Letter of self insurance explanation of no insurance template

When creating a letter to explain a lack of insurance coverage, it’s important to be clear and concise. Start by stating the reason why insurance is not in place. This could be due to a personal decision, a specific situation, or an exemption based on circumstances. Make sure to mention any relevant legal or financial reasons behind this choice.

Include details that help the recipient understand the context, such as the nature of your business or personal situation, and why this choice is temporary or permanent. If applicable, provide supporting documentation or references to clarify the situation. If the letter is required for legal purposes or to satisfy a contractual obligation, be sure to acknowledge any responsibilities or commitments that remain, despite the lack of coverage.

Finally, conclude with a willingness to discuss further if needed. Offer contact information for follow-up and ensure the tone is professional, yet accommodating. Keep the explanation direct and free of unnecessary details to maintain clarity and focus on the matter at hand.

Sure! Here’s the revised version with minimized repetition:

When writing a letter explaining your lack of insurance, be clear and direct. Begin by stating that you do not currently have insurance coverage and the reasons behind it. If the lack of insurance is due to a specific situation, such as personal financial constraints or other temporary factors, outline these clearly and factually. Keep the tone professional yet understanding.

Provide Supporting Information

Include any relevant documents or information that can clarify your situation, like proof of employment status, financial statements, or communications with insurers. Offering this will help contextualize your explanation and avoid unnecessary complications.

Offer Next Steps

End the letter by explaining your plans for acquiring coverage in the future. If you are actively seeking insurance, briefly mention the steps you are taking, such as comparing different policies or consulting with agents. This assures the recipient that you are addressing the matter responsibly.

- Letter of Self-Insurance Explanation Template

To create a clear and concise self-insurance explanation letter, structure it in a way that directly addresses the key points, while being straightforward and transparent. Here is a simple template to guide you:

1. Start with Your Details

Begin by stating your name, position, and the name of your company or organization. Include the address and any other relevant identifying information, such as your policy number if applicable.

2. Explain the Reason for Self-Insurance

In the next section, provide a brief explanation of why self-insurance is being used in place of traditional insurance. This may include reasons like financial strength, risk management preferences, or regulatory compliance.

3. State Coverage Information

Clarify the specific risks and assets covered under the self-insurance program. Be specific about what is included and what is not, detailing the scope of coverage to avoid confusion.

4. Mention the Financial Security Measures

Outline the financial provisions or reserves set aside to ensure that any claims or liabilities can be met. This could include a reference to the funds or assets earmarked for self-insurance purposes.

5. Provide Supporting Documentation

End the letter by referencing any supporting documents, such as financial statements, risk assessments, or legal documents, that back up your self-insurance program.

A self-insurance letter serves to confirm that an individual or company is not relying on external insurance providers for coverage but is instead self-insuring. This letter is commonly used for specific circumstances, such as legal requirements or when requesting exemptions from standard insurance policies.

Key Functions of the Self-Insurance Letter

The primary purpose of a self-insurance letter is to inform relevant parties–such as clients, vendors, or regulatory bodies–that the entity has the financial capacity and risk management strategies to cover potential losses independently. This is particularly useful in industries where self-insurance is allowed or preferred over traditional insurance policies.

When Is It Required?

A self-insurance letter is often required in situations where a business is operating in an area that typically mandates insurance coverage, but the company prefers to handle risks internally. It can also be used when requesting contracts or bids that require proof of insurance coverage but instead of presenting a traditional policy, the company confirms its self-insurance status.

| Purpose | Description |

|---|---|

| Legal Requirement | To fulfill regulatory requirements where insurance coverage is mandatory, but the entity is self-insured. |

| Contractual Obligations | To demonstrate to clients or vendors that the entity is sufficiently covered without external insurance. |

| Exemption Requests | To request exemptions from certain insurance-related policies or mandates. |

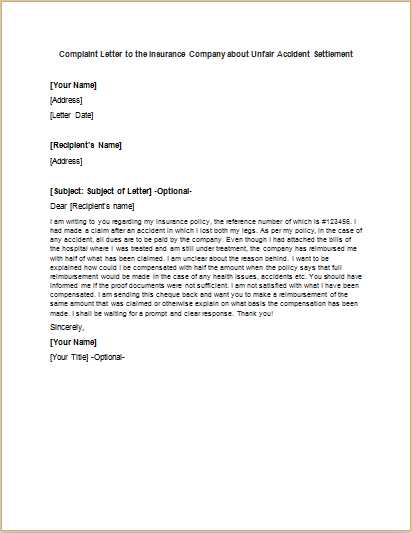

Begin by clearly stating that the letter serves to explain the lack of insurance coverage and outlines the self-insurance arrangements in place. It should include specific details about the type of coverage being self-provided, whether it is for property, liability, or another form of risk management.

Identification Information

Include the name and contact details of the individual or organization providing the self-insurance, including any legal business name if applicable. Add the relevant policy numbers or self-insurance account numbers, if any, for easy identification.

Coverage Details

Explain the specific risks or liabilities covered under the self-insurance plan. This section should outline the monetary limits, deductibles, and terms of coverage. Specify whether the self-insured party is covering the full risk or a portion of it, and clarify the financial capacity to handle potential claims.

| Coverage Type | Limit | Deductible |

|---|---|---|

| Property Damage | $500,000 | $1,000 |

| Liability Coverage | $1,000,000 | $5,000 |

Ensure the letter confirms the financial responsibility and any backup financial resources available to cover large claims, such as reserve funds or access to additional financing if needed.

Begin by clearly stating that you are self-insured. Specify the nature of the coverage and why you have chosen this route. Provide details on the type of risks or incidents covered by your self-insurance, and include any relevant financial or legal frameworks supporting your decision. Highlight the benefits of this approach in your particular case, such as cost savings or flexibility in managing risk.

Next, include specifics on the financial resources available to handle potential claims. This can be in the form of a self-insurance fund, reserves, or other financial backing that ensures you can cover any liabilities that may arise. Reference any relevant documentation, like financial statements or legal agreements, to verify the adequacy of your funds.

Ensure the explanation addresses any legal requirements or industry standards that apply to your self-insurance policy. Include references to any regulatory bodies or guidelines that support your self-insured status. Finally, mention any ongoing risk management practices you use to minimize the likelihood of claims and demonstrate proactive risk mitigation.

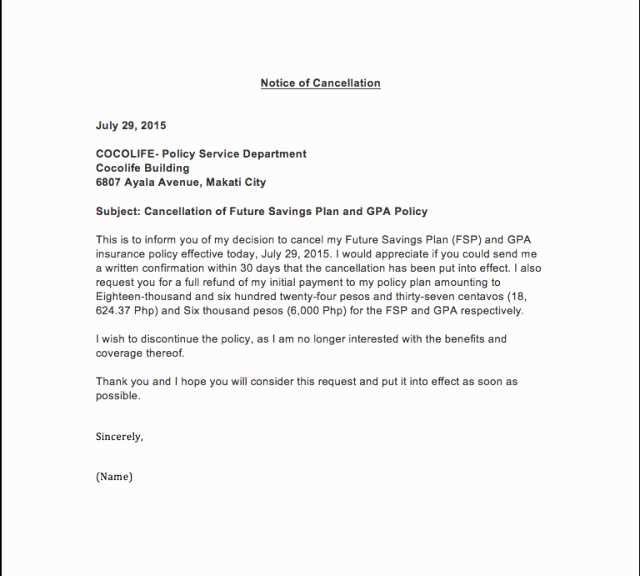

When drafting a no insurance letter, be clear and concise. Avoid vague statements like “I have no insurance” without further explanation. Always specify the reason, whether it’s due to a lack of coverage, a lapse, or an intentional choice to not carry insurance at this time.

Another mistake is neglecting to include relevant dates. It’s important to mention the period during which you were uninsured or the specific date your coverage ended. Without this, the recipient may not have enough context to assess your situation accurately.

Don’t forget to review the requirements of the entity requesting the letter. Some might ask for supporting documentation or a specific format. Failing to follow these instructions could delay processing or lead to rejection.

Be cautious with tone. A no insurance letter should be professional and factual. Avoid making excuses or being defensive. Stick to the facts and keep the tone neutral to prevent any misunderstanding or negative impressions.

Lastly, leaving out contact information or an offer for further clarification can be a major oversight. Include your phone number or email, so the recipient can easily reach out if needed.

Use a self-insurance explanation when you need to clarify your coverage status to an organization, such as a government agency, a lender, or a business partner. This type of explanation is particularly important when the entity requires proof of financial responsibility but you do not carry traditional insurance policies.

- When submitting documentation for contracts that request proof of insurance but you self-insure.

- When applying for permits or licenses that require verification of coverage, but you opt to manage risks internally.

- If a third party requests evidence of coverage, and you want to explain why you do not have standard insurance policies in place.

- For legal or regulatory purposes where providing a self-insurance option meets the necessary requirements.

- When negotiating with suppliers or business partners to clarify your method of risk management, especially if insurance is typically expected.

Providing a clear explanation helps prevent misunderstandings and shows your approach to managing financial risk. Ensure that the document specifies the scope, amount, and reasons for choosing self-insurance over traditional options.

To create a self-insurance explanation letter, focus on clarity and conciseness. Use the following steps to structure your letter effectively:

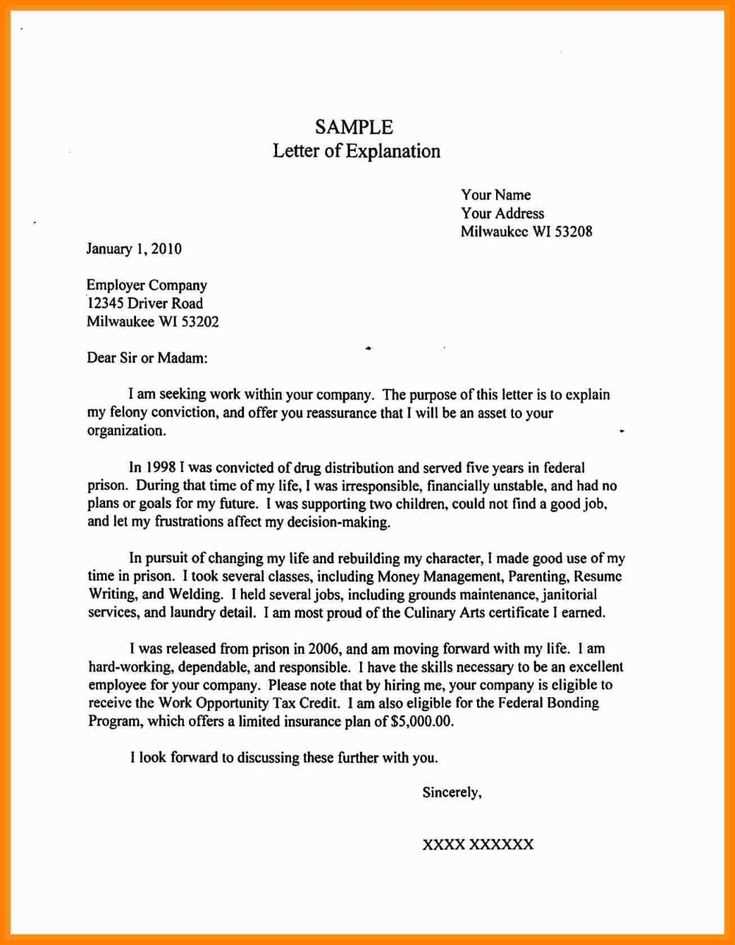

- Introduction: Clearly state the purpose of the letter, mentioning that you are explaining the absence of insurance coverage and why it does not apply to your situation.

- Details of Coverage: Specify any relevant details about the situation that would explain the lack of insurance, such as alternative coverage or self-insurance options.

- Legal Reference: If applicable, cite relevant laws, policies, or contractual terms that apply to your situation, supporting your claim of self-insurance.

- Conclusion: Summarize your main points, reaffirm the absence of traditional insurance, and express readiness to provide further clarification if needed.

Here’s a template you can use:

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient Name] [Recipient Title] [Company Name] [Company Address] [City, State, Zip Code] Dear [Recipient Name], I am writing to explain that I currently do not have insurance coverage under the typical policies. [Include your reason, such as alternative coverage or self-insurance arrangements.] According to [relevant law or policy], I am not required to maintain standard insurance coverage because [explanation]. I trust this clears up any confusion. If you require additional documentation or clarification, feel free to contact me. Sincerely, [Your Name]

Ensure that your template is tailored to your specific situation by adjusting the details as needed.

Clearly state in your letter that you do not have any insurance coverage. Begin with a concise statement outlining the reason for this, whether due to personal choice, cost, or any other factor. Include dates for clarity, particularly if it concerns a specific period. Mention any efforts you made to obtain coverage, if applicable, to demonstrate responsibility.

Provide Supporting Documents

Attach any relevant documents that support your claims, such as previous insurance cancellation notices or correspondence with insurance providers. This can add credibility to your explanation and help prevent misunderstandings.

Offer Alternative Solutions

If applicable, explain any backup plans you may have in place, such as self-insurance arrangements or savings to cover potential risks. This can reassure the reader that you have thought through your situation and have alternatives ready, should the need arise.