No Known Loss Letter Insurance Template Guide

In the world of risk assessment and coverage, it’s crucial to ensure proper documentation of the absence of certain claims or events. This type of formal statement helps both parties maintain clarity on potential liabilities, providing reassurance in managing potential issues in the future.

Crafting such a document requires attention to detail, as it serves as an official confirmation that no adverse incidents have occurred. Its role in protecting interests while maintaining transparency cannot be overstated. Properly structured, this statement is not only a sign of professionalism but also a safeguard for future dealings.

Properly drafting these documents requires understanding their structure and intent, ensuring accuracy in the information provided. The process involves specific language and a clear format to avoid ambiguity, allowing easy interpretation by all involved parties.

Understanding No Known Loss Letters

In certain professional contexts, a specific type of document is required to confirm that no incidents or claims have been made within a given period. This confirmation helps to clarify the status of risk management and ensures that there are no unresolved issues affecting future agreements or renewals.

Such a document is essential for organizations or individuals seeking to provide evidence that they have not experienced any disruptive events that would affect their standing. It serves as an official statement that there are no pending claims, disputes, or any factors that could potentially impact future arrangements.

These statements are typically requested by companies when reviewing ongoing or upcoming contracts, as they provide assurance that no hidden risks exist. The clear and precise language used in this type of communication is vital for avoiding misunderstandings and ensuring that all parties are fully informed.

Importance of No Known Loss Documentation

Accurate and clear documentation plays a pivotal role in risk management and ensures transparency between parties. It serves as an essential tool for confirming the absence of any issues that could potentially impact future agreements or contractual obligations. Without this type of record, both parties may face unnecessary uncertainties or complications that could be easily avoided.

This form of documentation provides a safeguard for businesses and individuals, offering assurance that no unresolved matters exist. It not only protects against future claims but also strengthens the trust between the involved parties by affirming that there are no hidden risks or concerns that could affect the relationship.

By including this type of record in regular procedures, organizations demonstrate their commitment to clarity and reliability. It ensures that both sides are fully aware of the current status, reducing the potential for misunderstandings or disputes as new agreements are entered into.

Key Elements of a Template

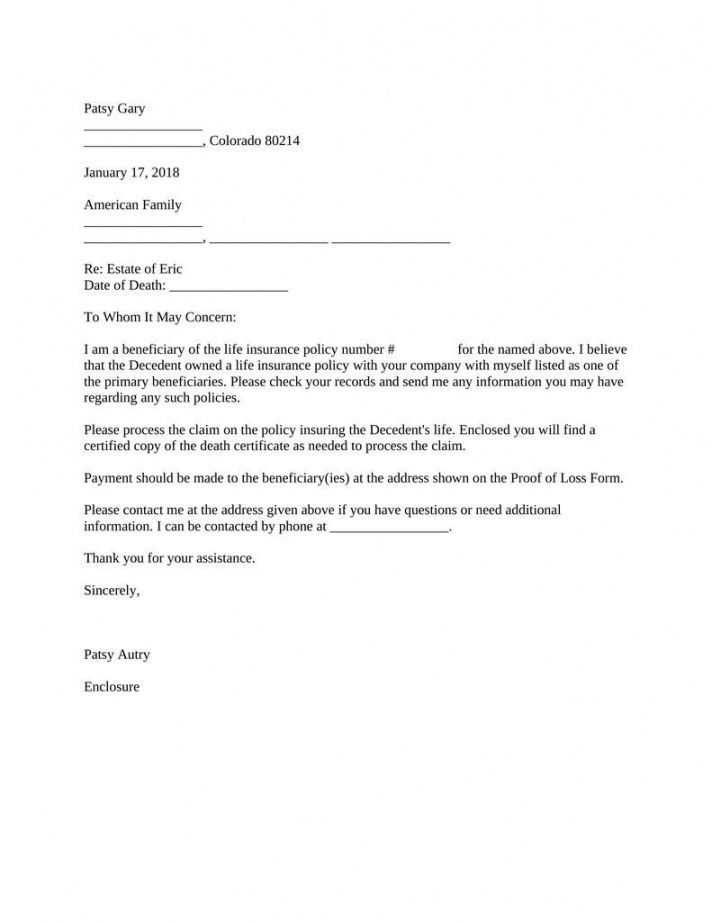

When creating a formal document to confirm the absence of claims or incidents, there are essential components that must be included for it to be effective and legally sound. These elements ensure that the statement is clear, comprehensive, and leaves no room for ambiguity. The structure of this document must be both precise and easy to understand to maintain its validity.

First, it is crucial to include the identities of both parties involved, along with relevant details about the covered period. This establishes context and ensures that the statement is specific to the intended timeframe. Additionally, the document should clearly outline the purpose of the statement and provide a straightforward declaration regarding the lack of any adverse events or actions.

Another important element is the inclusion of contact information for follow-up or clarification, ensuring that all parties have access to further details if necessary. Finally, the document should be signed by an authorized representative to validate its authenticity and confirm the accuracy of the statement provided.

Step-by-Step Guide for Crafting the Letter

Creating a formal statement confirming the absence of any claims or incidents requires careful attention to detail. By following a clear process, you can ensure that the document meets all necessary standards and serves its purpose effectively. Below is a structured approach to help you craft a precise and professional communication.

1. Gather Relevant Information

Before starting, collect all necessary details, such as the dates covered by the statement, the involved parties, and any relevant policy or contract numbers. This information forms the foundation of the document, ensuring it is accurate and specific to the context.

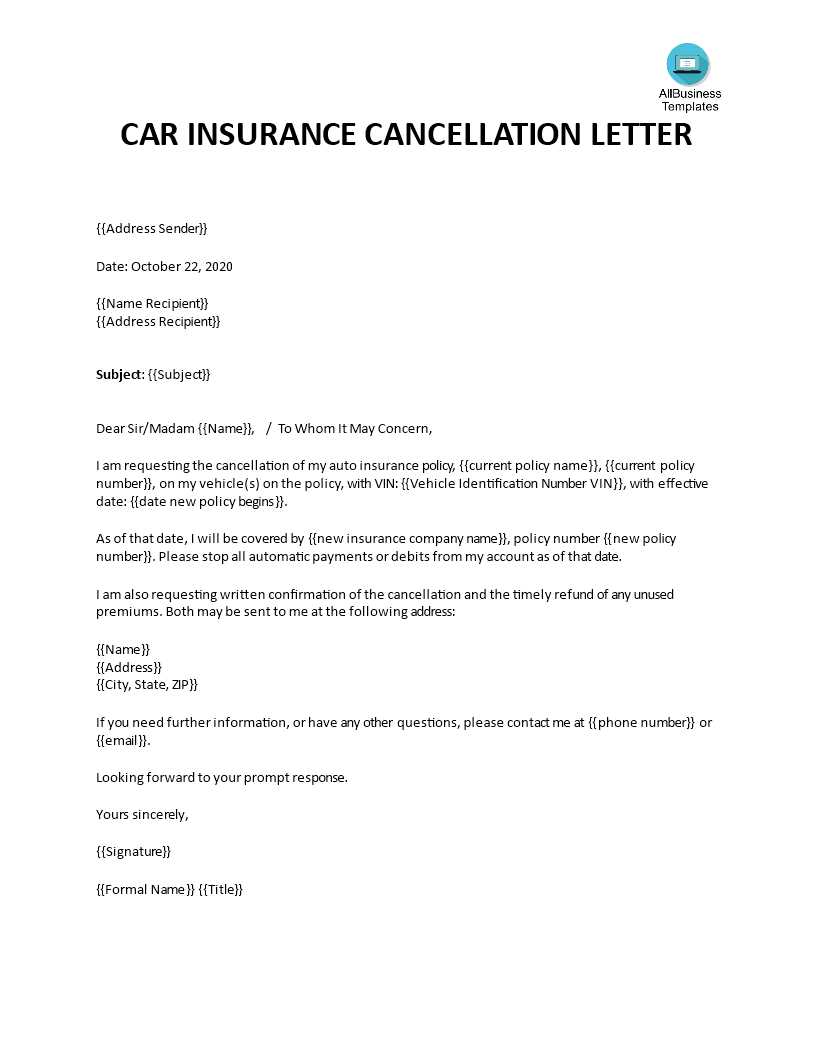

2. Draft a Clear Declaration

Start with a concise declaration affirming the absence of any incidents, disputes, or claims. Be direct and avoid unnecessary complexity to ensure the message is straightforward and easily understood by all parties.

Tip: Keep the language formal but simple, making sure the statement clearly addresses the key points without ambiguity.

Once your initial draft is ready, review it for completeness and accuracy. Make sure all essential details are included and that the content is free of errors. Only once you are confident in the draft should you proceed with signatures and finalization.

Common Mistakes to Avoid

When preparing a formal statement confirming that no incidents or claims have occurred, it’s easy to overlook certain details. These oversights can undermine the clarity and effectiveness of the document. Below are some of the most common errors people make and how to avoid them.

- Incomplete Information: Failing to include all relevant details, such as dates or parties involved, can lead to confusion. Always ensure that the necessary context is provided for the statement to be meaningful.

- Ambiguous Language: Using vague terms or unclear phrasing can lead to misinterpretation. Be direct and precise when making your declaration.

- Neglecting to Verify Facts: Before finalizing the document, double-check that all claims are accurate. Providing incorrect or false information can have serious consequences.

- Skipping Signatures: Omitting signatures from the appropriate authorized individuals can invalidate the statement. Ensure that the document is signed and dated by the right parties.

- Overcomplicating the Structure: A lengthy or convoluted document may confuse the reader. Keep it simple and to the point, with clear sections and headings.

By avoiding these common pitfalls, you can ensure that your formal statement is clear, accurate, and effective in communicating the necessary information.

When to Use a No Known Loss Letter

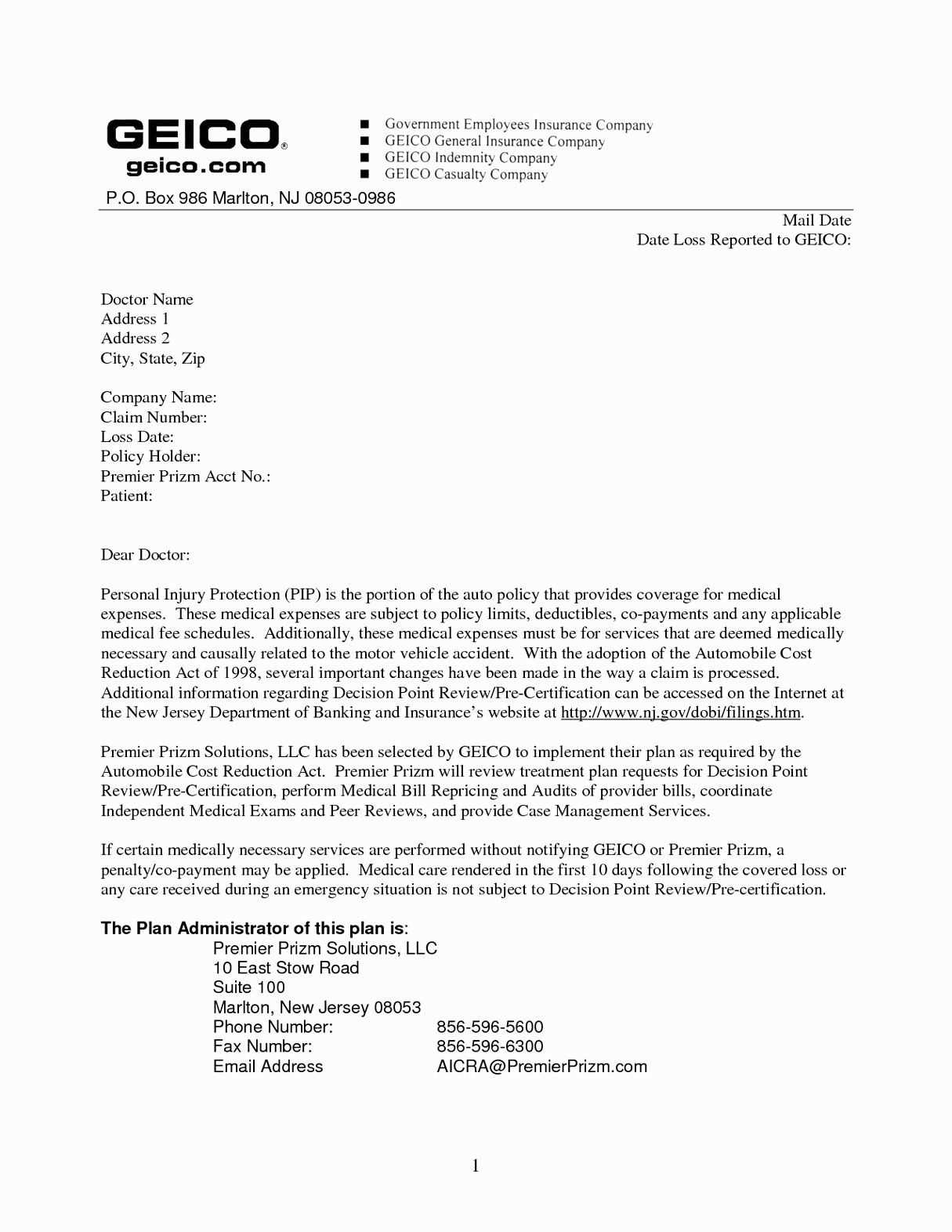

There are specific situations where a formal declaration confirming the absence of incidents or claims is necessary. This document is particularly important when dealing with matters that require transparency and assurance that no previous issues could affect future agreements or obligations.

For example, it is commonly required when renewing or starting new contracts, especially in sectors where risk assessment is crucial. Providing such a statement can help establish trust between parties and provide clarity regarding the status of previous events. Additionally, it may be necessary when updating coverage or seeking new financial agreements, where a clean record is essential for moving forward.

It’s also helpful when ensuring compliance with regulatory requirements or when asked by auditors to confirm that no unresolved matters exist. This type of confirmation ensures that all parties are on the same page, preventing potential misunderstandings or disputes later on.