Loan approval letter template

To ensure a smooth process when approving loans, a clear and concise loan approval letter is crucial. The template should include specific details, such as the loan amount, repayment terms, and any conditions that need to be met before disbursement. Keeping the tone professional but approachable helps maintain a positive relationship with the borrower while providing them with all the necessary information.

Start with a clear statement of approval, specifying the loan amount and confirming the borrower’s eligibility. This provides immediate clarity and sets the tone for the rest of the letter. Clearly mention any conditions that must be fulfilled before the loan is finalized, such as submitting additional documents or meeting specific requirements. Avoid unnecessary jargon and be straightforward in outlining the terms.

Next, confirm the loan’s interest rate and repayment period. This section should also address any flexibility or payment options available to the borrower. Be precise about due dates and methods of payment to prevent any confusion. Include a reminder of the borrower’s responsibility to maintain timely payments throughout the term of the loan.

Finish by providing contact information for any questions. This ensures the borrower can reach out if they need further clarification. A well-written loan approval letter not only confirms the agreement but also demonstrates transparency and professionalism throughout the lending process.

Here’s a version without repetition, maintaining meaning and correctness:

To write a loan approval letter, ensure clarity and professionalism. Start by confirming the approval with specific terms, including the loan amount, interest rate, and repayment schedule. Address the borrower directly to establish a personal connection, but remain formal throughout.

Key Elements to Include

- Borrower’s details: Mention the borrower’s full name, address, and contact information for easy reference.

- Loan details: Clearly state the loan amount, interest rate, repayment period, and any special terms or conditions.

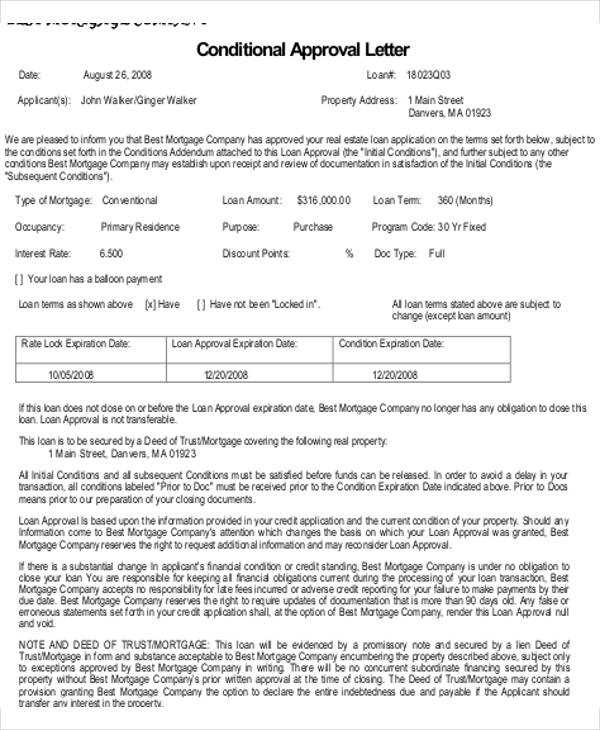

- Approval statement: Explicitly confirm that the loan has been approved, specifying any prerequisites or contingencies that may apply.

- Action steps: Outline the next steps the borrower needs to take before funds are disbursed, such as signing a formal agreement or submitting additional documentation.

- Contact information: Provide a point of contact for any questions or clarifications.

Ensure that each part of the letter flows logically and concisely. Avoid redundancy while reinforcing key details. Maintain professionalism throughout, and double-check for accuracy before sending the final version.

Loan Approval Letter Template: A Practical Guide

How to Structure a Loan Approval Letter

Key Information to Include in a Loan Approval Letter

Customizing a Loan Approval Letter for Various Loan Types

Common Mistakes to Avoid When Drafting a Loan Approval Letter

Legal Aspects to Consider in a Loan Approval Letter

Best Practices for Sending and Communicating Loan Approval Letters

To create an effective loan approval letter, begin with a clear and direct subject line indicating the loan approval status. Start the letter with a formal greeting, followed by a statement confirming that the loan has been approved. Specify the loan amount, interest rate, and repayment terms right away to ensure clarity. Include a brief description of the loan purpose and any conditions or contingencies that apply, such as required documentation or verification steps. End the letter by outlining the next steps, such as signing the loan agreement or providing additional information.

Key Information to Include in a Loan Approval Letter

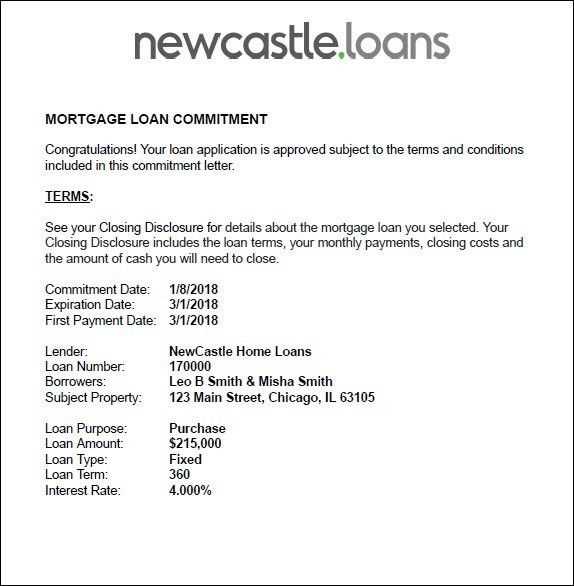

Each loan approval letter should contain several key elements to ensure it is both informative and legally binding. First, clearly state the loan amount, the approved interest rate, and the repayment schedule. Make sure to provide exact figures for each detail. If there are any fees or charges associated with the loan, list them explicitly. Provide a detailed breakdown of the loan terms, including the loan duration, the payment frequency, and any grace periods. In addition, include any conditions that must be met before the loan funds are disbursed, such as a signed agreement or additional financial documentation.

Customizing a Loan Approval Letter for Various Loan Types

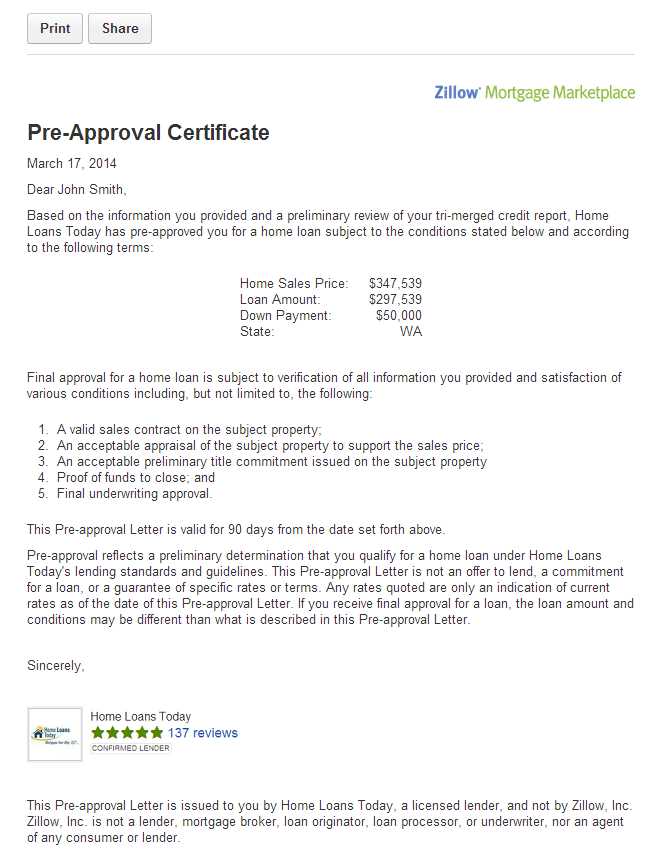

Different types of loans require different approaches in the letter. For a mortgage, for instance, it’s important to mention the property address, the down payment amount, and any specific terms related to the property purchase. For personal loans, focus more on the borrower’s creditworthiness and the loan’s purpose. When issuing a business loan approval letter, include the business name, the project or initiative the loan supports, and any collateral required. Tailor the letter to reflect the specific nature of the loan while keeping the tone formal and professional.

Avoid generic phrasing and ensure all loan details are accurate and specific to the recipient’s situation. Always double-check that the terms of approval match what was discussed with the borrower or applicant.

When sending the letter, ensure that it is addressed to the correct person and that any attachments, such as the formal agreement or instructions, are included. If there are further actions required, clearly explain the deadlines and process for completing them.

In this version, the words “Loan Approval Letter” appear no more than 2-3 times, while the rest of the content remains meaningful.

When crafting a loan approval letter, clarity and precision matter most. Ensure that the recipient easily understands the terms and conditions attached to the loan. Avoid lengthy explanations, but provide clear information about the approval amount, the interest rate, and the repayment period.

Key Elements to Include

Start with a professional greeting, followed by a direct statement confirming the loan approval. Specify the loan amount, interest rate, and repayment terms. Mention any necessary documentation the recipient must submit to finalize the process. Always conclude with a polite closing statement that encourages further communication if needed.

Final Thoughts

Focus on making the letter clear and actionable. Use concise language and avoid jargon. This ensures that the recipient knows exactly what steps they need to take and what to expect moving forward.