Income letter from employer template

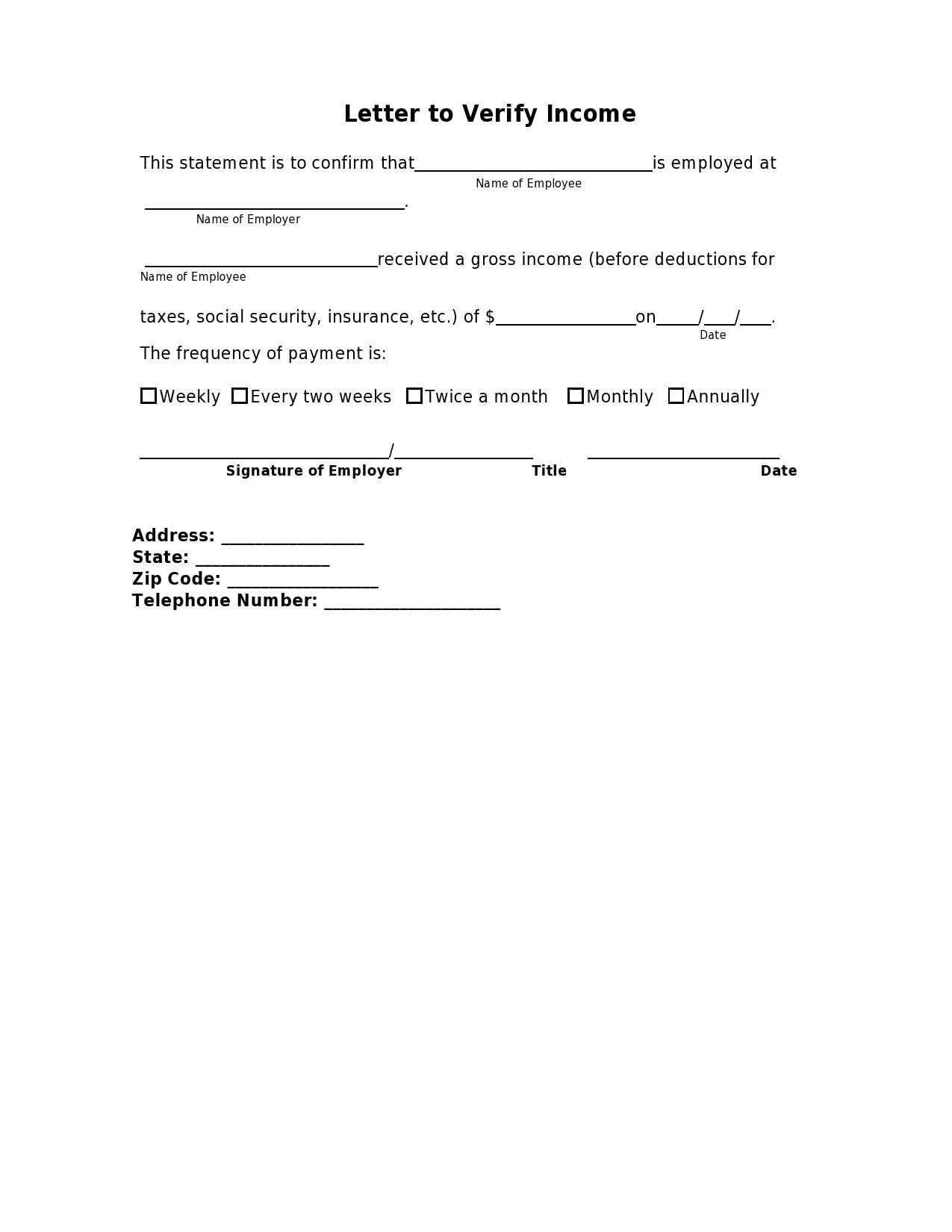

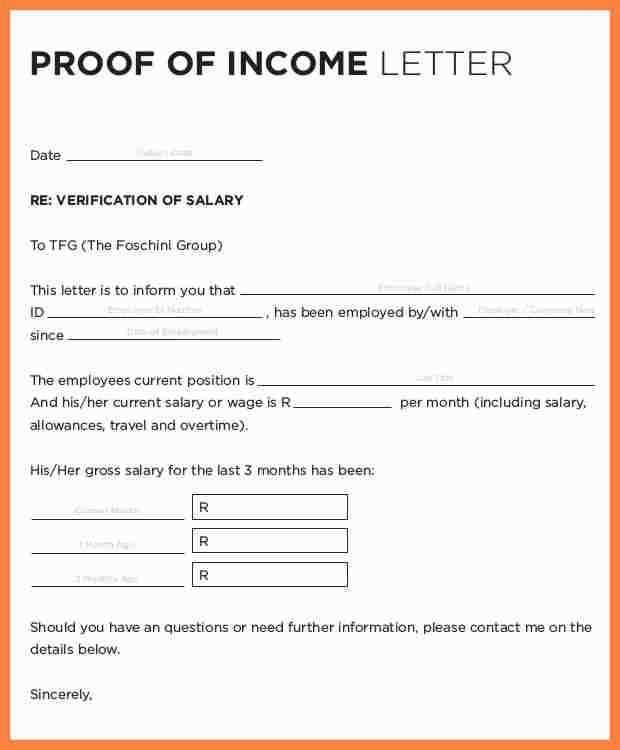

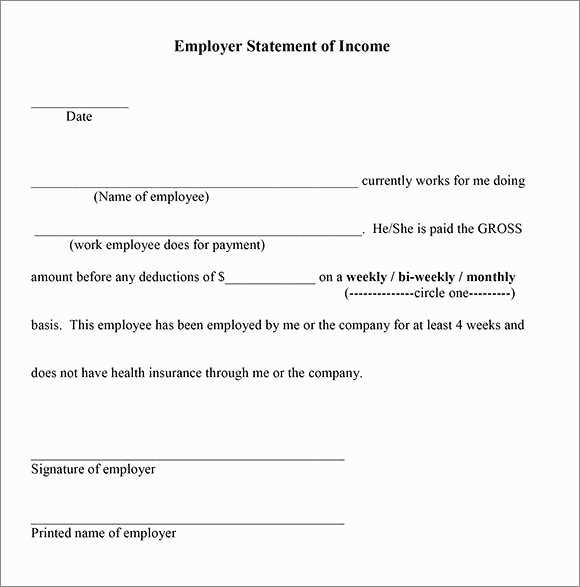

Key Elements to Include

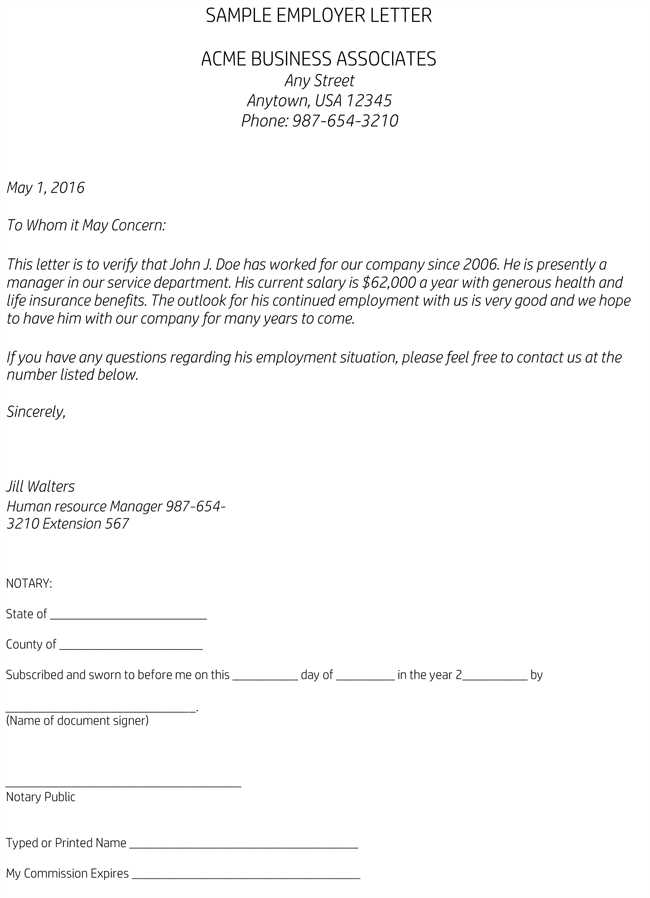

A well-crafted income letter from your employer should provide clear and precise details. Make sure to include the following key information:

- Employer’s Information: Full name, company name, address, and contact details.

- Employee’s Information: Your full name, job title, and employment start date.

- Income Details: Your salary, bonuses, commissions, or any other sources of income.

- Employment Status: Whether you’re full-time, part-time, or on contract.

- Duration of Employment: How long you’ve been working at the company.

- Additional Information: Any other relevant details, such as benefits or allowances.

Income Letter Format

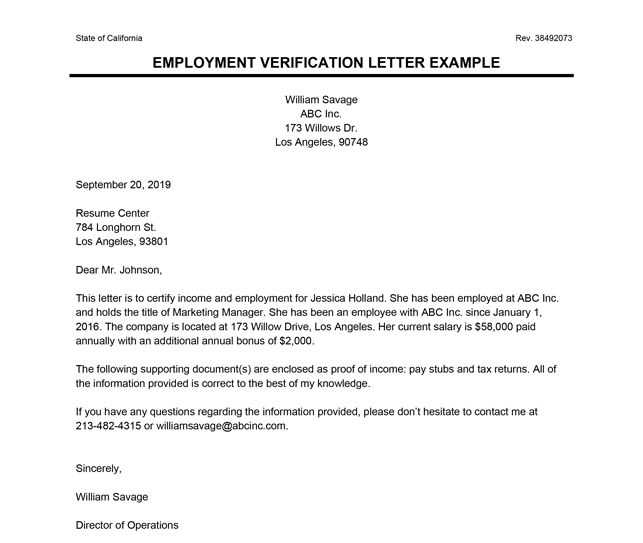

Here’s a basic structure you can follow when creating your income letter:

[Employer's Name] [Employer's Job Title] [Company Name] [Company Address] [Date] To Whom It May Concern, This letter is to confirm that [Employee's Full Name] has been employed with [Company Name] since [Employment Start Date]. They hold the position of [Job Title] and currently earn [Salary Amount] annually/monthly. Should you require any additional information, please feel free to contact us at [Employer’s Contact Information]. Sincerely, [Employer’s Signature]

Tips for Personalization

Ensure your employer customizes the letter to reflect your specific situation. Avoid generic phrasing, and double-check the accuracy of income details. Clear, direct information will avoid confusion when the letter is reviewed by a third party. If you have multiple sources of income, break them down to show the full picture.

How to Format the Income Letter Correctly?

How to Verify the Information’s Accuracy in the Letter?

Common Mistakes to Avoid When Writing an Income Letter

Can an Employer Modify the Template for Specific Needs?

When Should an Income Letter Be Requested and Why?

Begin with the employee’s full name, job title, and employment start date. Specify the income amount, including base salary and any additional compensation (e.g., bonuses or commissions). Clearly state the frequency of payment (weekly, bi-weekly, monthly). Ensure the employer’s contact details (name, position, company) and the company’s official letterhead are included for authenticity.

To verify the information’s accuracy, cross-check the salary details with payroll records. Confirm that the job title and employment dates align with official employment records. Ensure the letter reflects any recent raises or changes in compensation. A quick review by HR or the finance team can help catch discrepancies.

Common Mistakes to Avoid

Do not leave out essential details like salary breakdowns or payment frequency. Avoid vague language such as “approximate” or “estimated” when stating income amounts. Ensure the letter does not include personal or irrelevant information that may compromise confidentiality. Also, double-check for grammatical errors, as they can diminish the professionalism of the letter.

Can an Employer Modify the Template for Specific Needs?

Yes, employers can adjust the income letter template to suit particular situations. For example, if the letter is for a mortgage or loan application, it may need to include additional details like overtime or incentive payments. Always make sure to maintain the letter’s accuracy and avoid adding unnecessary or misleading information.

When to Request an Income Letter: Employees may need an income letter when applying for a loan, mortgage, rental lease, or government assistance programs. Request the letter well in advance of deadlines to allow time for processing and verifying the details. Ensure the letter is dated within the last 30 days to reflect current employment status and income.