First payment letter template

Crafting a payment letter for the first transaction is a straightforward but key step in establishing clear financial communication. The primary goal is to confirm the amount due and the terms surrounding payment, while ensuring that the tone remains professional and courteous. Always specify the payment deadline to avoid confusion and set clear expectations.

Start by clearly stating the amount owed, along with any relevant payment reference numbers or invoices. This helps the recipient easily identify the payment details and ensures that there is no ambiguity about the amount. Providing a breakdown of the charges can also be helpful if the payment is for multiple items or services.

Set a precise payment deadline to ensure the transaction moves smoothly. Clearly state when the payment should be made and outline the accepted payment methods. If there are any penalties for late payments, include those terms in a polite but firm manner, encouraging timely action.

Lastly, always express gratitude for the recipient’s prompt attention to the matter. Ending on a positive note helps maintain a good relationship and fosters future collaboration, ensuring that the financial exchange is not just a transaction, but part of a strong ongoing partnership.

Here is the revised text:

Begin with a clear subject line that makes it easy for the recipient to understand the purpose of your email. For example, “First Payment Request for [Invoice Number]”. This immediately communicates the reason for your communication.

Start the letter with a polite greeting. Address the recipient by their name to make the letter feel personal and direct.

State the purpose of the letter upfront: request for the first payment. Be specific about the amount and the due date. For example: “We kindly remind you that the first payment of $500 is due on [Date].”

Include any necessary details about the payment method, such as bank account information or online payment links. If you have provided an invoice, mention it by number and attach a copy for reference.

Reaffirm your expectations regarding payment terms and emphasize any late fees or consequences if the payment is not made on time. This provides clarity and avoids misunderstandings.

Close the letter with a polite thank you and a professional sign-off. For example, “Thank you for your attention to this matter. We appreciate your prompt payment.”

Ensure the tone remains courteous and professional throughout, as this helps maintain a positive relationship with the recipient.

- First Payment Letter Template

Clearly state the payment amount, method, and relevant reference number. Include details like the sender’s and recipient’s information, payment date, and a brief description of the transaction. This keeps things direct and transparent.

Key Elements to Include:

- Sender’s name and contact details

- Recipient’s name and contact details

- Amount of payment

- Payment method used

- Invoice or reference number

- Date of payment

Sample Template:

- Sender: [Your Name], [Your Address], [Your Email], [Your Phone]

- Recipient: [Recipient Name], [Recipient Address]

- Date: [Date]

- Subject: Payment for [Invoice Number or Service]

- Dear [Recipient Name],

- Payment Details: A payment of [Amount] was processed for [Invoice Number/Service] on [Date] using [Payment Method]. Reference number: [Reference Number].

- Closing: Please feel free to reach out if you need further details. Thank you.

- Sincerely, [Your Name]

Review the details for accuracy. A simple and clear letter will enhance communication and professionalism.

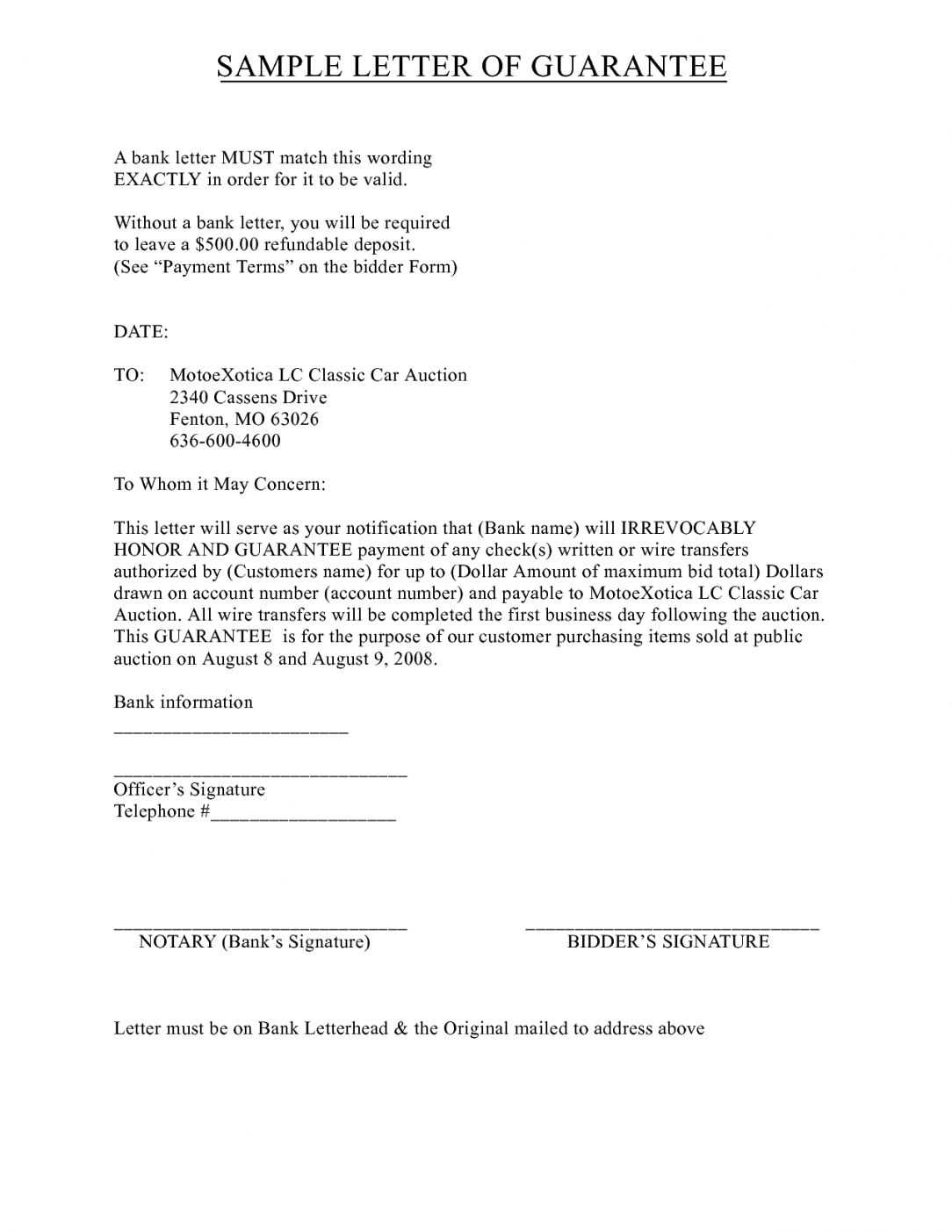

A payment letter serves as a formal document that communicates a financial transaction or payment to the relevant party. It typically outlines the amount owed, payment terms, and any additional information needed to complete the payment. By providing a clear record of the transaction, it helps prevent misunderstandings and ensures both parties are on the same page.

Use a payment letter to confirm the payment details and establish a timeline for when the payment will be completed. It acts as both a reminder and a guarantee that the agreed-upon financial obligations will be met. This helps maintain professional relationships and creates accountability for both the sender and the receiver.

For businesses, sending a payment letter can be an effective way to manage accounts receivable and ensure that payments are made on time. It also serves as evidence should any disputes arise, providing a concrete record of the financial agreement between the two parties.

Start by addressing the recipient with their correct title and full name to set a respectful tone. Clearly state the purpose of the letter early on to avoid confusion. Be specific about the amount due, including the exact figure and due date. Include payment instructions, such as preferred payment methods or bank details, ensuring they are easy to follow. Don’t forget to mention any necessary reference numbers, such as invoices or account numbers, for easy tracking. Conclude with a polite reminder about the importance of timely payment and offer assistance for any questions. Finally, express appreciation for their business to end on a positive note.

Maintain a professional yet approachable tone. Start with clear, respectful language and avoid overly formal or casual expressions. Address the recipient politely, using their name when possible, and express your points with clarity and brevity.

Be Concise and Direct

Avoid unnecessary details or jargon that could confuse the reader. Stay focused on the purpose of the letter, ensuring each sentence serves a clear function. This will prevent your message from feeling too wordy or diluted.

Balance Friendliness with Professionalism

While you want to be polite, make sure the tone does not come across as too familiar. Being friendly helps to establish rapport, but it’s important to maintain a level of professionalism to reflect the business relationship.

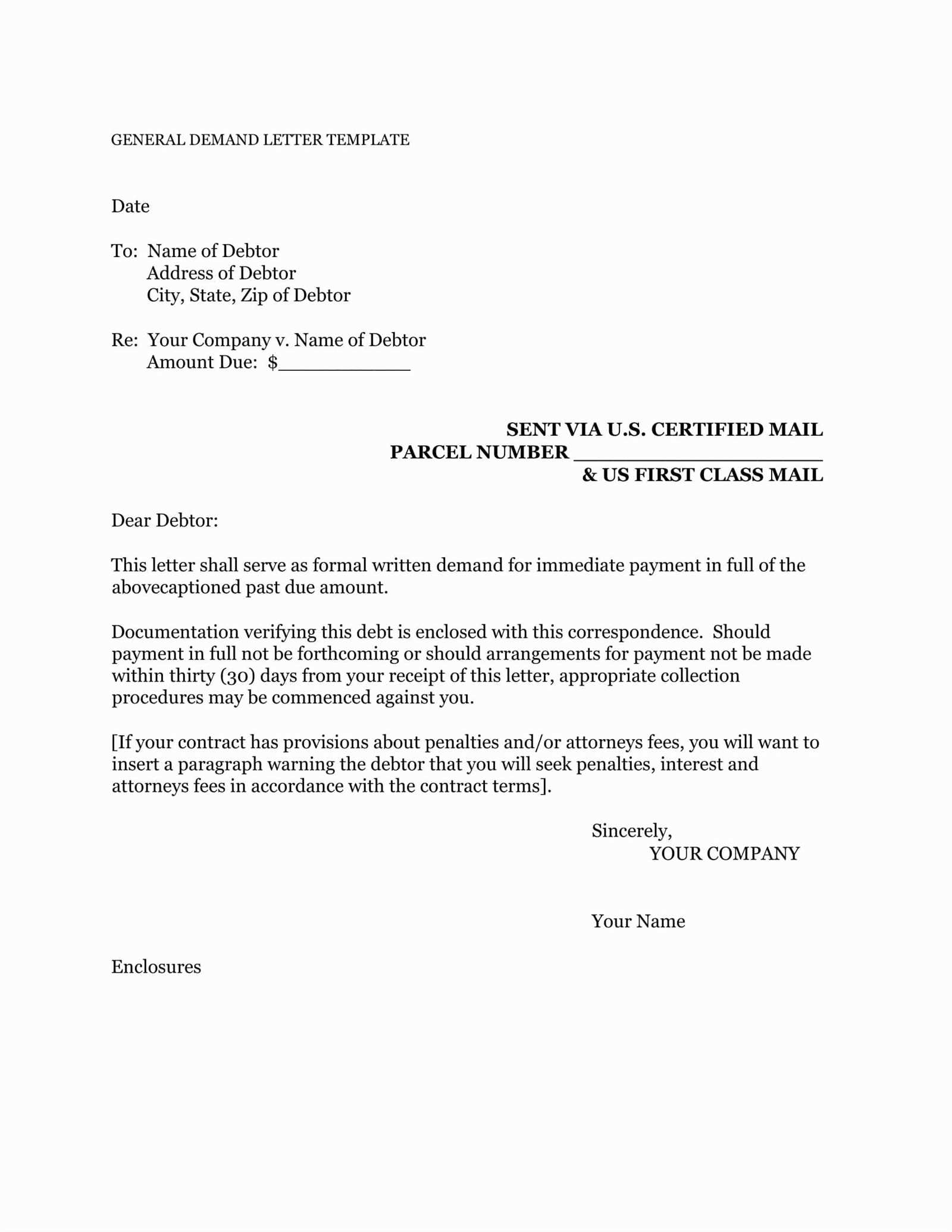

One key mistake is failing to tailor your tone to the recipient. Adjust the formality based on who you are addressing. For instance, a business letter should be more formal than a letter to a friend. Keep your language clear and appropriate for the situation.

Incorrect Structure

Another common error is not following a proper letter structure. Ensure the letter has a clear opening, body, and closing. The introduction should briefly state the purpose, the body should provide necessary details, and the conclusion should summarize and include any action you expect from the recipient.

Overly Complex Language

Avoid using overly complicated words or jargon. Keep your sentences simple and to the point. Too many complex phrases can confuse the reader and dilute your message.

- Stick to a direct approach.

- Avoid unnecessary filler words.

- Check spelling and grammar before sending.

Lastly, remember to include all the relevant information, but don’t overwhelm the reader with excessive detail. Keep the letter concise and focused on the most important points to ensure clarity and effectiveness.

Ensure the letter has a clear and structured layout. Start with the sender’s information, followed by the recipient’s details, making sure both are aligned to the left. Include the date after the recipient’s address. Leave a line of space before the salutation. Use a formal tone throughout, and ensure all text is aligned to the left. Avoid using justified text as it can make the letter harder to read.

For the body, break the content into clear paragraphs. Each paragraph should address one main point to make the letter easy to follow. After the body, end with a polite closing, followed by your name or signature. Make sure to leave enough space between the closing and your signature.

- Sender’s name and contact info at the top

- Recipient’s name and address below the sender’s details

- Date positioned after the recipient’s address

- Salutation, followed by a comma (e.g., “Dear [Name],”)

- Body, divided into clear and concise paragraphs

- Closing (e.g., “Sincerely,”), followed by space for your signature

Proofread the letter for any mistakes in spelling or grammar before sending it. The layout and clarity of your letter reflect your professionalism, so it’s important to maintain a clean and consistent format.

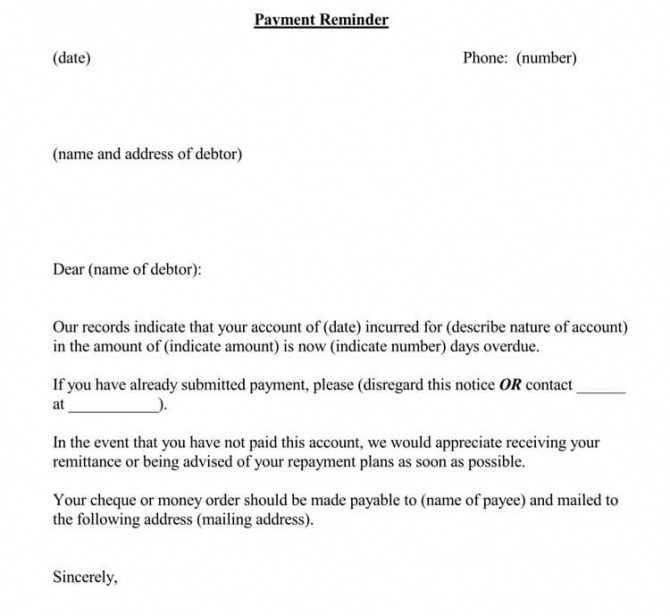

Ensure your first payment letter reaches the right person promptly. After sending, give the recipient some time to process the information. If you haven’t received a response within a week, follow up politely. Keep your message concise and reference the original letter for context.

Follow-Up Message Template

Here is a simple structure for your follow-up message:

| Section | Content |

|---|---|

| Greeting | Dear [Recipient’s Name], |

| Introduction | I hope this message finds you well. I’m following up on my previous letter regarding the first payment for [service/product]. |

| Clarification | If you’ve already processed the payment, kindly disregard this message. If not, I would appreciate an update on the status. |

| Closing | Thank you for your attention to this matter. I look forward to hearing from you soon. |

Being courteous but direct will help maintain a professional tone while ensuring the payment process continues smoothly.

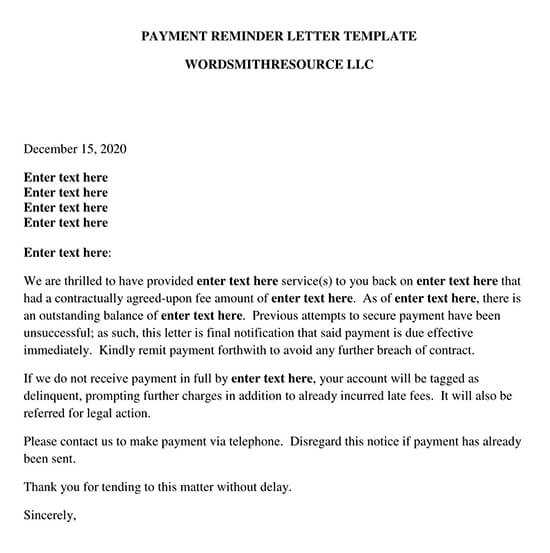

Crafting a Clear Payment Request

To write a first payment letter, include key details such as the invoice number, amount due, and payment terms. Address the recipient directly and use a polite yet firm tone. The goal is to clearly communicate the payment expectations without appearing aggressive. Here’s how you can approach it:

Key Elements to Include

| Section | Details |

|---|---|

| Invoice Information | Clearly state the invoice number, issue date, and due date for payment. |

| Amount Due | Highlight the total amount due, including any taxes or fees. |

| Payment Instructions | Provide clear payment methods and necessary account details. |

| Late Payment Policy | If applicable, mention any late fees or penalties for missed payments. |

Crafting the Tone

The tone of the letter should balance professionalism and friendliness. Acknowledge the relationship with the recipient, but also reinforce the importance of timely payment. Stay direct, yet avoid sounding too harsh. Be sure to thank the recipient for their attention and cooperation.