Engagement letter template for accountants uk

Accountants in the UK should always begin their professional relationships with clients by providing a well-crafted engagement letter. This letter sets clear expectations, outlines the scope of services, and helps protect both parties from potential misunderstandings. A solid engagement letter serves as a foundation for a transparent, smooth collaboration.

Make sure to include the specific details of your services, including the tasks you’ll handle and any limitations. It’s also important to clearly define the responsibilities of both the accountant and the client. By doing so, you prevent future disputes and ensure that both parties are on the same page from the start.

Additionally, be sure to address any billing arrangements, confidentiality clauses, and the duration of the agreement. The more specific the terms, the more reliable the agreement will be if any issues arise during the course of your services. By following these recommendations, you establish a professional and trustworthy relationship with your client.

Here’s the revised version without repetitive words while maintaining clarity and accuracy:

Ensure the engagement letter clearly outlines the scope of work, including specific tasks and responsibilities. Define deadlines and expected outcomes to avoid ambiguity. Include terms of payment, such as rates and billing schedules, to establish transparency. Specify confidentiality agreements and the handling of sensitive information. Clarify any limitations or exclusions in the services offered. Finally, outline the process for resolving disputes to prevent future misunderstandings.

- Engagement Letter Template for Accountants in the UK

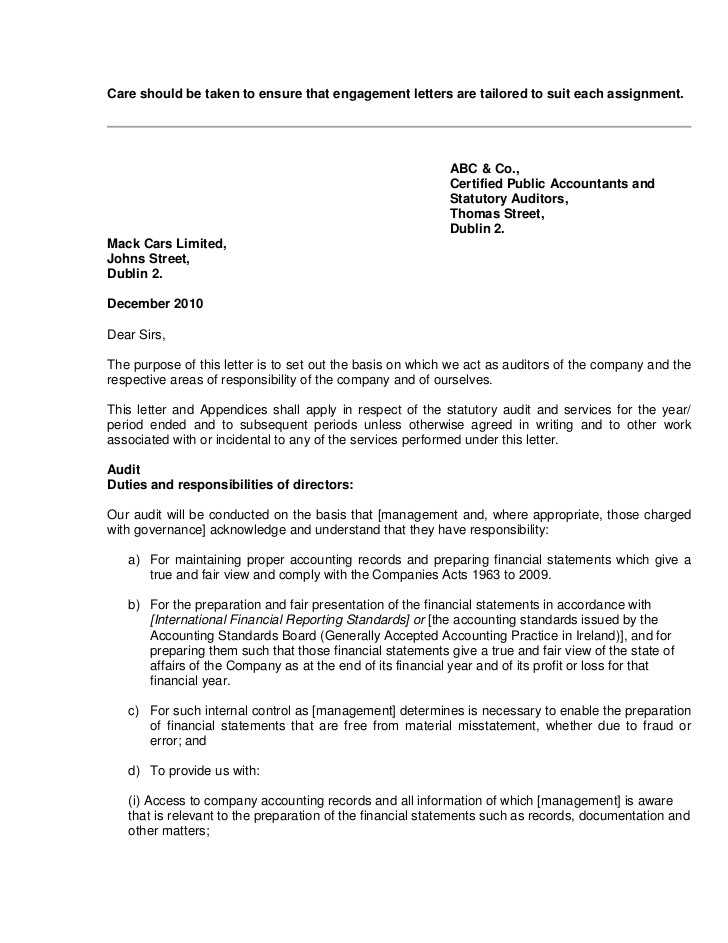

For accountants in the UK, an engagement letter is a formal agreement that defines the scope and nature of the professional relationship with clients. It’s important that the letter is clear and covers key points like the services offered, the fees, and the terms of engagement. The document should specify the responsibilities of both parties, the timeline for the services, and any other pertinent details, such as confidentiality clauses and the process for resolving disputes.

Below is a basic template outline to follow when creating an engagement letter for accounting services in the UK:

- Introduction: Clearly state the purpose of the letter and identify both parties (the accountant and the client).

- Scope of Services: Detail the specific accounting services provided, such as tax preparation, audit services, or bookkeeping.

- Fees and Payment Terms: Outline the fee structure (e.g., hourly rates or fixed fees) and payment terms, including due dates or schedules.

- Responsibilities: Define the roles and duties of both the accountant and the client. For instance, the client must provide accurate financial information, and the accountant will offer professional advice.

- Confidentiality Clause: Ensure both parties understand the need for confidentiality regarding sensitive financial data.

- Duration and Termination: Specify the duration of the engagement and the terms under which either party can terminate the agreement.

- Dispute Resolution: Outline the steps for resolving disagreements or issues that may arise during the engagement.

- Signature: Conclude with a section for both parties to sign and date, indicating their agreement to the terms.

This simple structure can be adapted based on the specific needs of the accounting services provided. Each section should be tailored to ensure clarity and avoid misunderstandings between the accountant and the client.

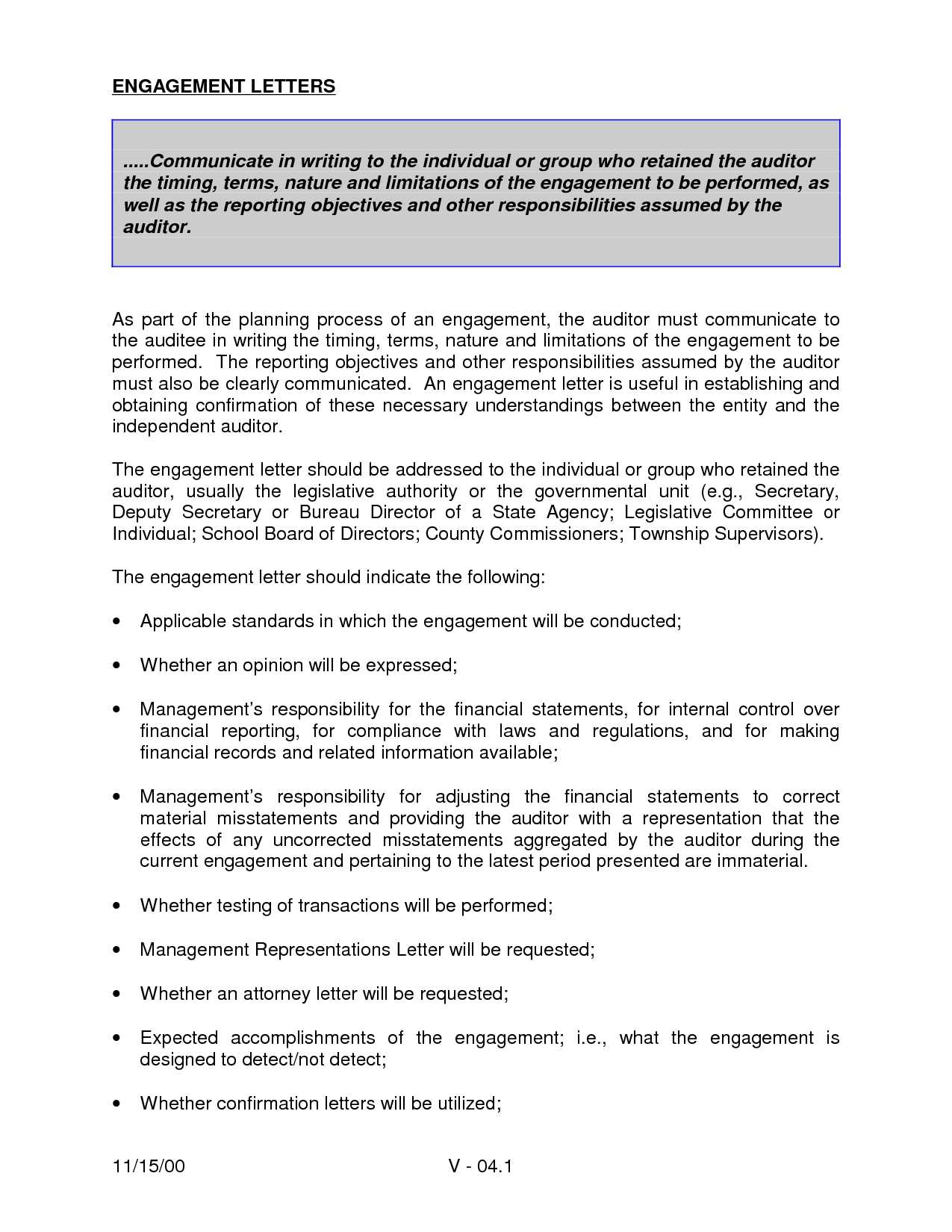

An engagement letter sets clear expectations between accountants and their clients. It outlines the scope of work, deadlines, and responsibilities, which helps prevent misunderstandings. This document also protects both parties in case of disputes, serving as a reference point for the agreed terms.

Clarifying Responsibilities

The engagement letter clearly specifies the accountant’s duties and the client’s responsibilities. This ensures that both parties understand their roles in the process, reducing confusion about what is expected at each stage. For example, it may detail the information the client must provide and the timeline for delivering the required financial records.

Managing Legal Risks

By defining the limits of the accountant’s work, the engagement letter helps mitigate potential legal risks. If issues arise, the letter can be referred to for clarity on agreed-upon tasks. This document acts as a protective shield in cases where services extend beyond what was originally discussed or if expectations are unmet.

| Aspect | Purpose |

|---|---|

| Scope of Work | Defines the specific services to be provided, preventing scope creep. |

| Timeline | Sets clear deadlines for deliverables and milestones. |

| Client Responsibilities | Outlines what the client needs to provide for the accountant to complete the work. |

| Legal Protection | Serves as a reference point in case of a dispute over the work or expectations. |

To create a clear and professional engagement letter, ensure it covers the following key components:

- Parties Involved – Clearly state the full names and business addresses of both the accountant and the client. Specify the capacity in which the accountant is acting, whether as an advisor, consultant, or other roles.

- Scope of Services – Define the specific services to be provided. List all the tasks and responsibilities the accountant will undertake, such as bookkeeping, tax filing, audits, etc. Clarify any services that are excluded to avoid confusion.

- Fee Structure – Include detailed information about how fees will be calculated (e.g., hourly rate, fixed price, or retainer). Specify payment terms, such as deadlines, late fees, and whether expenses will be charged separately.

- Duration of Engagement – Outline the start and end dates of the engagement. If it’s an ongoing relationship, specify the renewal terms or how either party can terminate the agreement.

- Responsibilities of the Client – Clarify the client’s obligations, such as providing accurate and timely information, maintaining proper records, and informing the accountant of any significant changes in their financial situation.

- Confidentiality – Address confidentiality measures, ensuring that all client information is kept private and only disclosed with consent or when required by law.

- Liability and Disclaimers – Specify the extent of the accountant’s liability and include any necessary disclaimers, particularly in relation to advice given, actions taken, or omissions.

- Dispute Resolution – Define a process for resolving disputes, including mediation or arbitration procedures. This helps avoid lengthy legal battles and encourages resolution through agreed-upon methods.

- Termination Clause – Explain the conditions under which the agreement can be terminated, such as breach of terms or at the request of either party. Include any termination notice period if applicable.

- Legal Compliance – Ensure that the letter adheres to UK legal requirements, such as compliance with data protection laws, tax regulations, and professional standards.

By including these key elements, both the accountant and the client can have a clear understanding of their rights, responsibilities, and expectations throughout the engagement. This reduces misunderstandings and establishes a professional relationship built on trust and clarity.

Begin by reviewing the specific services requested by the client. A clear understanding of their goals helps you focus on relevant details in the engagement letter. Avoid generalizations–highlight the exact scope of work that aligns with their needs.

1. Define the Scope and Deliverables

Specify the exact tasks you will handle, whether it’s tax preparation, auditing, or consulting. Outline any deliverables with precise deadlines and expected outcomes. If the project involves multiple phases, break them down to avoid ambiguity.

2. Address Client Preferences

If the client has specific preferences regarding communication frequency or meeting formats, incorporate these into the letter. Detail how often you’ll update them, via email, calls, or in-person meetings, and set clear expectations for response times.

3. Discuss the Timeline and Milestones

Include realistic timelines based on the client’s deadlines and the complexity of the work. Break down major milestones, such as data collection, analysis, and reporting, to provide transparency on progress.

4. Tailor Fees and Payment Terms

- Detail the agreed-upon pricing model: hourly rates, fixed fees, or retainer-based.

- Clarify payment schedules: upfront, milestones, or upon completion.

- Specify any extra charges for additional work outside the agreed scope.

5. Acknowledge Specific Client Requirements

If the client has unique needs, such as a focus on sustainability or compliance with specific regulations, make sure these are addressed directly in the letter. Customizing the letter for such nuances ensures both parties are aligned from the start.

6. Clarify Terms of Termination

Set out the terms under which either party can terminate the agreement, along with any applicable notice periods and conditions. This adds clarity and helps prevent misunderstandings in the future.

By adapting the engagement letter to your client’s specific needs, you create a clear, professional foundation for the working relationship. Keep the language direct and straightforward, ensuring that the client feels heard and understood.

Accounting engagement letters in the UK must comply with specific legal requirements to protect both the accountant and the client. These requirements ensure clarity, reduce the risk of disputes, and provide a clear understanding of the services being offered. The engagement letter should outline the accountant’s scope of work, fee structure, and responsibilities, as well as the client’s obligations. Failure to meet legal requirements can lead to misunderstandings and potential legal challenges.

The letter must specify the legal relationship between the parties, particularly whether the accountant is acting as an agent or in a different capacity. It should also clearly state whether the engagement is for a fixed term or ongoing. All terms and conditions must align with UK law, especially regarding liability and indemnity clauses. Failure to comply with these requirements could invalidate parts of the letter or lead to legal issues down the line.

Another key aspect is compliance with UK professional standards, such as those outlined by the Institute of Chartered Accountants in England and Wales (ICAEW). These guidelines require that the engagement letter be transparent about the nature of services provided and any limitations of the engagement. It’s important that the letter contains provisions addressing confidentiality, data protection, and the handling of sensitive financial information in accordance with the Data Protection Act 2018 and the GDPR.

Below is a table summarizing the key legal elements that should be considered when drafting an accounting engagement letter in the UK:

| Legal Element | Description |

|---|---|

| Scope of Work | Clearly outline the services provided, including any limitations. |

| Fee Structure | State how the accountant will charge, whether hourly rates or fixed fees. |

| Liability | Specify the accountant’s liability limits and any indemnity clauses. |

| Duration | Indicate whether the engagement is for a fixed term or ongoing. |

| Confidentiality | Outline the obligations regarding confidentiality and data protection. |

| Dispute Resolution | Include clauses on how disputes will be handled, such as through arbitration or mediation. |

Ensuring compliance with these requirements helps avoid legal challenges and establishes a clear, mutually agreed-upon framework for the professional relationship. Accountants should seek legal advice if there are uncertainties regarding the inclusion of specific terms or if changes to standard practices are required.

Ensure the terms and conditions are written in plain language. Avoid legal jargon or overly complex sentences. Use simple, direct wording that is easy for clients to understand.

Break down the information into digestible sections. Use headings and bullet points to highlight key points, making it easier for clients to navigate and find relevant details quickly.

Provide context for each clause. Instead of just listing terms, explain their purpose and how they affect the client. This helps build trust and ensures there’s no ambiguity.

Include a summary or a highlight of the most important terms at the beginning of the document. This gives clients a quick overview before they dive into the full details.

Ensure clients acknowledge the terms. Provide a clear confirmation method, such as a checkbox or a digital signature, to confirm that they have reviewed and agreed to the terms.

Use consistent formatting throughout. This makes the document easier to read and prevents confusion. Consistent fonts, spacing, and margins can improve readability and clarity.

Offer easy access to the terms. Make sure the terms and conditions are readily available on your website or through a direct link in communications. Avoid making clients search for them.

1. Lack of Clarity in Scope of Work

Be specific about the services you’re providing. Vague or broad descriptions can lead to misunderstandings. Clearly define each task, responsibility, and deliverable so that both parties have the same expectations. A detailed scope prevents confusion and potential disputes later on.

2. Missing Deadlines or Timeframes

Establish firm deadlines for the completion of tasks and deliverables. Leaving timeframes open-ended makes it difficult to track progress and can lead to delays. Include specific dates or periods for each key task to ensure everyone is on the same page.

3. Not Addressing Payment Terms

Define the payment schedule clearly. Include payment due dates, methods, and any penalties for late payments. Avoid leaving this section ambiguous, as it could result in cash flow issues or frustration between parties.

4. Ignoring Dispute Resolution Procedures

Specify how disputes will be handled if they arise. Whether through mediation, arbitration, or legal means, providing a clear path for resolving disagreements helps avoid costly and time-consuming litigation. A solid dispute resolution clause protects both parties’ interests.

5. Overlooking Confidentiality Clauses

If sensitive information is being exchanged, include a confidentiality clause. Failing to address this may lead to security breaches or misuse of private data. Make sure it clearly outlines both parties’ responsibilities in maintaining confidentiality throughout the engagement.

6. Failing to Review or Update Terms

Periodically review and update your engagement letter to ensure it remains relevant. Laws and regulations change, and outdated clauses may no longer be enforceable. Regularly revising the agreement ensures it stays aligned with current requirements and protects both parties.

Engagement Letter Template for Accountants in the UK

An engagement letter clarifies the working relationship between an accountant and their client, detailing the services to be provided, expectations, and legal responsibilities.

Key Components of an Engagement Letter

- Scope of Services: Specify the exact services you will provide, such as tax preparation, auditing, or consulting.

- Fees and Payment Terms: Include the payment structure, hourly rates, and due dates for payments.

- Responsibilities: Define the client’s and accountant’s responsibilities, including the provision of accurate financial information.

- Duration and Termination: State the duration of the engagement and conditions under which either party can terminate the agreement.

- Confidentiality Clause: Highlight the confidentiality of the client’s financial data and the accountant’s duty to protect this information.

Why Include an Engagement Letter?

- Prevent Disputes: By outlining the terms of the relationship, both parties avoid misunderstandings that may lead to conflicts.

- Legal Protection: An engagement letter provides a legal foundation should any disputes arise during the course of the relationship.

- Clear Expectations: Establishes clear, mutual expectations and ensures both parties are on the same page regarding the scope of work.