Late fee letter template

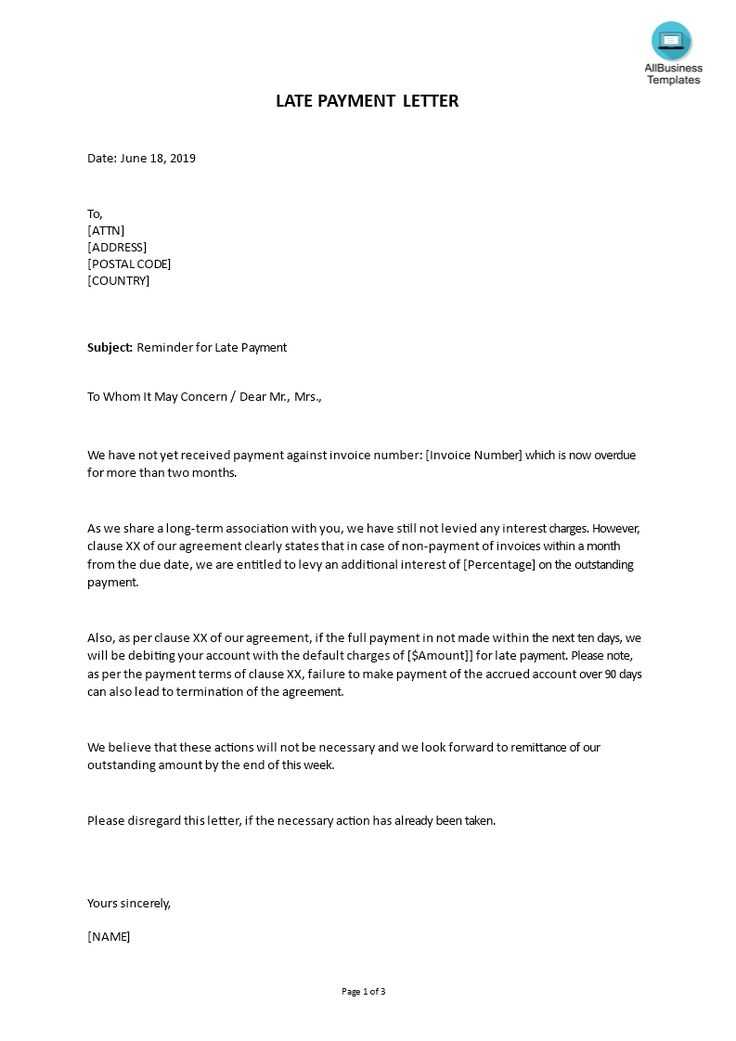

To ensure clarity and professionalism in your communication, always address late payments promptly with a clear and courteous letter. A well-crafted late fee letter helps maintain a positive relationship with clients while reinforcing the importance of timely payments.

Start by stating the exact amount owed and the due date. Make sure to include the specific late fee applied, if applicable, and a clear request for payment. The tone should be firm yet polite, encouraging the recipient to settle the outstanding amount without further delay.

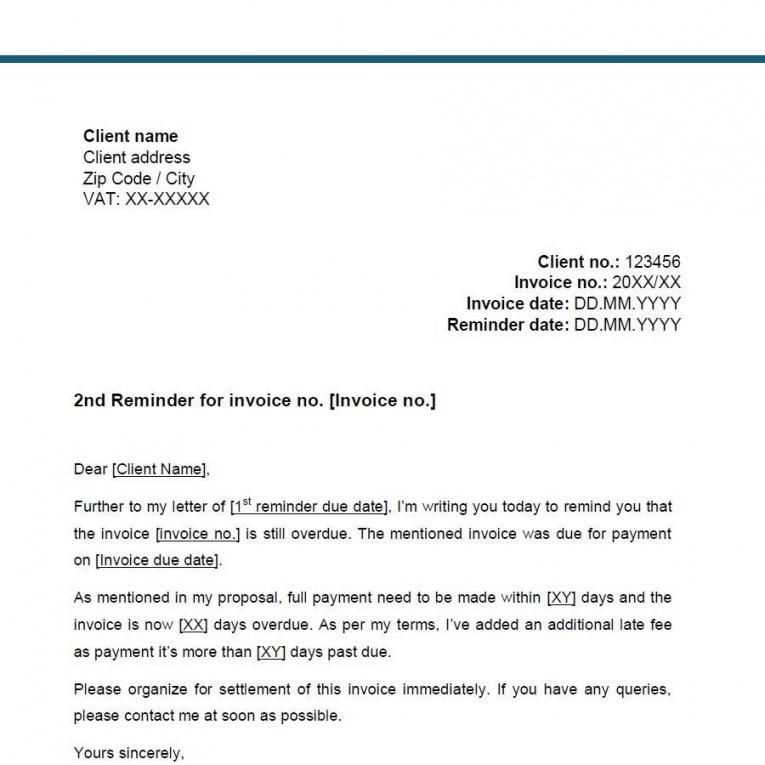

Here’s an example template to follow:

Dear [Client Name],

We hope this message finds you well. We are writing to kindly remind you that your payment for invoice [Invoice Number] was due on [Due Date]. As of today, your balance of [Amount] remains unpaid. According to our agreement, a late fee of [Late Fee Amount] has been applied, bringing the total balance to [New Amount].

We request that you make the payment by [New Due Date] to avoid any further complications. If you have already made this payment, please disregard this notice and let us know the payment details at your earliest convenience.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Contact Information]

Maintain professionalism and courtesy throughout your letter to ensure it serves as both a reminder and a prompt for action.

Late Fee Letter Template

Begin with a clear statement of the payment due date and the outstanding amount. Be firm but respectful in notifying the recipient of the late fee charge. Provide a breakdown of the fee, including the specific amount and the date it was applied. It’s helpful to remind the recipient of the payment terms stated in the agreement or contract. Conclude with an invitation for the recipient to contact you with any questions or to settle the payment promptly.

Example Structure

- Start with the subject line: “Late Payment Notification and Late Fee Applied”

- Address the recipient by name and acknowledge the payment delay.

- State the original due date and the unpaid amount.

- Clarify the late fee and the reason for the charge.

- Outline payment instructions and methods to resolve the issue.

- Invite the recipient to contact you for clarification or support.

- Thank the recipient for their attention to the matter.

Late Fee Details

The late fee should be a fixed amount or a percentage of the outstanding balance, depending on the agreement. Clearly state how this fee will increase if the payment remains unpaid. For example, you might say, “A $25 late fee has been added to your account for the overdue balance of $200. If payment is not received by [date], an additional fee of $15 will be charged.” This gives transparency and encourages swift action from the recipient.

Key Elements to Include in Your Letter

Begin by clearly stating the purpose of the letter. Identify the late payment, including the invoice number and the due date. This ensures the recipient understands the reason for the letter immediately.

Invoice Details

Provide specific details about the outstanding payment. Include the amount owed and a brief description of the service or product provided. This reinforces the point that the payment is overdue and highlights the reason for your request.

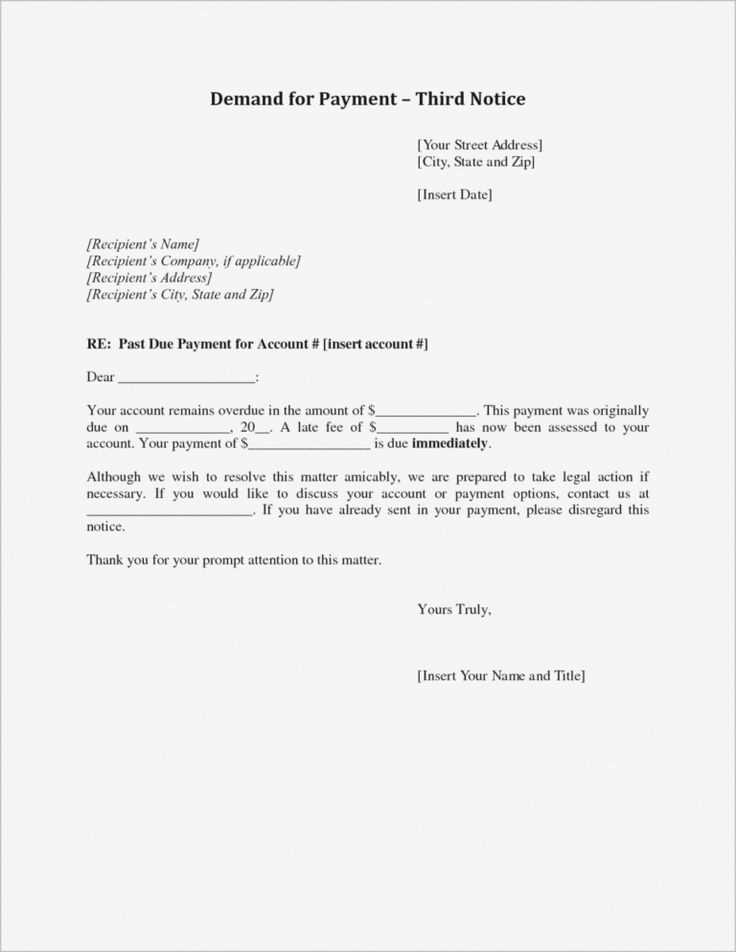

Consequences of Non-Payment

Be clear about what will happen if the payment is not received. Specify any late fees, penalties, or further actions you may take, such as suspending services or referring the matter to a collections agency. Be firm but respectful in your tone.

Payment Instructions

Include easy-to-follow payment instructions. Specify the preferred payment methods, due date for payment, and any contact information if the recipient has questions or issues regarding the payment process.

| Invoice Number | Amount Owed | Due Date |

|---|---|---|

| 12345 | $500 | 01/15/2025 |

Wrap up the letter with a polite request for prompt payment. Thank the recipient for their attention to this matter and express hope for resolving the issue without further delay.

How to Address the Recipient Politely

Begin your letter with a respectful salutation, using the recipient’s name if possible. This demonstrates a personal touch and establishes a courteous tone right from the start. If you are unsure of the recipient’s gender or title, opt for a neutral greeting like “Dear [Full Name]” to avoid assumptions.

Use Formal Language

Opt for formal language, especially if you do not know the recipient personally. Phrases like “I hope this message finds you well” or “I would like to kindly remind you” are polite and respectful ways to introduce the subject of the letter. Avoid using overly casual language that may seem disrespectful.

Show Appreciation

Express gratitude for the recipient’s time and attention, even when addressing a late payment. For instance, you might say, “I appreciate your prompt attention to this matter.” This adds a positive tone to the communication, showing that you value their cooperation.

Setting the Correct Tone in the Message

Keep the tone respectful, professional, and clear. While it’s important to convey the issue, ensure the language remains neutral and avoids sounding accusatory. Strive for a balance between firmness and politeness. Use concise and direct language without being confrontational.

Be Firm, Yet Polite

It’s essential to express the seriousness of the situation without sounding rude. Acknowledge the recipient’s previous interactions, and mention the overdue payment matter in a straightforward way. Avoid phrases that may come across as aggressive or condescending. Instead, politely emphasize the need for prompt attention to the issue.

Use Clear Deadlines

Provide a specific date for the overdue payment to avoid ambiguity. This ensures the recipient understands the urgency and gives them a clear expectation. Mentioning clear timelines conveys professionalism and prevents any misunderstandings.

- Avoid vague terms like “soon” or “at your earliest convenience.” Use specific dates instead.

- Consider offering flexible payment options if possible, without diminishing the message’s urgency.

Important Details to Mention About the Late Fee

Clearly specify the amount of the late fee in the letter. Be precise about the percentage or flat rate that will be applied to the overdue balance. Avoid ambiguity to ensure the recipient understands the financial consequences of their delay.

Due Date and Grace Period

State the exact due date for payment. If applicable, mention whether a grace period is provided before the late fee is charged. This helps the recipient manage expectations and ensures there is no confusion about when the fee will apply.

Calculation Method

Explain how the late fee is calculated. If it’s based on a percentage of the overdue amount, provide the rate. If it’s a fixed fee, make that clear. This transparency removes any potential misunderstandings.

How to State Payment Terms and Deadlines

Clearly define your payment expectations by specifying exact dates and methods. For instance, instead of saying “due in 30 days,” use “payment due by [specific date].” This provides certainty for both parties and minimizes misunderstandings.

Be Specific About Payment Methods

Outline which payment methods are acceptable. Whether it’s bank transfer, credit card, or another form, make sure to list it explicitly. Also, mention any required information, like account numbers or payment references, to avoid delays.

Late Payment Penalties

State the consequences of missing deadlines upfront. Include details on late fees, such as a fixed amount or percentage added to the total invoice after the due date passes. This encourages timely payments and sets clear expectations.

What to Do if Payment Is Not Received

If payment is not received by the due date, take the following steps to address the issue quickly and professionally:

Contact the Customer Directly

Reach out to the customer via email or phone to remind them about the overdue payment. Be polite but firm, providing clear details about the outstanding amount and the original due date. Ensure that your communication is professional and provides an opportunity for the customer to resolve the matter without feeling pressured.

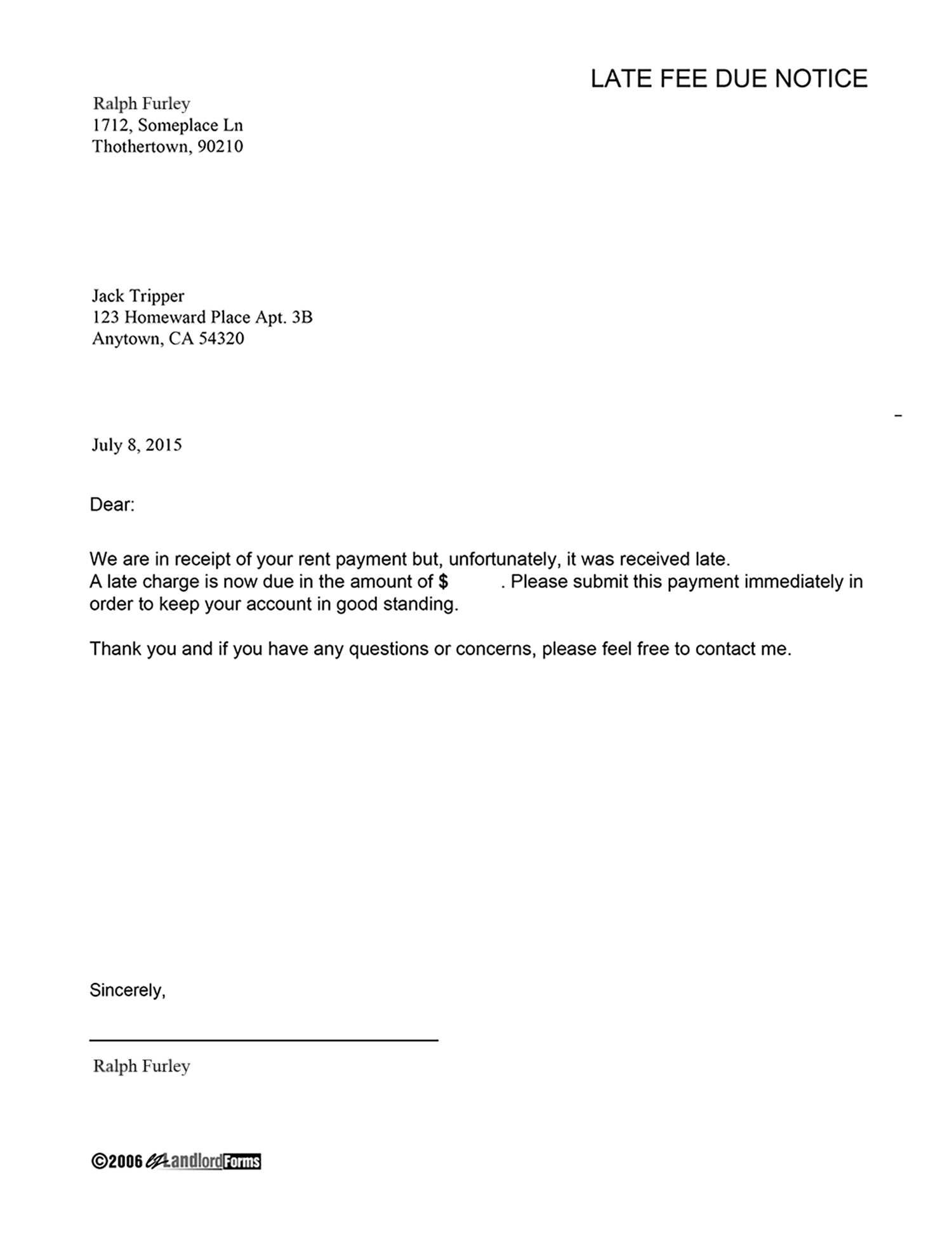

Send a Formal Late Fee Letter

If the payment still isn’t received, send a formal late fee letter outlining the overdue amount, any applicable late fees, and a new payment deadline. This letter should reference the terms agreed upon and specify the consequences if payment is not made by the new deadline, such as further fees or potential service suspension.

Taking these steps ensures that the issue is addressed respectfully while keeping the payment process on track.