Letter of Validation of Debt Template for Effective Use

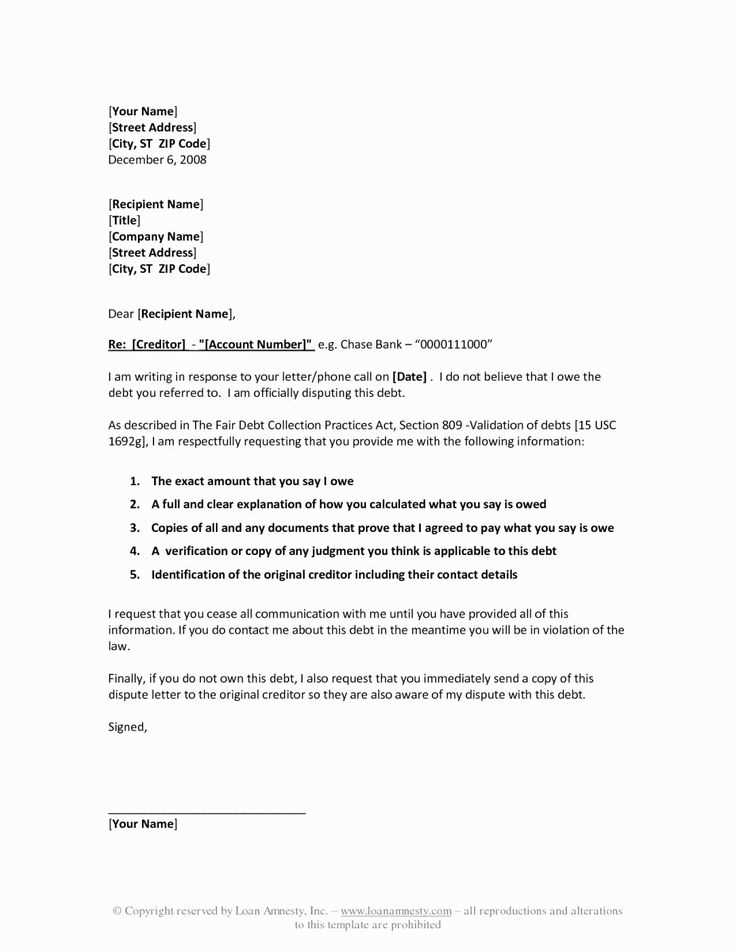

When disputing a financial claim, it’s crucial to ensure that the other party provides adequate proof of the amount owed. This step helps protect against any potential errors or misunderstandings regarding payments and agreements. An official document that requests clarification and evidence can be an effective tool in managing such matters.

What Should Be Included in the Request

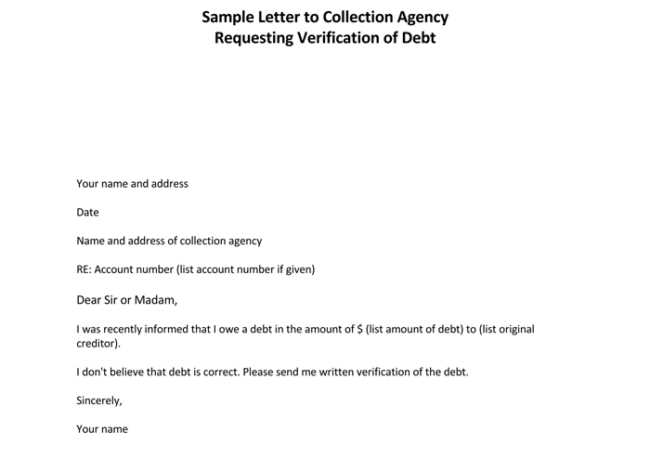

The formal communication should clearly outline the request for verification, specifying the exact amount and details being questioned. It should ask for documentation that confirms the legitimacy of the financial claim. The key to an effective message is being concise yet thorough in the request.

Essential Information to Request

- Amount of the financial obligation

- Proof of original agreement or contract

- Details of past payments or charges

- Any supporting documentation that validates the claim

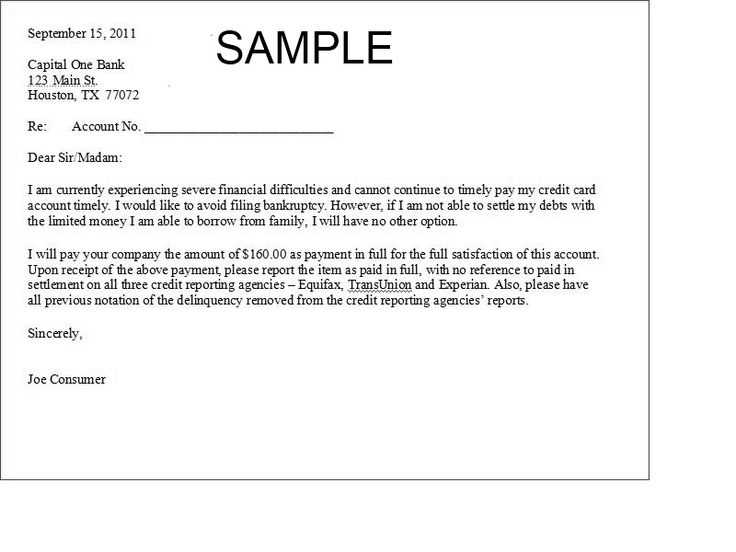

How to Structure the Communication

The format should be formal, yet polite. The person making the request should identify themselves clearly and provide their contact details. The request should be brief and to the point, emphasizing the importance of accuracy in handling the issue.

Effective Tone and Approach

- Use a neutral and professional tone

- Avoid aggressive or accusatory language

- Keep the language simple and direct

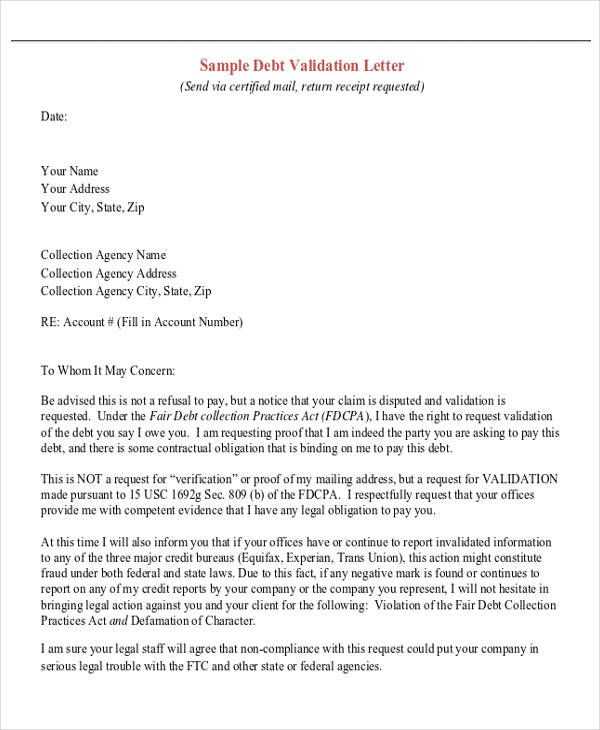

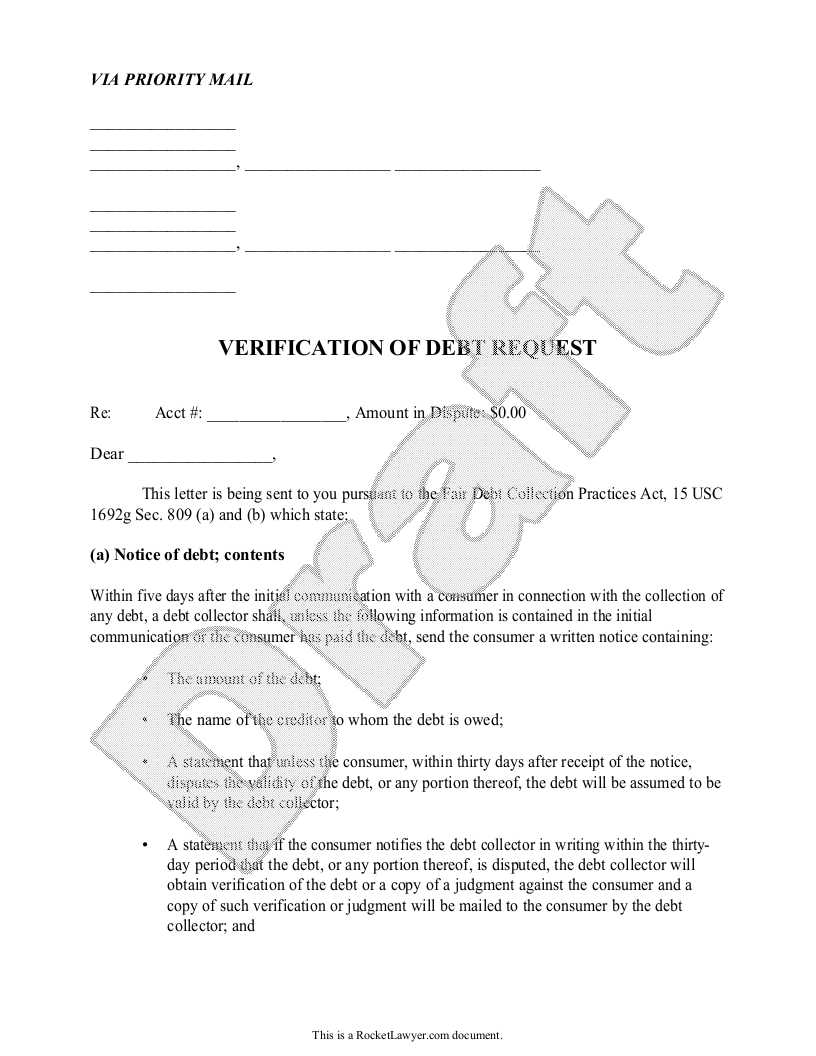

Legal Considerations

It’s important to be aware of your rights when requesting this type of confirmation. Depending on your location, certain laws may require the other party to respond within a set period. Being informed about these regulations can ensure that your actions are in line with legal expectations.

What to Do If No Response Is Received

If there is no reply within the stipulated time, you may need to take additional steps, such as seeking legal advice or pursuing further formal action. Understanding the next steps can help you make informed decisions about how to proceed.

Why Financial Confirmation Is Important

When disputes arise regarding outstanding obligations, requesting proof is essential to ensure the accuracy of the amounts being claimed. Properly addressing these issues helps avoid confusion and ensures both parties are on the same page. Understanding the process of requesting proof, and the importance of providing clear and concise communication, is vital for resolving financial matters.

Steps for Creating a Formal Request

To initiate a dispute over a financial claim, the first step is crafting a formal communication that clearly requests clarification. The content should include the basic details of the claim being disputed, with specific references to the amount in question and any agreements involved. The communication should remain polite and straightforward while asking for necessary documentation or evidence to verify the claim.

Key Information to Request

- Specific details of the alleged financial obligation

- Documentation supporting the original contract or agreement

- Transaction history showing previous payments or charges

- Any additional proof that can substantiate the claim

Including these essential elements in your formal communication ensures clarity and helps streamline the process of addressing the dispute.

How to Respond to Financial Inquiries

When receiving a request for verification, it’s important to acknowledge the inquiry promptly and provide the requested details or evidence. Clear and accurate responses can help resolve issues quickly and avoid further misunderstandings. If the information provided does not match the claim, be prepared to explain the discrepancies or seek additional clarification.

Legal Protections and Rights

It’s crucial to understand your legal rights when engaging in such discussions. In many jurisdictions, there are regulations that protect individuals from invalid claims. Knowing the timelines and required actions ensures that you are operating within the law, protecting your interests throughout the process.

Best Practices for Clear Communication

To ensure smooth communication, maintain a professional tone and avoid unnecessary conflicts. Be concise and accurate in your requests and responses, and ensure that all supporting documentation is clear and relevant. This approach helps prevent delays and ensures that the matter is handled efficiently.