Pre-approval letter template

To secure a smoother home buying experience, having a pre-approval letter in hand is a must. This letter confirms that a lender has reviewed your financial situation and is willing to loan you a specific amount for a mortgage. It provides you with a clear idea of what you can afford and gives sellers confidence in your ability to close the deal.

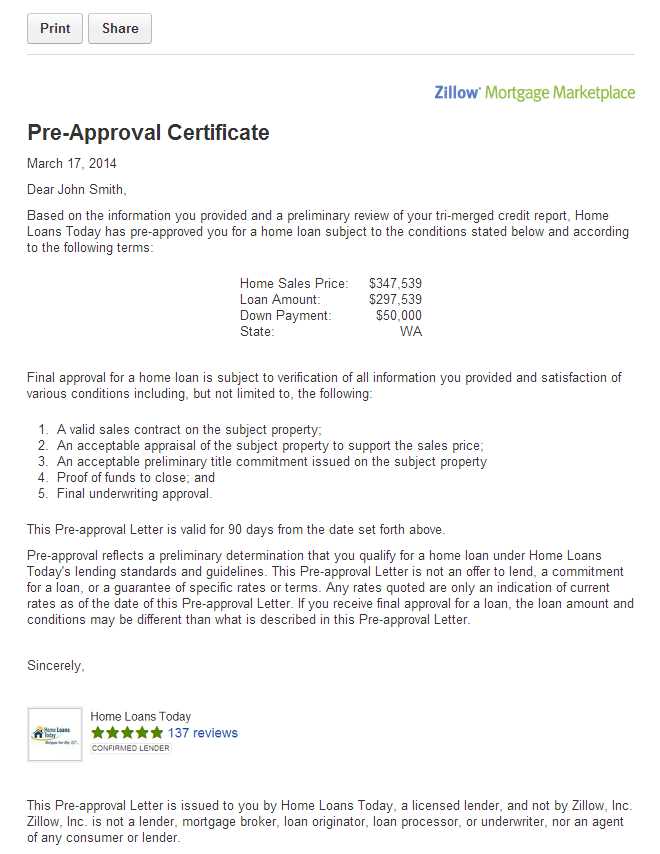

The key elements of a pre-approval letter should include your name, the loan amount, the loan type, and the terms of the approval. Make sure to include the lender’s contact information and the date of the approval. If applicable, also mention any conditions that must be met for the approval to remain valid.

When crafting this document, clarity is essential. Be specific about the loan details and avoid jargon that might confuse the reader. A well-structured and straightforward pre-approval letter can set you apart in competitive housing markets, making your offer more attractive to sellers.

Here is the corrected version:

When drafting your pre-approval letter, ensure that it includes the key details a lender uses to assess your application. Start by confirming the applicant’s name, the loan amount, and the type of loan they are applying for. Clearly state the terms, such as the interest rate and repayment schedule, while including a statement that the approval is subject to certain conditions like verification of financial status or an appraisal.

To increase the credibility of the letter, make sure it comes directly from a trusted financial institution. Include the lender’s contact information and signature, and ensure that the date is clearly visible to show when the approval was issued. This helps to avoid confusion and ensures that the buyer can move forward with confidence.

Finally, ensure that the language remains concise and professional, omitting any unnecessary jargon. Focus on the specifics that will provide clarity to both the buyer and the seller. A clear, direct pre-approval letter can make all the difference in the buying process.

- Pre-Approval Letter Template

A pre-approval letter is an important document in the home buying process. It helps potential buyers show sellers that they are serious and financially capable of purchasing a property. Below is a simple template you can use to create a pre-approval letter.

Pre-Approval Letter Template

Dear [Recipient’s Name],

We are pleased to inform you that after reviewing your financial information, you have been pre-approved for a loan. Below are the details of the pre-approval:

- Loan Amount: $[Amount]

- Interest Rate: [Rate]% (fixed)

- Loan Term: [Term] years

- Type of Loan: [Loan Type]

This pre-approval is based on the information you provided and is subject to verification, as well as standard underwriting approval. Please be aware that this pre-approval does not guarantee final loan approval, but it does indicate that, based on our review, you are likely to be approved for a loan in the amount specified above.

To proceed with the formal loan application process, please contact us at your convenience. We look forward to assisting you further with your home financing needs.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

Begin by addressing the recipient directly and clearly. Start with a formal salutation, such as “Dear [Recipient’s Name].” Clearly identify the purpose of the letter by stating the type of loan pre-approval being granted. Be specific about the loan amount, terms, and conditions associated with the pre-approval.

State the Key Financial Information

Outline the financial details supporting the pre-approval. This includes the loan amount, interest rate, and the terms of repayment. Ensure all relevant financial data is accurate and easy to understand, as it builds trust with the recipient.

Highlight the Importance of the Letter

Emphasize that the letter represents a preliminary approval based on the financial information provided. Clarify that this letter is subject to further review, and state any additional steps the recipient must take to finalize the loan approval process.

A pre-approval letter should be clear and contain key details that indicate the applicant’s financial standing. Below are the elements to include:

| Element | Description |

|---|---|

| Borrower’s Name | The applicant’s full legal name, ensuring there is no ambiguity. |

| Loan Amount | The maximum loan amount the borrower qualifies for, based on current financials. |

| Interest Rate | Specify the interest rate or range, including whether it is fixed or adjustable. |

| Loan Term | The duration of the loan (e.g., 30 years), helping the borrower understand repayment expectations. |

| Type of Loan | Clearly state whether it’s a conventional, FHA, VA, or other loan type. |

| Down Payment | Indicate the amount or percentage of the down payment required. |

| Expiration Date | Provide an expiration date for the pre-approval, ensuring the borrower knows the timeframe. |

| Loan Conditions | Outline any contingencies, such as property appraisal or inspection, that need to be met for final approval. |

By including these elements, the letter becomes a helpful and transparent tool for both the borrower and lender to move forward with the home-buying process.

Each loan type has unique requirements that must be reflected in your pre-approval letter template. Here’s how you can adjust the template for different loan scenarios:

- Conventional Loans: For conventional loans, emphasize the loan amount, interest rate, and terms. Include the applicant’s credit score, as conventional loans often rely on this metric. Be clear about the down payment percentage and the lender’s conditions for approval.

- FHA Loans: FHA loans are often available to borrowers with lower credit scores. Highlight the 3.5% minimum down payment requirement. Make sure to include information on mortgage insurance and the loan’s eligibility criteria, especially for first-time homebuyers.

- VA Loans: VA loans require specific wording to confirm that the borrower is eligible for military benefits. Ensure the template clearly states that the loan does not require a down payment or private mortgage insurance (PMI). Include the applicant’s military status and eligibility date for VA benefits.

- USDA Loans: For USDA loans, mention the rural property requirement and the income limits that apply. Clarify that the loan has no down payment requirement and may have lower mortgage insurance fees compared to other loan types.

- Jumbo Loans: Jumbo loans typically exceed conforming loan limits. In your template, specify the loan amount and highlight any stricter credit score and debt-to-income ratio requirements. It’s also useful to mention the need for a larger down payment compared to conventional loans.

Adjusting the language and specifics within the template will make sure that the pre-approval letter reflects the criteria and conditions for each loan type accurately. Always review and tailor the details based on the individual applicant’s circumstances for a more personalized document.

Ensure the loan amount is clearly stated. Avoid leaving it vague or unspecified, as this can lead to confusion later in the process.

Do not overstate the borrower’s financial situation. Be realistic about what they can afford, based on their income, debts, and credit score. A misleading or overly optimistic figure can complicate things during underwriting.

Incomplete Documentation

Missing details or incomplete information are red flags. Make sure to provide all necessary documents, such as proof of income, tax returns, and asset verification. Leaving out required paperwork can delay the process and even cause the pre-approval to be invalid.

Vague Conditions

A pre-approval letter should outline clear conditions for the loan. Avoid using vague language, such as “subject to approval,” without specific conditions. Detail the factors that will influence final approval, including any pending credit checks, income verification, or property appraisals.

| Common Mistake | Why it’s Problematic | How to Avoid It |

|---|---|---|

| Unclear loan amount | Confusion and potential issues during the application process. | State the exact loan amount approved in the letter. |

| Overstating financial capability | Leads to unrealistic expectations and complications during underwriting. | Accurately reflect the borrower’s financial standing and affordability. |

| Missing documentation | Delays approval and can make the pre-approval null and void. | Ensure all required documents are included and up-to-date. |

| Vague language in conditions | Creates uncertainty and delays in the process. | Clearly define all conditions that must be met for final approval. |

Avoid these mistakes to ensure a smoother pre-approval process, and improve the chances of securing a successful loan application.

To maintain a professional tone, ensure the letter is clear, concise, and free from errors. Pay attention to formatting and consistency in style.

- Use a Formal Template: Choose a clean, easy-to-read layout. Keep margins uniform and avoid cluttered designs. The letter should follow standard business formatting.

- Proper Greeting and Closing: Use a formal salutation such as “Dear [Name]” and close with “Sincerely” or “Best regards.” Avoid overly casual expressions.

- Professional Font and Size: Use a standard font like Arial or Times New Roman in size 11 or 12. This ensures readability and a polished appearance.

- Be Direct and Clear: State the purpose of the letter clearly in the opening sentence. Avoid lengthy or unnecessary explanations that may confuse the reader.

- Proofread for Grammar and Spelling: Before sending, check for grammatical or spelling mistakes. A well-proofread letter shows attention to detail.

- Accurate Contact Information: Double-check all details such as names, titles, and addresses. Accuracy enhances credibility.

Once you’ve sent the pre-approval letter, follow these steps to stay on track and keep the process moving smoothly.

1. Communicate with the Client

Reach out to your client to confirm they received the letter and answer any questions they might have. Clear communication now ensures they understand the next steps and prevents any confusion later.

2. Wait for Acknowledgement or Response

Give the client time to review the pre-approval letter. They might need additional information or want to discuss their options. Be ready to offer assistance promptly when they respond.

3. Begin the Property Search

Once the pre-approval is confirmed, assist the client with narrowing down properties that fit their criteria and budget. The pre-approval letter will help guide their search by setting realistic expectations for what they can afford.

4. Ensure Financial Documentation is Up to Date

Ask the client to provide any additional financial documentation if needed. This may include updated bank statements, employment verification, or other supporting documents to ensure their pre-approval stays valid.

5. Prepare for the Loan Application

Once the client selects a property, start preparing for the formal loan application. The pre-approval letter is a great first step, but the full application will require more detailed financial assessments.

To create a pre-approval letter, begin by addressing the recipient directly. Clearly state that they are pre-approved for a loan, and include the loan amount, terms, and conditions. Make sure the letter specifies the necessary documentation or next steps required from the recipient to finalize the approval process. Keep the tone clear, professional, and confident.

Example: “We are pleased to inform you that, based on our preliminary assessment, you have been pre-approved for a loan in the amount of $250,000. This pre-approval is subject to verification of your financial documents and a satisfactory appraisal of the property.”

Include a section outlining the timeframe for final approval. This helps set clear expectations for the recipient and ensures transparency. It’s also helpful to state any conditions that could affect the final approval, such as a change in credit score or employment status.

Example: “This pre-approval is valid for 60 days. Please submit your supporting documents within the next 30 days to avoid any delays. Should your financial situation change during this period, the terms of this pre-approval may be adjusted.”

End the letter by offering to assist with the next steps or provide further clarification. Include your contact information and encourage the recipient to reach out with any questions.

Example: “If you have any questions or need assistance with the next steps, please don’t hesitate to contact us. Our team is ready to guide you through the process.”