Payment Enclosed Letter Template for Professional Use

When sending a financial transaction, it’s essential to ensure clear communication. Proper documentation can help both parties stay informed and avoid any misunderstandings. A well-structured document serves as a record, providing the necessary details regarding the payment process and ensuring professionalism in all dealings.

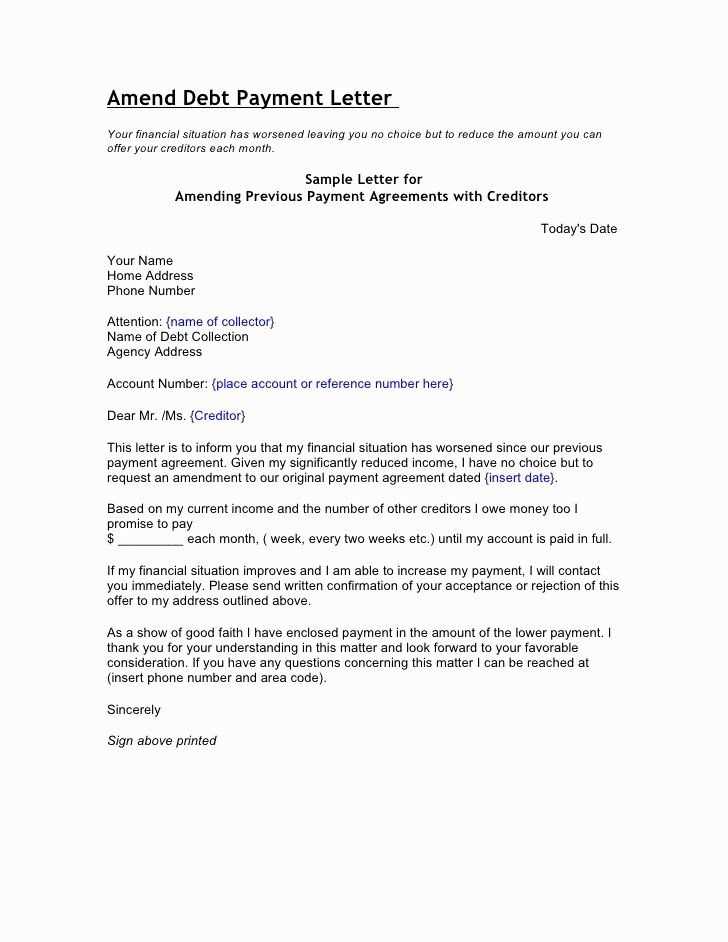

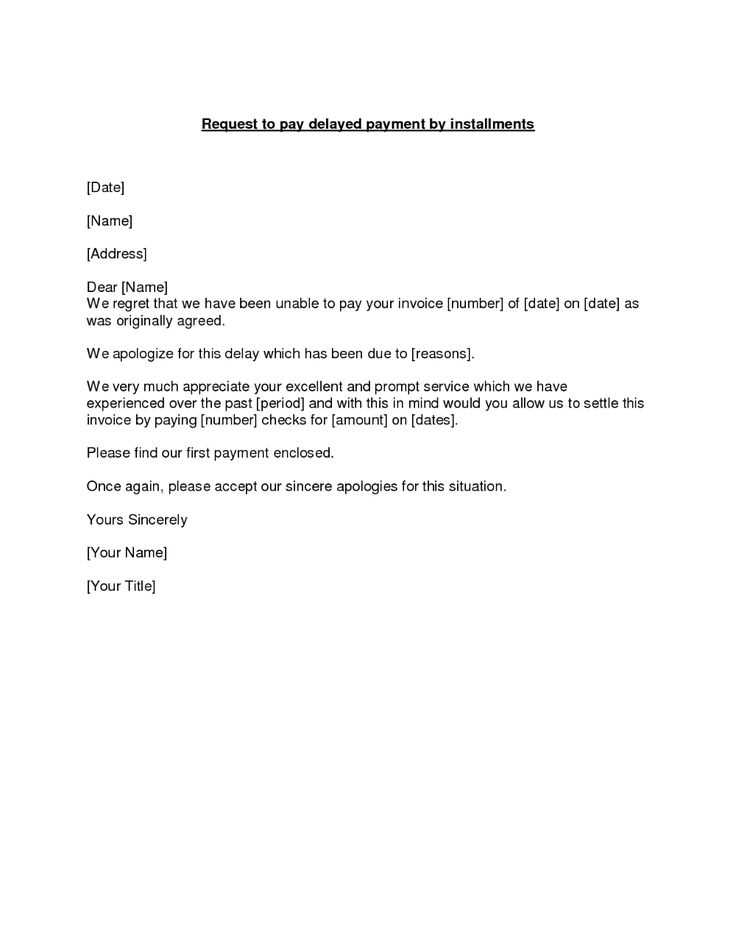

Important Elements to Include

When preparing such a document, make sure to cover all necessary details. Here are some key components:

- Recipient Information: Always include the name, address, and contact details of the individual or organization receiving the funds.

- Sender Information: Clearly state your own details to ensure there is no confusion about the transaction origin.

- Amount and Method: Specify the total sum being transferred and how it will be sent (e.g., bank transfer, check, or other means).

- Date: Mention the date of the transaction to establish a clear timeline.

- Reference Details: Include any necessary identifiers or invoice numbers that link to the transaction.

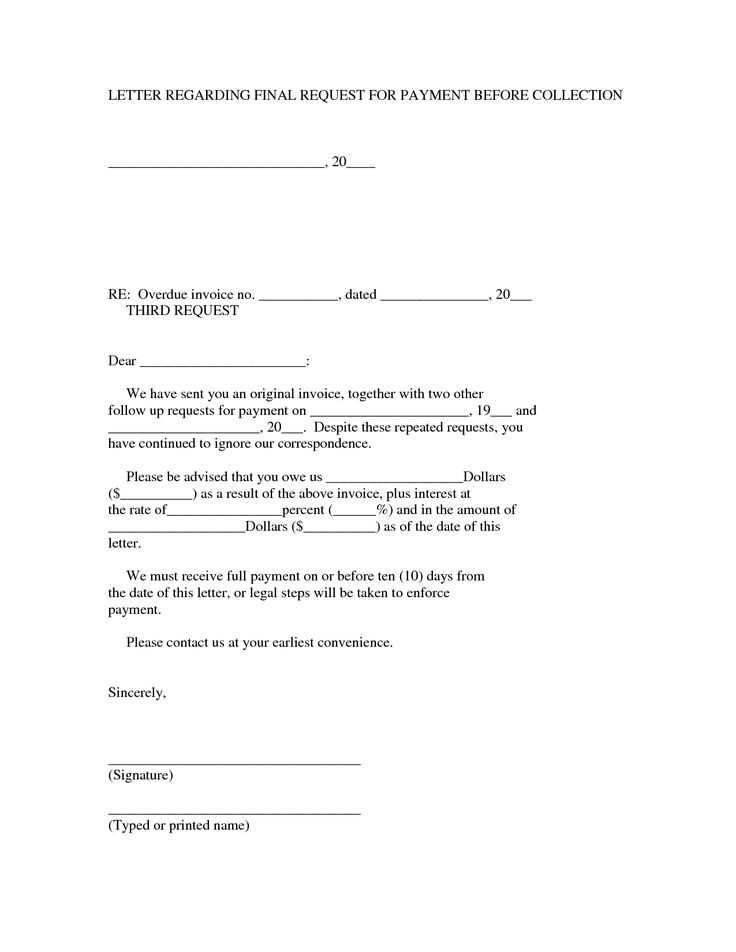

Common Mistakes to Avoid

While preparing the document, there are a few common errors you should steer clear of:

- Missing Contact Details: Not providing clear contact information can lead to confusion if any follow-up is needed.

- Unclear Payment Method: Failing to specify how the funds will be transferred can cause delays or complications.

- Ambiguous Amount: Ensure the amount is stated clearly and correctly, avoiding any potential for misinterpretation.

Benefits of Proper Documentation

Maintaining clear financial correspondence not only aids in transparency but also provides protection for both parties involved. It serves as a valuable reference for future communication and ensures that the process runs smoothly. By following best practices, you avoid potential disputes and establish trust in your financial dealings.

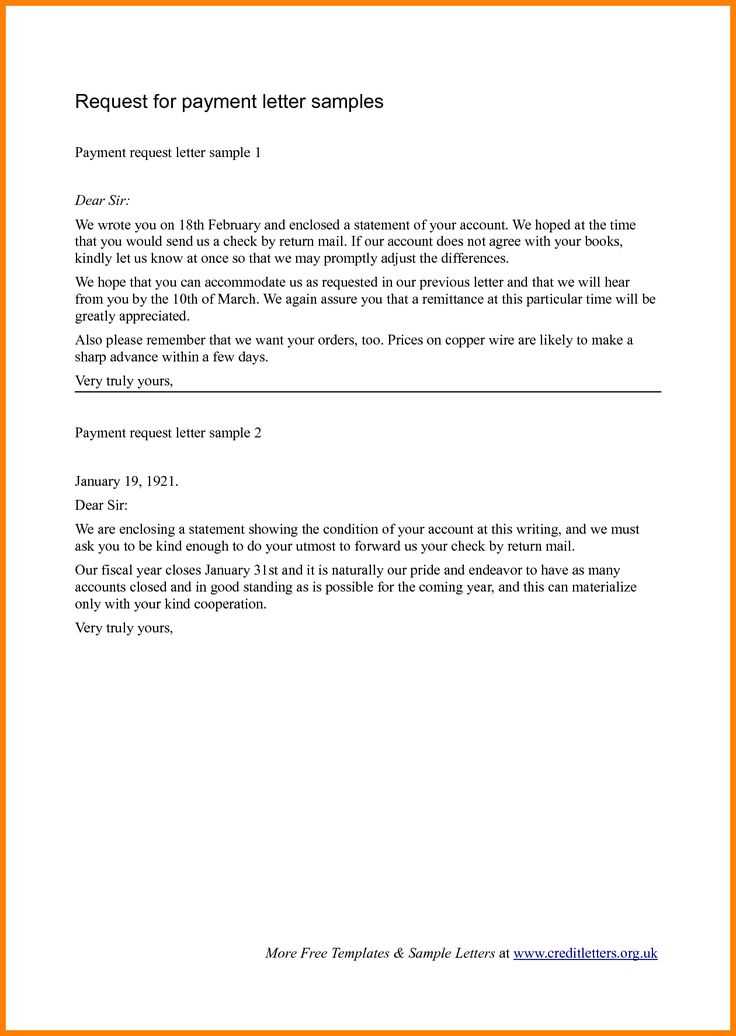

Understanding Financial Correspondence and Its Key Elements

When handling financial transactions, clear and precise communication is essential. This type of written communication ensures that both parties understand the details of the exchange, avoids confusion, and serves as a record for future reference. A well-structured document allows both the sender and the recipient to stay on the same page regarding the exchange process.

Key Details to Include in Your Message

To make your document comprehensive, consider these vital elements:

- Recipient’s Information: Ensure the recipient’s details, such as name and address, are included clearly.

- Sender’s Details: Include your own contact information to maintain transparency.

- Amount and Transfer Method: Specify the sum being transferred and how it will be delivered.

- Date of Transaction: Clearly mention the date when the transfer is made.

- Reference Number: If applicable, include any references like invoice or order numbers that help identify the transaction.

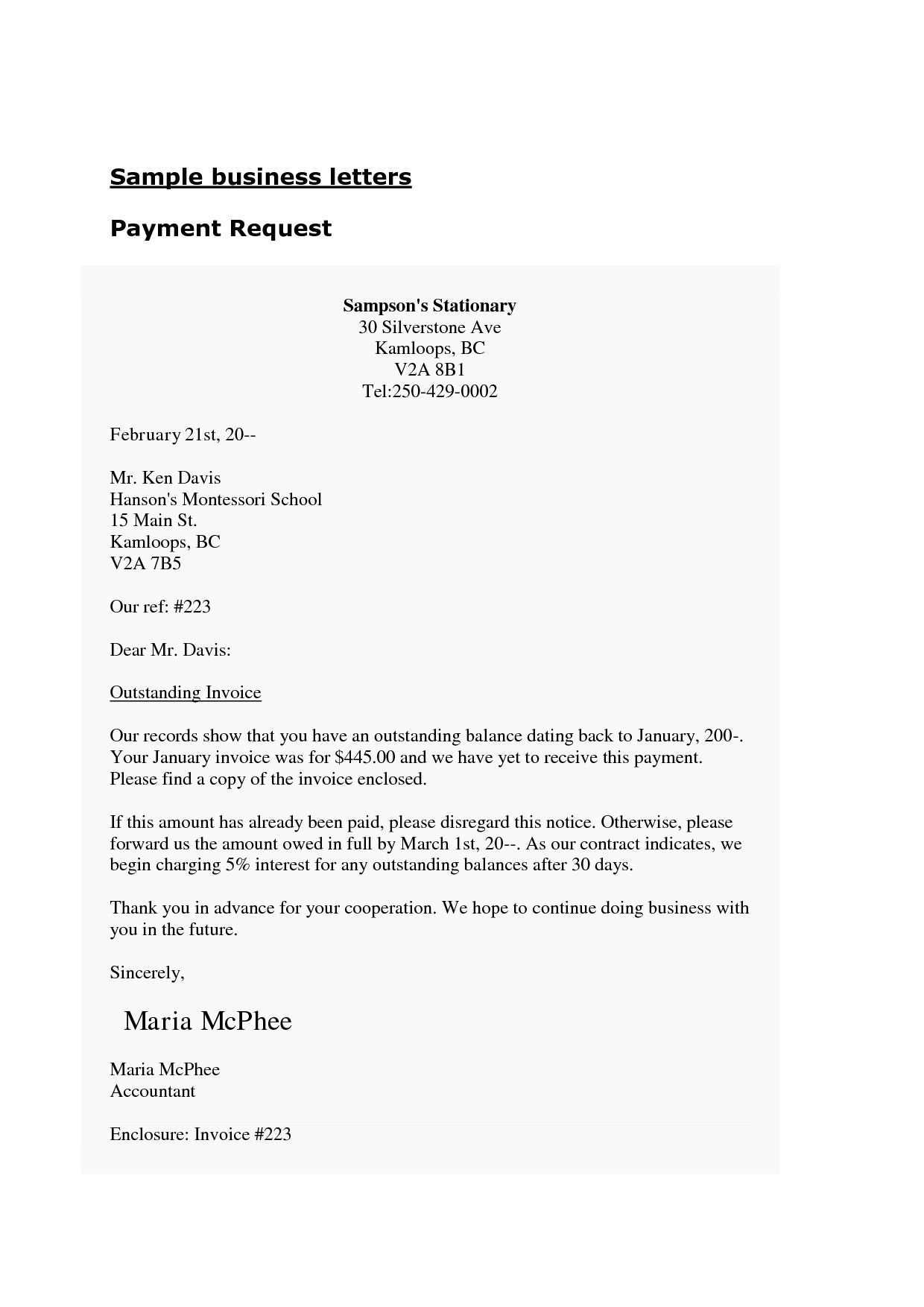

Formatting Tips for Effective Communication

Effective formatting makes the content easier to understand and ensures the message is professional. Use clear headings, bullet points, and short paragraphs to break down the information. Keep the language simple and concise. Proper alignment and consistent use of fonts contribute to a cleaner, more readable document.

Personalizing Your Financial Correspondence

Adding a personal touch to your communication can make a difference. Including specific details about the transaction or referring to previous conversations helps build a connection. Tailoring the content to the recipient’s preferences or needs can make the document feel more considerate and thoughtful.

Avoiding Common Mistakes in Financial Communication

To ensure your document is effective, avoid the following mistakes:

- Unclear Instructions: Always specify how the transfer is being made to prevent confusion.

- Missing Contact Information: Ensure both parties’ contact details are easy to locate for follow-up.

- Ambiguous Amount: Clearly state the exact sum to avoid misunderstandings.

Benefits of Well-Formatted Financial Correspondence

Using a structured approach to financial communication offers several advantages. It ensures accuracy and prevents disputes, while providing a reference for both parties involved. A well-prepared document also portrays professionalism, enhancing trust and clarity between sender and receiver.