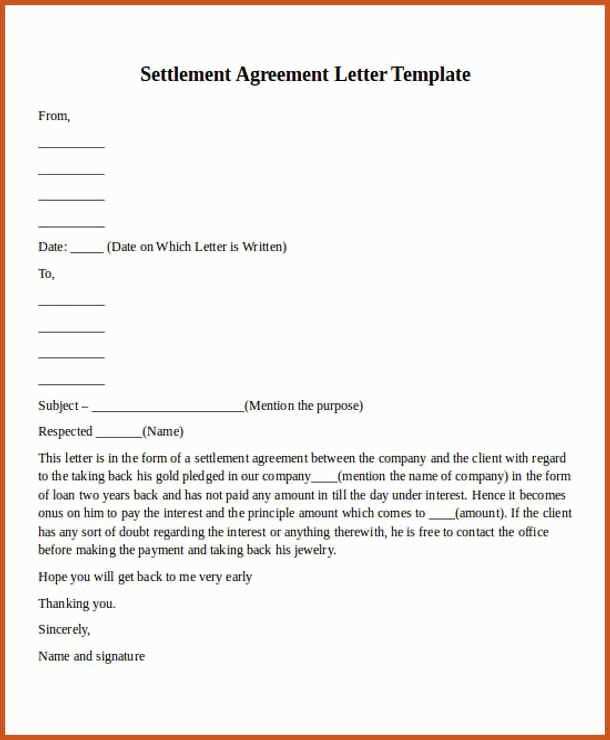

Letter of Agreement to Pay Template Guide

When parties enter into a financial arrangement, it is essential to formalize the terms of repayment. This ensures clarity and protection for both sides, outlining the responsibilities and deadlines involved. By creating a written record, individuals or businesses can prevent misunderstandings and potential disputes. A well-structured document helps establish trust and accountability between all involved.

Key Components to Include

To create an effective agreement, certain elements should always be present. These elements ensure both parties understand the expectations and obligations clearly.

- Amount Due: Specify the total sum involved in the transaction.

- Payment Schedule: Clearly state when payments are due and the frequency (e.g., weekly, monthly).

- Interest or Fees: Mention if there are any additional charges or interest rates applied to the debt.

- Consequences of Default: Outline what will happen if the agreed-upon terms are not met.

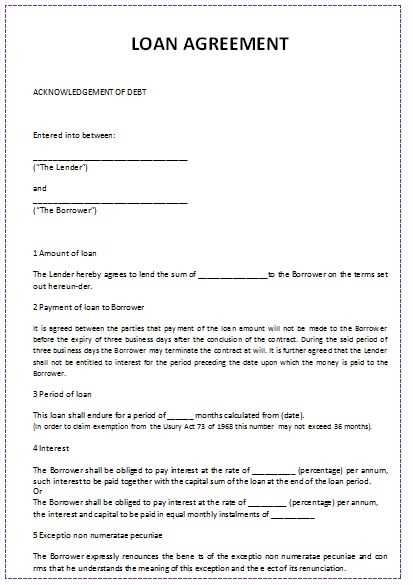

Customizing Your Document

Each situation is unique, so it’s important to tailor the document to suit your specific needs. Consider the following:

- Adjust payment amounts based on financial capability.

- Include provisions for extensions or modifications to the agreement, if necessary.

- Ensure that both parties’ rights and responsibilities are clearly defined.

Why This Document Is Crucial

By formalizing the payment process, the parties involved have a clear understanding of their duties, deadlines, and any consequences for failure to meet those responsibilities. It protects both individuals and organizations from legal challenges or disputes that may arise later. A well-documented agreement ensures transparency and fairness throughout the repayment process.

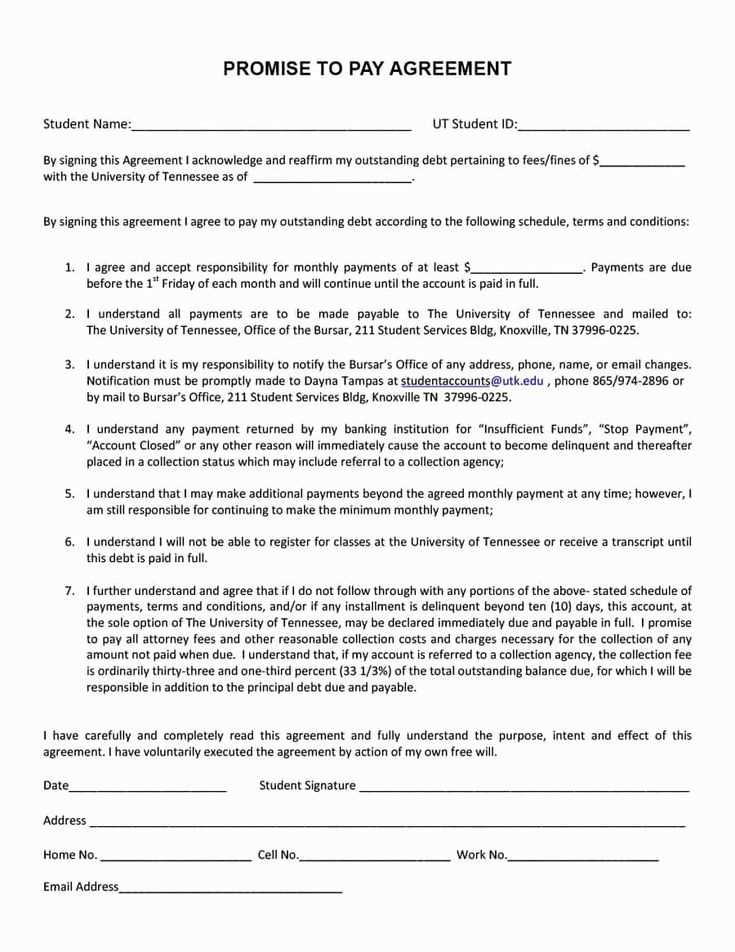

Understanding the Importance of a Financial Arrangement Document

Establishing clear terms for repayment between two parties is critical to maintaining trust and preventing future conflicts. By putting the conditions in writing, both sides can avoid misunderstandings and ensure that expectations are aligned. This type of document provides legal clarity and serves as a reference if disputes arise. It also formalizes the transaction and holds both parties accountable to their commitments.

Why This Document Is Necessary

Without a proper written record, both parties may have different interpretations of the terms. Having a well-defined document ensures that there is a mutual understanding of the payment structure, including amounts, deadlines, and any penalties for non-payment. This protects both parties legally and financially.

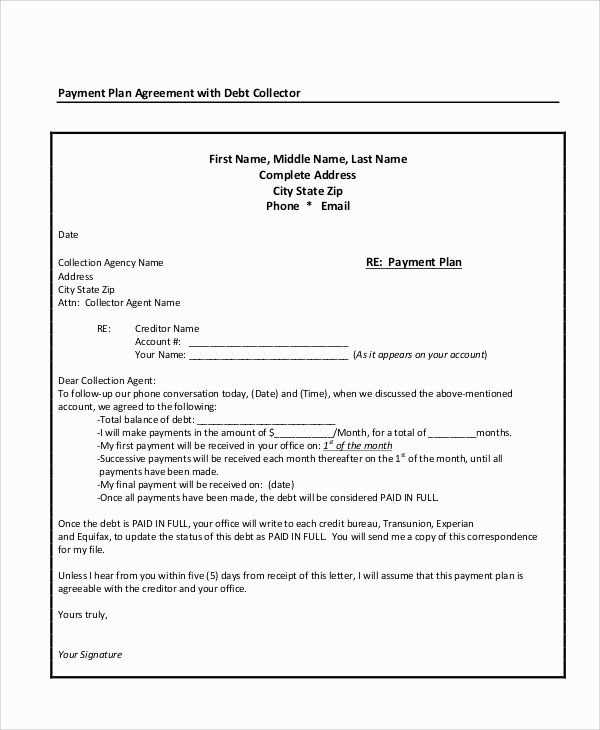

Key Aspects to Include

The essential details should include the amount to be paid, the due dates, and any interest or fees attached to the payment plan. Additionally, consequences for missed or late payments must be clearly outlined. It’s crucial to detail these terms in a manner that leaves no room for confusion.

Customizing the Document: Adjusting the details based on the specific situation, such as payment flexibility or changing circumstances, ensures the document works for both parties involved.

Common Mistakes: One common mistake is failing to clearly outline the payment schedule or not specifying what happens if a payment is missed. It’s essential to avoid ambiguity in these crucial aspects.

Legal Consequences

If the terms are not met, the document can serve as evidence in a legal dispute. It provides both sides with a clear record of their commitments and can help resolve issues through legal channels if necessary. Not adhering to the terms outlined in the document can lead to financial penalties or legal actions.

Using the Document Effectively: Once the terms are agreed upon, ensure that both parties keep a copy of the signed document and refer to it as needed. It can be an effective tool for managing expectations and guiding future transactions.