Letter of payment agreement template

When drafting a payment agreement, clarity is key. A well-structured letter helps both parties understand their responsibilities and avoids future disputes. Begin by outlining the terms of the payment, including amounts, due dates, and method of payment. This ensures that both the payer and the recipient are on the same page from the start.

Start with clear details. The agreement should specify the amount to be paid, the payment schedule, and any interest or late fees if applicable. Be specific about the due dates and payment methods, whether it’s a bank transfer, check, or cash.

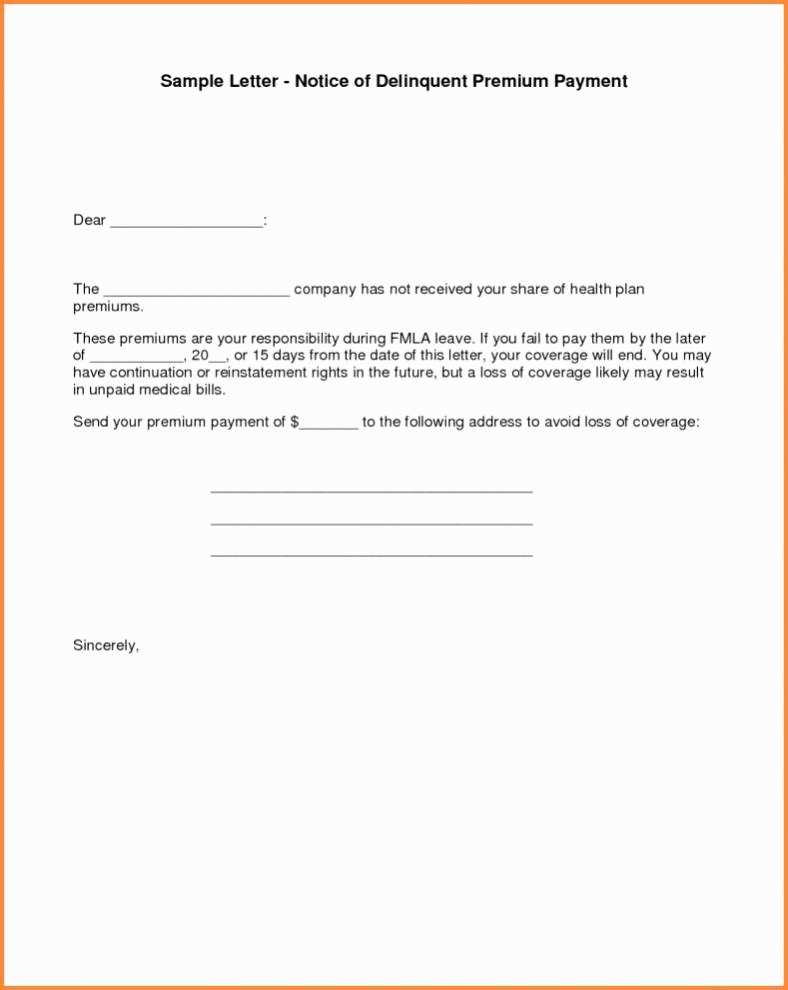

Address consequences of non-payment. It’s important to state what will happen if payments are missed or delayed. This could include penalties, additional fees, or legal actions. Make sure both parties agree to these terms before finalizing the document.

Lastly, include a section for signatures from both parties. This confirms that both individuals have read, understood, and agreed to the terms outlined in the letter. Keep a copy for your records and make sure the signed letter is delivered to both parties involved.

Here are the corrected lines without repetition:

Ensure clarity in your letter by focusing on precise wording. Avoid unnecessary repetition of terms that may confuse the reader.

- Specify the payment amount and due date clearly, without repeating phrases.

- Use consistent terminology for payment methods and delivery instructions, avoiding redundant statements.

- State the consequences of non-payment directly and concisely, keeping the focus on terms, not on over-explanation.

- Indicate the agreed payment schedule, if applicable, in a simple, straightforward manner.

- Clarify any fees or penalties without revisiting the same conditions repeatedly throughout the letter.

By eliminating redundancy, you ensure a professional and clear agreement that is easy to understand and legally sound.

- Letter of Payment Agreement Template

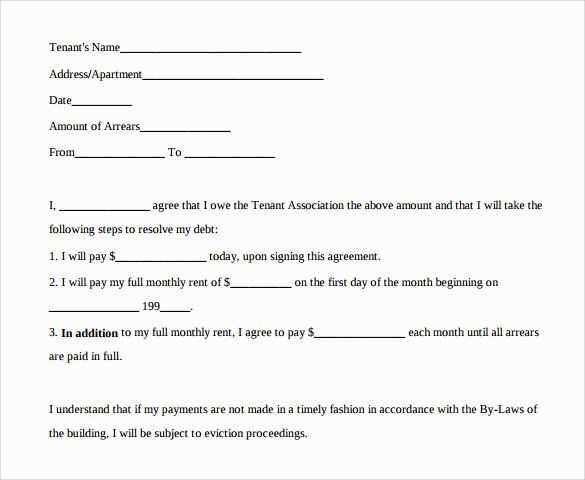

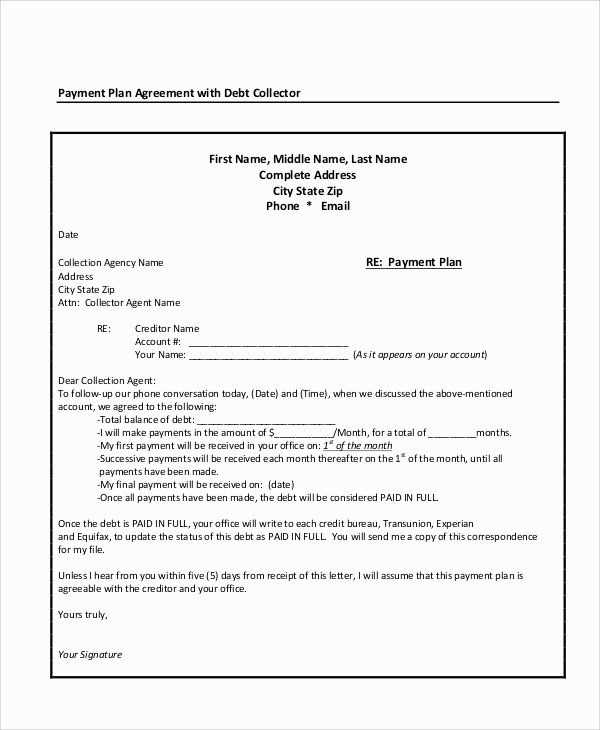

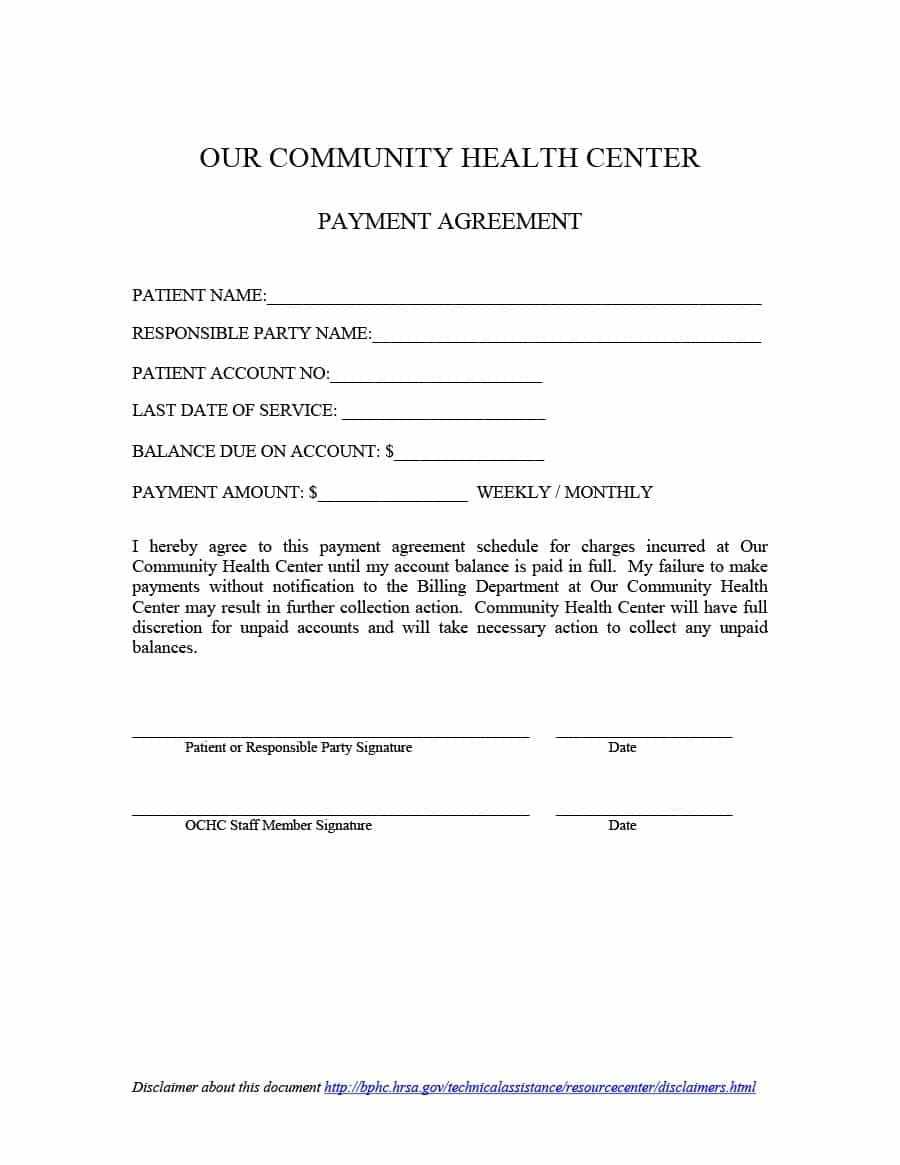

A payment agreement letter should clearly outline the terms between parties involved. Start with the full names and addresses of both the debtor and the creditor. Ensure to state the total amount owed and the agreed-upon payment schedule, including due dates and amounts for each installment.

- Specify the payment method: whether it’s bank transfer, check, or any other form.

- Detail any interest rates, penalties for late payments, or other fees applicable.

- Include the date of the agreement and a statement that both parties understand the terms.

For clarity, add a clause that acknowledges the debtor’s ability to make changes in the payment schedule, should any unforeseen circumstances arise, while still ensuring the creditor’s rights are protected.

- Conclude with a section for signatures of both parties and the date, confirming mutual agreement.

- Consider adding a clause for legal jurisdiction in case of disputes.

Clearly state the total amount owed. This should be the exact figure agreed upon, without ambiguity. Specify the payment due date or a clear schedule for installment payments. Include any interest charges or late fees if applicable.

List all payment methods available, such as bank transfers, credit cards, or checks. Define the payee’s full name and contact details to avoid confusion during the transaction process.

Outline the consequences of failing to meet payment terms, including any legal actions or additional fees that may apply. Make sure both parties understand these conditions to prevent future disputes.

Ensure both parties sign the agreement to confirm acceptance of the terms. Include a space for signatures, along with the date of signing. This solidifies the agreement and provides proof if needed later on.

State clear deadlines for payments. Use specific dates and avoid vague terms like “soon” or “when convenient.” For example, specify the payment due on the 15th of each month or 30 days after invoice receipt. This clarity prevents misunderstandings and ensures both parties are aligned on timing.

Specify Payment Methods and Conditions

Clearly outline the accepted methods of payment, such as bank transfers, credit card payments, or checks. Include any conditions, like payment fees or discounts for early payments. This information ensures there are no surprises for either party regarding transaction methods.

Set Consequences for Late Payments

Include penalties for late payments, such as interest charges or suspension of services. Specify the rate, such as “1.5% per month,” and clarify when this penalty will apply. Setting consequences helps reinforce the importance of timely payments and encourages adherence to the terms.

| Payment Term | Description |

|---|---|

| Due Date | Specific date when payment is due (e.g., 15th of the month). |

| Accepted Methods | Bank transfer, credit card, check, or other agreed methods. |

| Late Payment Penalty | Penalties for overdue payments, such as 1.5% interest per month. |

Clearly outline the consequences in your payment agreement. Specify any late fees, interest charges, or penalties that apply if the payment is delayed. Ensure these terms are reasonable and comply with local regulations to avoid legal issues.

Late Fees and Interest

Include a specific late fee or interest rate for overdue payments. Set a fixed percentage or amount that will be added to the outstanding balance after a specified number of days past the due date. Clearly state how this will be calculated and when it will be applied.

Legal Action

State that failure to pay may result in legal action, such as collections or litigation. Specify the process for pursuing this action, including who will cover legal costs if the matter goes to court.

Communicate that these consequences are in place to encourage timely payments while maintaining a fair and transparent agreement between all parties involved.

Clearly outline the total amount due, specifying the breakdown of payments. Set a realistic schedule that includes the number of payments, their amounts, and the due dates. Be specific about payment methods and how each installment will be processed.

Specify Terms for Late Payments

Include penalties or interest fees for missed payments to encourage timely compliance. State the consequences for continuous delays, such as potential legal action or termination of the agreement. Ensure both parties understand these terms.

Define Rights and Responsibilities

Make it clear who is responsible for what under the agreement. This includes payment duties, the delivery of goods or services, and any other obligations. Outline how any disputes will be resolved, whether through mediation, arbitration, or legal means.

To ensure the legal validity of a payment agreement, make sure all necessary elements are included and properly executed. This includes clear terms, signatures, and compliance with local laws. Below are the key steps to follow:

1. Clear and Unambiguous Terms

- Specify the amount to be paid, the payment method, and the deadlines.

- Ensure the terms of the agreement are understandable to both parties, avoiding complex legal jargon.

- Include any penalties for late payments or failure to fulfill obligations.

2. Proper Signatures

- Both parties must sign the agreement for it to be legally binding.

- Consider having the signatures witnessed or notarized for added validity, especially for large sums.

- Ensure that the parties involved have the legal capacity to enter into the agreement (e.g., age, mental capacity).

3. Compliance with Local Laws

- Review local regulations to ensure the agreement is enforceable in your jurisdiction.

- Verify that the agreement does not violate any laws regarding interest rates, debt collection, or consumer protection.

- Consult a legal professional to confirm that the terms comply with the applicable legal framework.

Always read the agreement thoroughly before signing. Look for any discrepancies between the terms you’ve discussed and what’s written. Pay special attention to payment terms, deadlines, and any penalties for missed payments.

Check for clarity in all sections. If any part of the document is unclear or ambiguous, ask for clarification before proceeding. This ensures both parties are aligned on expectations.

Verify all contact details and other personal information to avoid errors. If any of this information is wrong, request amendments before you sign.

Ensure that both parties’ signatures are clearly indicated and that the document includes a date for when it is being signed. Both parties should retain a signed copy for their records.

| Section to Review | Action |

|---|---|

| Payment Terms | Verify due dates and payment amounts. |

| Penalties | Ensure penalties for non-payment are clearly defined. |

| Signatures | Check that both parties sign and date the document. |

| Personal Information | Confirm all details are accurate. |

Consult with a legal advisor if necessary. This can prevent misunderstandings and legal issues down the line.

Ensure that your payment agreement letter clearly outlines the payment terms. Include the total amount due, the payment method, and the deadline for full settlement. Specify any late fees or interest charges for overdue payments to avoid misunderstandings later on.

Be specific when defining the payment schedule. If payments are to be made in installments, list the amounts and due dates for each. If a lump sum is required, indicate the exact date the full payment is expected.

State consequences for non-payment. Clearly mention what actions will be taken if payments are not made as agreed. This might include legal actions or termination of the agreement.

Include signatures at the end of the agreement. Both parties should sign the letter to confirm their understanding and acceptance of the terms. Consider having a witness or notary present to validate the document if necessary.