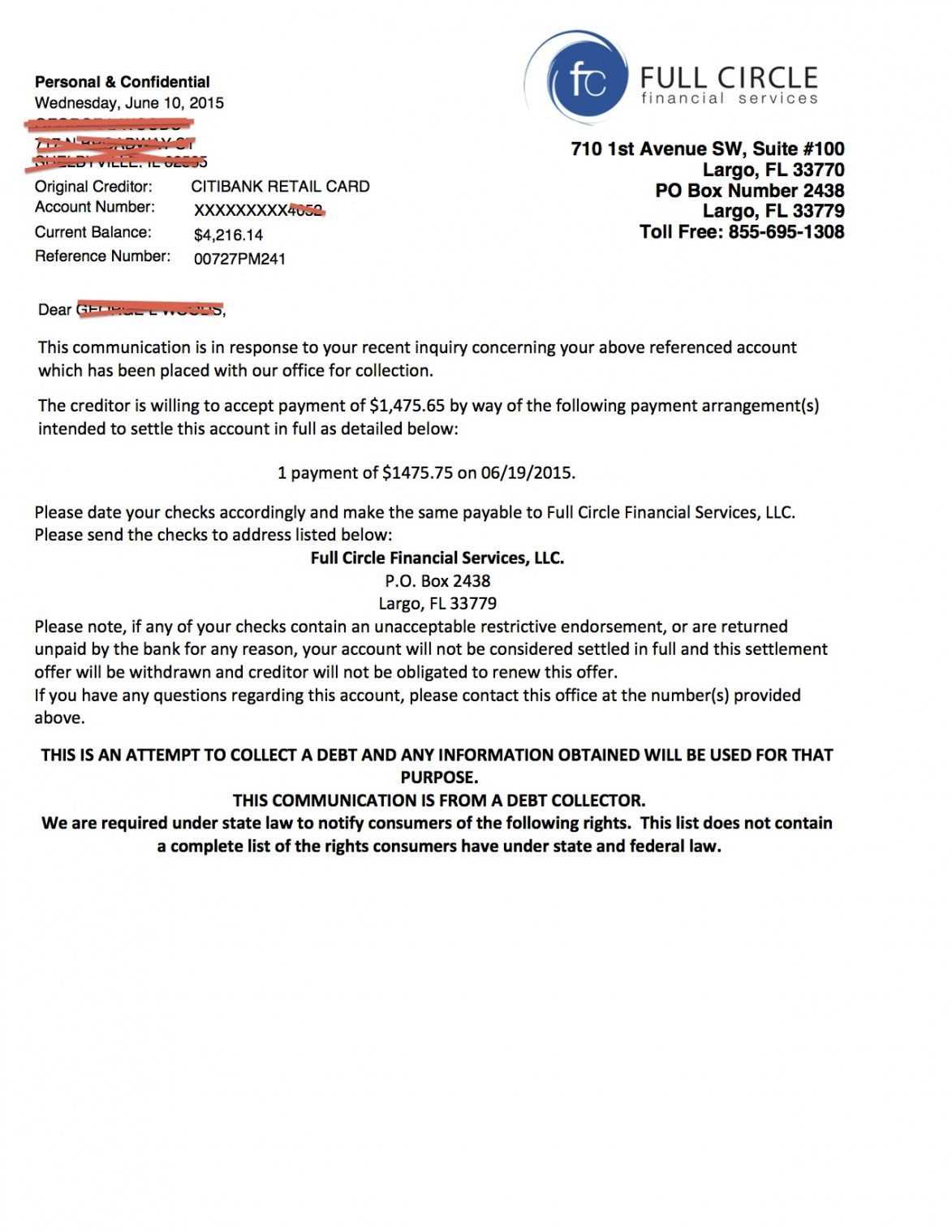

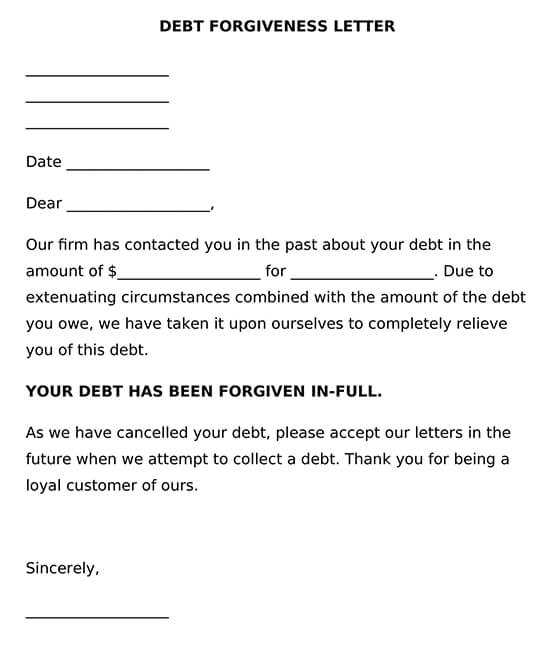

When managing multiple financial obligations, it can be overwhelming to keep track of all payments and balances. A well-structured written request can help simplify the process, allowing individuals to negotiate more manageable terms. Such a document serves as an official communication to creditors, outlining the intention to combine outstanding balances into a more accessible plan.

Key Components to Include in the Document

It is essential to ensure that the communication contains all necessary information for clarity and efficiency. Here are the main points to address:

- Personal Information: Include your full name, contact information, and relevant account numbers.

- Current Financial Status: Provide an overview of your financial situation, including total outstanding amounts and any ongoing payments.

- Request for Adjusted Terms: Clearly state the desired changes, such as reduced payments or extended deadlines.

- Reason for the Request: Explain the circumstances that led to the need for such adjustments, whether personal, medical, or otherwise.

- Action Steps: Outline any steps you have already taken to address the situation and express your willingness to cooperate further.

How to Structure Your Appeal

The format of your document is just as important as its content. Keep the message concise, professional, and respectful. Begin by addressing the recipient by name, if possible, and make sure to clearly explain your intent. Be direct but polite, and avoid any unnecessary details that could detract from your main request.

Common Mistakes to Avoid

- Being vague or unclear about what is being requested.

- Failing to include accurate account details or contact information.

- Using an overly aggressive or demanding tone.

- Neglecting to proofread for grammar or spelling errors.

Timing Your Request

Sending your appeal at the right time can significantly impact its success. Ideally, submit the request after reviewing your financial obligations and understanding your repayment abilities. Early communication is often key in establishing cooperation with creditors.

Conclusion

By following these steps and preparing a clear, respectful communication, individuals can make their financial requests more effective and improve their chances of receiving favorable terms. A well-crafted proposal can be an essential tool for regaining control over financial commitments.

How to Draft a Financial Request for Assistance

When managing multiple outstanding obligations, it can be challenging to stay organized and make timely payments. A formal request to restructure these financial commitments can be an effective way to gain better control over your finances. The following section will guide you through the essential steps and considerations when preparing such a request.

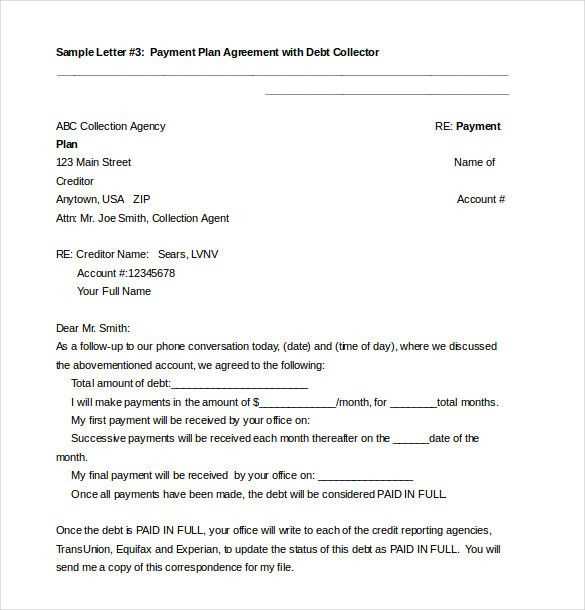

How to Create an Effective Financial Appeal

Begin by clearly outlining your financial situation. Ensure that you are direct about your request, but also polite and respectful. Address the recipient professionally, including your full contact details and any relevant account numbers. The communication should clearly state your intent to combine multiple balances into a more manageable payment plan. Keep the tone calm, concise, and solution-focused.

What Information to Include in Your Request

To ensure your proposal is taken seriously, be sure to include the following key details:

- Personal Information: Include your full name, contact details, and relevant identification or account numbers.

- Current Financial Status: Briefly explain the total amount of outstanding balances and any ongoing payment arrangements.

- Request for Modified Terms: Clearly specify what changes you would like to see, such as reduced payments or extended deadlines.

- Reason for Request: Be honest about the factors leading to your request–whether due to personal, medical, or financial hardship.

- Willingness to Cooperate: Show that you are committed to resolving the situation and working with creditors to reach a mutually beneficial solution.

Avoiding Common Pitfalls in Financial Requests

When drafting your appeal, avoid these common mistakes:

- Vagueness: Be specific about your request to avoid confusion.

- Missing Information: Double-check that all relevant details, including your account information, are correct.

- Impolite Tone: While you may be in a stressful situation, maintain a respectful and professional tone throughout your communication.

- Grammatical Errors: Proofread your request before sending it to ensure clarity and professionalism.

Benefits of Restructuring Financial Obligations

By reorganizing your outstanding payments, you can gain better control over your financial situation. This process often leads to lower monthly payments, reduced interest rates, and more manageable terms. It can provide much-needed relief and allow you to focus on improving your financial health.

When to Submit Your Financial Appeal

The timing of your request is critical. It’s best to send your communication once you have fully assessed your financial situation and are certain about the changes you need. Early intervention is often key to reaching a positive resolution, as creditors may be more willing to negotiate terms before the situation worsens.