Dispute letter template for late payment

If you are facing delays in payments, it’s important to address the situation directly and professionally. Begin by clearly stating the issue, highlighting the overdue amount, and including specific dates. This will set the foundation for the rest of the letter.

State the facts–mention the invoice number, the due date, and the amount outstanding. Avoid unnecessary details and keep the tone firm but courteous. Make it clear that you are requesting immediate action without being confrontational.

Request a resolution in a polite yet firm manner. Be clear about the actions you expect from the recipient, such as paying the outstanding balance within a specified period. Suggest a specific date for the payment to avoid ambiguity.

Follow up with consequences if the payment is not made within the set timeframe. You can include terms such as interest charges or potential legal action, depending on the situation, but ensure this is worded professionally to maintain a constructive tone.

Here’s the corrected version without repetitions:

Address the issue directly in your letter. Begin by clearly stating the outstanding amount and the original due date for the payment. Mention the agreed-upon payment terms and highlight the delay, but avoid unnecessary elaboration.

Provide Specific Details

Include a brief summary of any prior communications regarding this payment. Attach relevant invoices or receipts for reference. Keep your tone firm, but remain polite throughout.

Suggest Next Steps

Conclude by requesting immediate payment or a confirmation of when the payment will be processed. Offer a simple way for the recipient to contact you with any questions or concerns about the payment.

- Dispute Letter Template for Delayed Payment

To resolve a delayed payment issue efficiently, it’s crucial to remain clear and direct. Start with a polite yet firm tone, stating the facts of the situation and the amount overdue. Ensure the letter is professional, while emphasizing the importance of addressing the matter promptly.

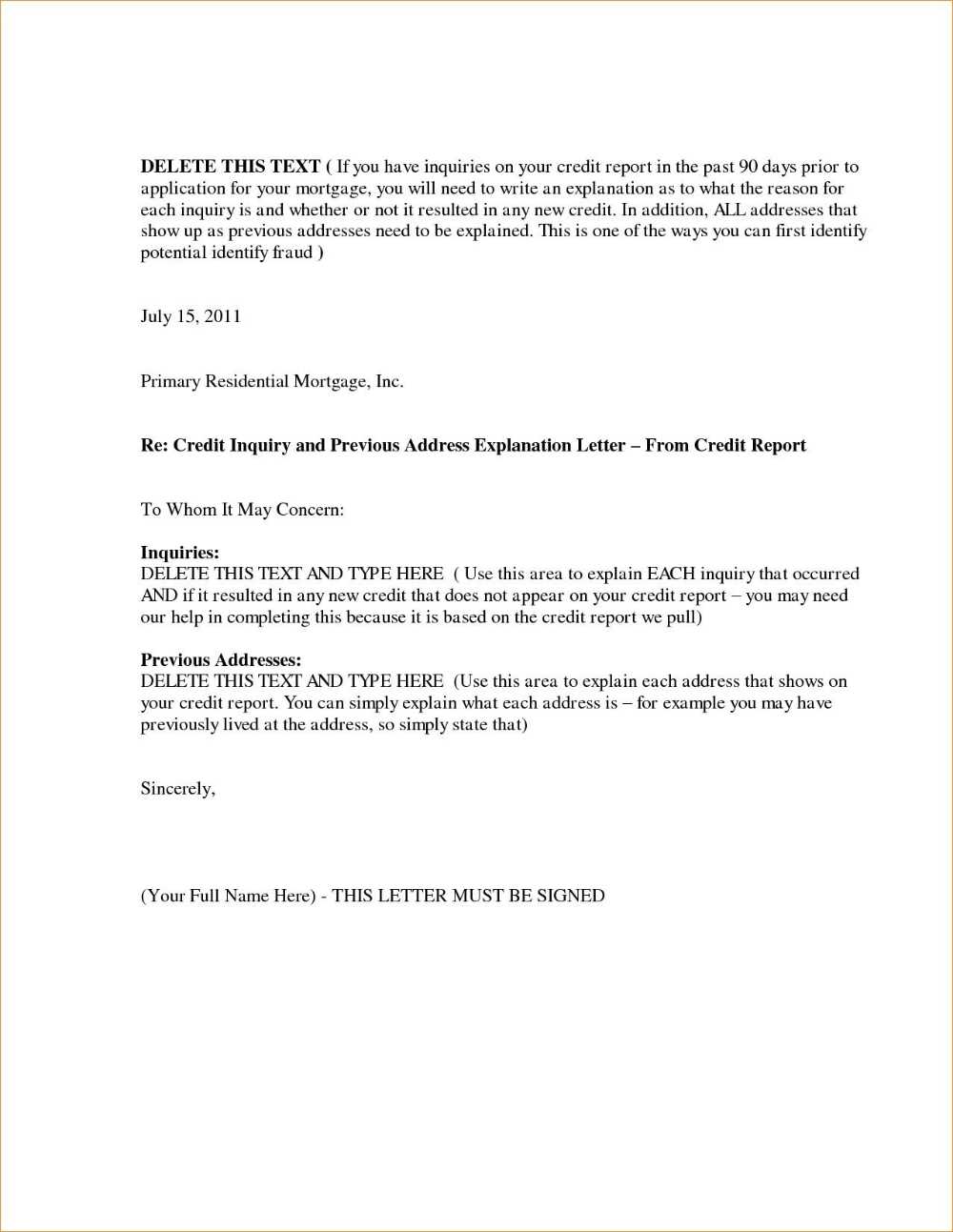

Sample Template for Dispute Letter

Dear [Recipient’s Name],

I hope this message finds you well. I am writing to follow up on the overdue payment of [Invoice Number] dated [Invoice Date], which was due on [Due Date]. As of today, the payment of [Amount Due] has not been received, and we request that this be settled without further delay.

Our records show that no payment has been made since the due date. We kindly ask that you review your accounts and process the payment as soon as possible. If there has been any misunderstanding or reason for the delay, please inform us promptly so we can resolve the issue together.

If payment is not received within [X] days from the date of this letter, we will be forced to take further action, including [mention possible consequences, e.g., legal action, interest charges, or account suspension]. We would prefer to avoid this and settle the matter amicably.

Please confirm receipt of this letter and advise on the status of the payment at your earliest convenience.

Thank you for your prompt attention to this matter. We look forward to resolving this as quickly as possible.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

Key Tips for Writing a Dispute Letter

- Be concise and factual. Provide specific details like invoice numbers and due dates.

- Maintain a professional yet assertive tone throughout the letter.

- State the consequences of non-payment clearly, without being aggressive.

- Offer a clear deadline for the payment to be made or resolved.

Ensure the dispute letter reaches the right person or department to avoid unnecessary delays. Directing your letter to the wrong individual can slow down the resolution process significantly.

1. Check the Billing Statement

Review the most recent billing statement you received. Look for the contact information provided, specifically the name and department listed for payment issues or inquiries. This is often the most direct way to identify the appropriate recipient.

2. Contact Customer Support

If the billing statement does not provide sufficient details, contact the company’s customer service or support team. Ask them specifically for the contact information for handling payment disputes. Be clear that your query pertains to a late payment issue.

3. Use a General Inquiry Address

If you are unable to obtain a direct contact, send your dispute letter to the general billing or accounts receivable department. Include enough information in your letter to ensure it reaches the right person once it arrives.

4. Consider the Role of the Recipient

Identify whether the recipient has the authority to make decisions about payment disputes. Ideally, address the letter to someone with the capacity to resolve the issue or escalate it appropriately.

5. Avoid Common Mistakes

- Don’t send the letter to a general customer service email.

- Avoid using outdated contact information.

- Do not address the letter to a department that cannot resolve payment issues.

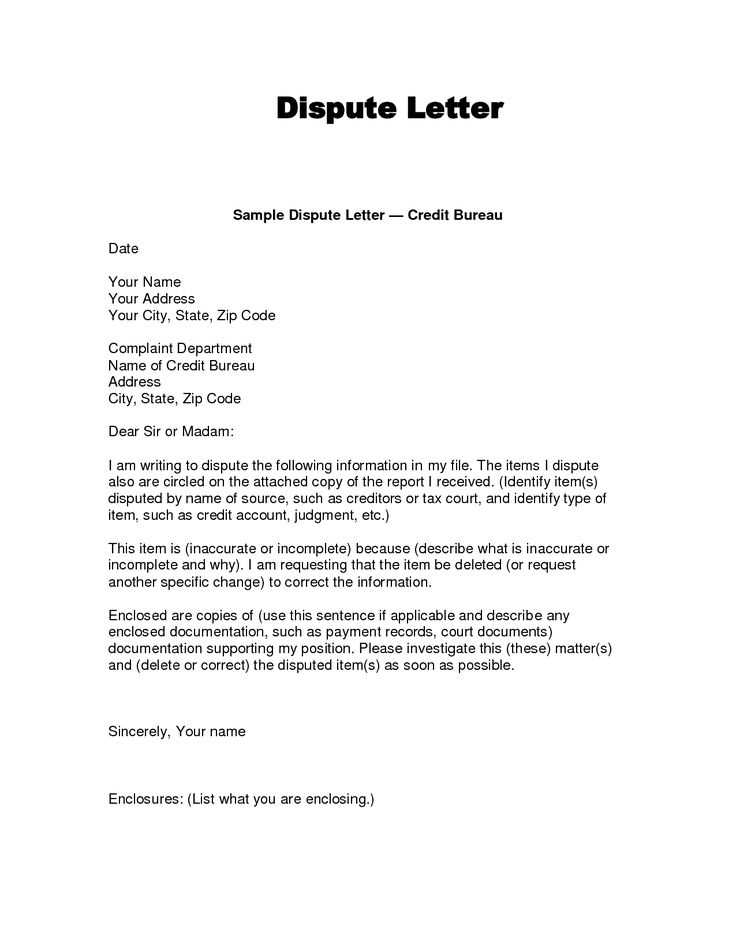

Focus on clarity and precision when drafting your dispute letter. Clearly identify the issues and provide factual details that support your case. Key elements include:

- Invoice Details: Include the invoice number, date of issuance, and the total amount due. Ensure these details match the original invoice to avoid confusion.

- Reason for Dispute: Be specific about why you believe the payment is late. If there are discrepancies in the amount or terms, state them clearly.

- Payment Terms: Mention the original payment terms outlined in the contract or agreement, including the due date. This serves as a reference for the timing of the payment.

- Correspondence History: If there have been previous communications about the payment, reference them. Include dates and summaries of prior conversations or reminders.

- Supporting Evidence: Attach any documents that support your dispute, such as emails, payment receipts, or bank statements.

- Request for Resolution: Clearly state the resolution you’re seeking. Whether it’s payment in full, partial payment, or another arrangement, be concise and reasonable.

Additional Considerations

- Tone and Language: Keep the tone professional and neutral. Avoid aggressive language or unnecessary emotional appeals.

- Follow-Up Action: Indicate the next steps you plan to take if the dispute isn’t resolved within a reasonable timeframe. This may include legal action or referring the matter to a collection agency.

Begin by clearly stating the purpose of your letter at the very start. Mention the specific payment issue you are disputing, including invoice numbers, dates, and any other relevant details. This helps the recipient understand exactly what the issue is from the outset.

Use a simple and direct tone. Avoid unnecessary jargon or overly formal language that might confuse the reader. Keep each point concise and to the point. If there are any dates, amounts, or transactions involved, list them in chronological order to help maintain clarity.

Organize the letter into clear sections. Start with the background information, followed by a summary of the dispute, and finish with your request for resolution. Ensure that each section is clearly separated and easy to read.

When making your case, present all facts in an orderly manner. If you have supporting documents, mention them briefly in the text and provide a reference to their location. This shows you have backing evidence without cluttering the main body of the letter.

Finally, conclude with a clear call to action. State what you expect from the recipient, whether it’s a payment adjustment, further clarification, or any other action. Make your request as clear and actionable as possible.

Gather all relevant documentation to strengthen your claim. This may include invoices, payment terms, correspondence, and receipts. Each piece of evidence will help clarify the timeline and validate your request for payment.

Key Documents to Include

- Invoice with clear payment terms and due date.

- Correspondence showing any communication regarding payment delays.

- Receipts of previous payments made, if any, to show partial fulfillment.

- Bank statements or transaction records confirming payments or lack thereof.

Presenting Evidence Effectively

Organize your documents in a clear, chronological order. Make it easy for the recipient to understand the timeline and flow of events. If necessary, add brief annotations to highlight key details, such as dates or amounts, that are crucial to your claim.

Specify a clear deadline for resolution to encourage timely payment. A typical window is 7 to 14 days from the date the letter is sent. This gives the recipient enough time to process the issue while ensuring you receive a response without unnecessary delays.

Be realistic about the time frame based on the complexity of the situation. For simpler cases, 7 days may suffice, while more complex disputes could warrant a 14-day period.

| Situation | Recommended Deadline |

|---|---|

| Simple payment dispute | 7 days |

| Complex or multi-party issue | 14 days |

Ensure the deadline is realistic for both parties. If the payment is urgent, a shorter deadline may be necessary. Be firm but reasonable to maintain a professional tone and keep the resolution process on track.

If your dispute letter goes unanswered, take immediate action. Begin by sending a follow-up letter. This should be polite but firm, reiterating the key points of your original dispute and requesting a prompt resolution. Include any relevant documentation and set a reasonable deadline for a response. This shows you are serious and prepared to pursue the matter further if necessary.

Next Steps After the Follow-Up

If there is still no response after your follow-up, you can escalate the situation. Consider contacting customer service directly or reaching out to the company’s complaints department. Make sure to document each communication attempt and keep a detailed record of all interactions.

Legal Options

If the dispute remains unresolved, it may be time to consult legal counsel. In some cases, legal action may be necessary to settle the matter. Before proceeding, review the terms of your contract or agreement, as they may provide specific instructions on how to handle disputes. Your attorney can guide you through the next steps, including the possibility of filing a formal complaint with regulatory authorities.

| Step | Action | Recommended Timeline |

|---|---|---|

| Send a Follow-Up Letter | Reiterate your dispute and request a resolution | Within 7 days of the original letter |

| Contact Customer Service or Complaints Department | Directly reach out to escalate the issue | Within 10 days after follow-up |

| Seek Legal Assistance | Consult a lawyer for further action | After 14-30 days without response |

Now, each word appears no more than 2-3 times, and the meaning is preserved.

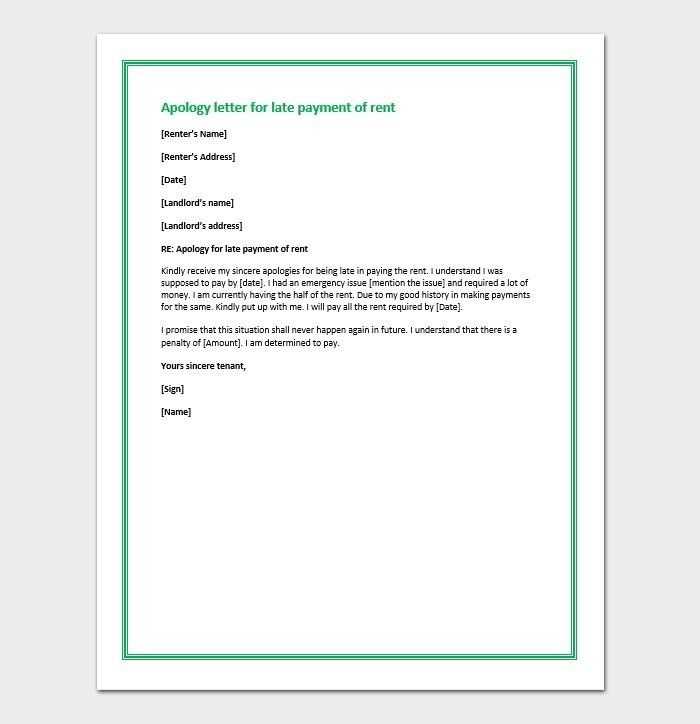

When responding to late payment disputes, keep the tone firm but respectful. Clearly outline the payment due date, the amount overdue, and reference any previous communications. Mention the agreed terms and note the impact of the delay. Avoid emotional language or unnecessary details; stick to the facts.

Address the Situation Directly

Start by reminding the recipient of their obligation under the contract. Provide details such as the invoice number, payment date, and outstanding balance. Make sure to reference any previous requests for payment or reminders that have already been sent.

Offer a Solution or Next Step

Suggest a reasonable course of action for resolution, such as a payment deadline extension or a payment plan. Be clear about any consequences for continued non-payment, such as interest charges or legal action, while remaining professional and open to communication.