Full and Final Settlement Letter Template for Quick Use

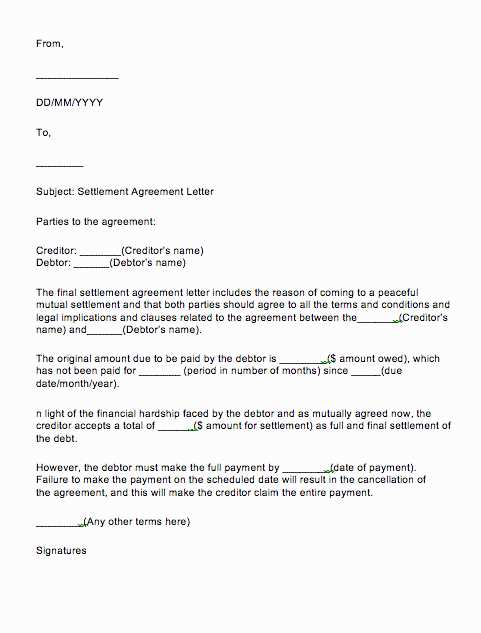

When concluding a financial arrangement, it’s essential to formalize the agreement between the parties involved. A written document helps both sides confirm the terms of the closure, ensuring all obligations have been met. This type of record acts as proof that the matter is resolved and no further claims will be made. Having a clear, professionally crafted record is crucial for maintaining transparency and avoiding future disputes.

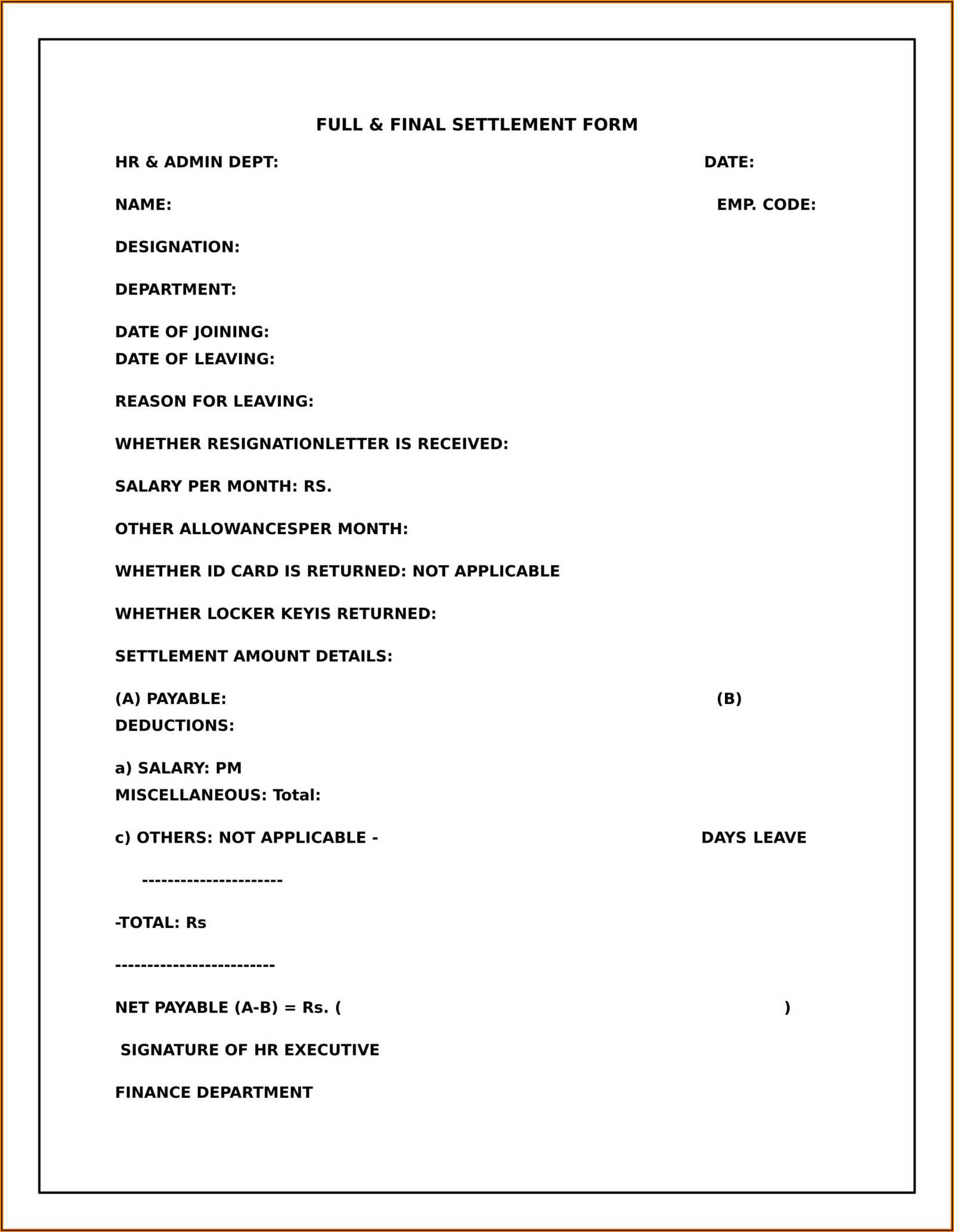

Key Elements of a Closing Agreement

To ensure the document serves its purpose, certain components must be included. These key points guarantee clarity and accuracy:

- Identification of parties: Names and roles of all involved individuals or organizations.

- Details of the agreement: A brief summary of the prior arrangement, including the amount or obligations fulfilled.

- Confirmation of payment or performance: Proof that all agreed-upon actions have been completed or compensated.

- Mutual release: A clause stating that no further claims will be made by either side.

- Signatures: Signed by all parties to acknowledge acceptance and agreement.

Why Using a Structured Document is Beneficial

Having a predefined structure for the document provides several advantages. It ensures that no essential information is left out and reduces the likelihood of errors. Templates also save time and effort, allowing you to quickly draft a professional document with confidence.

Steps to Draft a Proper Closing Document

- Start by gathering all relevant details about the agreement, including the names, amounts, and actions taken.

- Draft the text with clear, unambiguous language. Avoid complex terms that could cause confusion.

- Review the document for accuracy, ensuring everything is correct and complete.

- Have both parties sign the document, confirming their agreement to the terms.

- Distribute copies of the signed document to all involved parties for their records.

Common Errors to Avoid

Even with a template, it’s important to avoid common mistakes. Here are some pitfalls to watch out for:

- Missing information: Ensure all required details are included to avoid ambiguity.

- Unclear wording: Use simple and straightforward language to prevent misunderstandings.

- Not obtaining signatures: A document without signatures is not legally binding.

By following these guidelines and utilizing a structured format, you can ensure that your closing document is clear, professional, and legally effective.

Understanding the Agreement Closure Process

When concluding a financial or legal relationship, it’s important to formalize the end of the matter with a document that confirms both parties have met their obligations. This serves as an official record, ensuring that no further claims or disputes arise after the agreement is completed. A well-drafted document is essential to provide clarity and closure for all involved parties.

Essential Components of a Concluding Document

To create an effective closing agreement, it’s crucial to include the following elements:

- Party Identification: Clear identification of all individuals or entities involved in the agreement.

- Summary of the Agreement: A concise description of the terms and obligations that were fulfilled.

- Proof of Completion: Evidence that all financial or contractual duties have been met by both parties.

- Mutual Release Clause: A statement confirming that both sides waive any future claims related to the matter.

- Signatures: A section for all parties to sign, indicating their agreement to the terms outlined.

Advantages of Using Predefined Formats

Using a structured framework to draft your document streamlines the process by ensuring all necessary information is included. Templates provide consistency and reduce the chance of missing key details, helping you quickly create an accurate, legally binding agreement. This also saves time and effort compared to writing a document from scratch.

When drafting the final document, keep in mind common mistakes, such as neglecting important clauses or failing to gather signatures. By following a clear structure and reviewing the document carefully, you can avoid errors and create a solid, reliable agreement.