Letter Before Action UK Template for Debt Recovery

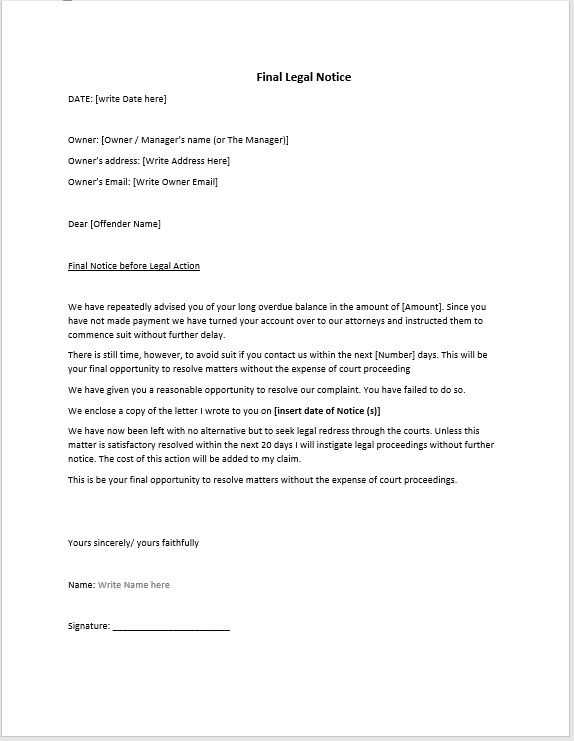

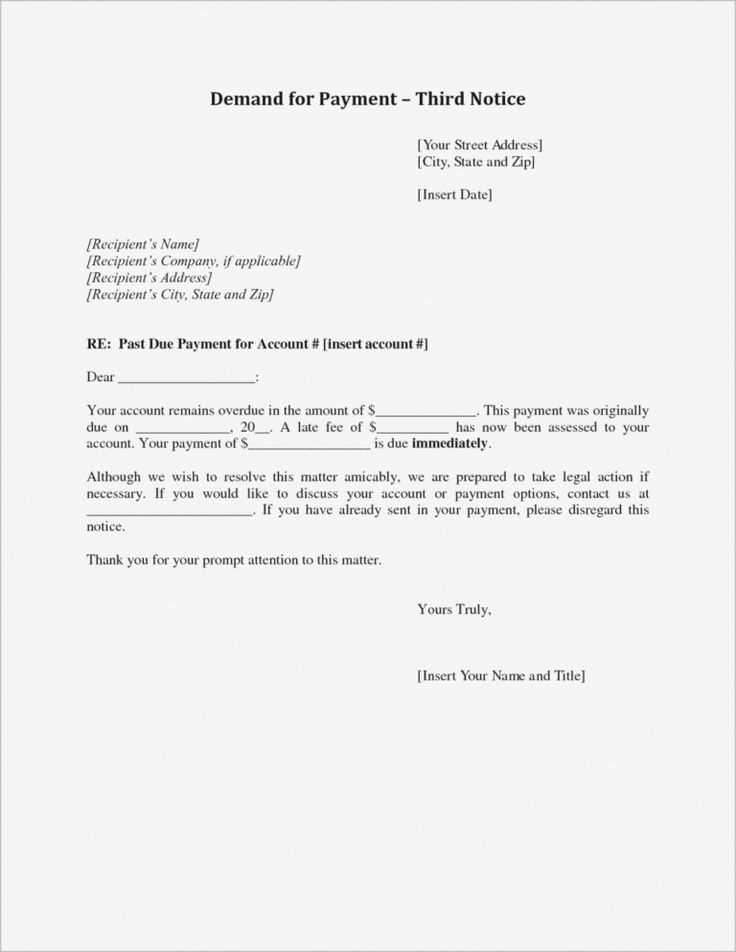

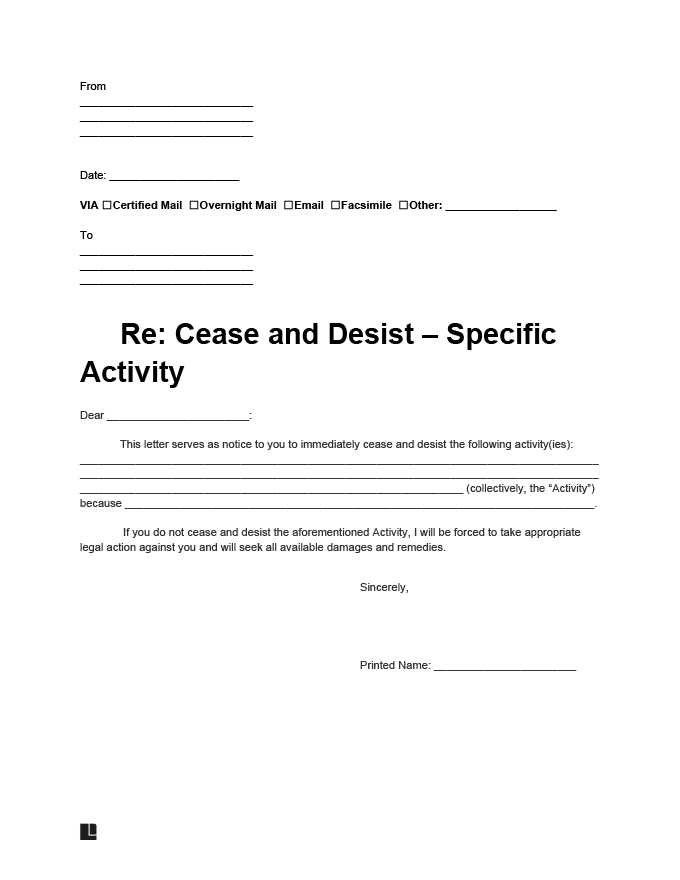

When pursuing a financial claim, it is crucial to formally notify the other party of the potential legal steps you might take. This communication serves as a warning that if the matter is not resolved within a specified period, legal proceedings may be initiated. Crafting such a document is vital for ensuring clarity and demonstrating that all reasonable efforts to settle the issue have been made before moving forward with a lawsuit.

Why is a Pre-Legal Notice Important?

This type of notice acts as a final reminder to the recipient of their outstanding obligation. It clearly outlines the amount owed, the timeline for payment, and the consequences if payment is not made. By sending this document, you provide the debtor with a clear understanding of the situation, offering them an opportunity to settle the issue without the need for court involvement.

Key Information to Include

- Amount Due: Clearly state the total amount owed, including any interest or additional fees that have accrued.

- Deadline for Payment: Set a specific date by which the payment should be made to avoid further legal action.

- Consequences: Briefly explain the potential legal actions that could follow if the matter remains unresolved.

- Contact Details: Provide clear instructions on how the recipient can contact you to discuss or settle the matter.

When to Send This Communication

It is essential to send this communication after exhausting all other avenues of resolving the dispute informally. If informal requests for payment have failed, sending the formal notice is often the next logical step before pursuing legal action. Typically, the notice should be sent after several reminders or follow-ups have been ignored.

What Happens If the Notice Is Ignored?

Should the recipient disregard the notice and fail to pay by the deadline, the next step is often to initiate court proceedings. Ignoring the communication can lead to legal consequences such as a court order to pay the amount owed, and in some cases, the recovery of additional costs associated with the lawsuit.

Benefits of Using a Formal Communication

Utilizing a formal pre-legal notice can significantly improve the likelihood of resolving a debt dispute without court intervention. It offers the debtor a chance to settle the issue promptly and avoid the complications and costs of legal proceedings.

Understanding Pre-Legal Notices and Their Role in Debt Collection

In the process of recovering an outstanding debt, a formal communication is often the first step before resorting to court proceedings. This document serves to inform the debtor of the legal actions that may follow if the issue is not resolved promptly. It is a crucial step in establishing a clear record of attempts to settle the matter amicably, offering the debtor one final chance to make payment or respond before further steps are taken.

The importance of sending a formal notice in debt recovery cannot be overstated. Not only does it provide a clear outline of the situation, but it also offers the debtor an opportunity to settle the matter before escalating the dispute legally. By notifying the individual of the potential consequences, you give them a fair chance to resolve the debt without involving the courts.

To create an effective pre-legal notice, it is important to include certain key elements. These include a clear statement of the amount owed, the deadline for payment, and a description of the legal steps that will follow if the payment is not made. The document should be straightforward and easy to understand, leaving no room for confusion about the terms and expectations.

Timing is essential when sending such a communication. It should typically be dispatched after informal reminders or attempts at resolution have been ignored. This ensures that the debtor is fully aware of the seriousness of the matter and understands that legal action is the next step if they do not comply.

Ignoring the formal notice can lead to serious consequences. If the debtor fails to pay or respond within the specified timeframe, the next step is often to take the matter to court. This could result in a formal ruling that obligates them to pay the debt, as well as additional costs associated with the legal process.