Foreclosure Template Letter for Homeowners

When homeowners face difficulties in keeping up with their mortgage payments, it becomes crucial to communicate with the lender. A well-crafted formal communication can be a helpful tool in negotiating terms or explaining one’s financial situation. The goal is to ensure that all parties understand the circumstances, and to avoid further complications in the process.

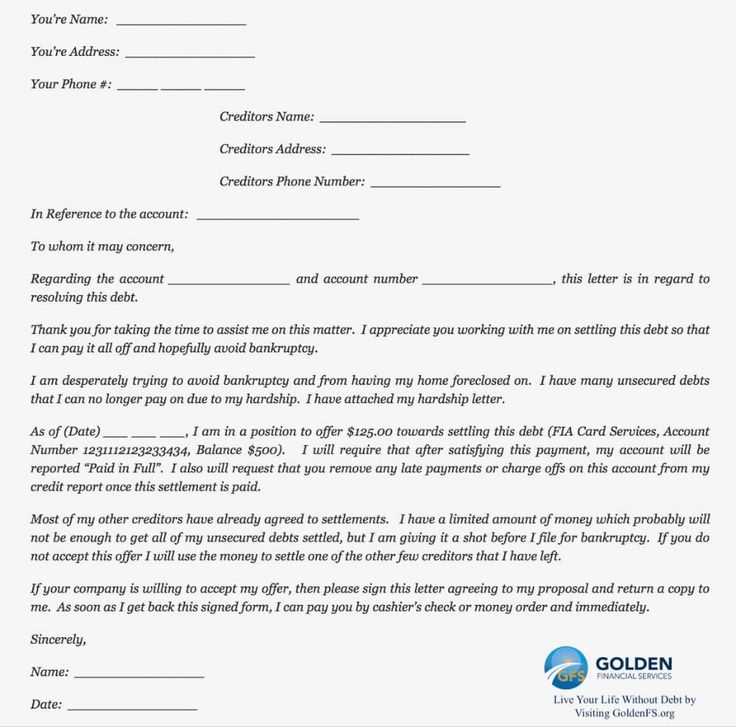

Essential Information to Include

To ensure the message is clear and effective, certain key elements should be present in your communication:

- Personal Details: Include your full name, address, and account number.

- Explanation of Financial Hardship: Briefly explain why you are unable to meet the payment terms.

- Request for Assistance or Adjustment: Specify any alternatives or relief options you seek, such as a loan modification or temporary suspension of payments.

- Proposed Solution: Offer a reasonable plan for catching up on missed payments or adjusting the repayment schedule.

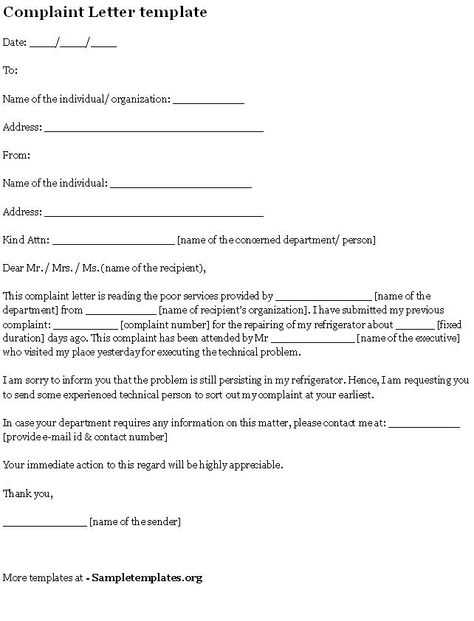

How to Write a Persuasive Communication

While addressing the situation with your lender, it’s essential to maintain a tone that is respectful and professional. Here are some tips to ensure your message is received positively:

- Stay Concise: Avoid unnecessary details that may obscure your main points.

- Be Honest: Clearly explain the reasons for your situation, without exaggeration.

- Be Polite: A cooperative and courteous tone can help build rapport with the lender.

- Show Willingness to Work Together: Make it clear that you are open to finding a mutually beneficial solution.

When to Send This Communication

It’s important to send this written request as soon as possible after missing a payment or realizing that future payments may be missed. The earlier you communicate with your lender, the more likely you are to receive understanding and options to resolve the situation.

Remember, the purpose of the communication is to open a dialogue and seek a constructive resolution, not just to inform your lender of the issue. Taking a proactive approach can help prevent further complications down the line.

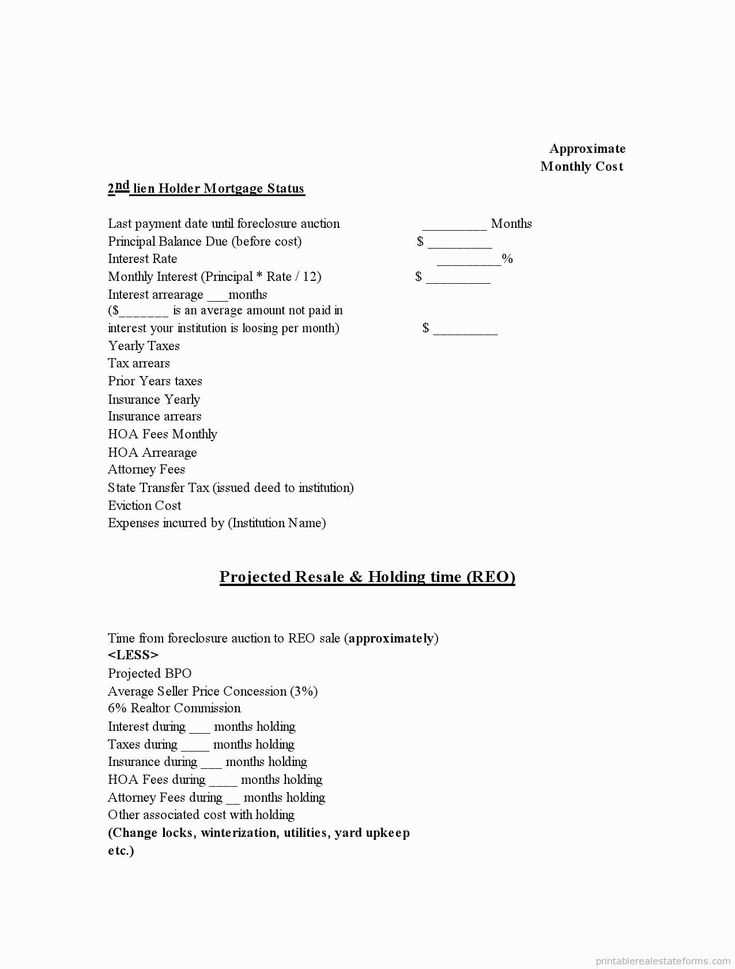

Understanding Financial Default and Its Consequences

When homeowners struggle to meet their financial obligations, particularly regarding their mortgage, it can lead to serious consequences. Addressing these issues promptly through formal communication can help reduce the risk of property loss and facilitate negotiations with the lender. Knowing how to properly draft such correspondence can be a key step toward finding a solution and avoiding further escalation.

What is a Formal Communication for Default?

A formal communication for default is a written request that explains your financial situation to the lender. It typically outlines your current difficulties, requests for assistance, and suggests possible solutions. This document is crucial for initiating a dialogue that could lead to payment adjustments, forbearance, or other options to help you get back on track.

How to Draft an Effective Financial Request

When crafting this important document, clarity and professionalism are paramount. The tone should be respectful and straightforward. Be sure to include the following:

- Personal Information: Clearly state your name, account details, and contact information.

- Explanation of Hardship: Provide a concise but honest account of why you’re unable to meet the current terms of repayment.

- Proposed Solution: Offer realistic alternatives or options to resolve the issue, such as a modified payment plan or temporary relief.

Always remain courteous, as a cooperative approach can lead to better outcomes.

Key Elements to Include in a Default Notification

The key components of a formal request for assistance include:

- Identification Information: Your name, address, and any relevant loan or account numbers.

- Financial Hardship Explanation: A brief and honest explanation of the situation causing the inability to pay.

- Request for Assistance: Clear articulation of what you need from the lender, such as loan modification, repayment plan, or forbearance.

Common Mistakes to Avoid

While drafting this document, avoid the following common pitfalls:

- Being Vague: Always be specific about your situation and the assistance you need.

- Over-explaining: Keep the communication concise and focused on the essential points.

- Failing to Include a Solution: Lenders appreciate when you show initiative and suggest reasonable solutions.

Using Formal Notices to Prevent Loss of Property

Sending this document promptly can open a path for negotiation and potentially prevent more drastic measures, such as property auction. The goal is to demonstrate your commitment to resolving the issue and to create a platform for cooperation between you and the lender.

Timing for Sending a Default Notice

Sending your request as soon as you anticipate an issue with payments is crucial. The earlier you act, the more options are likely available to you. Procrastination can limit your ability to negotiate favorable terms, so make sure to send this communication promptly after realizing you may miss a payment.