Gift Letter Template for Mortgage UK

When applying for a home loan, applicants often receive assistance from family or friends to help with the required funds. This assistance typically involves a formal document to confirm that the contribution is a gift, not a loan. Such documentation ensures that the financial support is properly recorded and can meet the criteria set by lenders. The document plays a crucial role in demonstrating that the applicant’s financial stability is not dependent on borrowed money.

Key Components of a Financial Support Document

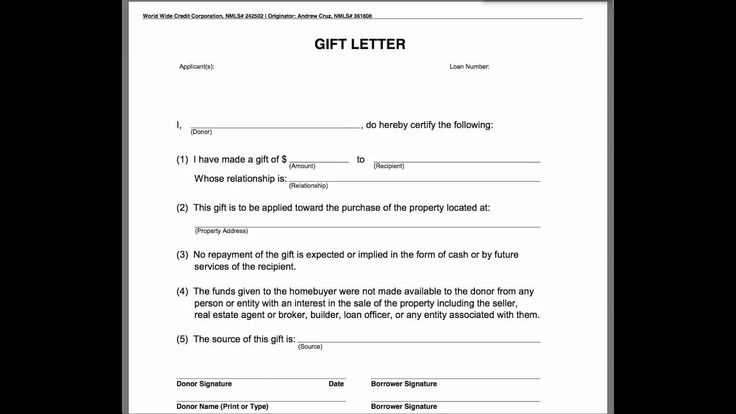

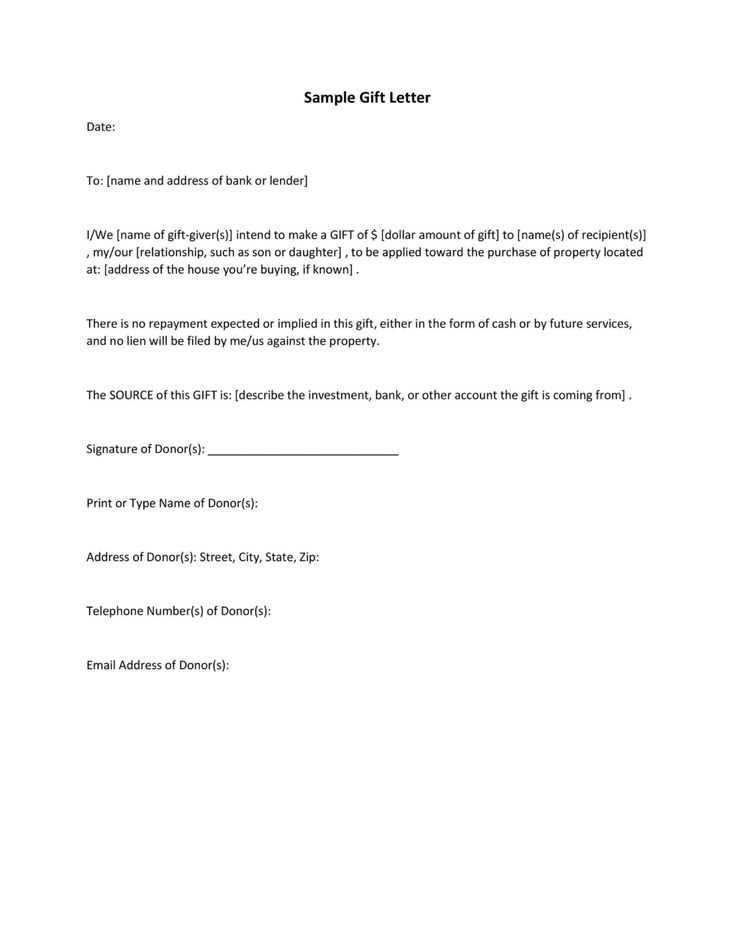

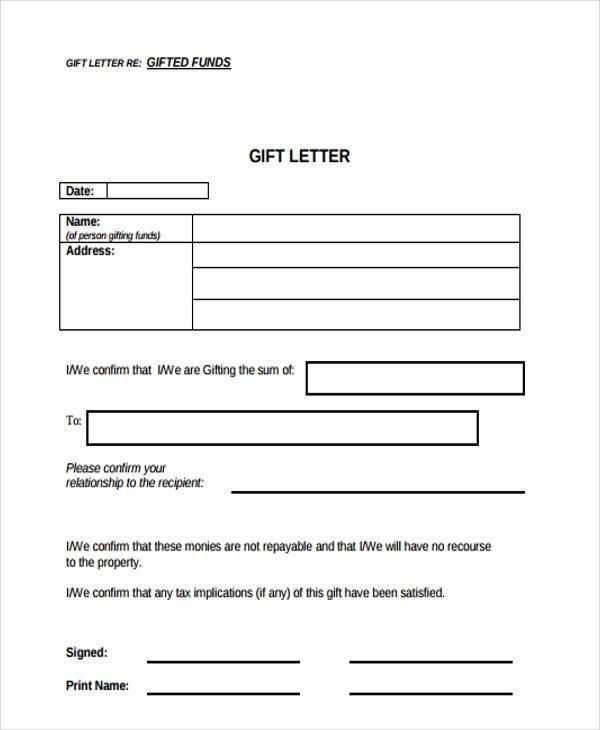

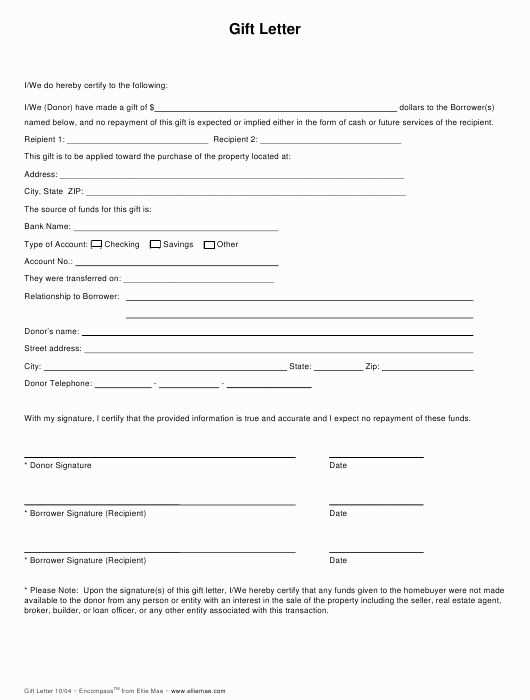

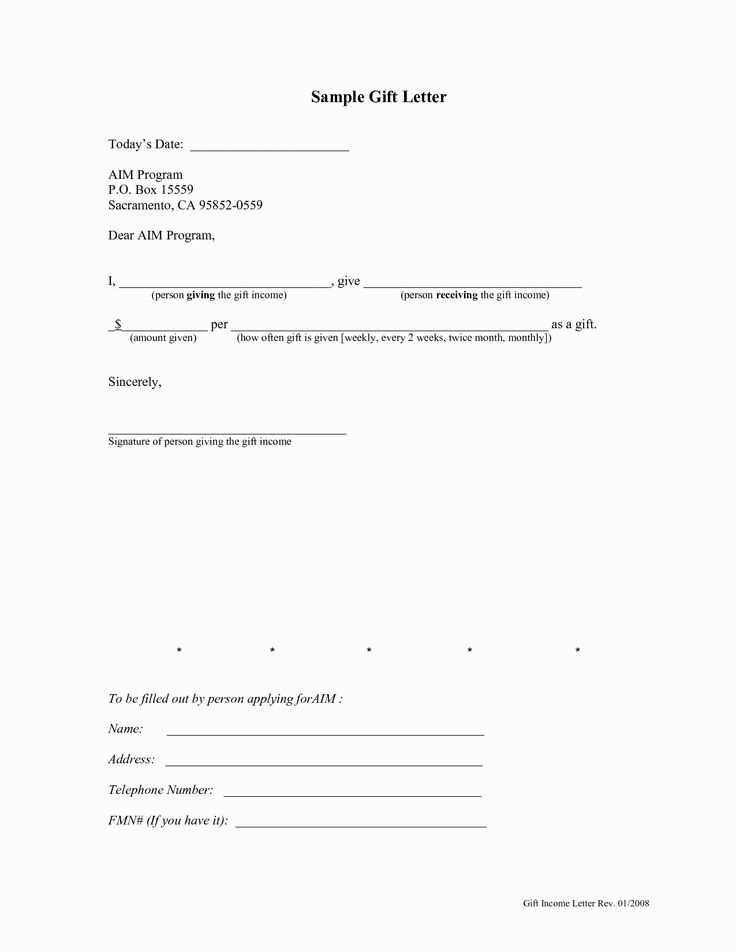

A well-constructed statement should include several essential details to satisfy lender requirements. The following are the key elements:

- Donor Information: The full name, address, and relationship to the applicant.

- Recipient Information: The full name of the individual receiving the financial support.

- Amount of Contribution: The specific amount being given, with clear reference to the source of funds.

- Declaration of Non-Repayment: A statement confirming that the contribution is a gift with no repayment expected.

Who Can Provide Financial Assistance?

Support can come from various sources, most commonly family members or close friends. However, some lenders may allow gifts from other individuals, as long as the relationship to the applicant is verified and deemed acceptable. It’s important that the donor has the necessary funds available and can legally transfer the amount to the applicant.

Why the Document is Necessary

Lenders require this type of document to ensure that the applicant is not taking on additional financial obligations that could affect their ability to repay the loan. Without this confirmation, lenders may not proceed with the application, as they cannot guarantee the applicant’s financial situation is stable enough to support a home purchase.

Steps to Prepare the Document

Creating the formal record is a straightforward process. The donor and recipient must work together to draft a statement, ensuring all necessary details are included. Following these steps can help avoid complications during the application process:

- Write a clear statement detailing the nature of the financial contribution.

- Include both the donor’s and recipient’s full information and relationship.

- Clearly indicate the amount of money being provided, along with a declaration of no repayment obligation.

- Sign and date the document, ideally with a witness if required by the lender.

Having this document in place ensures transparency and meets the requirements set by lenders, ultimately helping the applicant’s chances of securing the home loan.

What is a Support Document for Home Loans?

When applying for a home loan, many applicants receive financial assistance from relatives or friends. This contribution must be documented to clarify that the funds are a gift, not a loan. The document confirms that the provided amount does not require repayment, ensuring the applicant’s ability to meet the lender’s criteria. Properly preparing this document plays a critical role in securing loan approval.

Role of Financial Contributions in UK Home Loans

In the UK, lenders often expect borrowers to demonstrate a stable financial foundation. Financial help from close connections can significantly improve the chances of loan approval. By receiving a non-repayable sum, applicants can increase their available deposit and strengthen their financial profile. It helps lenders assess the applicant’s ability to repay the loan without adding extra debt obligations.

Key Information to Include in the Document

A comprehensive statement should include specific details to meet the expectations of financial institutions:

- Donor’s Identity: Full name, address, and relationship to the recipient.

- Recipient’s Details: Full name and address of the person receiving the support.

- Contribution Amount: Clear mention of the sum being given without repayment obligations.

- Affirmation of Non-Repayment: Explicit statement that the contribution is a gift, not a loan.

Who Can Provide Financial Assistance?

The primary sources of assistance are typically family members or close friends. However, other individuals may also contribute, depending on the lender’s specific requirements. The donor must have sufficient funds and legally transfer them to the applicant. The relationship between the donor and recipient is an important factor that lenders consider when evaluating the document.

Step-by-Step Guide to Drafting the Document

Preparing this record involves the following simple steps:

- Begin by writing a clear statement describing the nature of the financial support.

- Include the donor’s and recipient’s full names and their relationship.

- Specify the exact amount provided and confirm that no repayment is expected.

- Ensure both parties sign and date the document, with a witness if necessary.

Essential Legal Requirements

The legal framework surrounding this type of document is crucial to ensure its validity. The document must be signed by both the donor and recipient and should include a clear declaration that the funds are a gift. Some lenders may require the donor to provide proof of their financial capacity to offer the support. Following the proper legal process helps avoid any complications during the loan application process.