Pre Action Protocol Letter Debt Template Guide

htmlEdit

When pursuing financial claims, it’s essential to follow a structured approach to ensure a smooth process. Effective communication plays a critical role in resolving disputes and recovering outstanding amounts. Understanding the necessary steps and the proper way to engage with the involved parties can help avoid misunderstandings and legal complications.

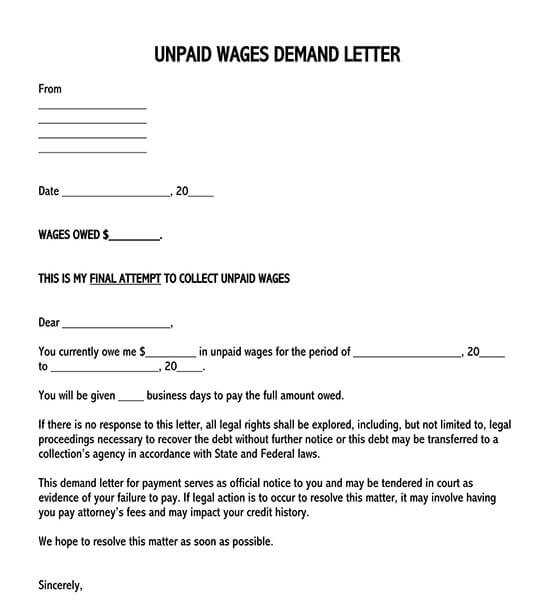

Formal notifications serve as an important initial step in initiating a claim. These documents outline the nature of the issue, the amount owed, and a clear request for repayment. Properly preparing and sending such communications can prevent unnecessary escalation and provide a basis for further legal action if needed.

By adhering to established practices, individuals and businesses can create a clear record of their attempts to resolve matters amicably. This helps protect all parties involved and ensures compliance with relevant regulations. This section covers the key aspects to keep in mind when drafting the essential communications for financial recovery.

htmlEdit

Overview of Debt Recovery Communication Guidelines

In situations where a financial dispute arises, initiating formal communication with the other party is crucial for resolving the matter efficiently. This step ensures that both parties are aware of the issue and have an opportunity to settle before further legal actions are taken. Properly handling these communications can streamline the resolution process and minimize the need for court involvement.

Key Elements of an Effective Communication

When crafting a message regarding an outstanding claim, certain key components must be included to ensure clarity and compliance with legal requirements. These components help outline the nature of the dispute and the steps necessary for resolution.

- Clear description of the issue: The nature of the financial matter must be described in detail, including relevant dates and amounts.

- Requested action: Specify the required steps the recipient should take to resolve the issue, such as making a payment or providing a justification for the amount owed.

- Timeframe for response: Clearly state the deadline for the recipient to take action to avoid further steps.

Benefits of Following Proper Communication Guidelines

Adhering to the recommended communication steps provides several advantages, including:

- Preventing escalation: By formally addressing the issue, both parties are given the opportunity to resolve the matter before involving legal professionals.

- Building a case: Properly documented communication can be used as evidence should the matter proceed to court.

- Reducing costs: Avoiding unnecessary litigation can save both time and money for all involved.

htmlEdit

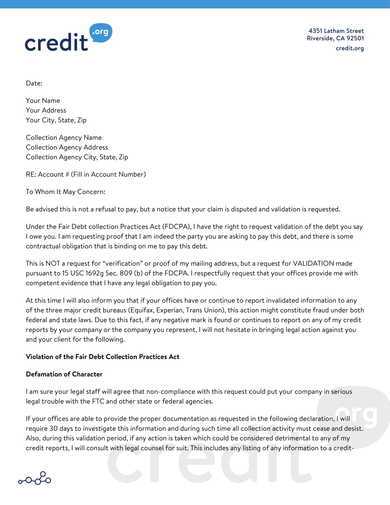

Key Elements of a Recovery Notification

When attempting to resolve a financial dispute, it is essential to ensure that the communication includes all necessary information to avoid confusion or misinterpretation. The message should clearly convey the nature of the issue, the amount in question, and the steps required to address the situation. By incorporating these critical elements, the sender increases the chances of a successful resolution.

Essential Information to Include

In order for the communication to be effective, certain components must be included to make sure the recipient understands the situation and what is expected from them.

- Subject of the claim: Clearly state the reason for the communication and the financial obligation in question.

- Details of the amount: Break down the total amount owed, including any additional fees, charges, or interest that has accrued.

- Instructions for payment: Provide clear guidance on how the recipient can settle the amount, including any payment methods or channels.

Tone and Language Considerations

The tone of the communication is equally important to ensure the message is received in the correct manner. A formal yet polite tone helps maintain professionalism and encourages cooperation. Avoiding harsh or overly confrontational language can prevent escalation and facilitate a more amicable resolution.

- Politeness: Use respectful language to maintain professionalism and avoid alienating the recipient.

- Clarity: Ensure that all instructions and expectations are stated in a straightforward manner to avoid misunderstandings.

htmlEdit

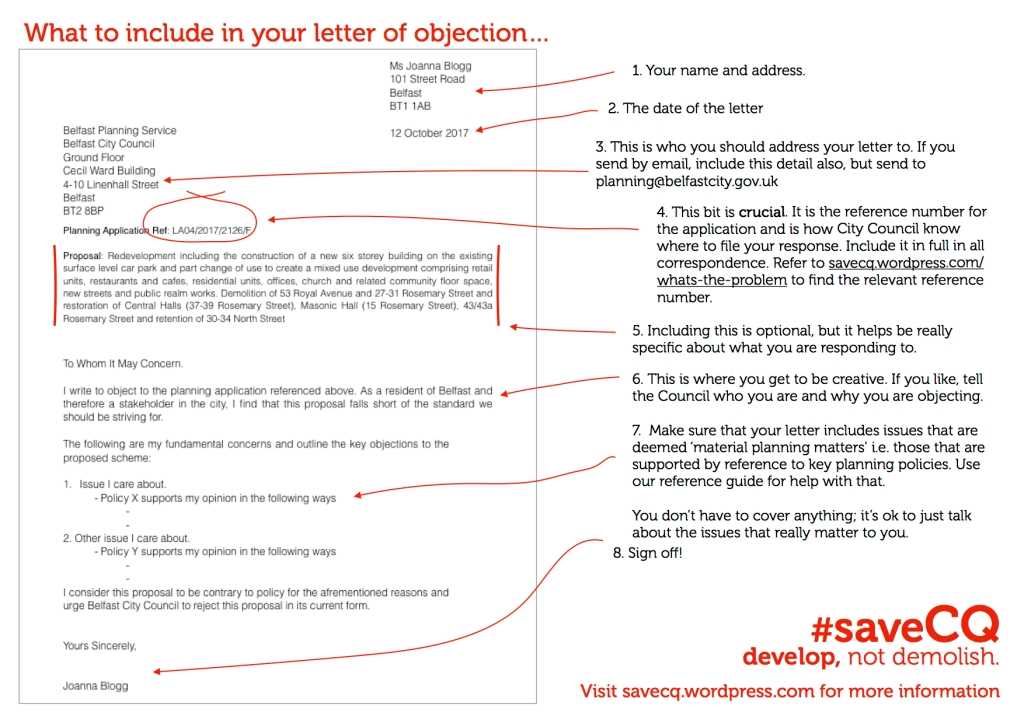

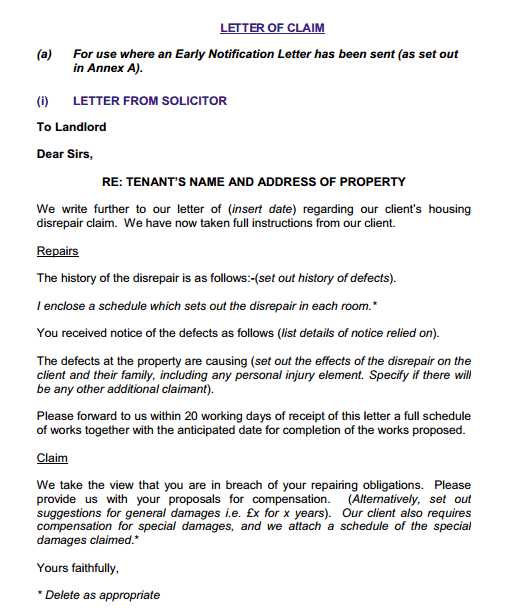

How to Structure a Legal Document

Creating a well-structured legal document is essential for ensuring clarity and compliance with legal requirements. A properly formatted document helps the reader easily understand the issue at hand and the necessary actions. By following a logical structure, both parties can engage with the content more effectively, potentially avoiding further legal complications.

Basic Components of a Legal Document

Each document should include several core elements that clearly present the details of the case and outline the steps for resolution. These components ensure that the document serves its purpose and provides all necessary information for both parties.

- Title: Clearly identify the purpose of the document, such as a notice of an outstanding claim.

- Introduction: State the purpose of the communication, offering an overview of the situation.

- Details of the Claim: Provide specific information about the financial matter, including amounts, dates, and any related circumstances.

- Next Steps: Clearly outline the actions the recipient needs to take to resolve the issue, such as making a payment or providing further information.

Formatting Considerations

The presentation of a legal document is just as important as its content. Proper formatting ensures that the information is easy to read and follow. Using clear headings, bullet points, and concise paragraphs will help to break down the text and guide the reader through the necessary information.

- Headings: Use headings to divide the document into sections for easy navigation.

- Numbered or bulleted lists: Organize important details, such as instructions or timelines, in a clear, digestible format.

- Consistent fonts and spacing: Ensure readability by using standard fonts and appropriate spacing between sections.

htmlEdit

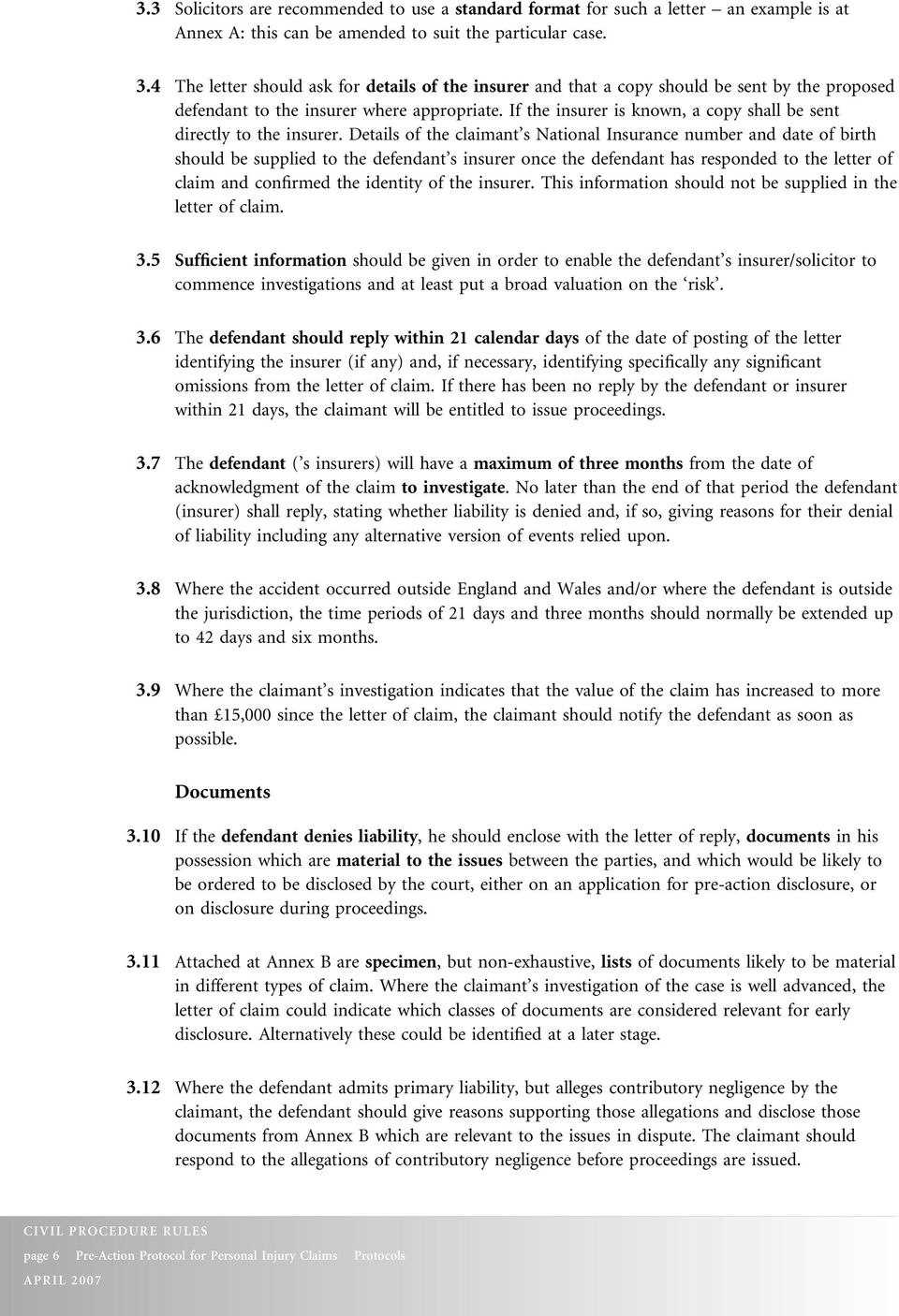

Legal Importance of Financial Notices

Financial notifications play a crucial role in resolving disputes before escalating to formal legal proceedings. They serve as an official warning to the recipient, outlining the nature of the issue and the necessary steps for resolution. By sending such communications, the sender demonstrates a willingness to settle the matter outside of court, potentially saving both time and money.

Role in Legal Proceedings

These formal notices establish a record of the claim and are an essential step before initiating further legal actions. Their importance is reflected in their ability to provide a clear timeline and give the recipient an opportunity to address the matter. When executed correctly, these communications can prevent unnecessary court interventions and streamline the settlement process.

- Evidence of attempted resolution: These documents serve as proof that the sender made reasonable efforts to resolve the issue amicably before seeking legal action.

- Protection for both parties: By outlining the dispute and next steps, these notices safeguard the interests of both the claimant and the recipient.

Impact on Court Decisions

In the event that the matter escalates to court, properly issued notifications can have a significant impact on the legal proceedings. Courts often view the failure to engage in prior communication as a failure to resolve the issue cooperatively. By sending a formal notice, the sender demonstrates their intent to resolve the matter without court intervention, which can positively influence the outcome.

- Influence on rulings: A well-documented notice may improve the chances of a favorable outcome in court by showing that proper steps were taken before pursuing litigation.

- Legal compliance: Sending the appropriate notices ensures compliance with legal requirements, avoiding delays or dismissals due to improper procedures.

htmlEdit

Common Mistakes in Financial Communications

In any financial exchange, clear communication is key to resolving issues effectively. However, there are common errors that can undermine the process, leading to confusion or even escalation of the situation. Recognizing and avoiding these mistakes ensures that both parties can engage in a productive dialogue and reach a fair resolution.

Failure to Provide Clear Information

One of the most frequent mistakes in financial notices is the lack of clarity regarding the nature of the claim or the required actions. A vague or unclear message can cause the recipient to misunderstand the situation, leading to unnecessary delays or disputes.

- Unclear descriptions: Ensure that the details of the claim, including the amounts involved and the timeline, are presented clearly.

- Ambiguous next steps: Be specific about what is expected from the recipient, whether it is payment or further communication.

Overcomplicating the Message

Another mistake is overloading the message with excessive information or legal jargon that may confuse the recipient. Simple and straightforward communication fosters understanding and ensures that the message is easily actionable.

- Excessive details: Avoid adding irrelevant information that may distract from the main issue.

- Technical language: Use plain language to ensure the recipient fully understands the terms and expectations.

Ignoring Legal Requirements

It’s also crucial to comply with any legal obligations when sending financial notices. Failing to follow the proper procedures or omit required details could render the communication ineffective or even invalid in court.

- Missing legal information: Make sure that all mandatory details, such as deadlines or dispute resolution steps, are included.

- Non-compliance with regulations: Ensure that the notice adheres to applicable laws to avoid complications later on.

htmlEdit

Effective Approaches for Collection Communications

When attempting to recover owed funds, it is essential to adopt a strategic approach in crafting communications that are clear, professional, and constructive. The tone and content of the message can significantly influence the outcome, either fostering cooperation or leading to further conflict. By following best practices and understanding the key components, you can increase the chances of a successful resolution.

Maintain a Professional and Neutral Tone

Keeping a neutral, respectful tone in financial notices ensures that the recipient is more likely to engage positively with the request. Avoiding aggressive language or unnecessary threats can help maintain a professional relationship, which may be beneficial for future transactions.

Include Clear and Precise Information

Effective communications must clearly state the specifics of the situation. This includes the amount owed, the date by which payment is expected, and any available payment options. The recipient should never be left confused about what is being requested.

| Component | Description |

|---|---|

| Amount Due | Clearly specify the exact amount owed, including any interest or fees. |

| Due Date | Indicate the exact date by which payment should be received. |

| Payment Options | Provide various methods for payment to accommodate the recipient’s preferences. |

Encourage Dialogue and Offer Solutions

Instead of simply demanding payment, offering potential solutions or discussing payment plans can help establish trust and encourage the recipient to take action. Offering alternatives can also demonstrate flexibility and a willingness to cooperate, which might lead to a quicker resolution.