Past due reminder letter template

Sending a reminder letter for a past due payment is a simple but effective way to maintain cash flow and reinforce professional communication. Be clear and polite while emphasizing the need for prompt payment. This template will help you get the message across without sounding too harsh, but still keeping the focus on the issue at hand.

Start by clearly stating the amount owed and the due date, referencing the original terms of the agreement. This helps eliminate confusion and reinforces the expectations set in the contract or invoice. Next, express understanding but request that the overdue balance be cleared as soon as possible. Politeness plays a role in maintaining good relationships, even when addressing payment issues.

Conclude with a firm yet friendly reminder that failure to pay may result in further action. Offering solutions, like payment plans, can ease tensions and potentially speed up the resolution. A well-worded past due reminder maintains professionalism while encouraging swift action.

Here is the modified version of the text with minimal repetition of words:

When creating a past due reminder letter, make sure to include these key components:

- Clear Subject Line: Indicate the overdue status right away to ensure the reader understands the urgency.

- Polite but Firm Tone: A friendly yet direct tone helps maintain professionalism while encouraging prompt payment.

- Invoice Details: Specify the outstanding amount, invoice number, and due date to make it easier for the recipient to identify the payment.

- Consequences of Non-Payment: Briefly mention the actions that may follow if payment is not received within a specific time frame.

- Request for Confirmation: Ask the recipient to confirm receipt of the reminder and their plan for payment.

Maintain a positive and clear approach throughout, without sounding overly harsh or aggressive. This will help preserve a professional relationship while encouraging payment.

- Past Due Reminder Letter Template

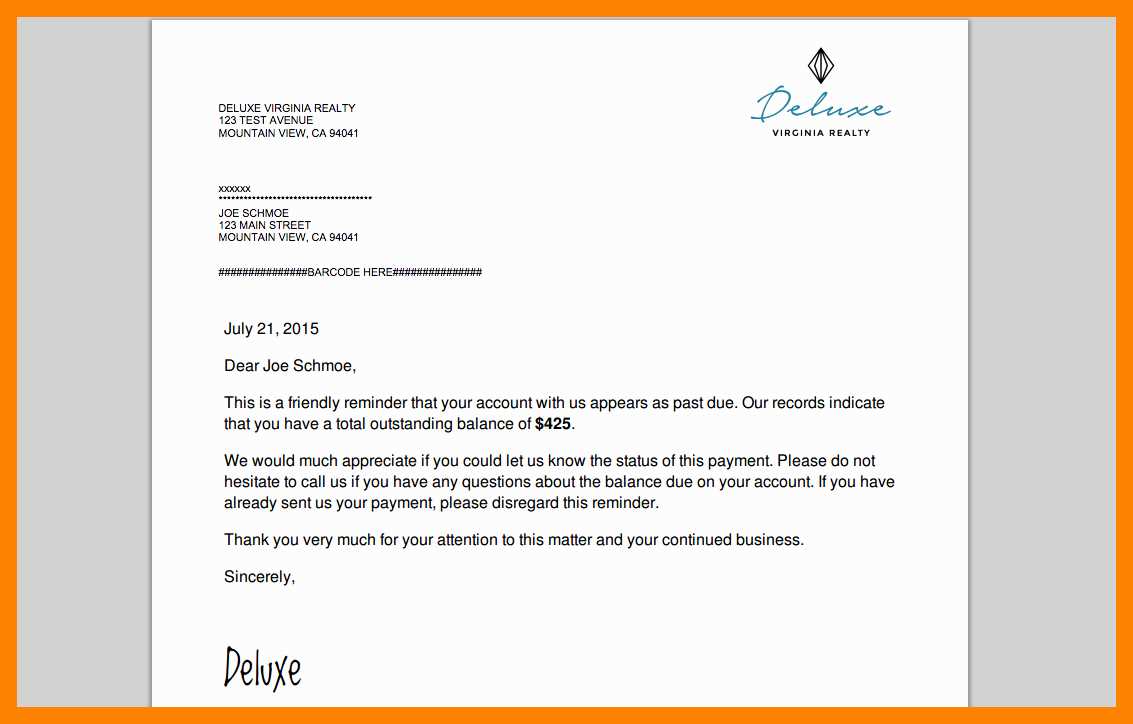

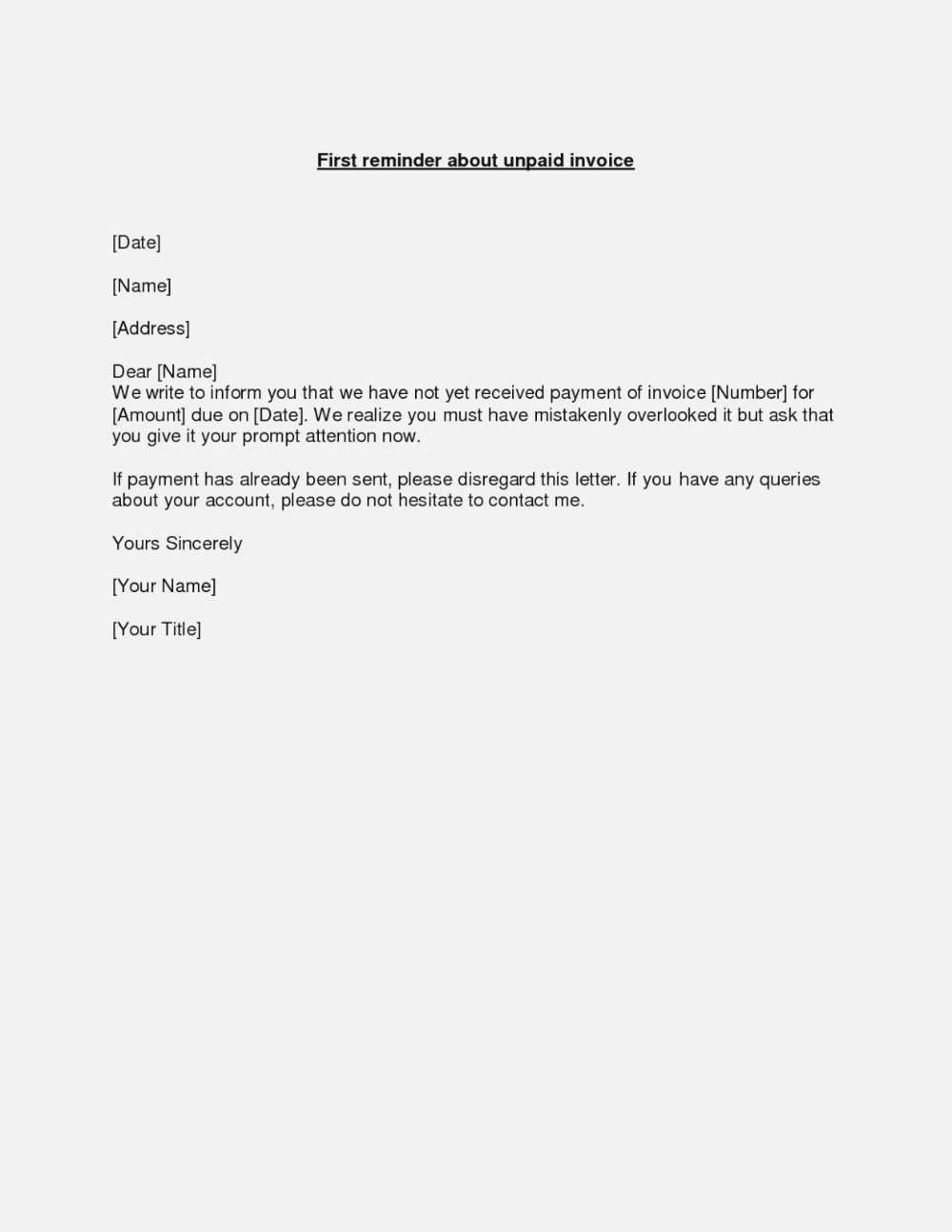

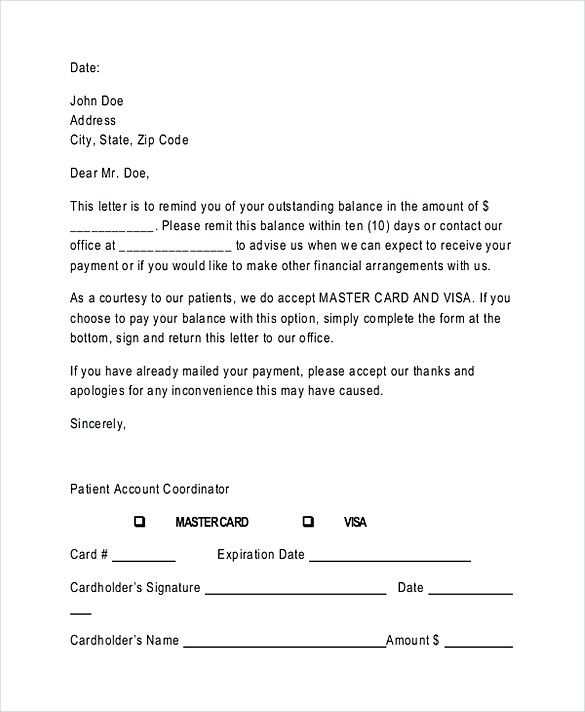

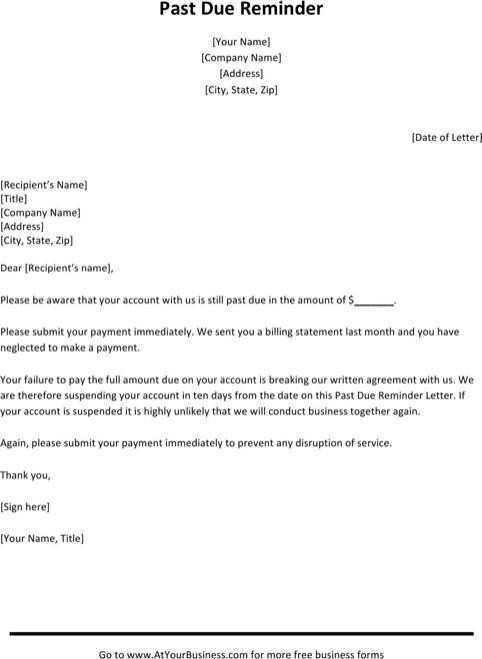

A well-structured past due reminder letter can encourage prompt payment without damaging customer relationships. Keep your tone polite, firm, and direct. Here’s an effective template:

[Your Company Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

[Customer’s Name]

[Customer’s Address]

[City, State, ZIP Code]

Dear [Customer’s Name],

This letter serves as a reminder that the payment for invoice # [Invoice Number], which was due on [Due Date], has not been received. The outstanding balance of $[Amount Due] is now [X] days overdue.

We kindly ask that you remit payment as soon as possible. If payment has already been made, please disregard this notice. Otherwise, please contact us immediately to arrange payment or discuss any issues related to this invoice. You can reach us at [Phone Number] or [Email Address].

If payment is not received by [Final Payment Date], we may have to take further action, which could include [brief mention of consequences, e.g., additional fees, service suspension].

We value your business and look forward to resolving this matter swiftly.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

Begin by clearly addressing the recipient and mentioning the invoice details right at the start. A straightforward and respectful tone will encourage prompt attention. For instance, state the invoice number and the due date to avoid any confusion.

Be Direct and Clear

Avoid any ambiguity in your opening sentence. For example, “We are writing to remind you that payment for Invoice #12345, which was due on January 15, has not yet been received.” This immediately draws attention to the matter at hand without unnecessary elaboration.

State the Amount Due

Include the exact amount owed and any late fees if applicable. This provides a clear financial expectation and reduces back-and-forth. For example: “The total balance of $500 is now overdue, with an additional late fee of $25.” This ensures transparency and clarity in your communication.

Begin the reminder letter by addressing the recipient by name. This adds a personal touch and shows respect. Include the date of the original invoice or agreement, as this helps the reader identify the specific matter in question.

Clearly state the outstanding amount. Ensure that the total sum is easy to locate in the letter, whether it’s a single invoice or a collection of overdue payments. Break down the charges if necessary, so the recipient can quickly understand what is owed.

Provide a due date or payment period, especially if the recipient has missed it. Remind them politely of the terms and the deadline they missed.

If applicable, offer information on how they can resolve the matter, such as payment methods, account details, or a link to an online payment portal.

Also, mention any consequences if the payment is not made, like late fees, interest charges, or further action. Keep this section neutral and polite, focusing on the importance of settling the balance rather than threatening legal action.

| Item | Description |

|---|---|

| Recipient’s Name | Personalized greeting to establish rapport. |

| Outstanding Amount | Clearly state the total amount owed and a breakdown of charges. |

| Original Due Date | Reference the missed deadline for clarity. |

| Payment Instructions | Detail how the recipient can make the payment. |

| Consequences | Outline any potential consequences for not paying, such as fees or service interruptions. |

Close the letter politely, offering assistance if needed, and encourage the recipient to take prompt action. Always include your contact information to make it easier for them to respond.

Use clear, concise, and direct language. Focus on the facts, providing essential details such as the amount due and the payment date. Avoid ambiguous language that could confuse the recipient or delay action.

Maintain a polite yet firm tone. Acknowledge that mistakes happen but emphasize the need for prompt resolution. Aim for a respectful but assertive approach to convey urgency without sounding confrontational.

Personalize the notice by addressing the recipient directly. Use “you” to create a more direct and human connection. This approach increases the likelihood of the recipient taking responsibility for the overdue payment.

Stay neutral and objective. Refrain from assigning blame or making assumptions about the recipient’s intentions. Stick to the facts about the overdue payment, keeping the tone professional and free of emotions.

Be specific about the next steps. Clearly outline how the recipient can settle the debt and provide all necessary information, such as payment options and contact details. This removes any ambiguity and helps the recipient respond promptly.

One common mistake is being overly harsh in tone. A reminder letter should maintain professionalism and politeness. Avoid using aggressive language that might escalate the situation. Instead, keep the tone friendly, yet firm.

1. Lack of Specific Details

Failing to include important details such as the due date, amount owed, or invoice number can create confusion. Be clear and specific to ensure the recipient understands the exact issue. This helps avoid unnecessary follow-ups.

2. Overcomplicating the Message

Writing long-winded paragraphs can make the letter hard to read and may cause the recipient to miss key information. Stick to the point with short, concise sentences. Highlight the most important information clearly.

3. Ignoring the Previous Communication

Neglecting to reference previous attempts at communication can be counterproductive. Always acknowledge earlier reminders or agreements. This shows that you have already made an effort and are only sending a reminder due to non-payment.

4. Failing to Include a Clear Call to Action

Without a clear action to take, the recipient might not know how to resolve the issue. Include specific instructions, like payment methods, deadlines, or who to contact for questions.

5. Using Ambiguous Language

Using vague terms like “soon” or “ASAP” leaves room for confusion. Be precise about what you expect and when you expect it. This avoids misunderstandings and sets a clear deadline.

6. Not Offering a Solution

Merely pointing out the issue without offering a way to fix it can lead to frustration. Consider suggesting a payment plan or alternative ways to resolve the matter amicably.

7. Forgetting to Proofread

Spelling errors or grammatical mistakes can undermine the professionalism of your reminder. Always proofread your letter before sending it to ensure it is polished and error-free.

How to Customize the Template for Various Situations

To adjust the past due reminder letter for specific scenarios, begin by modifying the tone to suit the relationship with the recipient. For a friendly reminder, keep the language polite and understanding. If the situation requires urgency, make sure to emphasize the need for prompt payment without sounding overly aggressive.

1. Adjust the Salutation and Opening Statement

For a formal business context, address the recipient by their full name or title. In less formal cases, use a first-name greeting. The opening sentence should match the tone. For instance, “We are kindly reminding you that your payment is overdue” works well for a gentle approach, while “This is a final notice regarding your overdue payment” sets a firmer tone for more serious cases.

2. Modify the Payment Details

Be clear about the overdue amount, the original due date, and any late fees. If the client has a history of delayed payments, you may want to include details about previous reminders. On the other hand, if this is a first-time occurrence, offering a brief explanation or a grace period can help maintain good relations.

Tailoring the letter’s content ensures that the recipient understands the urgency and specifics of the situation, helping you maintain professionalism and clarity throughout the process.

Ensure your payment reminder does not cross into harassment or intimidation. Maintain a professional tone and avoid threatening language, as it could violate consumer protection laws. Be clear and polite in your request, outlining the amount due and the payment terms without being aggressive.

Stay compliant with fair debt collection practices. In many jurisdictions, you cannot contact a debtor at unreasonable hours or repeatedly. Understand the legal limits on the number of reminders you can send and the acceptable frequency.

Do not include misleading or deceptive statements. All communication must accurately represent the amount owed and the nature of the debt. False claims or misrepresentations can lead to legal repercussions.

Ensure your reminder does not infringe on privacy laws. Avoid disclosing sensitive information to unauthorized third parties. If you outsource your reminders to a collection agency, make sure they follow legal guidelines regarding debtor privacy and communication.

Be aware of the statutes of limitation on debt recovery. If the debt is too old, your reminder may not be enforceable in court. Check the legal time frame before sending reminders for debts that could be past the statute of limitations.

Include a clear subject line that highlights the purpose of the letter. For instance, use phrases like “Reminder: Past Due Payment” or “Action Required: Outstanding Invoice”. This sets the tone immediately.

Start with a friendly, straightforward opening that acknowledges the business relationship. Express appreciation for previous payments if applicable, but remain firm about the overdue status. A simple statement like “We hope all is well. Our records show that your payment of [amount] due on [due date] has not been received” is clear and professional.

Next, mention the invoice details and any previous attempts to contact the client. Provide specifics like invoice number, date, and the amount due. This reinforces the seriousness of the situation.

- Invoice Number: [Invoice Number]

- Amount Due: [Amount]

- Due Date: [Due Date]

Offer a gentle reminder of the consequences of not addressing the overdue balance. Keep this part polite but firm to encourage prompt action. For example, “Please note that if we do not receive your payment by [new due date], we may need to consider additional actions to resolve the matter.”

Include clear instructions on how the payment can be made, along with contact details for questions or clarifications. This removes any ambiguity and makes it easy for the recipient to act quickly.

End with a polite closing, thanking them for their attention and cooperation. Keep the tone professional yet courteous, like “We appreciate your prompt attention to this matter and look forward to your payment.”