Goodwill Deletion Letter for Paid Collection Template

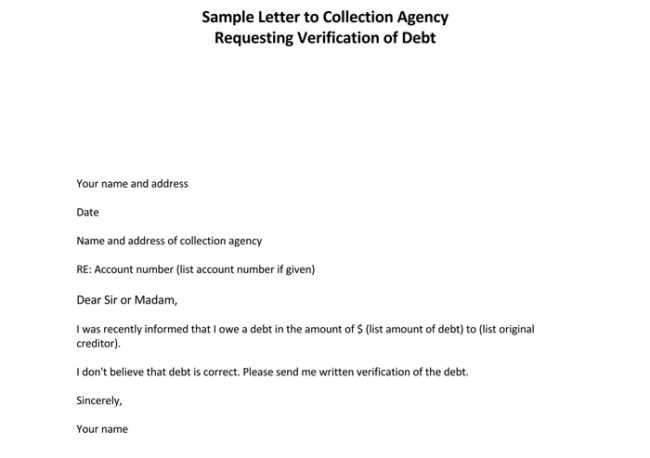

When dealing with past financial issues, you might find yourself hoping to improve your credit report by removing certain negative marks. A well-crafted request can sometimes lead to the removal of these entries, even if they’ve already been settled. This process relies on effective communication with creditors, where you ask for leniency and a reconsideration of the negative impact on your score.

By reaching out to the relevant parties and explaining your situation, you can initiate a process that could potentially benefit your credit standing. Understanding the proper structure and tone for this type of correspondence is crucial to increase your chances of success. Being clear, polite, and professional in your approach may help you get the results you want.

Goodwill Deletion Letter Basics

When seeking to improve your credit, one option is to reach out to lenders and ask them to remove an unfavorable entry from your record. This process involves requesting that a resolved issue be erased, typically after a payment has been made. The goal is to gain a more accurate reflection of your financial standing by eliminating past mistakes that have already been addressed.

What You Need to Know Before Reaching Out

Before crafting your request, it’s important to understand the key elements of an effective approach. Start by identifying the specific entry you wish to address and ensure that you have cleared any outstanding debts associated with it. Being clear and concise in your communication is essential to making a compelling case for why the record should be reconsidered.

When and How to Make Your Request

Timing is critical when initiating this type of request. After a debt has been settled, waiting a few months before sending your inquiry can show a commitment to responsible financial behavior. Be sure to address your communication professionally, including details of your payment and your reasoning for asking the item to be removed. A respectful tone can increase the likelihood of a positive outcome.

Understanding the Impact on Credit Score

Your credit score plays a significant role in determining your financial health, affecting everything from loan approvals to interest rates. Negative marks on your credit report can lower your score, making it more difficult and costly to obtain credit in the future. These marks can stay on your record for years, but resolving the underlying issues can help improve your financial reputation over time.

Removing past negative entries can have a positive effect on your score, but it’s important to understand the extent of this impact. The influence on your credit score depends on a variety of factors, such as the number of recent marks, the severity of the negative entries, and your current credit behavior. Below is a table outlining potential changes in your score based on different types of records:

| Entry Type | Potential Credit Score Impact |

|---|---|

| Late Payments | Moderate decrease (up to 100 points) |

| Settled Debt | Small increase (up to 50 points) |

| Charge-offs | Significant decrease (up to 150 points) |

| Bankruptcy | Major decrease (up to 200 points) |

By addressing these issues and requesting the removal of resolved entries, you may be able to improve your overall creditworthiness. However, the degree of improvement depends on various circumstances, so it’s important to manage your credit wisely even after removing negative entries.

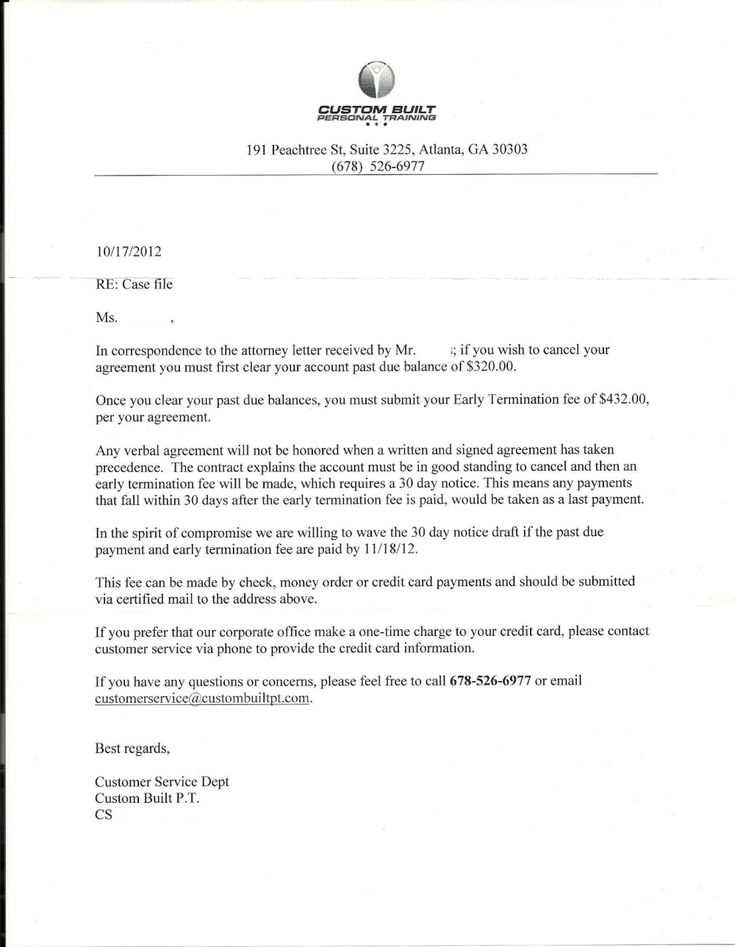

How to Write an Effective Request

When asking a creditor to reconsider a past negative mark on your financial record, it’s crucial to approach the situation thoughtfully. The tone, content, and clarity of your request can significantly influence the outcome. A well-crafted communication can increase the chances of a favorable response, helping to remove unwanted entries that are no longer relevant to your current financial standing.

Key Elements of a Strong Request

Start by being concise yet detailed. Include your account information, such as the reference number, and specify the item you wish to have reconsidered. Make sure to acknowledge your past mistake but focus on your current financial stability and commitment to responsible credit management. Politeness and professionalism are key throughout your message to maintain a positive relationship with the creditor.

Additional Tips for Success

While it’s important to provide sufficient details, ensure your request remains respectful and to the point. Be sure to include any supporting documentation that can demonstrate your payment history and current financial standing. Stay positive and confident, focusing on how the resolution of the issue could benefit both parties, especially in terms of fostering a long-term relationship built on trust and responsibility.

Key Elements of a Goodwill Letter

When reaching out to a creditor, it’s important to structure your communication effectively to increase your chances of success. Including all the relevant details and ensuring your tone is respectful and clear are critical factors. Here are the essential components that should be part of your message:

- Introduction: Briefly introduce yourself and state the purpose of your request.

- Account Information: Include your account number and any reference details that can help the creditor identify your record.

- Explanation of the Situation: Politely acknowledge the past mistake and explain the circumstances, emphasizing any extenuating factors.

- Current Financial Status: Highlight your current responsible behavior, such as timely payments, and your commitment to maintaining a positive credit history.

- Request for Removal: Clearly state your request to have the negative entry reconsidered or removed from your record.

- Polite Closing: End with a respectful note, expressing appreciation for their time and consideration.

By covering these key elements, you create a compelling request that shows professionalism and a genuine desire to resolve the issue. Additionally, ensuring that your request is concise and polite can improve your chances of receiving a favorable response.

Common Mistakes to Avoid

When requesting that a past negative record be reconsidered, there are several common pitfalls that can reduce the chances of success. It’s crucial to approach the situation professionally and carefully, avoiding errors that might weaken your request or damage your relationship with the creditor. Here are some of the most frequent mistakes to be mindful of:

Tone and Language Errors

- Being Demanding: Making aggressive or entitled statements can hurt your chances. Always maintain a respectful and polite tone.

- Too Vague: A request that lacks details or clarity may be ignored. Provide necessary information without overwhelming the recipient.

- Using a Negative Tone: Focusing too much on blaming the creditor or expressing frustration can make the request less compelling.

Content and Structure Mistakes

- Missing Account Information: Failing to include critical details such as your account number can delay or prevent processing.

- Being Overly Emotional: While it’s important to explain your situation, avoid being overly emotional or pleading. Stick to the facts.

- Not Showing Responsibility: Acknowledge the past issue and demonstrate your current financial responsibility. Avoid sounding like you’re deflecting blame.

By steering clear of these common errors, you can present a much stronger case and improve your chances of getting a positive response from the creditor.

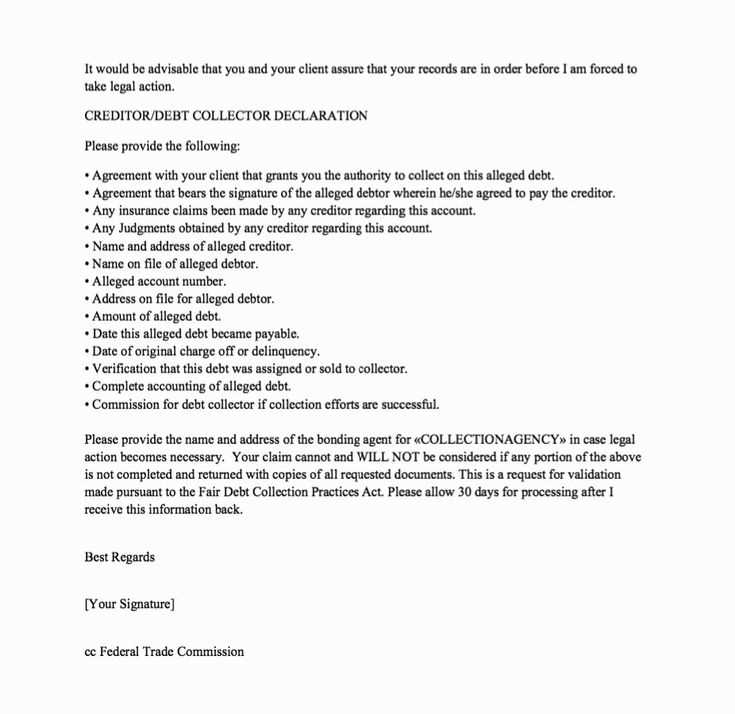

What Happens After Sending the Letter

After submitting your request to the creditor, the next steps are crucial in determining the outcome. While the timeline and response may vary, it’s important to understand the typical process and what to expect moving forward. This can help manage expectations and ensure you stay prepared for any necessary follow-ups.

Once your request is received, the creditor will review the details you’ve provided, including the context of your situation and your current financial behavior. They may take time to assess the validity of your request, especially if it involves removing or adjusting a past entry in their records. Some creditors may respond quickly, while others might require several weeks to reach a decision.

If the decision is favorable, you will likely receive confirmation that the negative mark has been updated or removed from your financial record. In case the request is denied, it’s important to review their reasoning and consider whether further action, such as providing additional documentation or making another request, is necessary.

Throughout this process, maintaining a professional tone in any follow-up communications is key. Patience is important as well, as creditors are processing multiple requests and need adequate time to make informed decisions.

Tips for Successful Collection Deletion

When trying to have a negative mark removed from your credit history, the approach you take can make a significant difference. While there’s no guarantee of success, following the right strategies can improve your chances. Here are some tips that can help make your request more effective:

Prepare Thoroughly

- Be Clear and Specific: Ensure your communication is clear, concise, and provides all relevant details to help the creditor understand your situation.

- Include Supporting Documentation: If possible, provide evidence of your current responsible financial behavior, such as recent on-time payments or an improved credit score.

- Personalize Your Request: Tailor your message to show that you’ve taken the time to understand the creditor’s policies and are genuinely asking for reconsideration based on your specific case.

Maintain a Professional Tone

- Stay Polite and Respectful: Approach the situation with courtesy. A respectful tone can go a long way in maintaining a positive relationship with the creditor.

- Be Patient: Understand that creditors may need time to review your request. Avoid being overly persistent, as this can come across as demanding.

- Avoid Blame: Focus on the resolution and avoid blaming the creditor or making excuses for past mistakes. Instead, highlight how you’ve worked to improve your financial habits.

By following these tips, you increase the likelihood of receiving a positive response and potentially having the negative record removed from your financial history.