Effective 609 Letter Template for Credit Disputes

htmlEdit

Many people face challenges when addressing inaccuracies in their financial records. A well-structured approach can simplify the process and improve outcomes. This guide will help you understand how to construct a compelling request to address errors efficiently.

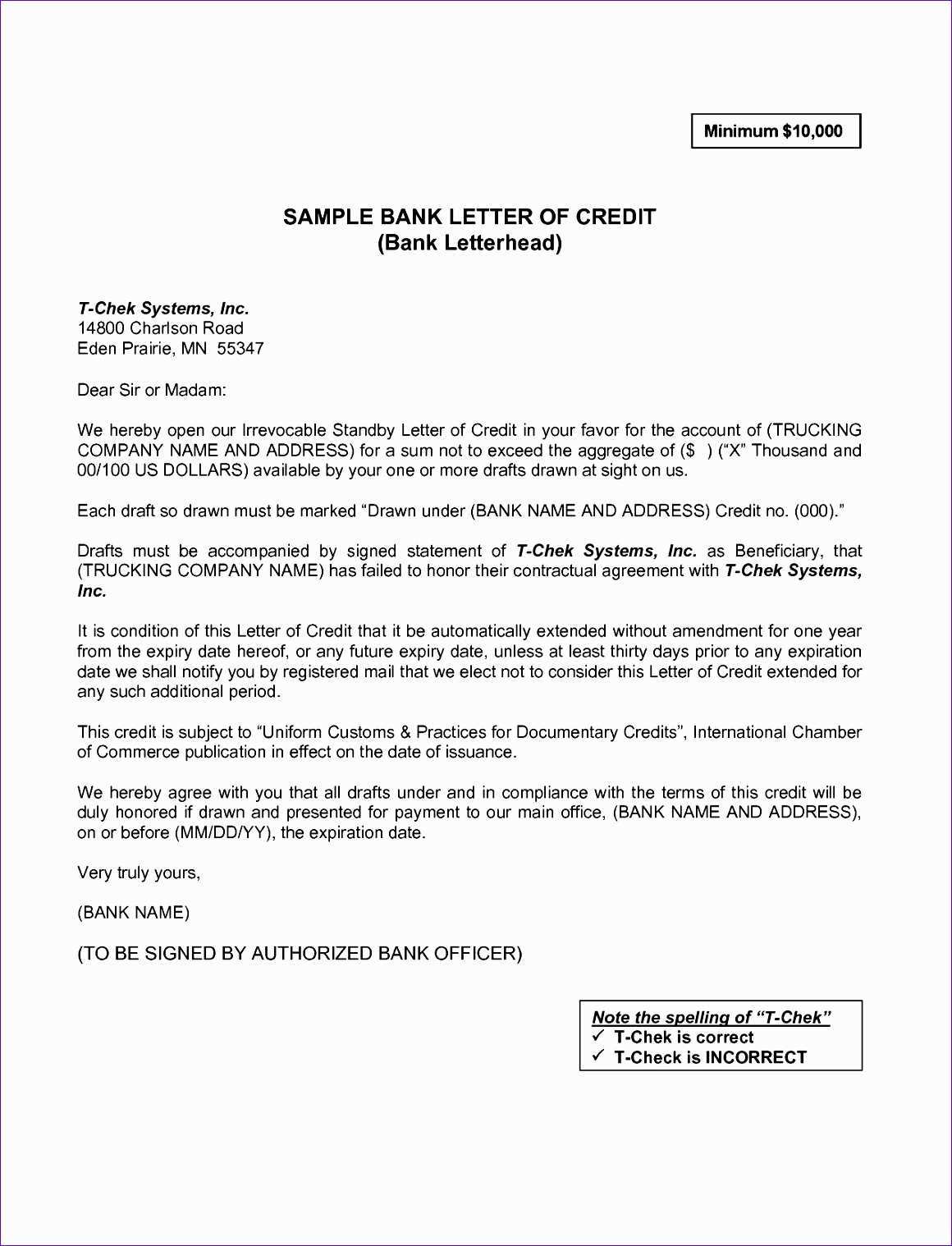

Understanding the Purpose of the Document

The primary objective of this type of correspondence is to formally communicate discrepancies found in reports. It serves as a powerful tool to ensure compliance with established rules and guidelines.

Key Elements to Include

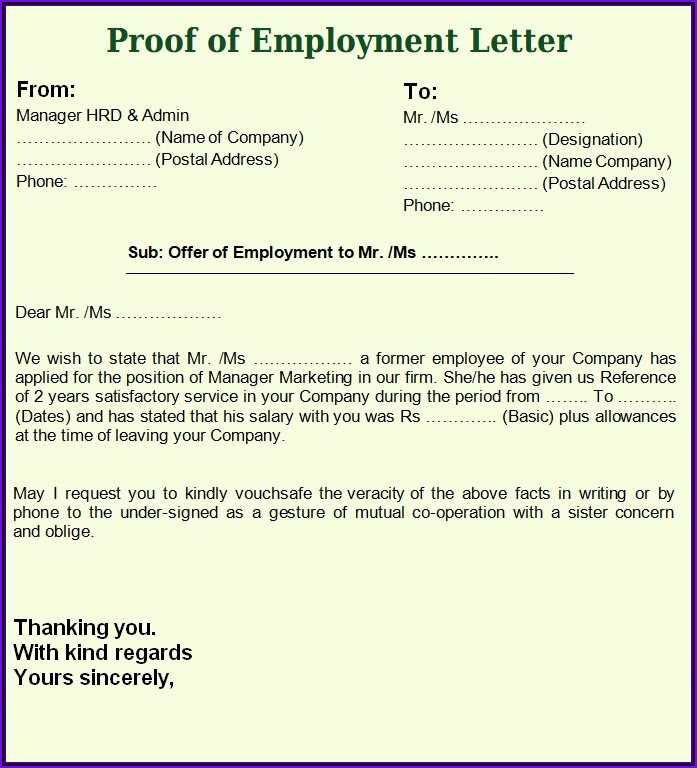

- Personal Information: Begin with accurate details about yourself to validate the authenticity of your request.

- Specifics of the Dispute: Clearly outline the inaccuracies you’ve identified, citing relevant details for clarity.

- Supporting Evidence: Attach documents that reinforce your claims, such as statements or receipts.

Steps to Draft Your Communication

- Review your records thoroughly to identify potential errors.

- Organize supporting documents to back your claims.

- Write a concise but comprehensive explanation of the issue.

- Proofread to eliminate errors and ensure professionalism.

Following Up After Submission

After sending your request, monitor progress closely. Keep copies of all correspondence and track responses. If necessary, escalate the matter through appropriate channels to ensure resolution.

htmlEdit

What Is a Dispute Letter and How to Use It Effectively

This section covers the essentials of addressing inaccuracies in your financial records. A formal request is a useful tool to challenge errors and ensure that reports reflect accurate information.

Key Benefits of Using This Approach

By submitting a well-written request, you can compel the relevant parties to review and potentially correct inaccuracies. It’s an efficient way to protect your creditworthiness and take control of your financial future.

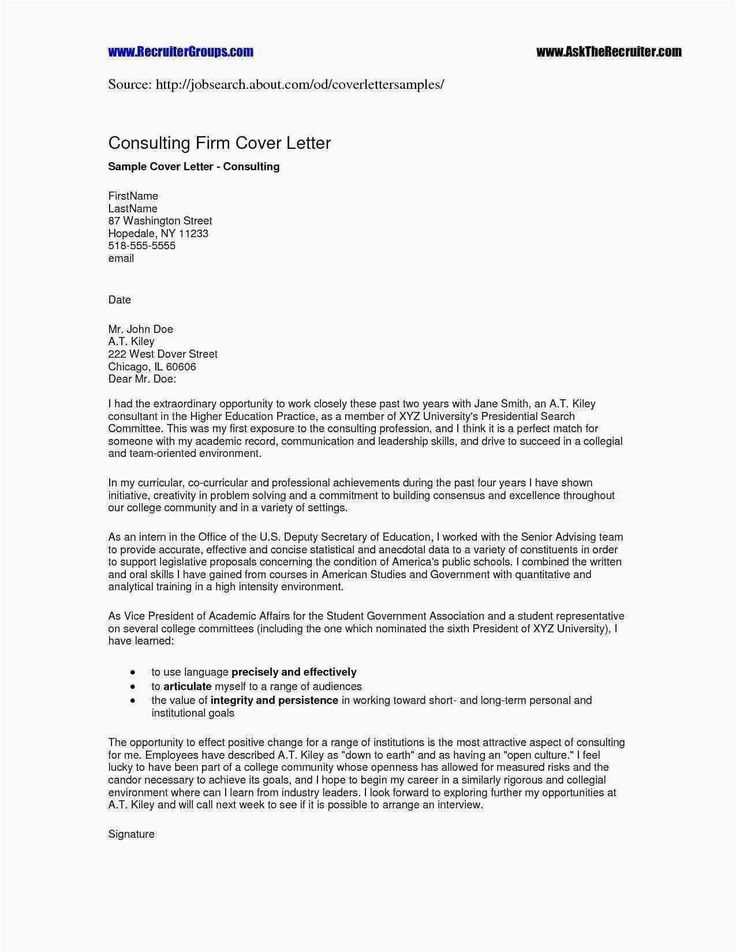

How to Draft an Effective Document

Begin by clearly stating the discrepancies in your records. Provide detailed evidence to support your claims, and ensure your request is concise, respectful, and professionally written. Highlight specific items that need correction and include any documentation that can substantiate your case.

Common Errors to Avoid

- Failure to provide accurate personal information or relevant account numbers.

- Being vague about the errors you’re disputing.

- Not attaching proper supporting evidence.

- Using inappropriate or aggressive language that could delay the process.

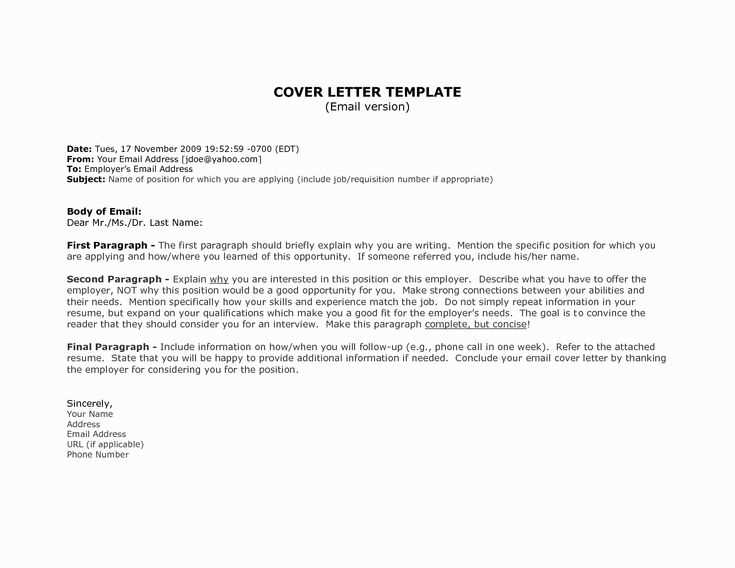

Steps for Sending the Request

Once your document is ready, double-check for errors and clarity. Send it through a reliable delivery method to ensure it’s received. Keep copies of all documents for your records, and consider using certified mail to confirm receipt.

What Actions to Take After Sending

Monitor the response carefully. If you don’t hear back within the specified time frame, follow up with a polite inquiry. If the issue remains unresolved, escalate it through the appropriate channels.