Payment Remittance Letter Template for Easy Use

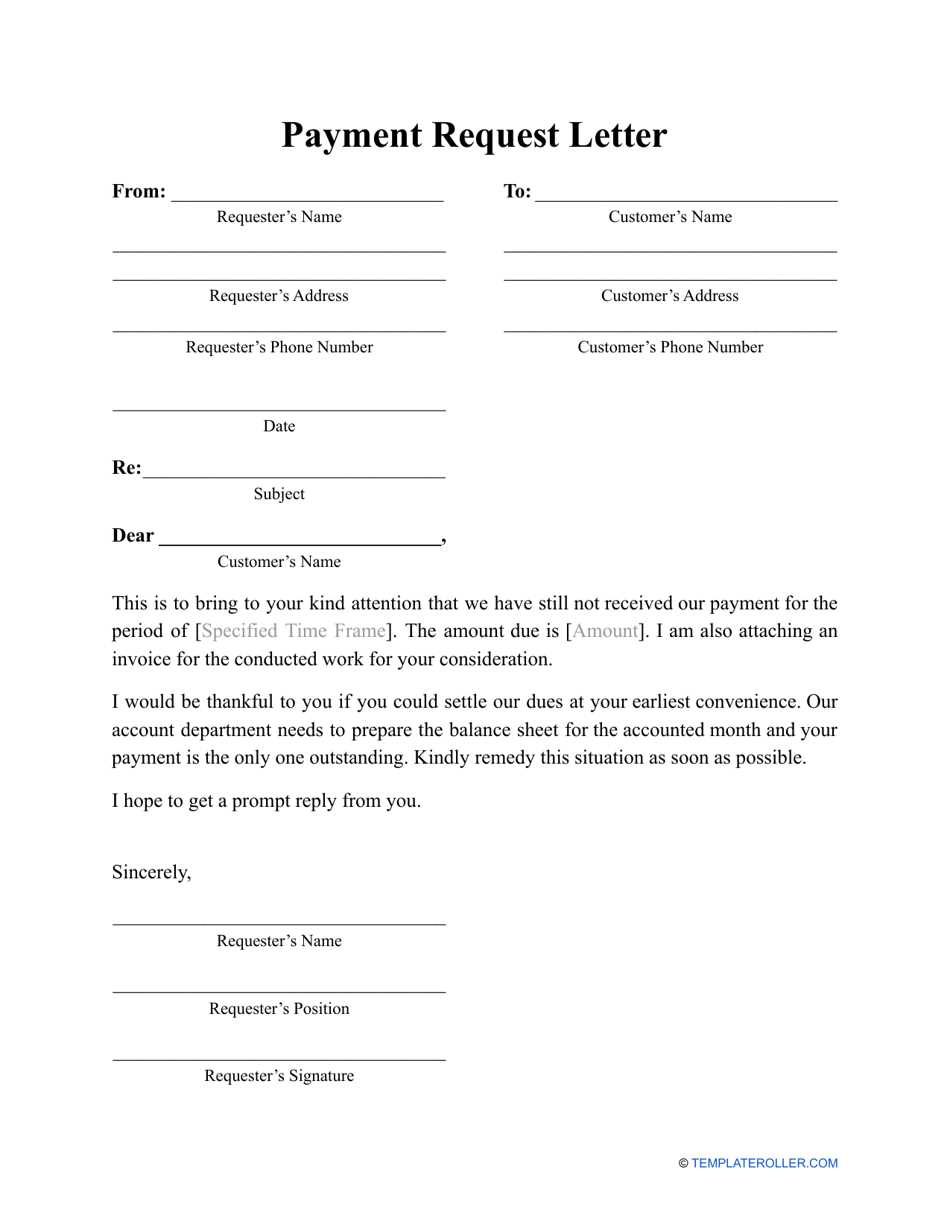

When you need to confirm a financial transaction or notify a recipient of a completed payment, crafting a clear and concise document is essential. This communication ensures that both parties are informed about the transaction details, fostering trust and transparency. Below, we will explore the necessary components and provide guidance on how to create such a document effectively.

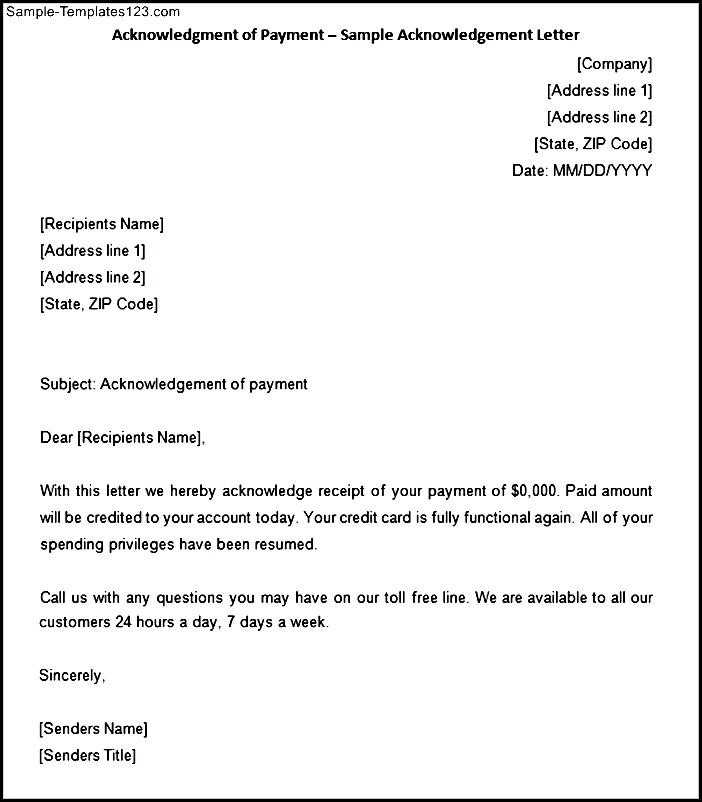

Key Elements of an Effective Payment Confirmation

To ensure clarity, the document should include specific details about the transaction. These elements are crucial for both the sender and the recipient to verify the payment has been processed successfully.

- Sender Information: Include the name, contact details, and address of the person making the payment.

- Recipient Information: Provide the name, contact information, and address of the person receiving the payment.

- Amount and Currency: Clearly state the amount paid and the currency used for the transaction.

- Date of Payment: Mention the date when the payment was completed.

- Transaction Reference: Include any unique reference number associated with the payment.

Customizing the Document for Different Situations

Depending on the nature of the payment, you may need to adjust the language or include additional details. For example, payments made for services might require a description of the work completed, while payments for products may need to mention the specific item purchased.

Why Clear Communication is Important

Clear and precise information not only avoids confusion but also helps prevent disputes in the future. A well-constructed document serves as both a receipt and a record of the financial transaction, ensuring that all parties have a mutual understanding of the payment made.

Best Practices for Crafting Your Document

Here are some tips to help you write a professional and effective payment confirmation:

- Keep the tone formal and businesslike, avoiding unnecessary jargon.

- Double-check all details for accuracy, as errors can lead to misunderstandings.

- Be concise but ensure all necessary information is included.

- Provide contact information in case further clarification is needed.

By following these guidelines, you can create a clear, concise, and accurate document that serves its purpose and ensures a smooth transaction process.

Key Elements of a Financial Confirmation Document

When drafting a financial confirmation, there are several essential components that must be included to ensure clarity and prevent misunderstandings. These key elements serve to verify the transaction details for both the payer and the recipient.

Sender’s Information: Always begin by listing the sender’s name, contact details, and any relevant account information.

Recipient’s Information: Include the full name, address, and contact information of the person or company receiving the payment.

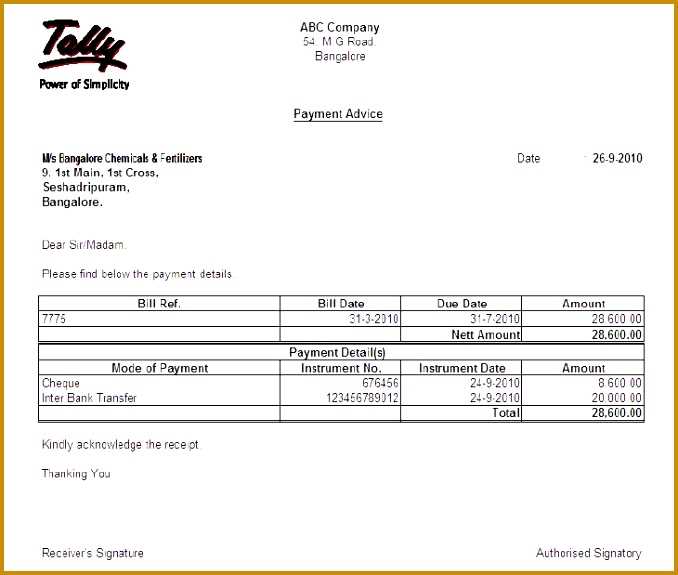

Transaction Details: Specify the amount paid, the method of payment used, and the date the transaction occurred.

Reference Number: A unique transaction ID helps identify the payment and serves as a point of reference for both parties.

How to Adjust a Financial Confirmation Document

Customizing this communication may be necessary depending on the nature of the transaction. If the payment is related to services, you might need to mention the work completed or the duration of the contract. For product payments, you should specify the item purchased, including any associated order or tracking number.

Avoiding Common Mistakes in Financial Confirmations

One of the most common errors is missing key details such as the payment amount or reference number. It’s also important to ensure that the date and recipient information are correct. Omitting these details or providing inaccurate information can lead to confusion and disputes later on.

Why Use a Financial Confirmation

These documents are not only a formal way to confirm payments but also act as proof of transaction. They help ensure transparency, reducing the likelihood of future disputes. Whether for personal or business purposes, they provide a reliable record that both parties can refer to when needed.

Examples of Financial Confirmation Formats

There are various ways to format such a document, depending on the context. A simple format may just include the sender and recipient details, payment amount, and date. For more complex transactions, additional information such as terms of agreement, services rendered, or product details may be necessary. A formalized format often helps add professionalism to the communication.

Choosing the Right Time to Dispatch a Confirmation

Timing is crucial when sending this kind of document. It should be sent immediately after the transaction is completed, ensuring that both parties have a record of the payment. If there are any delays or issues, sending the document promptly can help resolve any questions or concerns before they escalate.

Effective Communication Strategies

To ensure your message is clear, use straightforward and concise language. Avoid overly complex terms or jargon, as these can lead to confusion. Additionally, providing contact details for follow-up queries will make it easier for the recipient to reach out if they have questions about the transaction.