Letter to a bank template

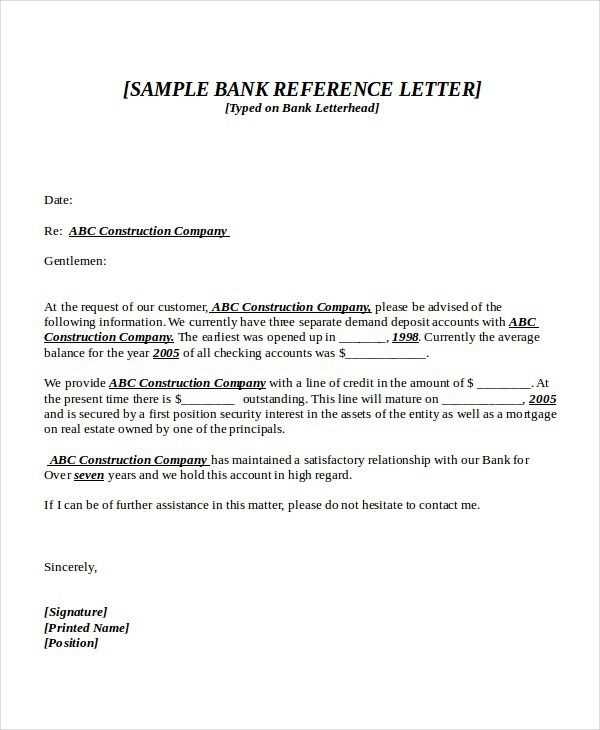

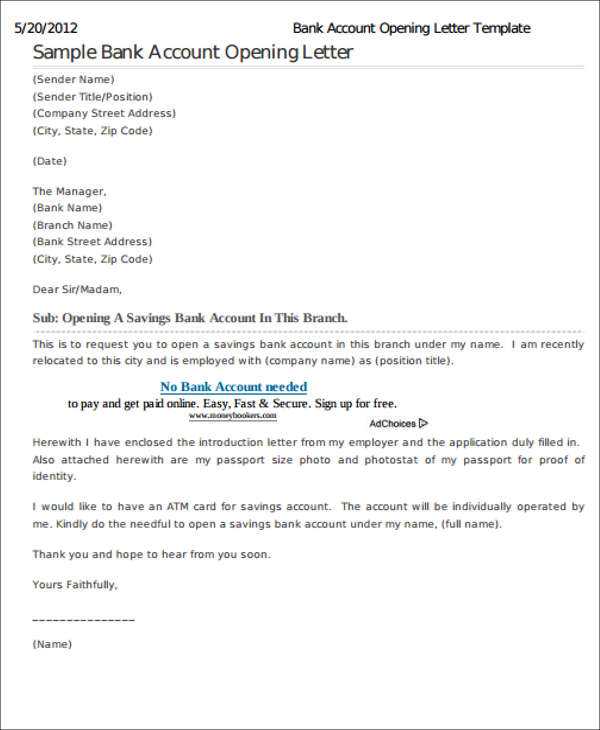

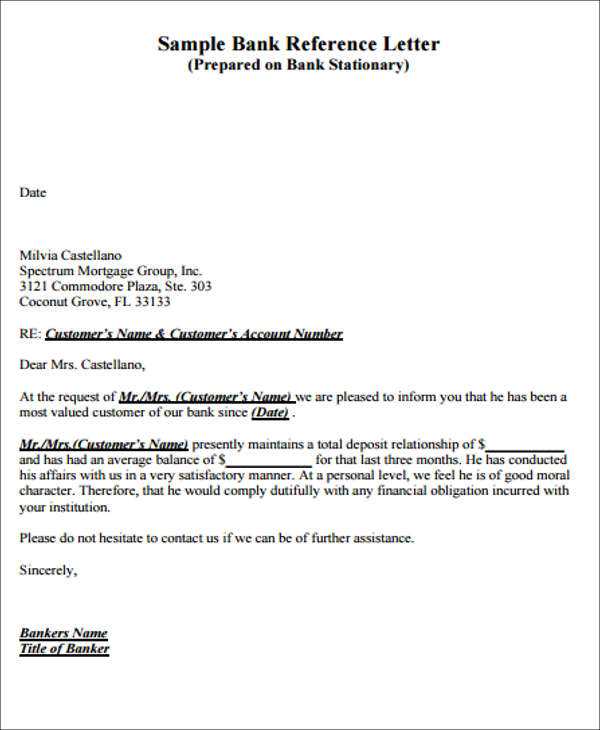

When writing to a bank, begin with a clear purpose. Whether it’s for a request, complaint, or inquiry, your letter should be direct and to the point. Use a professional tone, but ensure that the content is concise to avoid unnecessary details that may dilute your message.

Start by identifying yourself and providing relevant account details. Clearly state the issue or request and provide any supporting information to help the bank understand your situation. If you’re seeking action, make sure to specify what you expect from the bank.

Close the letter politely, ensuring you leave the door open for further communication. Thank the recipient for their attention and provide contact information for follow-up. Remember to keep the tone respectful throughout the letter for a smooth resolution of your matter.

Here’s the corrected version:

Address the bank directly with your full name and account details at the start. Specify your request clearly, whether it’s a transaction query or a service issue. Include any reference numbers or documents that support your request. Be concise and avoid unnecessary explanations. Keep your tone polite and straightforward. Ensure that the bank has all the information needed to address the matter efficiently. End with a request for confirmation or action, and thank them for their attention to the matter.

- Letter to a Bank Template

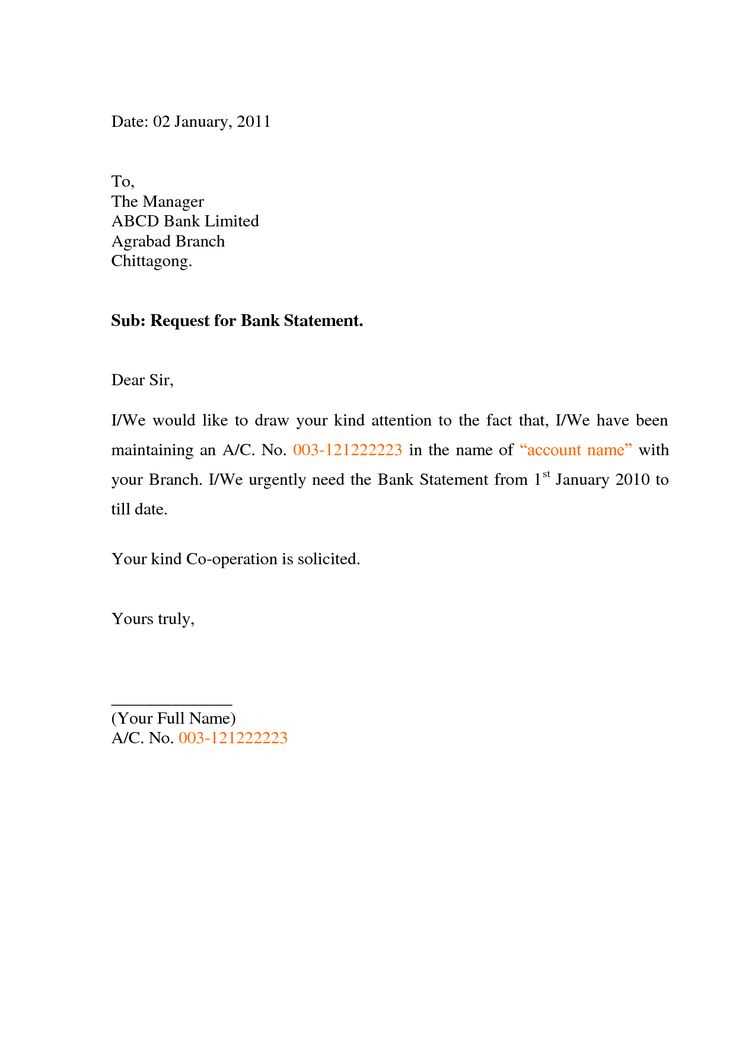

Begin the letter by including your full name, address, and contact details at the top. Below that, write the bank’s name and address. Use formal language and be specific about your request. Provide necessary details, such as account numbers or transaction references, to make your request clear. Address the appropriate department or individual directly.

Here’s a template to guide your letter:

| Sender’s Information | Bank’s Information |

|---|---|

| Your Name Your Address Your Contact Information |

Bank Name Bank Address |

Dear [Bank Name/Representative],

I am writing to [state your request clearly]. Please find the details below:

| Account Number | Request Details |

|---|---|

| [Account Number] | [Specific request] |

Please confirm receipt of this request and let me know if any additional information is required. Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

Begin your letter with a clear statement of your intent. Directly address the bank by its formal name or use “Dear [Bank Name] Team” if you’re unsure about the recipient. This sets the tone for professionalism. Make sure to include any relevant account details immediately after the salutation to help the bank locate your information quickly. For example:

Example of a Starting Line:

Dear [Bank Name] Customer Support,

I am writing regarding my account [Account Number] to request [specific action].

Next, briefly explain the reason for your communication, such as inquiries, requests, or issues. Be direct to avoid unnecessary delays in processing your request. For instance, if you’re reporting a problem, make it clear and concise:

Example of a Direct Request:

Dear [Bank Name],

I would like to inquire about a charge on my account [Account Number] dated [Date].

Always be polite and provide all necessary information right away to avoid confusion. The clearer your opening statement, the smoother the rest of the correspondence will go.

Make sure to provide the following information for clear communication with the bank:

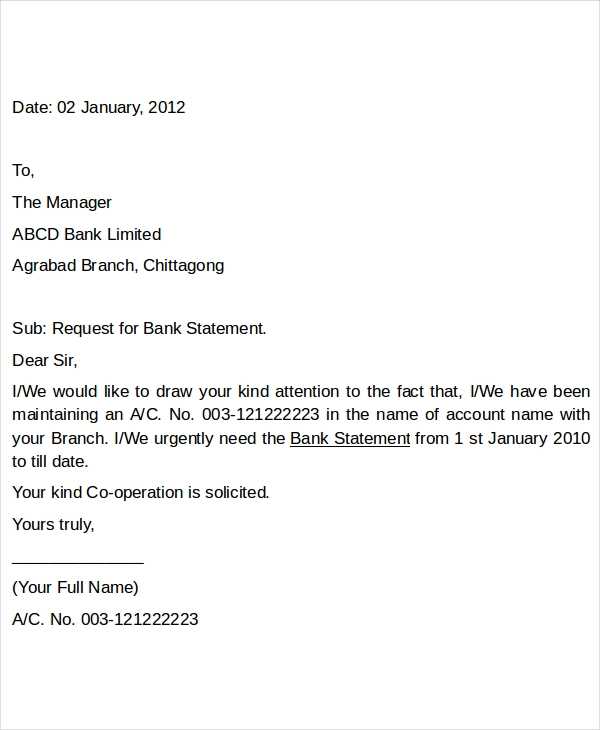

- Subject Line: Start with a concise subject line summarizing the purpose of the correspondence (e.g., “Request for Account Statement”).

- Account Information: Include your account number, branch code, and any other relevant identifiers to help the bank locate your records quickly.

- Specific Request or Issue: Clearly state what you need from the bank, such as requesting a transaction history, making a complaint, or asking for account clarification.

- Supporting Documents: Attach any relevant documents or evidence that support your request, such as receipts, previous correspondence, or identification.

- Preferred Method of Response: Indicate how you would like the bank to respond–whether by email, phone, or another means.

- Contact Details: Provide up-to-date contact information, including your phone number or email address, for follow-up communication.

Additional Considerations

- Clear and Professional Language: Avoid informal language and ensure your message is straightforward and respectful.

- Timeliness: If the matter is urgent, highlight this in your message to expedite the response.

Use a formal font like Times New Roman or Arial in size 12. This ensures readability and maintains professionalism throughout your letter.

Align your text to the left and use single spacing between lines. Leave a space between paragraphs for clarity. Always include a margin of 1 inch on all sides of the page.

Start with your contact information at the top, followed by the date, and then the recipient’s details, including their full name, title, and institution. Ensure accuracy in these details to avoid any confusion.

Address the recipient properly with “Dear [Title] [Last Name]”. Avoid using first names unless you are certain of the level of formality required.

Use short, clear paragraphs to convey your message. Avoid lengthy blocks of text. Each paragraph should focus on a single point, helping the reader easily understand your intent.

End with a formal closing such as “Sincerely,” followed by your signature and typed name. Ensure that all spelling, grammar, and punctuation are correct to maintain a professional tone.

If you’re submitting the letter by email, include your contact information in the signature area rather than the top of the letter.

To request a bank statement or account details, begin by contacting your bank using their preferred communication method. This might be through online banking, email, or by phone. Specify the time period for which you need the statement, ensuring the request is clear and concise.

Online Banking

If you have access to online banking, log in to your account, navigate to the ‘Statements’ or ‘Account Services’ section, and choose the relevant statement period. You may be able to download the statement directly or request it to be sent to your email address.

Phone or Email Request

Alternatively, call the bank’s customer service line or send an email. Include your account number, personal details for identification, and the specific dates for which you need the statement. Be clear about whether you require a physical copy or an electronic version.

Ensure you follow up if you do not receive the requested information within the expected timeframe. Confirm that your request was processed correctly and ask for a reference number for tracking purposes.

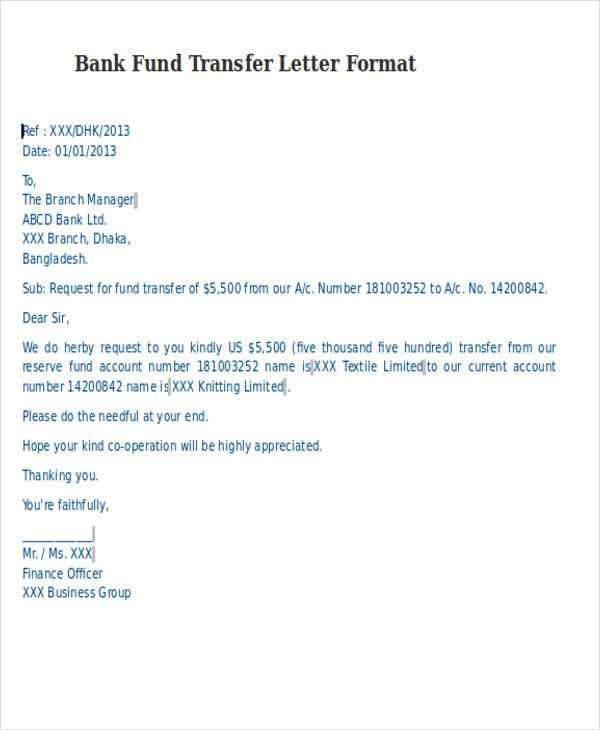

To dispute a transaction, act quickly. Contact the bank as soon as you notice an issue with a charge. Most banks offer a specific process for resolving disputes, and acting promptly increases the chances of a successful resolution.

Gather all related documentation, such as receipts, statements, or emails, that support your claim. This will help substantiate your case and speed up the process.

Check your bank’s policies on disputed transactions. Some banks have specific timeframes within which you must report an issue, and understanding these terms will ensure you don’t miss critical deadlines.

Submit a formal dispute letter with clear details. Include the transaction date, amount, and a brief explanation of the issue. Be concise, but make sure to include all necessary information. Below is a table outlining key details to include in your letter:

| Detail | Description |

|---|---|

| Transaction Date | The exact date the transaction occurred |

| Transaction Amount | The total amount of the disputed charge |

| Merchant Name | Name of the business or service provider involved |

| Reason for Dispute | A short explanation of why the transaction is being disputed |

Follow up with the bank regularly. Keep track of all communication and ensure the issue is being addressed in a timely manner. Some disputes can be resolved in a few days, while others may take longer.

If the bank fails to resolve the dispute or if you are not satisfied with their response, you may escalate the issue to a financial ombudsman or a relevant regulatory body.

Clearly state your purpose right at the beginning of the letter. Specify the type of loan or credit you’re inquiring about, whether it’s personal, business, mortgage, or another type. Be concise and direct, stating that you would like to know more about the available options, terms, and requirements for the loan or credit you’re considering.

- Provide any necessary personal details, such as your full name, account number (if applicable), and contact information.

- Explain why you are interested in the loan or credit and how it aligns with your current financial situation or goals.

Make sure to ask about specific details that matter to you, such as interest rates, repayment terms, and any additional fees. If applicable, inquire about eligibility criteria and the steps involved in applying. For example, you might ask:

- What documents are required for the application?

- What are the interest rates for different loan amounts?

- Are there any early repayment penalties or fees?

Close your letter by thanking the recipient for their time and consideration. Request a prompt response, and express your eagerness to proceed with the next steps in the loan or credit process.

To craft an impactful letter to a bank, begin with a clear subject line, followed by a polite but direct request or issue. Address the specific concern without ambiguity. Be concise while providing all relevant details, such as account numbers, dates, and amounts. This ensures the bank can easily follow up.

Steps to Structure Your Letter

- Start with a formal salutation (e.g., “Dear [Bank Name] Customer Service”).

- Briefly state the reason for your letter. Specify the service, transaction, or issue at hand.

- Provide supporting details: account numbers, dates, transactions, and the specific issue or request.

- Clearly outline your desired outcome or resolution, ensuring it is actionable.

- Conclude politely, offering any further information if needed. End with a formal closing (e.g., “Sincerely”).

By maintaining clarity and professionalism, your letter will stand out and receive prompt attention from the bank.