Loss of Coverage Letter Template for Age 26

When a significant change occurs in your health insurance status, it’s crucial to inform the relevant parties in a formal and structured manner. Whether due to a shift in employment, age limits, or other factors, ensuring that the transition is handled efficiently helps prevent potential issues with healthcare access. A well-written communication can play a key role in managing these changes smoothly.

Crafting this communication involves providing the necessary details about the situation, explaining the reason for the shift, and addressing next steps. By following a clear structure, you can ensure that all required information is presented effectively, reducing the risk of confusion or delays.

For individuals nearing the end of certain health benefits or transitioning out of a plan, a properly formatted message can make the process clearer and provide peace of mind. This section will guide you through the essential elements and steps needed for composing such a message.

Why a Loss of Coverage Letter is Important

When a change in health benefits occurs, especially under specific circumstances, it is essential to notify the relevant parties in a clear and concise manner. This ensures all parties are informed about the shift and can make necessary arrangements accordingly. Having a formal communication in place helps in managing transitions without unnecessary delays or confusion.

Effective communication allows individuals to outline the reason for the change, the expected consequences, and the steps to be taken next. This proactive approach can prevent misunderstandings and ensure a smoother transition to new health plans or coverage options.

In particular, individuals nearing the end of eligibility for certain benefits need to send such communications promptly. By doing so, they can ensure uninterrupted access to healthcare services and avoid any complications with their insurance providers. Properly addressing this matter in a structured manner gives both the person affected and the insurer a clear understanding of the situation.

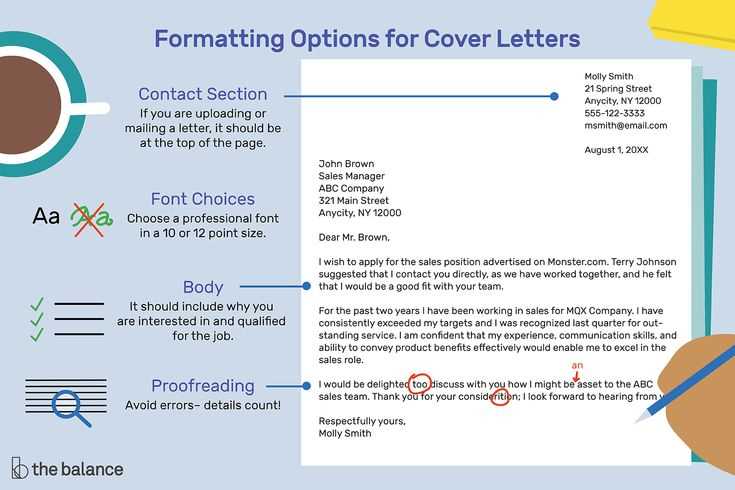

How to Create a Coverage Loss Notification

When informing an organization about a change in your health benefits, it’s crucial to present the details in an organized and professional manner. This ensures clarity for both parties and helps in addressing the situation effectively. A well-structured communication should be clear, concise, and include all necessary information related to the change.

Start by clearly stating the reason for the modification and the date it is expected to take effect. Follow this by explaining how the change may affect your access to healthcare services and outline any next steps or actions that need to be taken. Being transparent about the situation can prevent potential issues down the road.

Finally, ensure that the document is polite and respectful while maintaining a formal tone. This approach not only shows professionalism but also increases the likelihood of a smooth process when dealing with insurance companies or employers. Proper documentation of this shift is key to avoiding gaps in coverage or disruptions in care.

Key Details for a Coverage Loss Notification

When crafting a formal communication regarding changes in health benefits, it’s important to include specific information that will ensure the recipient understands the nature of the change and its implications. A well-detailed message should cover all the necessary points to avoid any confusion and facilitate the next steps in the process.

Key information to include includes the following details:

| Detail | Description |

|---|---|

| Reason for Change | Explain the cause of the modification and when it will take effect. |

| Effective Date | Specify the exact date when the change will be implemented. |

| Impact on Services | Clarify how the change may affect access to healthcare or related services. |

| Next Steps | Provide guidance on what needs to be done after the change takes effect. |

| Contact Information | Include details for further inquiries or follow-ups if needed. |

By ensuring these details are clearly addressed, you help ensure a smooth transition and avoid any misunderstandings about the process.

Causes of Coverage Loss at Age 26

There are several reasons why individuals may lose their health benefits or insurance eligibility once they reach a certain milestone in their life. Understanding these causes can help individuals prepare and take the necessary steps to address the situation before any gaps in care occur.

Transitioning from family plans is one of the most common reasons for a change. Once individuals reach a specific point, they are no longer eligible to remain on a parent’s health plan. This shift often happens when they turn 26, which is the cut-off age for many dependent health benefits.

Changes in employment can also lead to a loss of benefits. For example, if someone moves from a job that offers health insurance to one that does not, they may face the challenge of securing new coverage. Another potential cause is financial constraints, where individuals are unable to afford the premiums required for continued health benefits.

Lastly, changes in legal status or residency can affect health insurance eligibility. Moving out of state or country, or experiencing changes in legal status can all impact an individual’s access to healthcare plans.

Managing Health Insurance Gaps Effectively

When individuals experience interruptions in their health benefits, it’s essential to take proactive measures to minimize the impact of those gaps. Effectively managing these breaks ensures continuous access to necessary care and helps avoid financial burdens related to unforeseen medical expenses.

Explore Temporary Coverage Options

One of the first steps to consider is exploring temporary health plans. These short-term solutions can offer coverage during transitional periods, providing essential healthcare services until a more permanent solution is secured. Options may include government-sponsored programs or private insurers that offer temporary policies tailored to those in-between jobs or plans.

Seek Assistance from Employers or Providers

If a gap in benefits occurs due to a change in employment, it’s advisable to speak with your employer or insurance provider. Many companies offer options like COBRA (Consolidated Omnibus Budget Reconciliation Act), which allows individuals to continue their existing plan for a limited period after losing eligibility. Understanding the specific options available can help mitigate the disruption caused by the coverage gap.

Next Steps After Submitting the Letter

Once the formal notification has been submitted, there are several important steps to follow in order to ensure that all necessary actions are taken promptly. These steps will help to maintain continuous access to health care services and facilitate a smooth transition to alternative coverage if needed.

Follow Up with the Relevant Authorities

After sending the necessary documentation, it’s crucial to follow up with the appropriate organization or provider to confirm receipt and verify the next actions. This ensures that no steps are missed, and any deadlines or requirements are clearly understood.

- Contact the insurance provider to confirm that the document was received.

- Ask for any further steps required to finalize the process.

- Ensure you have a clear timeline for when coverage options will be finalized.

Explore Alternative Health Care Solutions

During this transitional period, it’s important to explore other health care options that may be available. This can include applying for government programs, looking into new employer-sponsored plans, or considering individual insurance policies to ensure you’re covered in the meantime.

- Check eligibility for state-based or federal programs such as Medicaid or health exchanges.

- Review job-based health plans if you’re entering a new role.

- Consider short-term insurance options to bridge any coverage gaps.

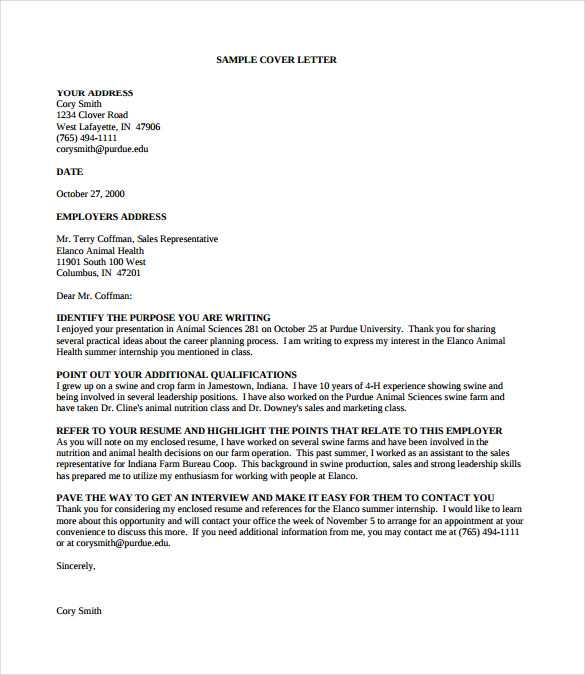

Sample Templates for Coverage Loss Notification

When notifying an insurance provider or other relevant entities about the cessation of health protection, it’s important to use clear and effective communication. A well-structured notification ensures that all necessary information is provided, and helps to prevent confusion or delays. Below are sample outlines to guide you through the process of informing the appropriate parties about the change in your health coverage situation.

General Notification Format

This format can be adapted for various situations where you need to inform about a change in your health coverage status. Ensure that all critical details are included and communicated in a timely manner.

- Introduction: Begin by clearly stating your reason for writing and provide a brief overview of your situation.

- Personal Details: Include your full name, policy number, and any other identifying information that can help the recipient verify your coverage details.

- Date of Change: Specify when the coverage change took place or is expected to take effect.

- Action Request: If applicable, request information on the next steps or inquire about options for continuing health protection.

- Closing: End by expressing appreciation for their attention to the matter and provide your contact details for any follow-up.

Example Notification Outline for Health Coverage Changes

The following is a more specific example that can be customized to fit your situation. This sample is designed for individuals who are about to experience a shift in their health care benefits, ensuring all necessary details are conveyed properly.

- Subject Line: Notification of Health Protection Change

- Opening Sentence: “I am writing to inform you of a recent change regarding my health protection status. As of [date], my health plan will no longer be in effect due to [reason].”

- Personal Information: “My name is [Full Name], and my policy number is [Policy Number].”

- Details of Change: “This change will occur on [specific date].”

- Next Steps/Questions: “Please inform me of any steps I need to take to ensure I remain covered or to explore other available options.”

- Closing: “I appreciate your attention to this matter and look forward to your guidance. If any further information is needed, feel free to contact me at [Phone Number] or [Email].”