Irrevocable Standby Letter of Credit Template

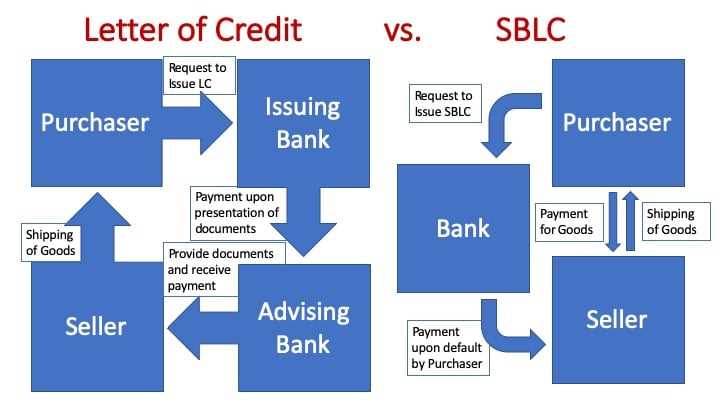

In the world of financial transactions, ensuring the fulfillment of agreements often requires a written commitment from a third party, offering a guarantee if certain conditions are met. This type of arrangement serves as a safeguard, providing both parties with reassurance that obligations will be honored, especially in international dealings or high-value contracts. Understanding how to craft such an assurance document can help mitigate risks and streamline processes in various industries.

Key Elements of a Financial Assurance Document

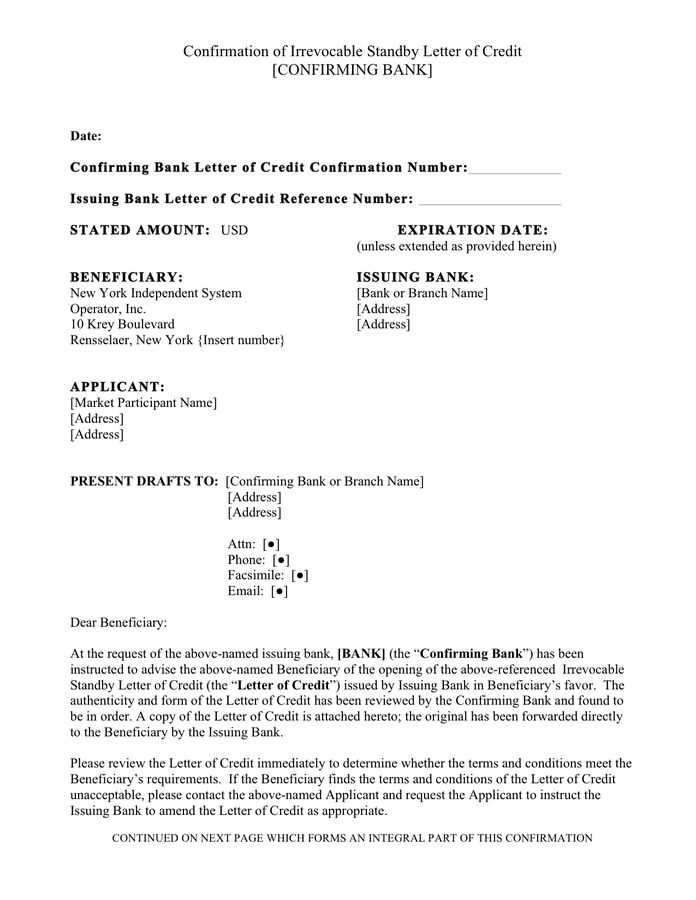

When preparing an agreement that serves as a financial guarantee, several core components must be included to ensure its validity and effectiveness:

- Parties Involved: Clearly identify the entities or individuals entering into the arrangement.

- Conditions for Payment: Define the specific circumstances under which the guarantee will be executed.

- Amount Guaranteed: State the precise value or limit of the guarantee provided.

- Duration of the Agreement: Specify the time frame for which the agreement remains in effect.

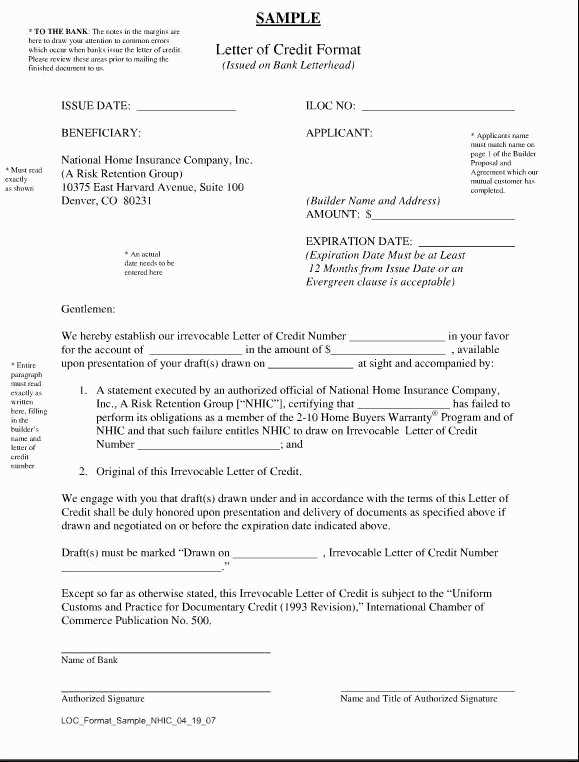

Structuring the Assurance Agreement

To create a valid and reliable document, it’s essential to adhere to a clear and organized structure. Begin by outlining the intent of the arrangement, followed by detailing the obligations of all parties involved. Ensure that the document is legally sound, with clearly defined terms to avoid any ambiguity. Also, include provisions for any potential disputes, specifying how they will be resolved.

Legal Considerations and Compliance

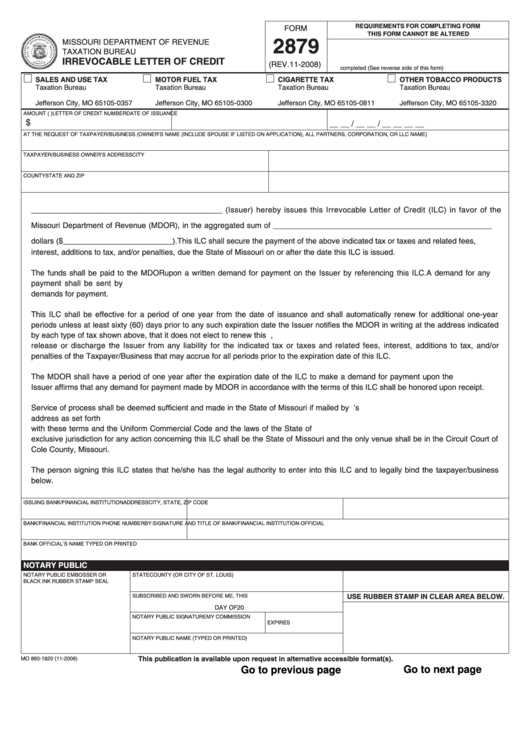

Compliance with applicable regulations is crucial when drafting a financial guarantee agreement. Local laws, international trade regulations, and industry standards must all be taken into account. Seeking legal counsel during the drafting process can help ensure that the agreement aligns with legal requirements and that all potential risks are adequately covered.

Common Applications of Financial Assurance Agreements

Such agreements are often used in various sectors where large sums of money or complex transactions are involved. They provide security in cases such as construction projects, import/export contracts, and corporate loans. In these contexts, the document serves to protect against financial loss, ensuring that obligations are met even in the event of non-performance by one party.

Benefits and Drawbacks

While offering a level of security, these agreements come with both advantages and disadvantages. On the positive side, they enhance trust between parties and reduce financial risk. However, they may also come with significant costs, such as fees for the third-party institution providing the guarantee, and in some cases, complications arise if conditions are not met or are interpreted differently by the involved parties.

Comprehensive Guide to Secure Financial Assurance Documents

In various industries, a reliable financial instrument is essential to ensure that obligations will be met. These agreements offer a form of protection for both parties involved, guaranteeing payment under certain circumstances. A well-structured agreement helps mitigate the risk of non-performance, making it a valuable tool in international trade and other high-stakes transactions.

What is a Financial Assurance Instrument?

A financial assurance instrument serves as a safeguard, promising payment if specified conditions are fulfilled. This kind of document is often issued by a financial institution on behalf of a client, ensuring the other party that they will receive payment or compensation should the primary party fail to meet their obligations. It is typically used in large transactions, such as international trade, construction projects, or corporate financing.

Essential Components of a Financial Agreement

To draft a reliable and enforceable agreement, the following elements must be included:

- Parties Involved: Clear identification of all entities or individuals entering into the arrangement.

- Terms of Execution: Precise conditions under which payment will be made or performance will be ensured.

- Guaranteed Amount: The specific value or limit of the financial commitment.

- Validity Period: The time frame within which the agreement remains effective.

Steps to Draft an Effective Agreement

Creating a well-structured financial instrument begins with defining the purpose and scope of the arrangement. All terms must be clearly outlined to avoid ambiguity, and the responsibilities of all parties should be well-documented. It is also crucial to include any dispute resolution mechanisms in case disagreements arise over the terms of execution.

Key Legal Aspects of Financial Assurance Documents

Legal considerations are critical when drafting these agreements. Local and international laws must be taken into account, as well as any industry-specific regulations. Consulting with legal professionals ensures that the document meets all necessary legal requirements and reduces the risk of complications in the future.

Common Applications of Financial Assurance Tools

These instruments are commonly used in various sectors, including construction, international trade, and corporate loans. They provide assurance that financial obligations will be met, offering security to both parties involved in the transaction. For example, in construction, a financial institution may issue an assurance to guarantee that the contractor will be paid upon successful completion of the project.

Pros and Cons of Financial Assurance Options

On the positive side, these documents provide peace of mind, reducing the risk of financial loss for both parties. They also build trust and facilitate smoother transactions. However, they can come with costs, including fees for the institution providing the guarantee, and may complicate negotiations if the terms are not properly defined. Additionally, if the conditions for execution are unclear, disputes may arise over the fulfillment of the agreement.