Loss of coverage letter template age 26 shrm

When you turn 26, your health insurance coverage through your parent’s plan will typically end. This can create uncertainty for many, but it’s important to act promptly to ensure continued access to health care. A loss of coverage letter serves as formal documentation to notify your health insurer and relevant parties of the change in your status.

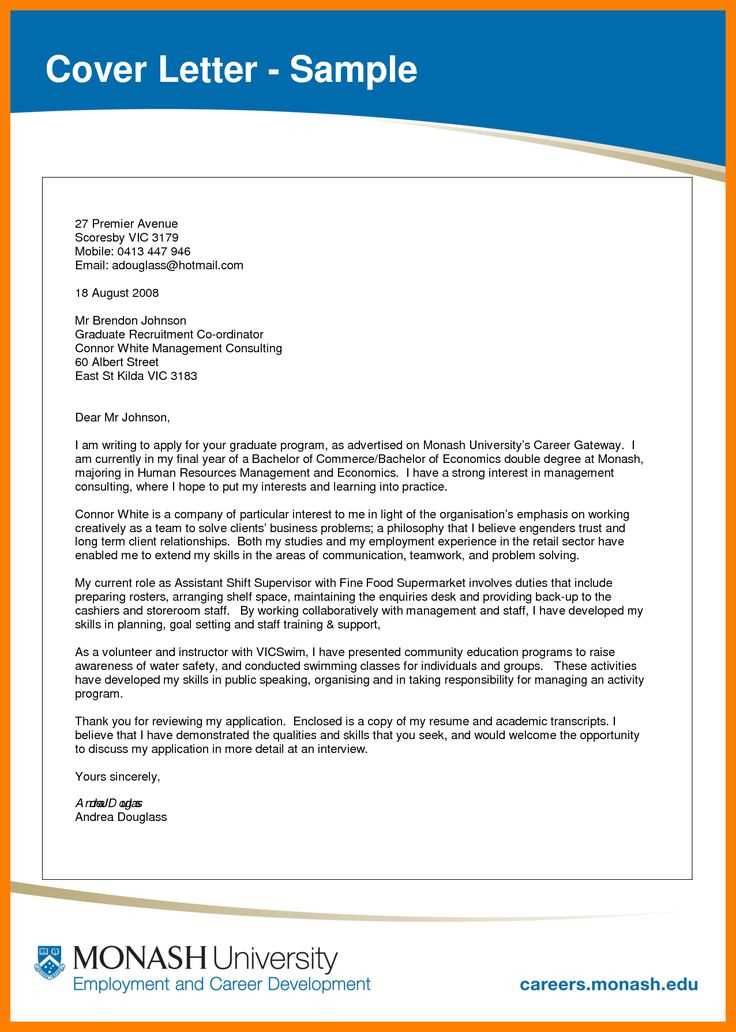

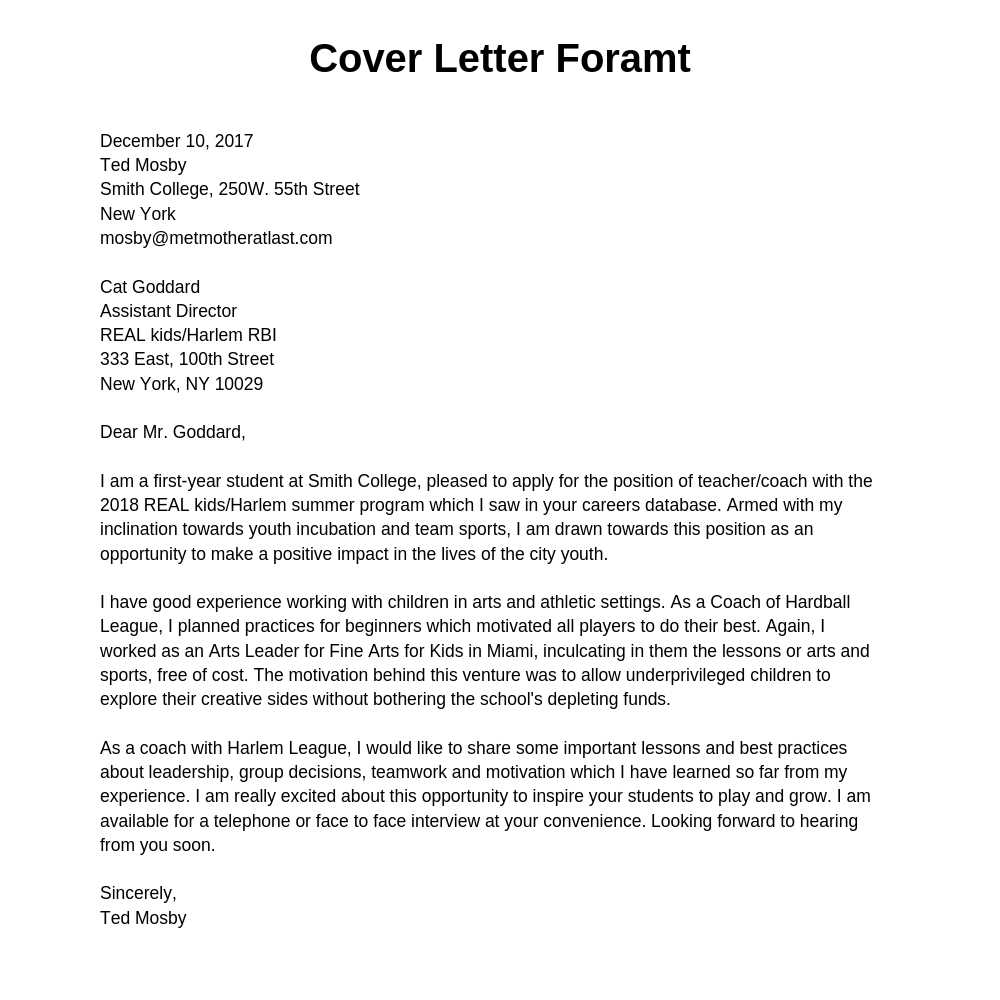

Start by detailing your personal information, including your full name, address, and date of birth. In the body of the letter, clearly state that you are reaching the age limit for remaining on a parent’s plan and outline the specific date your coverage ends. This provides your insurer with the necessary details to update their records and make any required adjustments.

Next, mention any steps you have already taken to secure new coverage. If you’ve signed up for an employer-sponsored plan, a new marketplace plan, or any other health insurance option, be sure to include those details. This shows that you’re proactively addressing your health coverage needs without any lapse.

Conclude the letter by thanking the recipient for their attention to this matter. Request confirmation of the loss of coverage and ask for any additional steps you may need to take. Make sure to sign the letter and include a date to formally complete the process.

Here’s the revised version with minimal repetition:

If you’re facing a loss of coverage after turning 26, act quickly to secure your health insurance options. Review your current plan’s rules for coverage expiration once you reach this age and explore alternatives. Start by determining your eligibility for the following:

- Special Enrollment Period: If you were on a parent’s plan, the loss of coverage opens a 60-day window to enroll in new health insurance under the Affordable Care Act (ACA). Don’t miss this period.

- Employer-sponsored plans: Check with your employer to see if you can join their health plan. Some companies allow new employees to enroll at any time, especially if you’ve had a coverage gap.

- Medicaid or CHIP: Depending on your income, you may qualify for Medicaid or the Children’s Health Insurance Program (CHIP). Apply as soon as you lose coverage.

- Marketplace plans: During open enrollment, you can shop for coverage through the Health Insurance Marketplace. Prices vary based on income, so check for subsidies or assistance.

Gather the necessary documents to prove the loss of coverage and apply for new insurance as soon as possible. Many programs require proof of the date your prior coverage ended. Be proactive and plan ahead to avoid any gaps in your healthcare.

- Detailed Plan for “Loss of Coverage Letter Template for Age 26 SHRM”

Begin with a clear and concise subject line that informs the reader of the purpose of the letter. For instance, “Notice of Loss of Health Coverage Due to Age Limit.” This helps set expectations right away.

Introduction

Provide a brief introduction explaining the reason for the letter–age 26 limit–along with the effective date when coverage will end. Avoid unnecessary elaboration and get straight to the point.

Body of the Letter

In the body, specify the details of the coverage that is being lost, including the date it will no longer apply. If applicable, provide a breakdown of the health plans that the person may transition into after they turn 26, if those options are available under the company’s policy.

Be sure to mention any steps the employee can take to extend coverage, such as enrolling in an individual health insurance plan or continuing coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA), if eligible. Include clear instructions on how they can proceed with these options.

In addition, offer any necessary support or contact information for someone who can answer questions or help with the transition. This ensures that the employee feels supported during the process.

Closing

Conclude the letter with a respectful closing statement that emphasizes the importance of transitioning smoothly. Reassure the employee that any questions will be addressed promptly. Include your contact details for follow-up inquiries, and provide a polite sign-off, such as “Sincerely,” followed by your name and job title.

Begin by clearly stating your intent. Address the letter to your health insurance provider or employer, specifying that you are writing to notify them of your upcoming loss of coverage due to turning 26. Make sure the letter is concise and direct. Include your full name, contact information, and policy details.

Key Elements to Include:

- Subject Line: Clearly mention the purpose, such as “Notice of Health Insurance Loss Due to Age 26.”

- Introduction: State the date you will lose coverage and provide your policy number.

- Reason for Loss: Indicate that the coverage is ending because you are turning 26, referencing any relevant policy terms.

- Request for Assistance: Ask about any available options for continuing coverage, such as a parent’s plan, marketplace options, or alternative solutions.

Sample Structure:

- Start with a clear subject line that highlights the issue.

- In the first paragraph, state your name, policy number, and the fact that you will lose coverage due to reaching the age of 26.

- In the second paragraph, provide additional context if needed, such as the exact date coverage ends and reference your policy’s terms.

- In the closing, express appreciation for their time and request guidance on how to proceed.

Conclude the letter by thanking the recipient for their attention and requesting prompt confirmation or guidance regarding your coverage options.

Clearly state the effective date when the coverage will end. This ensures that the recipient knows exactly when their benefits will no longer be valid.

Provide a brief explanation of the reason for the loss of coverage, whether it’s due to age, employment status change, or other qualifying circumstances.

Offer information on available alternatives. For example, include options for continuing coverage, such as COBRA, or direct the recipient to their state’s health insurance marketplace if applicable.

Include contact details for further assistance. Make sure the recipient can reach someone for more information or help regarding their coverage transition.

Clarify any actions the recipient needs to take. If they need to enroll in new coverage or update their personal information, outline the necessary steps to avoid lapses in coverage.

Finally, include a reminder of any deadlines or important dates they should be aware of to avoid losing their eligibility for coverage alternatives.

The SHRM (Society for Human Resource Management) guidelines on health insurance eligibility at age 26 clarify that dependents are typically covered under their parent’s health insurance plan until they turn 26. After reaching this age, eligibility for coverage depends on specific factors, including the plan’s provisions and whether the dependent has access to employer-sponsored coverage.

Employers must offer continued coverage for dependents up to 26 years old under the Affordable Care Act (ACA). This rule applies to both individual and family plans. However, some plans may allow coverage extensions for specific circumstances, such as if the dependent is enrolled in school or has a disability.

Employees should check their health insurance plan to understand the terms and conditions regarding coverage for dependents. If the dependent has aged out of the parent’s plan, they may be eligible for coverage through their own employment or through government programs like Medicaid or the Children’s Health Insurance Program (CHIP).

| Age | Eligibility Status | Notes |

|---|---|---|

| Under 26 | Eligible for coverage under parent’s plan | Must meet other eligibility criteria such as living with parents or being a full-time student |

| Age 26 | Age-out of parent’s plan | May seek alternative coverage through employer or other public options |

| Over 26 | Ineligible for parent’s health plan | Needs to secure individual or employer-sponsored coverage |

It is important for both employers and employees to understand these guidelines to ensure health coverage remains uninterrupted during the transition at age 26. Employees should start exploring alternative health insurance options well before the dependent reaches this age to avoid gaps in coverage.

Ensure the recipient’s details are accurate. Double-check the name, address, and contact information to avoid unnecessary delays in processing the letter.

Clearly state the reason for coverage loss. Avoid vague language or assumptions about why the coverage ended. Provide specific dates and details to support your explanation.

Do not overlook the inclusion of all necessary documentation. Attach relevant documents, such as insurance policy statements or proof of eligibility, to avoid follow-up requests.

Maintain a professional tone throughout the letter. Avoid overly emotional or accusatory language, as this can reduce the letter’s effectiveness and may lead to misunderstandings.

Do not neglect to include any options for continued coverage or steps the recipient can take next. This shows a proactive approach and helps in addressing potential solutions.

Avoid sending a letter without reviewing it for grammatical errors. A letter filled with mistakes can create confusion and negatively impact your communication. Double-check spelling, punctuation, and sentence structure.

Once you turn 26, you are no longer eligible for coverage under a parent’s health plan. This transition requires quick action to secure new health insurance. Explore your options to avoid any gaps in coverage, as staying uninsured can lead to unexpected costs. Begin by assessing eligibility for a Special Enrollment Period (SEP), which allows you to apply for marketplace insurance outside the open enrollment period due to life changes like losing parental coverage.

Explore Marketplace Plans

Visit HealthCare.gov or your state’s marketplace to compare available plans. If you’re eligible for an SEP, you can apply for a plan during the designated window. Marketplace plans often provide various coverage levels, from bronze to platinum, allowing you to choose based on your healthcare needs and budget. Many states also offer subsidies or Medicaid options to help lower your premiums, especially if you’re in a lower income bracket.

Consider Employer-Sponsored Insurance

If you’re employed, check if your employer offers health insurance. Many employers provide coverage with competitive premiums and may even contribute toward your premium costs. Applying for employer-sponsored insurance is a great way to secure coverage quickly after losing your parental plan. If you’re unsure about your employer’s offerings, reach out to your HR department for more details.

To prevent any gaps in your health coverage, be sure to address the exact dates and details of your loss in the letter. Specify the date when your coverage officially ended and confirm whether a grace period applies. This provides clarity and assures that your insurer understands the timeline accurately.

Next, mention whether you are transitioning to another insurance plan. If you’re applying for new coverage, indicate the expected start date for the new policy and confirm whether there is a gap between the two plans. This proactive step can help bridge any potential coverage interruptions.

If applicable, provide evidence of any ongoing medical treatments or prescription needs during the transition. It’s beneficial to include a statement on how you plan to maintain coverage during the gap, such as applying for COBRA or state health insurance options.

| Action | Details |

|---|---|

| Include Coverage End Date | Specify when your insurance ends, avoiding any ambiguity. |

| Mention Transition to New Plan | Confirm the date when the new coverage begins and whether a gap exists. |

| Provide Proof of Treatment | Include details of ongoing medical care during the gap, if any. |

| State Gap Coverage Options | Explain how you plan to stay covered, such as through COBRA or other alternatives. |

By directly addressing these potential gaps, you’ll reduce confusion and improve the chances of securing seamless coverage. Always follow up with your insurer if there are delays or additional steps needed to confirm your new policy’s activation.

This keeps the meaning intact while reducing redundancy.

Consider outlining key points clearly to maintain clarity without repeating information. Simplify complex ideas and avoid unnecessary elaboration. Focus on presenting the most crucial elements of your message concisely.

Rephrase for Clarity

Rewriting complex sentences can significantly reduce redundancy. Shorten long phrases by removing unnecessary qualifiers. For example, instead of saying “in order to reduce the likelihood,” simply say “to reduce the likelihood.”

Use Bullet Points to Organize Information

- Avoid repeating information in multiple sections.

- Use concise language to maintain clarity.

- Group related points together in bullet points or lists for easier readability.

By eliminating redundant phrases, the message becomes easier to follow and more direct. Always prioritize clarity over length to avoid unnecessary complexity.