Hard Inquiry Removal Letter Template for Credit Repair

If you’ve noticed negative entries affecting your credit score, addressing them promptly can help restore your financial standing. By challenging incorrect or outdated records, you can work towards improving your creditworthiness and increasing your chances of securing better loan terms. In this section, we will walk you through the process of disputing such entries effectively.

Steps to Initiate a Dispute

The first step in tackling unfavorable marks is understanding the process of dispute initiation. Here are the key steps to follow:

- Gather Documentation: Before drafting any request, ensure you have all relevant information, including your credit report and any supporting documents that prove the entry is incorrect or outdated.

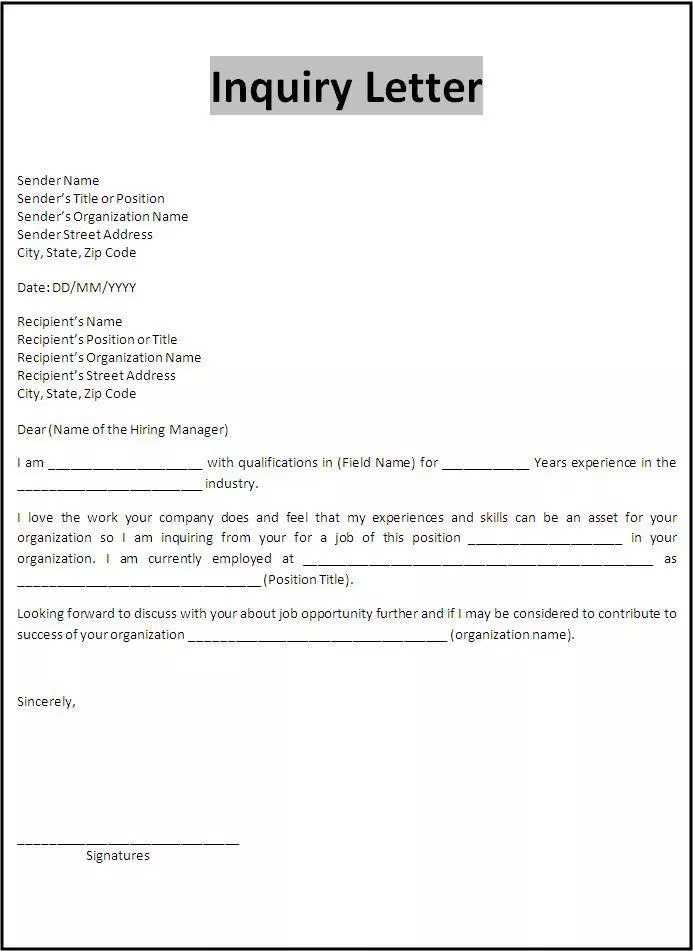

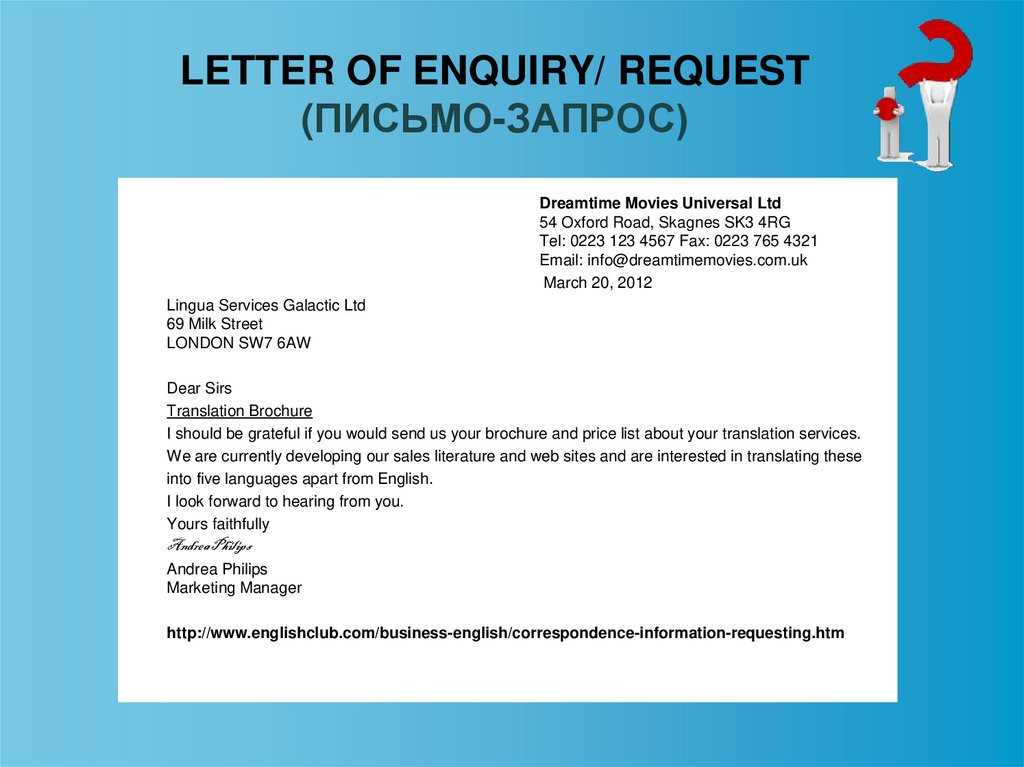

- Craft a Formal Request: Once you have the required details, write a clear and professional dispute letter. State your case concisely, mentioning the specific entry that is in question and why it should be revised.

- Send to the Correct Party: Address your dispute to the credit reporting agencies or the financial institution responsible for the entry. Ensure you send it via a traceable method to confirm receipt.

Effective Communication Tips

When drafting your dispute request, ensure that the tone remains formal and respectful. Clearly outline the issue and avoid emotional language. Be concise and provide all necessary details that back your claim. Here’s a structure you can follow:

- Introduction: Briefly state the purpose of your communication and the entry you are challenging.

- Explanation: Provide a clear reason why you believe the record should be altered, with any supporting documentation.

- Request for Action: Politely ask for a review and correction of the issue.

Understanding Your Rights

As a consumer, you have the legal right to dispute inaccurate or obsolete information on your credit report. The Fair Credit Reporting Act (FCRA) ensures that credit agencies investigate the validity of disputed entries within a reasonable time frame, typically 30 days. If they fail to respond or correct the error, you may escalate the issue or seek further assistance.

By following these steps and staying proactive, you can address credit report discrepancies effectively and potentially improve your credit score.

Overview of Disputing Negative Credit Entries

Managing and correcting negative marks on your credit report is a crucial aspect of maintaining a healthy financial profile. Challenging inaccurate or outdated entries can improve your credit score and increase your chances of obtaining favorable terms when applying for loans or credit. This section will guide you through the entire process, offering tips and important information for successfully disputing these entries.

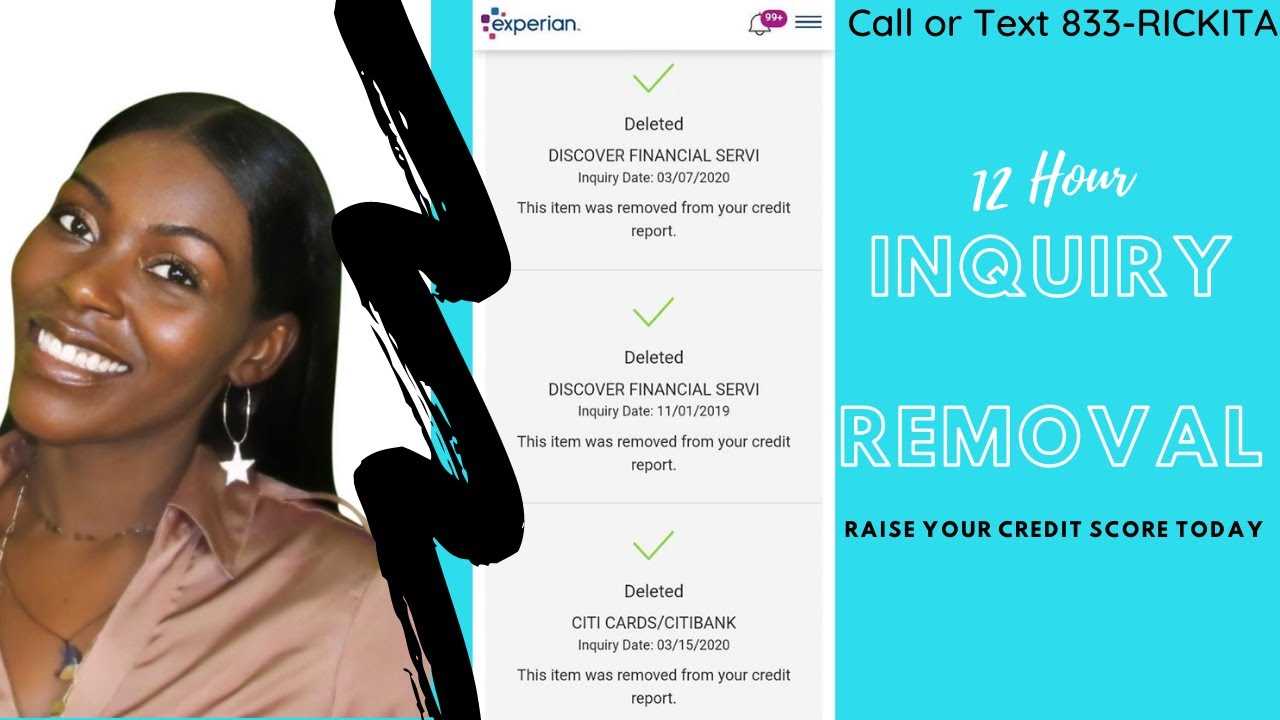

Understanding the Impact of Credit Checks

When a financial institution checks your credit history, it can influence your credit score depending on the nature of the check. A thorough understanding of how these checks affect your rating is important, as excessive or unneeded requests can lower your score. Being aware of this can help you make informed decisions before granting permission for such reviews.

How to Craft an Effective Dispute Request

To effectively challenge an erroneous entry, it’s essential to draft a well-structured and clear dispute. Provide specific details about the entry in question and the reason it should be updated or removed. Include all necessary supporting documentation, such as reports or records that substantiate your claim, and address the communication in a professional manner to ensure your request is taken seriously.

Avoiding Common Mistakes

There are several common pitfalls to avoid when disputing inaccurate marks. Failing to include sufficient proof, being vague in your explanation, or submitting your request to the wrong party can significantly delay the process or result in rejection. Always ensure you have accurate documentation and a clear, respectful request before proceeding.

Your Legal Rights During the Dispute Process

As a consumer, you have the legal right to challenge any incorrect information listed on your credit report. The law ensures that credit agencies must investigate your dispute and respond within a set time frame. If the disputed information is not corrected or properly addressed, you have the option to escalate the matter further, either with the credit bureau or through legal means.

Timing Your Dispute Request

Submitting your request promptly is key. It’s essential to file your dispute as soon as you notice any discrepancies to prevent further damage to your credit. Delaying the process may allow negative entries to stay on your report longer, affecting your ability to secure loans or favorable credit terms.

Strategies for Speeding Up Credit Repair

To expedite the process, make sure your request is clear, well-supported, and sent through a traceable method. You can also follow up periodically to ensure the issue is being addressed within the legal time frame. Consistency and persistence can help speed up the resolution and improve your credit score faster.