Loan Paid in Full Letter Template for Easy Use

When you finish clearing a debt, it’s important to have formal documentation stating that the balance has been resolved. This document serves as proof that your commitment has been met, providing peace of mind for both parties involved.

Creating such a notice doesn’t have to be complicated. With the right structure, you can easily craft a statement that is both professional and effective. It ensures that you and the lender are in agreement about the settlement, preventing future misunderstandings.

Understanding the key elements of this document and knowing what to include will help ensure its validity. Whether you’re sending it to a bank, a private lender, or another financial institution, proper wording and clarity are essential.

By following a simple guide and using an efficient structure, you’ll be able to draft a statement that guarantees your financial history is officially marked as complete.

Understanding the Importance of Loan Closure

Concluding a financial commitment is a significant step that reflects both personal responsibility and financial discipline. It marks the completion of an agreement, signaling that all obligations have been fulfilled. This process is not only essential for the individual but also plays a crucial role in maintaining healthy credit and establishing trust with financial institutions.

The Benefits of Finalizing Financial Agreements

When a financial agreement reaches its conclusion, the positive impacts extend beyond just fulfilling a contractual duty. Some of the key advantages include:

- Improved credit history and score

- Clear financial standing with lenders

- Increased opportunities for future financial assistance

Why It’s Critical to Obtain Confirmation

Securing official recognition that all terms have been met provides assurance to both parties. This acknowledgment serves as:

- A safeguard against potential disputes or misunderstandings

- A confirmation that no further payments or actions are necessary

- An opportunity to close accounts and move forward with a clean slate

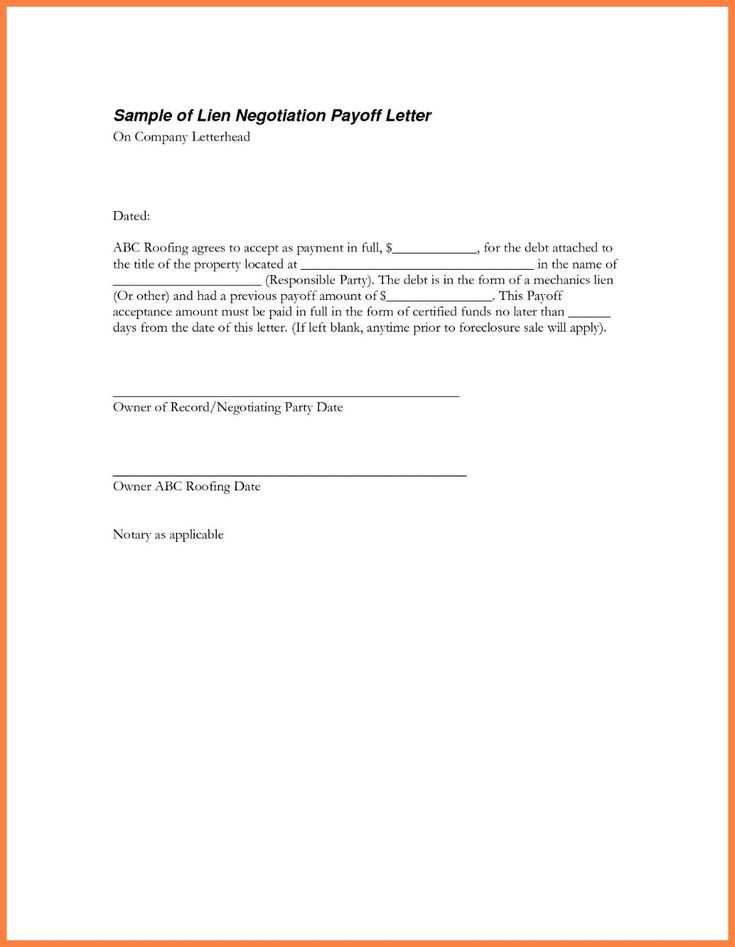

What to Include in Your Letter

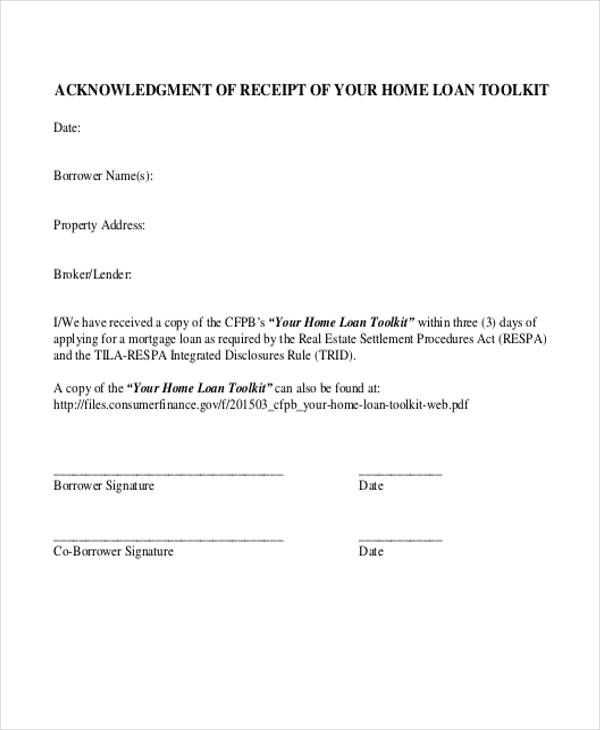

When concluding a financial agreement, it is important to clearly communicate the completion of all terms. The document should contain essential information that serves as confirmation for both parties. By including the right details, you ensure that everything is understood and recorded properly, preventing any future confusion or disputes.

The following elements should be part of your correspondence:

- Account Identification: Include the relevant account number or reference to ensure clarity on which agreement has been settled.

- Confirmation of Completion: Clearly state that all obligations have been met in accordance with the agreed terms.

- Date of Final Payment: Specify the exact date when the final payment was made, which signifies the end of the arrangement.

- Contact Information: Provide your contact details for any follow-up questions or clarifications.

- Request for Confirmation: Politely ask for official acknowledgment that all terms have been completed.

How to Format a Paid in Full Letter

Creating an official document to confirm the resolution of a financial agreement requires a clear structure and proper formatting. The format ensures that the recipient understands the purpose of the document and the actions taken. Proper organization allows for a smooth communication process and serves as a formal record of completion.

Key Elements to Include

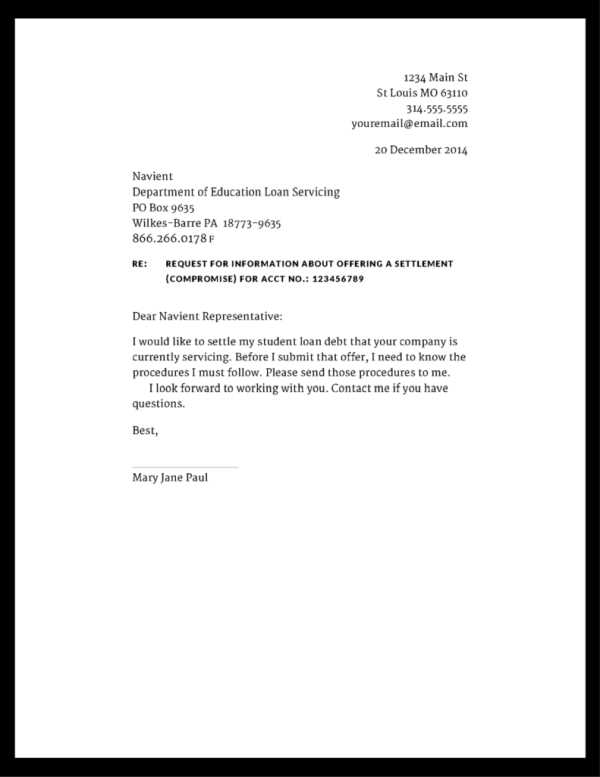

The document should start with a professional header, including your contact information and the recipient’s details. Follow this with a formal greeting and a concise introduction. Then, provide the main body, clearly stating that all obligations have been met. Here are the critical sections to include:

- Sender’s Details: Your name, address, and contact information should be placed at the top of the document.

- Recipient’s Information: Include the name and address of the party to whom you are addressing the document.

- Date: Make sure to include the date of writing to keep track of the communication timeline.

- Formal Greeting: Use a professional salutation, such as “Dear [Recipient’s Name],”.

Finishing the Document

The conclusion should request formal confirmation from the recipient, acknowledging the completion of all terms. Use a polite tone, and offer to provide any further details if needed. End with a courteous closing, such as “Sincerely” or “Best regards,” followed by your name and signature. Be sure to keep the content brief and professional.

Common Mistakes to Avoid When Writing

Writing a formal document to confirm the conclusion of a financial agreement can be straightforward, but there are several pitfalls to avoid to ensure clarity and professionalism. Small mistakes can lead to misunderstandings, delays, or even legal complications. Being aware of these common errors will help you craft a document that is both clear and effective.

- Ambiguity in Language: Avoid using vague terms that could lead to confusion. Be specific about the terms and the completion of the agreement.

- Omitting Key Details: Failing to include important information such as account numbers, final payment dates, or confirmation requests can weaken the document’s purpose.

- Overly Casual Tone: While it’s important to be polite, maintaining a formal and professional tone is crucial in financial communications.

- Incorrect Date or Details: Double-check the dates and other details to ensure they are accurate. A mistake in the timeline can cause unnecessary confusion.

- Failure to Request Confirmation: Always include a request for formal acknowledgment of the agreement’s completion to ensure all parties are on the same page.

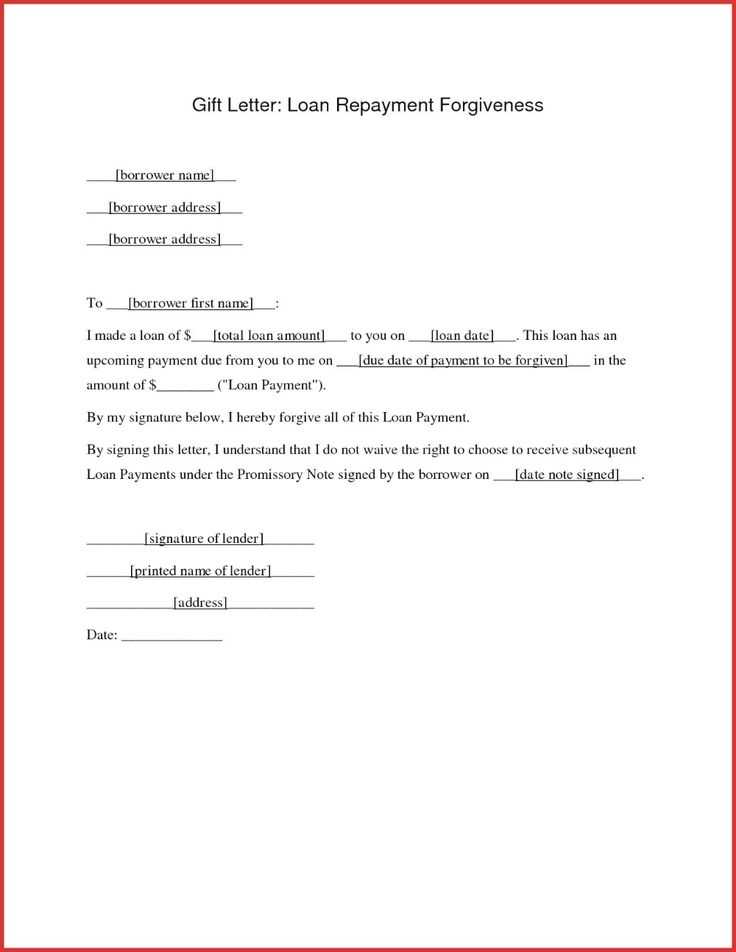

Benefits of Using a Template

Utilizing a pre-designed structure for formal documents can save time and reduce the likelihood of mistakes. It provides a clear framework, ensuring that all necessary details are included while maintaining consistency and professionalism. This approach is particularly useful for individuals who may not be familiar with the nuances of drafting formal communications.

Time Efficiency

One of the primary advantages of using a pre-made format is the speed it offers. Instead of starting from scratch, you can simply fill in the relevant information. This streamlined process ensures that you can complete the task quickly and focus on other important matters.

Consistency and Accuracy

Templates help ensure that all required elements are included and formatted correctly. By following a consistent structure, you minimize the risk of omitting critical details. This consistency also improves the overall professionalism of the document, reflecting well on you and your organization.

When to Send Your Paid in Full Letter

Knowing the right time to send a confirmation of the completion of a financial arrangement is crucial. Sending this document at the appropriate moment ensures that all parties are clear on the conclusion of the agreement. It is essential to avoid sending it prematurely or waiting too long, as timing can impact how the communication is received.

After the Final Payment is Processed

Once all payments have been successfully processed and cleared, this is the most appropriate time to send the document. It confirms that no further actions are required and that the agreement has been fulfilled in its entirety.

When to Avoid Sending

There are also times when it’s important to hold off on sending the document. These include situations where:

| Condition | Reason to Wait |

|---|---|

| Payment Pending | Sending the confirmation before the final payment clears may cause confusion. |

| Disputed Terms | If there are any unresolved issues regarding the terms, it’s better to wait until they are addressed. |

| Incomplete Documentation | Ensure all required paperwork and proof of completion are provided before sending the confirmation. |