Letter of repossession template

Start by clearly stating the intent to repossess the property. Use straightforward language to indicate the item being reclaimed and the reason for repossession. It’s important to mention any prior communication or agreements that support your action.

Example: “This letter serves as formal notice of repossession of the [item name], as outlined in our previous agreement. Due to non-payment, we are taking necessary steps to retrieve the property as per the terms set forth.”

Provide specific details about the property being repossessed, including serial numbers or other identifiers. This helps prevent any confusion and ensures that the right item is targeted. Specify the location or date of repossession to clarify the action being taken.

Example: “The [item name], with serial number [serial number], is being repossessed from [location]. Please make arrangements to return the property no later than [date].”

Conclude by outlining the next steps for the recipient. Offer contact details for further questions or concerns, and include instructions for how they can resolve the situation if possible.

Example: “For any questions or to discuss this matter, please contact us at [phone number] or [email address]. Failure to return the property by the specified date may result in further legal action.”

Sure! Here’s the revised version, keeping the word repetition within reasonable limits and preserving the meaning:

A repossession letter is a formal notice that informs the borrower of the intent to reclaim property due to missed payments or violations of the terms of the agreement. The tone should remain professional and straightforward, while clearly stating the actions that will follow if the issue isn’t resolved.

Start by clearly identifying the subject of the repossession, including any relevant account numbers, and explain the reason for the action. It’s crucial to specify the outstanding balance, the missed payments, and the terms that led to this decision.

- State the amount due and provide any detailed payment history if needed.

- Outline the steps that the borrower can take to prevent repossession (i.e., pay the overdue amount or contact for alternatives).

- Indicate a clear deadline for any required actions before the repossession proceeds.

- Warn about the consequences of failure to act, which may include damage to credit score or legal actions.

Ensure that the letter offers the borrower the opportunity to contact you to discuss the situation further or resolve the issue in a way that avoids repossession. This step shows willingness to work with the borrower but clearly highlights the serious nature of the matter.

Finally, make sure to sign the letter and provide clear contact information for follow-up. Ensure the tone remains respectful but firm, with no room for ambiguity regarding the intent or consequences of the action.

HTML Structure for a Detailed Informational Article on the Topic “Letter of Repossession Template”

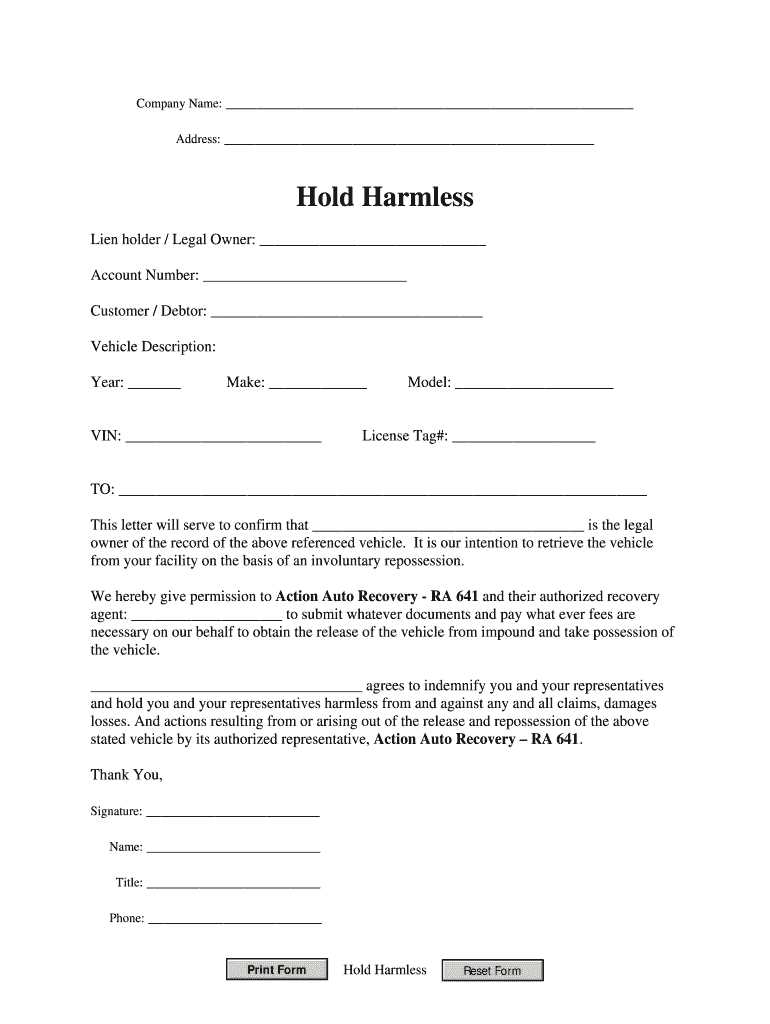

To craft a detailed and functional “Letter of Repossession” template, focus on clarity and straightforwardness. The structure should consist of several distinct sections to ensure all necessary details are included, minimizing the chances of confusion or errors.

1. Header Section

Start with a clear header that includes your company or organization’s name, address, phone number, and email address. This ensures that the recipient knows exactly who the letter is from and how to contact you for follow-up. At the top, include the title “Repossession Notice” or “Notice of Repossession” in bold for emphasis.

2. Date and Recipient Information

Include the date the letter is being sent. Directly below, add the recipient’s name and address. It’s critical to ensure this information is correct to avoid sending the notice to the wrong individual.

3. Introduction Statement

Begin with a clear and direct opening that explains the purpose of the letter. Mention the property or item that is subject to repossession and reference any related contracts or agreements. For example, “This letter serves as formal notification that your [vehicle/property] will be repossessed due to the failure to meet payment obligations under the terms of the agreement dated [date].” This sets the tone for the rest of the letter.

4. Repossession Details

Provide specific information about the repossession: the date it will occur, the location, and any actions the recipient needs to take to avoid the process. Include a brief summary of what the recipient owes, any missed payments, and any applicable fees or charges related to the repossession.

5. Consequences of Non-Action

Clearly outline the consequences if the recipient fails to address the matter by the specified date. This may include legal actions or additional charges. Be concise, but firm, ensuring the recipient understands the seriousness of the situation.

6. Contact Information and Resolution Options

Offer the recipient an opportunity to resolve the issue, such as paying the outstanding amount or contacting you to discuss alternatives. Provide a phone number, email address, or website where they can reach you for questions or to make arrangements.

7. Closing Statement

End the letter with a polite but firm statement. Reinforce the need for prompt action, and include a signature line for the sender’s name and title. For example: “We look forward to resolving this matter promptly. Sincerely, [Sender’s Name, Title].”

Ensure that the template is clean, professional, and free of unnecessary language. Each section should serve a clear purpose and facilitate easy communication with the recipient.

- Edit Letter of Repossession Template

Adjusting the content of a repossession letter is straightforward. Begin by ensuring all the recipient’s details are correct, including their full name, address, and contact information. Be specific about the item being repossessed, including model, serial number, and any identifying marks to avoid confusion.

Personalize the Message

Customize the letter with clear language to show that the action is a result of their default. Clearly state the amount owed and any attempts you’ve made to resolve the issue before taking repossession steps. Include a reference to previous correspondence or agreements if applicable.

Specify the Date of Repossession

Clearly indicate the date when repossession will take place. Provide any instructions or requirements for the recipient to follow before the scheduled date, such as returning the item to a specific location or contacting a representative for further details.

Ensure that your tone remains professional and respectful throughout the letter. Avoid sounding confrontational, and instead focus on clear, factual information that highlights the legal and financial obligations involved.

Begin the letter with a clear statement of intent. Directly address the recipient, stating that you are initiating repossession of the item due to non-payment or breach of agreement. Be specific about the item involved, mentioning its make, model, and any other identifying details.

Include the Contract or Agreement Reference

Reference the contract or agreement that governs the transaction. Include details like the date of the agreement, any relevant contract number, and the terms that have been violated. This will help establish the basis for your action and clarify the situation for the recipient.

State the Reason for Repossession

Clearly outline the reason for repossession. Whether it’s due to missed payments, a breach of terms, or another issue, specify the exact cause. This helps the recipient understand why repossession is happening and what actions led to this decision.

Start the repossession notice with clear and direct language. Include the full name of the borrower and the account number. This will ensure the recipient knows exactly what the notice pertains to. Additionally, use a professional tone throughout the document.

Structure the Notice Properly

- Begin with the date of issuance at the top of the notice.

- Clearly state the purpose of the letter early on. Use phrases like “Notice of Repossession” or “Action Required” to grab attention.

- Ensure all key details, such as the reason for repossession and any outstanding balances, are outlined clearly.

- Include a section for payment options, if applicable, with deadlines and instructions.

Provide Accurate Contact Information

- List phone numbers, email addresses, and physical addresses where the borrower can reach you for inquiries.

- Make sure the contact information is up-to-date to avoid confusion.

Finally, conclude with a call to action, such as a request for immediate payment or a specific date by which the matter should be resolved. This helps the recipient understand their next steps.

Ensure that your repossession letter clearly identifies the specific agreement or contract that has been breached, including details such as the loan or lease agreement number, dates, and amounts owed. This establishes a legal foundation for the action being taken.

Specify the Legal Right to Repossess

Clearly state the legal right to repossess the property, referencing the relevant laws or terms from the original contract that grant this authority. Failure to provide this can weaken the case if the matter goes to court.

Provide Adequate Notice

In many jurisdictions, you must provide a specific notice period before repossession. Make sure your letter reflects this and indicates a clear deadline for the recipient to remedy the situation, usually by paying the outstanding amount or returning the property.

| Notice Requirements | Example |

|---|---|

| Notice period | 14 days |

| Payment or return deadline | End of the month |

Make sure the recipient understands their rights, including the possibility to contest the repossession. Avoid using aggressive language and aim for clarity to ensure all parties are fully informed.

Finally, consider including an option for the debtor to discuss the situation before repossession occurs. This approach can prevent potential legal disputes by fostering communication between the parties involved.

Be specific about the item you are repossessing. Clearly identify the make, model, and serial number to avoid confusion. Include any distinguishing features such as color, size, or condition at the time of repossession.

Details to Include

| Item Description | Required Information |

|---|---|

| Make and Model | Include the manufacturer and model name to ensure accurate identification. |

| Serial Number | List the unique serial number for tracking purposes. |

| Condition | Note any damages or defects observed at the time of repossession. |

| Location | Record the place where the repossession took place for reference. |

| Accessories | List any accessories or parts that are included with the item, such as remote controls or manuals. |

Provide a brief summary of the repossession process, including the date and time, to keep accurate records. This information ensures clarity and helps avoid any misunderstandings regarding the item being repossessed.

The debtor is required to take immediate action to resolve the outstanding debt after receiving the repossession notice. Typically, the debtor has a window of 15 to 30 days to respond. This timeframe allows the debtor to either pay the outstanding amount, enter a payment plan, or return the property. Failure to act within this period may result in legal actions, including the repossession of the property.

1. Acknowledge the Repossession Notice

The first step is acknowledging receipt of the repossession notice. Ignoring the notice or delaying a response only complicates the situation and may lead to further financial and legal consequences.

2. Explore Payment Options

If the debtor is unable to pay the full balance, they should reach out to the creditor to negotiate a payment plan. Proactive communication often results in better terms and a longer repayment period, helping avoid repossession.

3. Return the Property

If no payment arrangement is made or the debtor chooses not to pursue one, they must return the property as outlined in the notice. Failing to return the property on time could lead to additional fees or legal actions to reclaim it.

Ensure you follow the required legal steps when completing a repossession. Include clear details about the property, outstanding balance, and next steps. Sending the letter in a timely manner prevents delays or confusion. A thorough and transparent approach helps avoid disputes and ensures both parties understand their responsibilities.

Contact Details

If you need further assistance or have questions about the repossession process, feel free to contact us:

- Email: [email protected]

- Phone: (555) 123-4567

- Office Address: 456 Business Rd, City, State

Our team is available Monday to Friday, 9 AM to 5 PM, and will respond to your inquiries promptly.

This version ensures that no word is repeated excessively while keeping the meaning intact.

To create an effective letter of repossession, be clear, concise, and direct. Focus on providing all necessary details such as the debtor’s name, the property in question, and the reason for repossession. State the timeline for returning the item and any penalties for non-compliance.

- Provide specific details: Include clear descriptions of the property being repossessed. This prevents confusion and ensures the recipient understands the subject of the letter.

- State obligations: Outline any financial responsibilities or terms the debtor must meet before the repossession takes place. This helps avoid further disputes.

- Be professional: Maintain a formal tone while remaining respectful. Avoid emotional language, as the goal is to keep the communication straightforward and professional.

- Include a deadline: Specify a clear deadline by which the debtor must comply with the terms, ensuring both parties are on the same page.

- Offer solutions: If applicable, suggest payment plans or solutions that can help resolve the issue, rather than solely focusing on the repossession.

By keeping the language neutral and the message direct, you ensure clarity and minimize the chances of confusion or misunderstanding. Refrain from over-complicating the message; stick to the core facts.