FCRA 609 Letter Template for Credit Dispute Resolution

If you believe there are errors on your credit report, there are ways to formally challenge these discrepancies. By sending a well-structured dispute request, you can address inaccuracies and potentially improve your credit score. Understanding the process and knowing what to include in your dispute can help ensure that your rights are protected and the issue is resolved promptly.

Understanding the Dispute Process

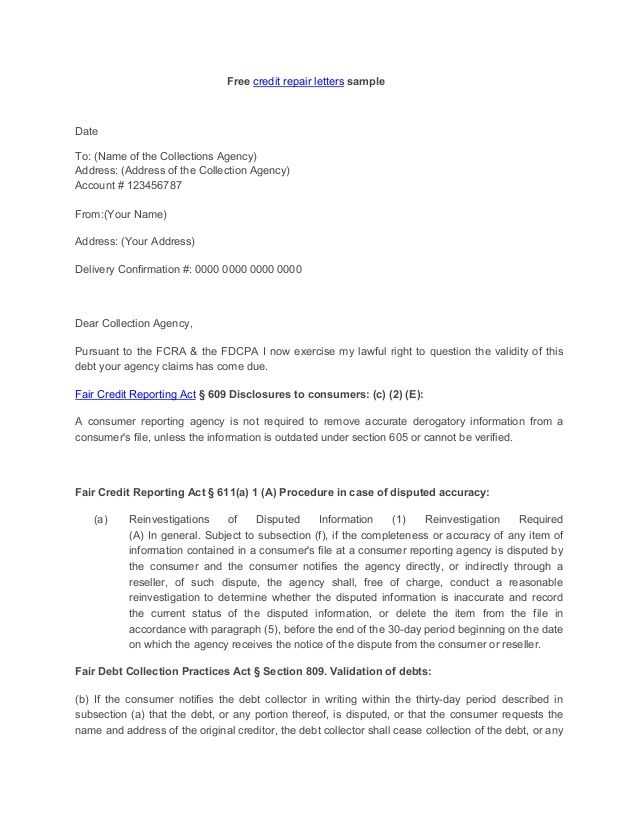

The first step in resolving a credit report issue is to clearly state the problem with supporting evidence. A dispute letter should be concise and direct, detailing the inaccuracies and providing relevant documentation. Whether it’s a mistaken late payment or an incorrect balance, your goal is to request a thorough review from the credit bureaus or lenders involved.

Key Components to Include

- Your full name and address: This ensures that the credit agency or lender can accurately identify you and your records.

- Description of the issue: Be clear about the exact mistake, such as the incorrect account or transaction.

- Proof of accuracy: Attach copies of statements or documents that support your claim.

- A clear request for correction: Politely ask for the specific action you want to be taken, such as removal or adjustment of the entry.

Why It’s Important to Be Specific

Providing clear and precise details helps the recipients quickly understand the issue and take necessary action. Vague or overly general statements may delay the process or result in an unsatisfactory response.

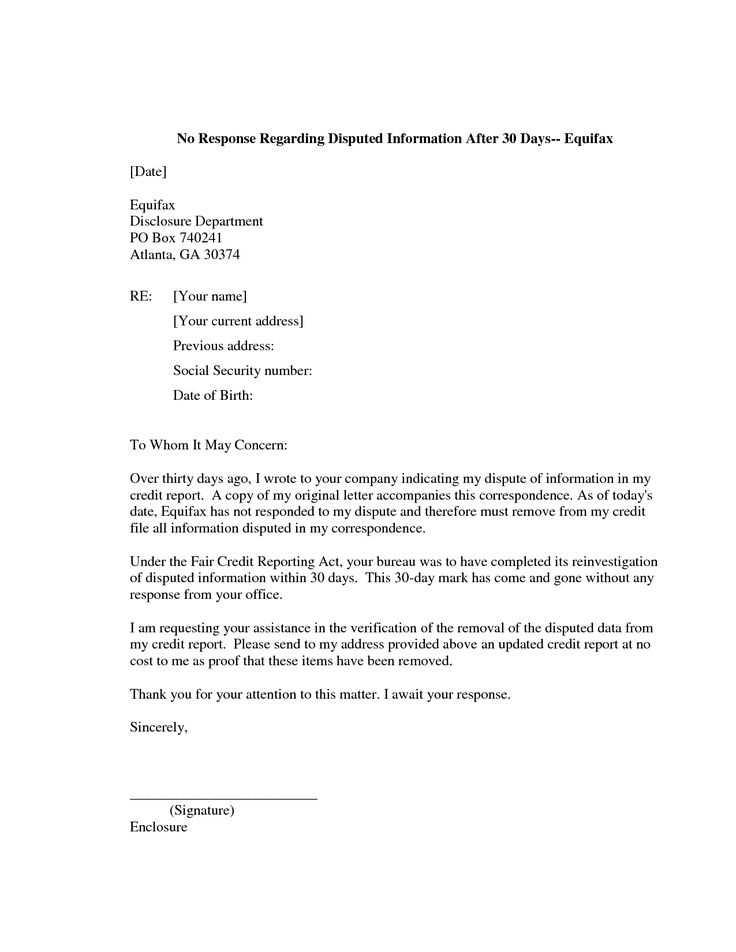

After Sending Your Dispute

What to Do if Your Dispute Is Denied

If the response to your dispute is not in your favor, there are additional steps you can take. You may need to provide more evidence, escalate the issue to a higher authority, or pursue legal advice if necessary.

What is a Dispute Document?

How to Draft a Dispute Request

Essential Elements of an Effective Dispute Communication

Common Obstacles in Credit Report Challenges

How Dispute Processes Protect Consumer Rights

What Happens After Submitting a Dispute Request

A formal dispute document is a request made by an individual to challenge incorrect information on their credit record. This communication is essential for addressing errors that could negatively affect one’s credit score and financial reputation. When disputing an inaccurate entry, it is crucial to follow a structured approach to ensure the issue is reviewed and corrected appropriately.

Creating an effective dispute request involves presenting the issue clearly, providing supporting evidence, and asking for a specific correction. The key is to be concise yet thorough, ensuring that the recipient understands the nature of the problem and can take the necessary steps to resolve it.

The most important elements of a valid dispute include your identifying information, a clear description of the discrepancy, relevant supporting documents, and a specific request for action. These components help streamline the investigation process and increase the likelihood of a favorable outcome.

Credit report disputes often come with challenges, such as delayed responses or insufficient evidence. Additionally, some inaccuracies may require more effort to prove, especially if the credit bureau or lender does not immediately recognize the mistake.

The process of filing a dispute is designed to safeguard consumers by ensuring that their credit reports accurately reflect their financial history. Consumer protection laws provide individuals with the right to challenge false information, preventing unfair damage to their credit standing.

Once the dispute is submitted, the relevant parties typically investigate the claim and respond with a decision. If the issue is resolved, the error will be corrected, and the updated information will reflect on the credit report. In cases where the dispute is not upheld, further steps may be needed to escalate the issue or provide additional proof.