Mortgage gift letter template canada

Gift Letter Requirements

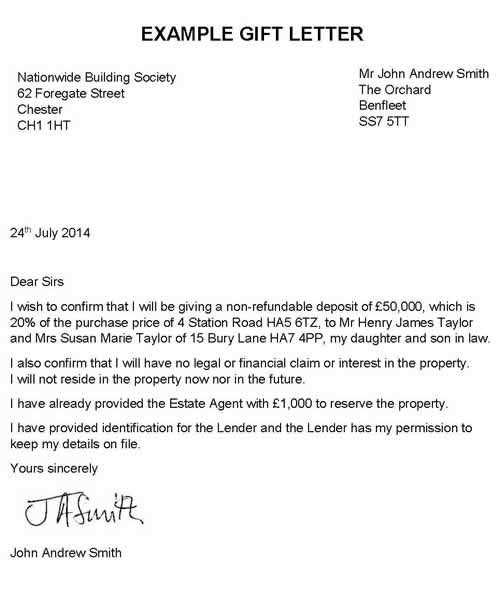

In Canada, a mortgage gift letter confirms that a financial gift provided for a down payment is not a loan and does not need to be repaid. This letter is a key requirement when applying for a mortgage, especially for first-time buyers or those receiving financial assistance from family or friends.

Key Elements to Include

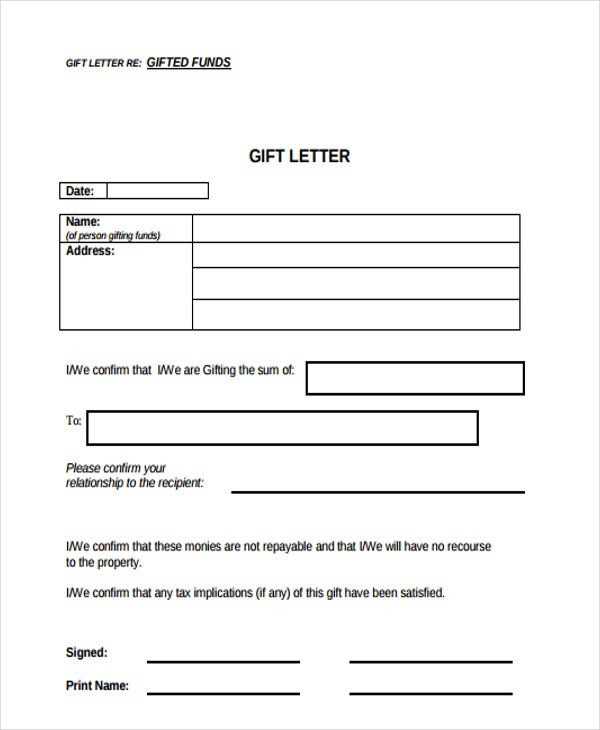

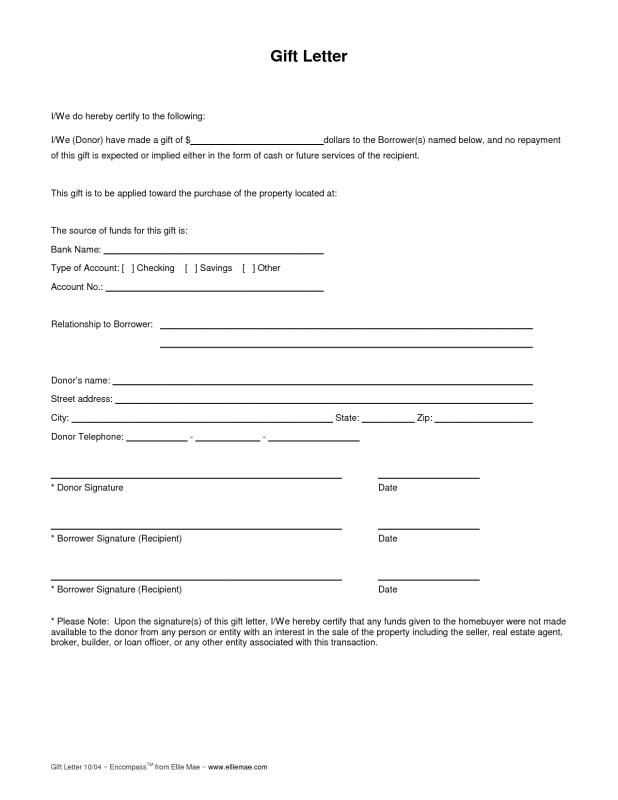

Ensure your gift letter includes the following details:

- Donor’s Name and Contact Information: Full name, address, phone number, and relationship to the recipient.

- Amount of the Gift: Specify the exact amount of money being gifted for the down payment.

- Statement of No Repayment: A clear statement that the gift is non-repayable, meaning no repayment is expected now or in the future.

- Signature of the Donor: The donor must sign the letter to validate the information provided.

- Bank Account Information: Sometimes, lenders require bank details of the donor to verify the source of the funds.

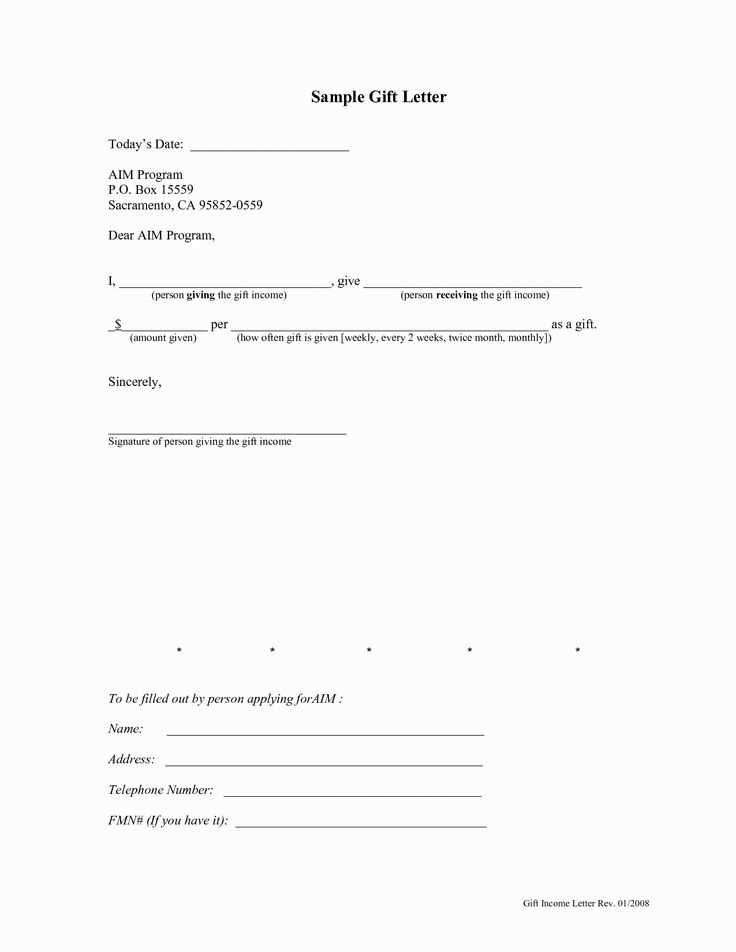

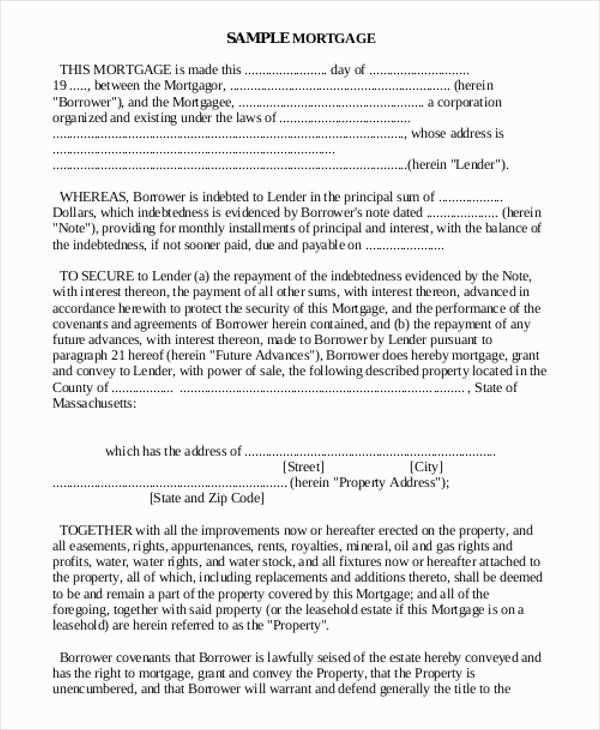

Sample Gift Letter Template

Here’s a sample format to follow when drafting the mortgage gift letter:

[Donor’s Name] [Donor’s Address] [City, Postal Code] [Phone Number] [Email Address] [Date] [Recipient's Name] [Recipient's Address] [City, Postal Code] Re: Gift Letter for Down Payment To whom it may concern, I, [Donor’s Name], confirm that I am gifting the amount of [amount in numbers] to [Recipient's Name], my [relationship to recipient], to assist with the purchase of their home. This gift is provided with no expectation of repayment now or in the future. The funds for this gift are from my personal savings and were transferred to [Recipient’s Name] on [date]. Sincerely, [Donor’s Signature]

Common Mistakes to Avoid

To avoid delays in the mortgage application process, double-check the letter for these common errors:

- Missing Donor’s Information: Ensure that the donor’s details are correctly stated to avoid confusion.

- Unclear Statement of No Repayment: The lender must know that the gift is not a loan. Be explicit.

- Failure to Provide Bank Account Information: If the lender requests bank details to verify the source of funds, provide this promptly.

By following these guidelines and ensuring the letter is correctly drafted, you can streamline the mortgage application process and avoid unnecessary delays. Always review your letter for accuracy before submission to the lender.

Mortgage Gift Letter Template Canada

Understanding the Purpose of a Gift Letter

Key Information to Include in Your Letter

How to Structure Your Gift Letter for Lenders

Common Mistakes to Avoid When Writing a Gift Letter

Legal Requirements and Compliance for Gifts in Canada

How to Handle Different Types of Gift Sources in Your Letter

Ensure your gift letter clearly states the nature of the financial gift, confirming it is a true gift and not a loan. Lenders require this documentation to evaluate your financial situation, ensuring there are no obligations or future claims tied to the funds. Be transparent about the source of the gift and avoid any language that could imply repayment.

Key details to include are the donor’s name, relationship to you, the amount gifted, and a statement that the funds are a gift and not a loan. The letter must also mention that the donor is not expecting repayment, and any conditions attached to the gift should be disclosed clearly. Include the donor’s address and contact information for verification purposes.

Start the letter by identifying the gift amount and confirming the relationship between you and the donor. Structure it in a straightforward format: introduction of the donor, statement of the gift, and closing. Provide all the required information without unnecessary details. Make sure the letter is signed by the donor to validate authenticity.

Avoid vague language that could lead to confusion, such as using terms like “assistance” or “help,” which may imply a loan. Be clear and direct about the nature of the gift, and ensure no promises or future repayments are implied. Refrain from including unrelated information that could distract from the primary purpose of the letter.

Gifts in Canada must comply with federal tax regulations. Make sure that the gift does not affect your ability to meet other financial obligations. The gift must also come from a legitimate source; any large or unusual transfers may require additional documentation to prove its legitimacy. Check with your lender for any specific requirements they may have for accepting gift letters.

If the gift is coming from a third party, clarify the source and provide any necessary documentation to confirm the legitimacy of the funds. Gifts from foreign sources may require additional verification. Be transparent about the origin of the funds to prevent any issues down the line during the mortgage approval process.